Blog > How Cash Flow Conversion Can Enhance Your Business’s Operational Efficiency

How Cash Flow Conversion Can Enhance Your Business’s Operational Efficiency

In the dynamic business world, efficiency often rests on a delicate balance of finances. Cash flow conversion, a simplified way of understanding this balance, can be the difference between thriving and merely surviving.

Free cash flow conversion is not just a financial term but a crucial indicator of a company’s financial health. By understanding and optimizing cash flow conversion, businesses position themselves for greater liquidity, flexibility, and resilience against market challenges.

What is free cash flow?

Free cash flow (FCF) measures how efficiently a business turns operating profits into cash flow available for stakeholders. It goes beyond just paper profits, focusing on cash inflows from operations.

This free cash flow conversion metric is crucial for assessing the health of a company’s cash-generating abilities, helping stakeholders understand how well a company can meet its financial obligations and fund growth opportunities without borrowing.

The free cash flow conversion calculation involves deducting capital expenditures from operating cash flows. This simple formula provides insight into the resources a business converts into cash flows, offering a clear picture of liquidity and operational efficiency.

Overall, free cash flow conversion is critical for assessing company performance and making informed investment decisions.

Importance of optimizing cash flow conversion for financial health

Optimizing cash flow conversion is vital for maintaining a company’s financial health.

A shorter cash conversion cycle can increase liquidity, enabling you to reinvest resources into growth opportunities while promptly meeting financial obligations.

By managing terms with suppliers and leveraging favorable payment terms, a company can improve its operational efficiency and bolster cash inflows.

Efficient inventory management is another crucial aspect, as it can quickly convert inventory into sales, boost days sales outstanding, and reduce excess stock. Additionally, streamlining the operating cycle by converting raw materials into cash from sales swiftly enhances the company’s financial performance.

Prioritizing these areas can lead to a negative cash conversion cycle, where cash inflows from sales occur faster than cash outflows for suppliers, significantly strengthening financial stability.

Now that it’s apparent why optimizing cash flow conversion is so important, you can learn how to calculate the ratio to improve your company’s financial health further.

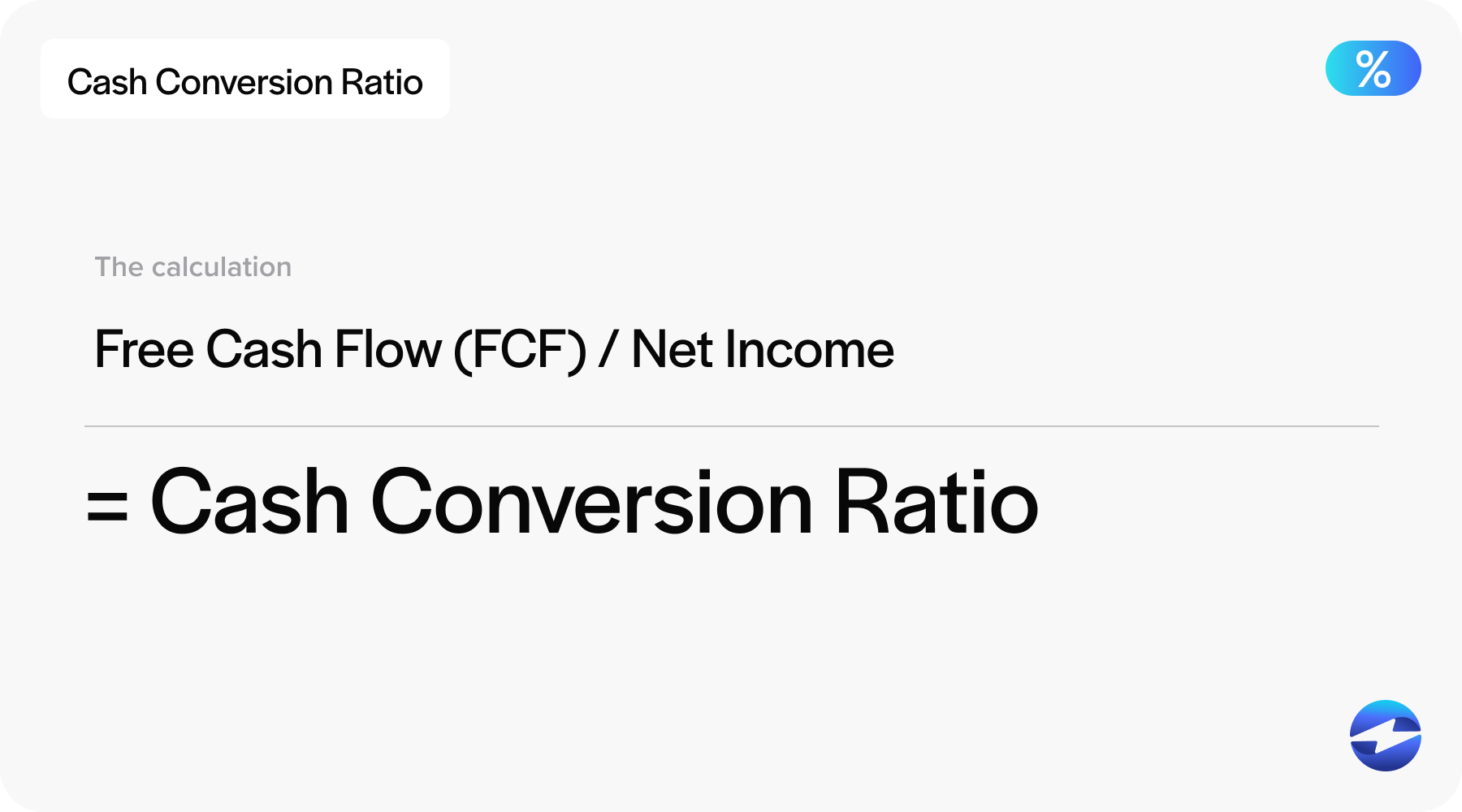

Calculate the free cash flow conversion using the cash conversion ratio

Calculating free cash flow conversion using the cash conversion ratio is crucial for evaluating a business’s operational efficiency.

The cash conversion cycle (or cash cycle) measures how effectively a company turns its resources into cash flows. To calculate this, you’ll use the formula:

Cash Conversion Ratio = Free Cash Flow (FCF) / Net Income

FCF represents the cash flows from operating activities minus capital expenditures. It indicates the cash a company generates after fulfilling financial obligations like inventory or raw materials investments. Net Income is a company’s profit after deducting all expenses, such as operating costs and taxes.

An efficient cash conversion process enhances financial performance by minimizing days sales outstanding (DSO) and optimizing inventory levels. It may lead to a shorter cash conversion cycle, allowing businesses to manage capital better, reduce late payments, and invest in growth opportunities.

Monitoring this financial metric enables proactive capital management and improves terms with suppliers, leading to more favorable payment terms and improved resource efficacy.

Valuable insights provided by cash flow conversion

Cash flow conversion is a critical financial metric that indicates how efficiently a business converts its resources and operations into cash flow. This metric is essential for assessing how quickly a company can turn its inventory into cash from sales.

A shorter cash conversion cycle suggests higher operational efficiency, as the company spends less time turning raw materials into finished goods, making sales, and collecting customer payments.

One key aspect of cash flow conversion is negotiating favorable payment terms with suppliers and managing days payable effectively, allowing more flexibility in capital management. Businesses can enhance their cash inflow and overall financial performance by optimizing inventory levels and reducing DSO.

Understanding cash flow conversion helps identify growth opportunities and address potential financial obligations by focusing on the company’s operating cycle. Companies with a negative cash conversion cycle can use cash from sales before settling their bills, freeing up capital for investments in inventory or other growth-related activities.

Monitoring this cycle ensures that resources are efficiently allocated, minimizing excess stock and late payments. Overall, effective cash flow conversion is vital for maintaining operational efficiency and improving financial health.

4 benefits of optimizing cash flow conversion

By effectively managing cash conversion cycles and resources, companies can unlock numerous advantages that support growth and sustainability. This optimization aids in financial planning and strengthens the overall business strategy.

Here are four benefits of optimizing your cash flow conversion:

- Improved liquidity and financial flexibility

- Enhanced ability to reinvest in growth opportunities

- Reduction in dependency on external financing

- Better alignment of financial strategy with operational goals

1. Improved liquidity and financial flexibility

By shortening the cash conversion cycle, companies can increase their liquidity levels, providing greater financial flexibility.

With more liquidity and flexibility, businesses can readily meet short-term financial obligations, invest in necessary inventory, and cover operational costs without strain.

2. Enhanced ability to reinvest in growth opportunities

An optimized cash flow conversion enables merchants to rapidly convert inventory into cash from sales, which creates surplus capital that can be reinvested into growth opportunities like new projects or market expansions.

With improved cash inflows, businesses are better equipped to pursue strategic investments that drive future success.

3. Reduction in dependency on external financing

Businesses with efficient cash flow conversion cycles often find a reduced need for external financing.

By effectively managing resources and cash flow, companies minimize their reliance on loans or credit lines, thus lowering interest expenses and financial risks. This self-sufficiency facilitates sustainable growth and strengthens financial independence.

4. Better alignment of financial strategy with operational goals

A better cash flow conversion can align your company’s financial strategy with its operational goals.

By maintaining efficient inventory management, aligning payment terms, and managing DSO, merchants can synchronize their financial objectives with day-to-day operations. This alignment improves economic performance and strategic coherence to encourage more business growth.

Rapidly improve cash flow conversion with better expense control

Merchants can improve their cash flow conversions quickly by closely controlling their expenses.

To achieve more controlled expenses, start by analyzing your operating cycle and identifying areas where costs can be reduced without compromising quality or performance. Focus on streamlining raw materials procurement and minimizing excess stock, thus decreasing capital tied up in inventory.

Next, negotiate favorable payment terms with suppliers to extend days payable outstanding (DPO), allowing more time to generate cash from sales before settling financial obligations.

Businesses can enhance inventory management by moving inventory into sales faster, increasing cash inflow. They can also monitor inventory levels regularly to ensure they align with their sales forecasts and to avoid unnecessary surpluses.

Lastly, merchants can enforce a strategic approach to managing DSO by encouraging timely customer payments, offering incentives for early payments, and establishing clear credit terms. This results in a shorter cash conversion cycle, improving overall financial performance and unlocking growth opportunities.

By focusing on these areas, your business will swiftly convert resources into more capital to enhance operational efficiency and better financial management. Another way to improve your cash flow is by utilizing a reliable payment solution like EBizCharge.

Transform your expense management with EBizCharge

Managing expenses is vital to the success of any business. Thankfully, a robust payment processing provider like EBizCharge can provide more expense control for your business and robust payment tools to generate more revenue.

By integrating seamlessly with the top accounting and enterprise resource planning (ERP) software, EBizCharge simplifies payment processing, allowing businesses to effortlessly track and reconcile transactions. This aids in reducing errors, streamlining cash flow, and improving financial operations.

EBizCharge provides real-time updates, enabling companies to closely monitor their transactions and effectively manage their cash flow. This feature helps merchants maintain better control over their financial resources to encourage more timely customer payments and avoid late payment penalties.

Moreover, EBizCharge’s user-friendly platform allows companies to gain deeper insights into their cash conversion cycles, assisting in strategic decision-making.

With robust security measures and automated processes, EBizCharge minimizes the need for manual intervention, significantly reducing fraud risks and human error for a more efficient cash cycle and improved financial performance to generate more growth.

Summary

- What is free cash flow?

- Calculate the free cash flow conversion using the cash conversion ratio

- Valuable insights provided by cash flow conversion

- 4 benefits of optimizing cash flow conversion

- Rapidly improve cash flow conversion with better expense control

- Transform your expense management with EBizCharge

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.