Blog > Guide to Cash Application Automation Software

Guide to Cash Application Automation Software

Imagine a world where managing financial transactions is as easy as clicking a button, free from the tedious task of manual data entry and the errors that come with it.

Cash application automation software is steadily transforming that image into a reality for businesses around the globe. By streamlining financial processes, this innovative technology plays a pivotal role in modernizing company operations.

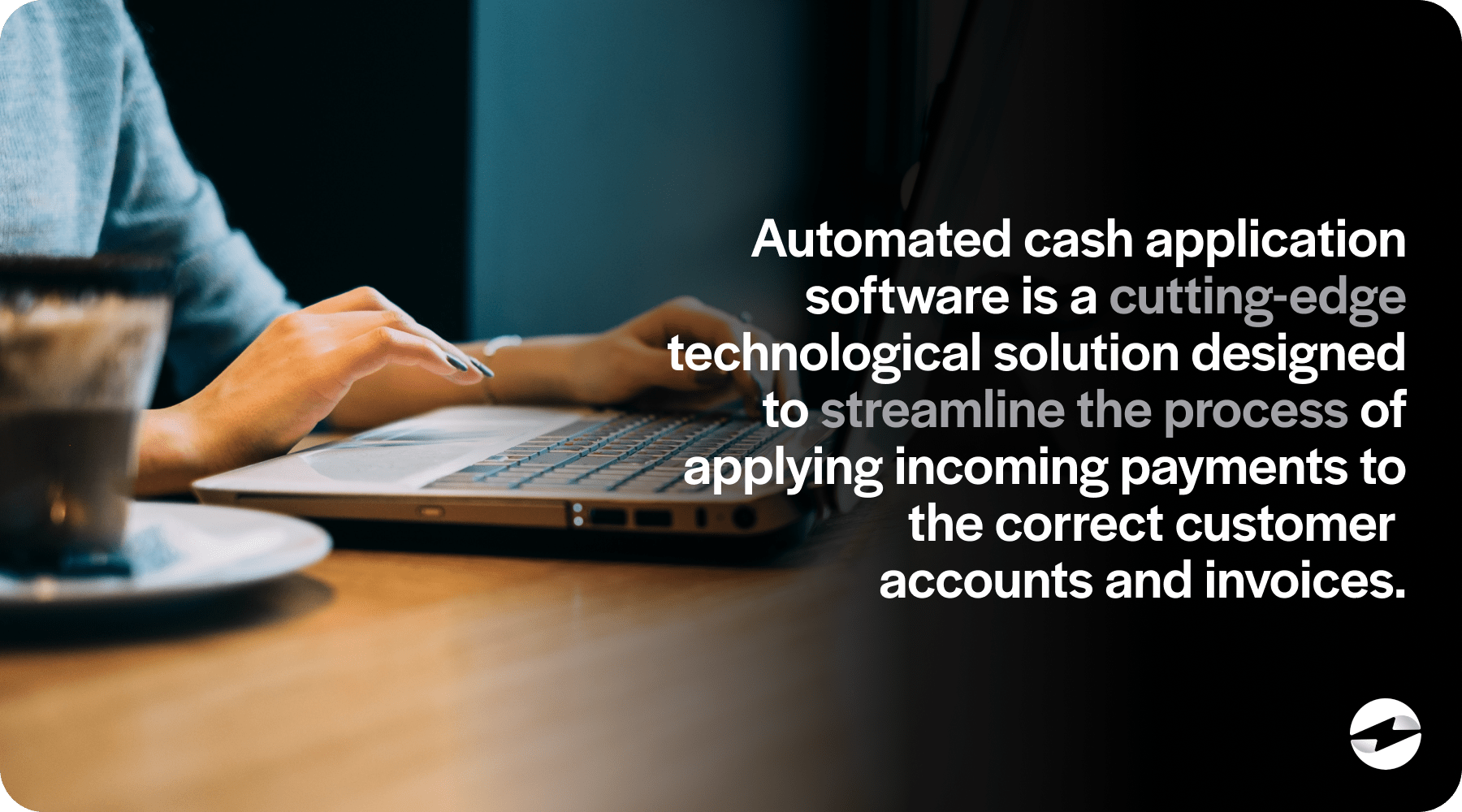

What is automated cash application software?

Automated cash application software is a cutting-edge technological solution designed to streamline the process of applying incoming payments to the correct customer accounts and invoices.

Traditionally, this could be labor-intensive, with cash application specialists manually cross-referencing payments to invoices, a process prone to human error and inefficiency. Now, automated cash application software employs artificial intelligence and machine learning to automatically match payments received via various payment methods, like credit cards, wire transfers, and electronic payments, to their corresponding invoices. This mitigates the need for manual data entry or interpretation of remittance advice, allowing for a more accurate and expedient reconciliation process.

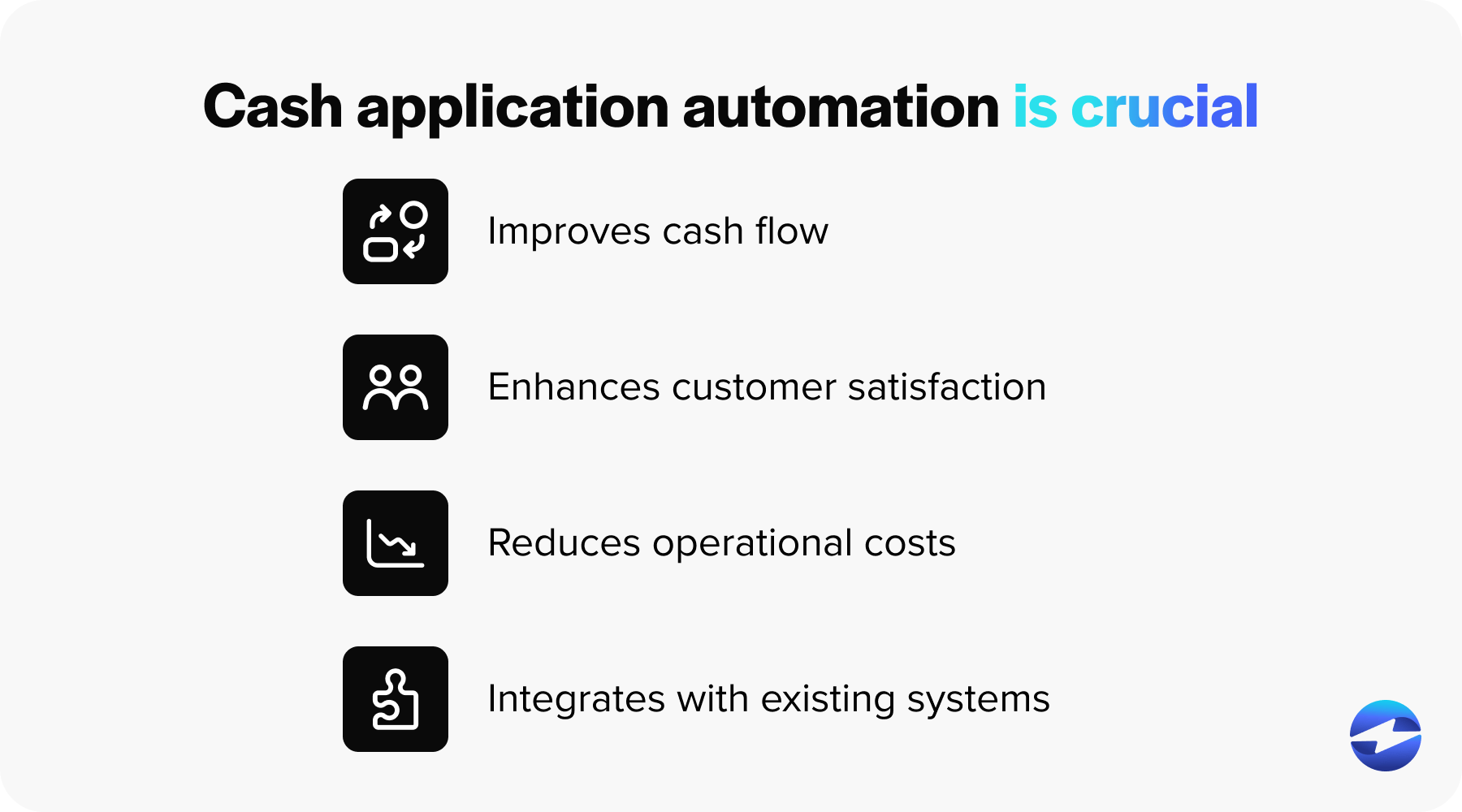

Why is cash application automation crucial for businesses?

Cash application automation is imperative for businesses due to its significant impact on operational efficiency and financial health.

Here are a few reasons why it’s become crucial:

- Improves cash flow: Rapid and accurate application of incoming payments ensures that a business’s cash flow is updated in real time.

- Enhances customer satisfaction: Faster payment processing can minimize discrepancies and disputes with customer accounts.

- Reduces operational costs: Automated cash application solutions eliminate the need for a large team, cutting labor costs.

- Integrates with existing systems: Good cash application software typically integrates seamlessly with enterprise resource planning (ERP) systems, further enhancing automation across accounts receivable (AR) processes.

By deploying cash application automation software, businesses can ensure their receivable teams focus on more strategic tasks rather than getting bogged down with manual processes, enhancing overall productivity and operational agility.

What is remittance data?

Remittance data is the detailed information accompanying a payment, indicating the purpose of the payment and instructing the recipient on how to apply it against outstanding invoices.

Remittance data comes in many forms, such as checks, bank transfers, or electronic remittance formats. This data is crucial for businesses accurately attributing received funds to the corresponding AR.

Why is it common for remittance data to be disorganized?

Disorganized remittance data is often due to the variety and complexity of payment methods and documentation provided by different customers.

Customers may use different formats, such as PDFs, emails, or even paper documents, to provide payment instructions. Each customer might also have a unique layout or protocol for indicating the relevant payment details, leading to inconsistencies and difficulty in processing this information efficiently.

Digitizing remittance data with cash application automation software

Cash application automation software is instrumental in applying payments to invoices and managing and digitizing remittance data.

Typically, remittance information accompanies payments and specifies what invoices or bills the payment covers. Automating this aspect of the cash application process means reducing the time spent deciphering various remittance formats and manually entering data into systems.

By leveraging this technology, companies can convert disparate remittance data into a structured, digital format, easing the application of payments and enhancing visibility into transaction details.

What is Optical Character Recognition (OCR), and how does it digitize remittance information?

Optical Character Recognition (OCR) is a technology that converts different types of documents, such as scanned paper documents, PDFs, or images captured by a camera, into editable and searchable data.

In the context of cash applications, OCR can scan remittance advice and automatically extract payment details. This advanced technology can recognize and interpret characters, as well as the layout of the information, thus digitizing the remittance details without manual input.

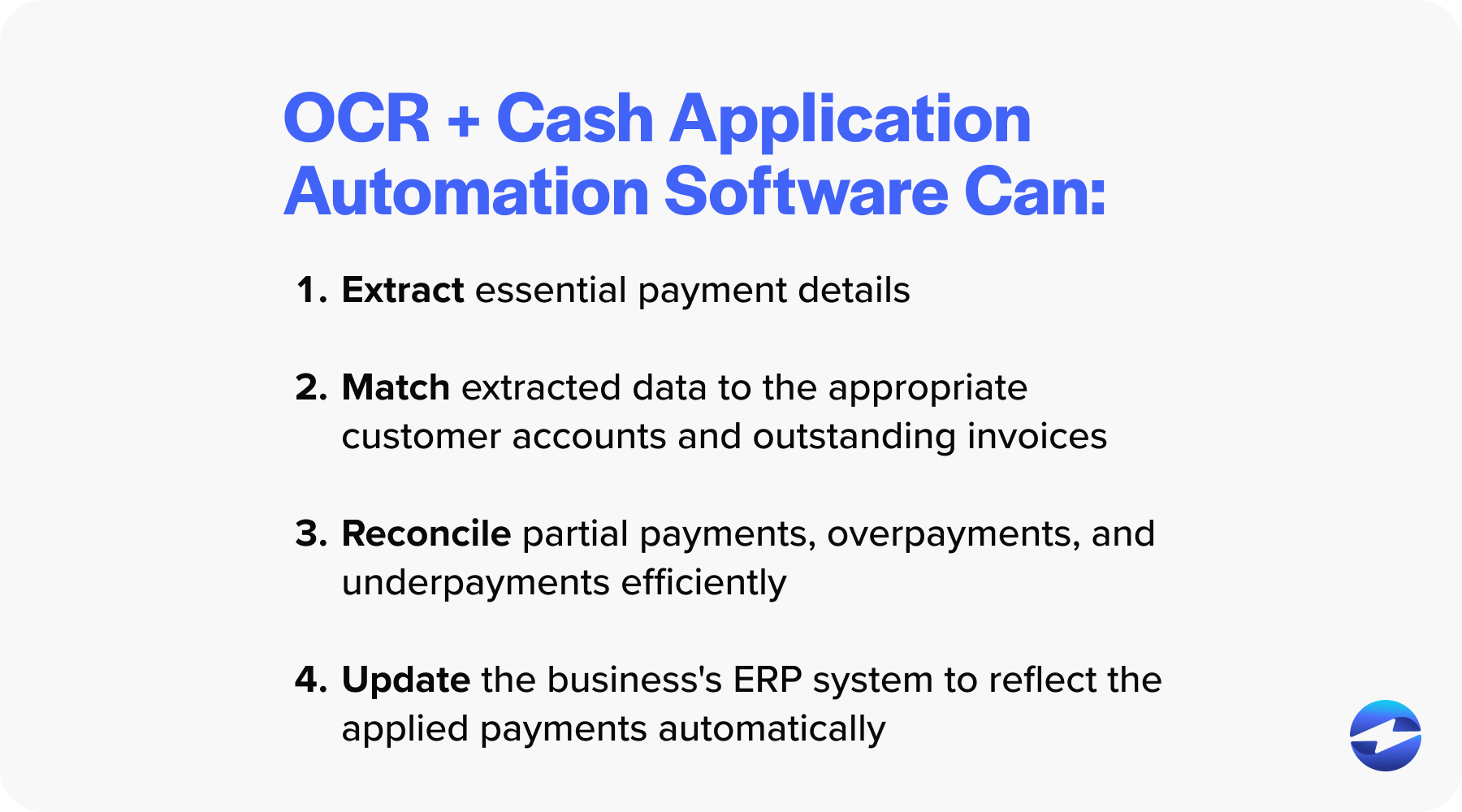

Capturing remittance data with OCR and cash application automation software

Cash application automation software with OCR capability can capture and consolidate remittance data from various sources and formats, interpreting it intelligently to match payments accurately to invoices. It handles critical steps in the process, including:

- Extracting essential payment details from remittance documents

- Matching extracted data to the appropriate customer accounts and outstanding invoices

- Reconciling partial payments, overpayments, and underpayments efficiently

- Updating the business’s ERP system to reflect the applied payments automatically

This automation dramatically mitigates the potential for manual errors, reduces operational costs, and accelerates the cash application process.

By centralizing and organizing payment and remittance data, businesses enjoy the dual benefit of efficiency and improved financial health while delivering better customer service through quicker and more accurate account reconciliation.

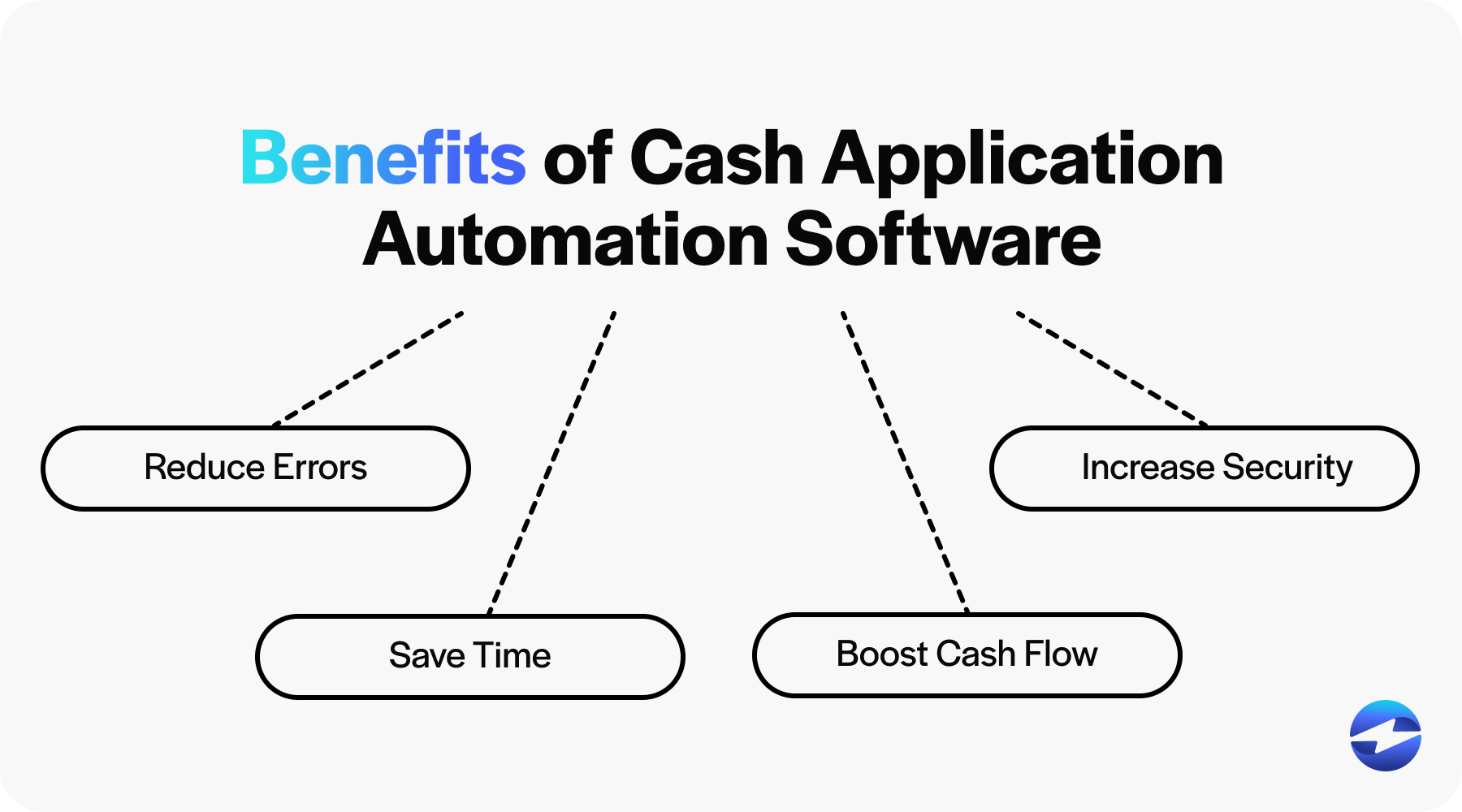

4 benefits of cash application automation software

Cash application automation software offers significant advantages for businesses by streamlining the process of matching incoming payments to their corresponding invoices.

Implementing this payment technology can help your business reduce errors, save time, boost cash flow, and increase security.

1. Reduced errors

Cash application automation software significantly reduces errors by leveraging advanced algorithms and machine learning to match incoming payments accurately with their respective invoices.

Unlike manual processes, prone to human error and inconsistencies, automation ensures that data is processed accurately and swiftly. This reduces the likelihood of misapplied payments, discrepancies, and the need for time-consuming corrections. By minimizing errors, businesses can improve their financial accuracy, enhance customer satisfaction, and maintain better financial records.

2. Saves time

Implementation of cash application automation software can yield substantial time savings. Tasks that previously required hours of meticulous manual work can now be completed in a fraction of the time.

Automated cash application expedites the process, from capturing and decoding remittance information to applying payments against the correct customer accounts. Productivity surges as staff are freed from the chains of manual efforts and can refocus their talents on more strategic activities within the business.

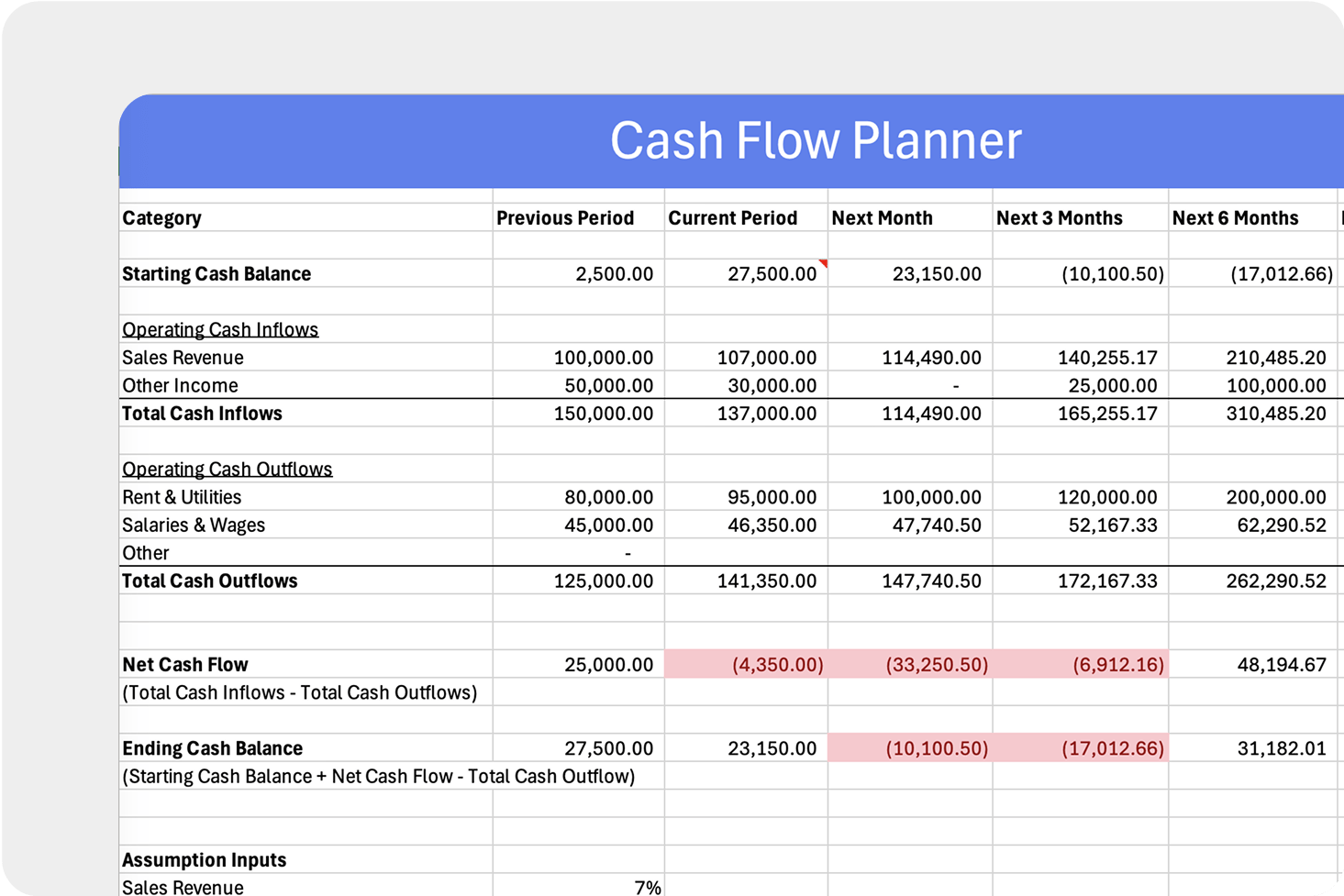

3. Boosts cash flow

Automated cash applications can directly impact AR operational efficiency, which dictates financial health and cash flow. Thankfully, automated cash application software enhances the visibility and speed at which payments are applied.

With faster processing, businesses can ensure their AR is up-to-date, reducing days sales outstanding (DSO) and improving the overall management of working capital. Enhanced cash flow allows for better budgeting, planning, and potential investment opportunities to propel the business forward.

4. Increases security

Security concerns are paramount when handling financial transactions. Cash application automation software offers robust security features that safeguard sensitive financial data.

By minimizing human touchpoints in the cash application process, the risk of fraud and data breaches is significantly lower. Moreover, audit trails are automatically generated, providing clear and comprehensive records that support compliance with financial regulations and corporate policies.

How do cash application automation solutions handle exceptions and complex matching scenarios?

Cash application automation solutions excel in managing exceptions and intricate matching scenarios that frequently challenge manual cash application processes.

When payments don’t correspond to outstanding invoices — due to partial payments, multiple invoice numbers lumped into a single transaction, or even discrepancies arising from human error — the cash application software simplifies matters.

These sophisticated systems harness artificial intelligence and machine learning to intelligently match payments to invoices, even when remittance advice is unclear or incomplete. They can automatically parse and apply remittance information from various payment methods, including wire transfers, electronic payments, and more.

Cash application automation software employs robotic process automation to flag these exceptions when a perfect match isn’t possible. It prompts cash application specialists to intervene to review manually, ensuring customer account accuracy and financial health.

Revolutionize your business with cash application automation software

Cash application automation software marks a revolutionary step forward in managing finance operations. Automated cash application frees businesses from labor-intensive manual operations, allowing them to focus on more strategic tasks.

By connecting seamlessly with customer accounts and ERP systems, cash application automation reduces the cash application challenges associated with remittance advice and varying payment methods.

Businesses looking to optimize their cash process consider cash application software an indispensable tool that cements a more streamlined and prosperous future.