Blog > EBizCharge vs. Epicor Payment Exchange: Direct Comparison

EBizCharge vs. Epicor Payment Exchange: Direct Comparison

If you’ve been using Epicor for a while, there’s a good chance you’ve reached the point where payments deserve a closer look. Early on, payment processing often feels secondary. Invoices go out, payments come in, and the system works well enough.

That tends to change as payments grow, though. Transaction volume increases, payment methods multiply, and customers expect more flexibility. Finance teams start paying closer attention to fees, posting delays, and manual work that once felt manageable.

This is usually when Epicor users begin comparing Epicor Payment Exchange with third-party options like EBizCharge Epicor integrations. The goal is to find the best Epicor payment solution that aligns with how the business actually operates.

If you’re responsible for AR, finance, or operations, you’re likely feeling this pressure firsthand. This article is written for Epicor users evaluating that decision. It offers a practical, side-by-side Epicor payment processor comparison, focused on real workflows, long-term scalability, and day-to-day impact inside the Epicor ERP system.

Epicor Payment Exchange and EBizCharge: High-Level Overview

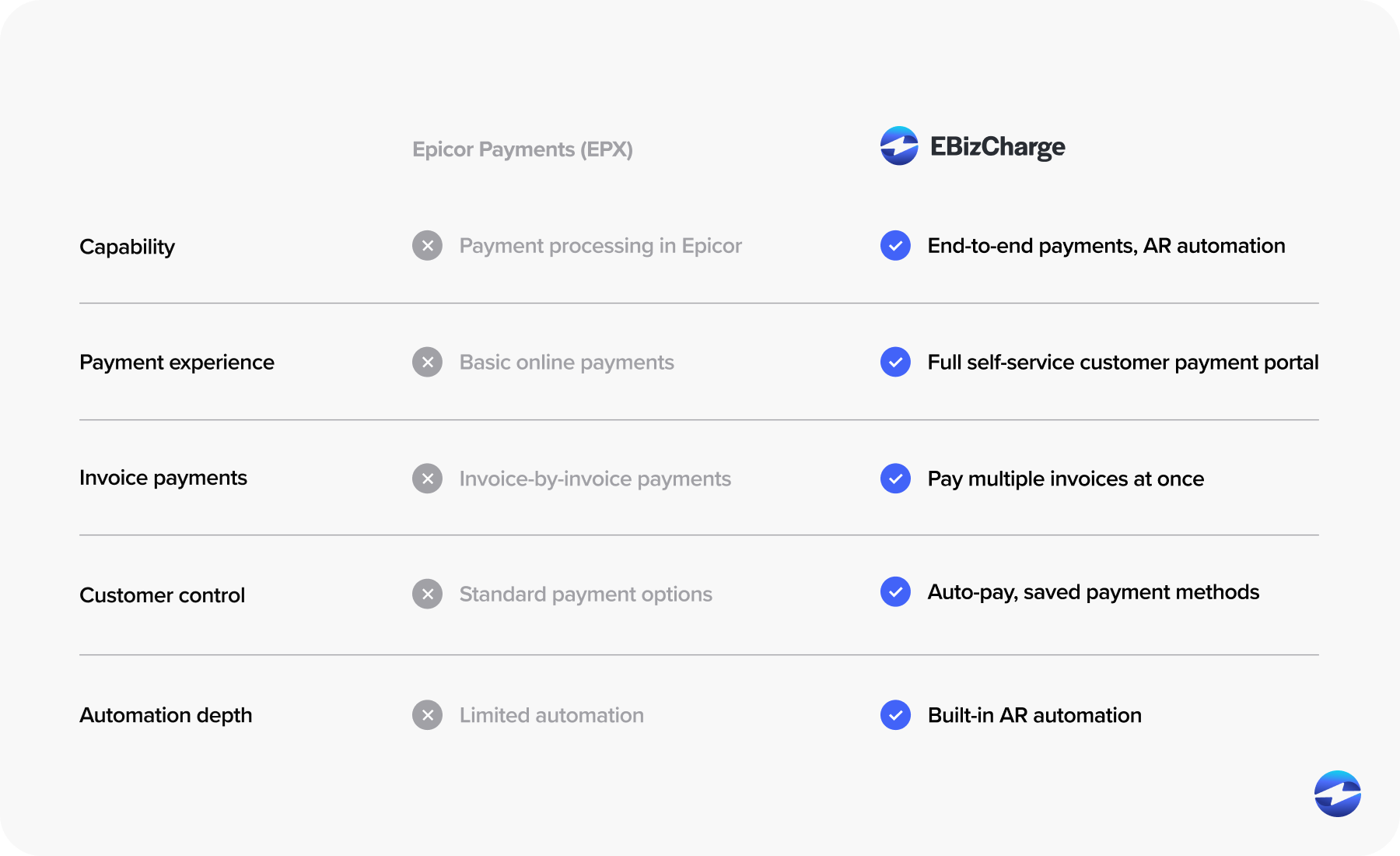

Epicor Payment Exchange, often referred to as EPX, is Epicor’s built-in payment offering. It’s designed to provide basic card processing within the Epicor ERP environment, keeping payments relatively close to core ERP workflows.

For organizations with simple needs, EPX can be a reasonable starting point. Smaller transaction volumes, limited payment methods, and straightforward billing structures tend to fit well within its capabilities.

EBizCharge takes a different approach. Rather than offering a baseline tool, it’s built as a full payment processing solution designed for deep Epicor integration. Payments are embedded into AR, invoice, and customer workflows instead of operating alongside them.

In practice, EPX tends to fit best early in an Epicor lifecycle, while EBizCharge Epicor integrations are often evaluated as requirements become more complex. Understanding that distinction helps frame the rest of the comparison.

Integration Depth and Daily Workflow Impact

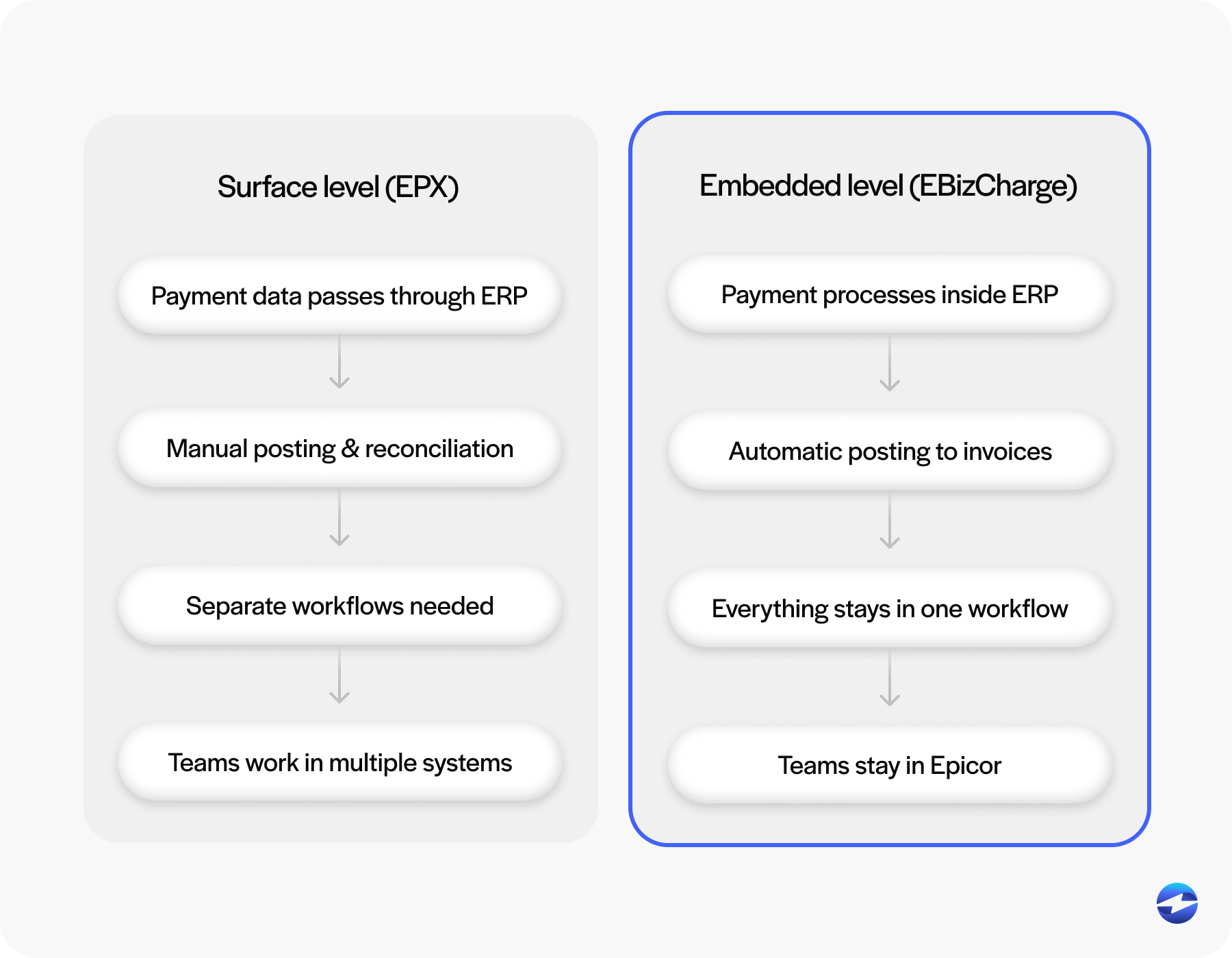

Integration depth is where most Epicor users first notice the difference.

EPX provides functional integration with the Epicor ERP system, but it’s relatively shallow. Payment data flows in and out, but many steps still require manual involvement. Posting delays, duplicate entries, and reconciliation work are common, especially as volume grows.

EBizCharge focuses on deeper Epicor integration. Payments can be accepted, processed, and posted directly within Epicor screens that teams already use. This reduces duplicate work and keeps payment data aligned with invoices, customers, and jobs.

This matters across Epicor versions. Whether you’re running Epicor 10 or Epicor Kinetic, integration quality affects how much time teams spend managing payments versus managing exceptions. Over time, deeper integration becomes a deciding factor in choosing the best Epicor payment solution.

Payment Capabilities and Flexibility

Payment needs in Epicor environments tend to vary more than teams expect, especially as the business grows.

EPX covers the basics. It supports standard credit card transactions and limited ACH functionality, which can work well when billing is simple and consistent. As soon as payment scenarios become more nuanced, however, that simplicity can start to feel restrictive.

EBizCharge is designed to handle a wider range of real-world situations. ACH payments, recurring billing, deposits, partial payments, and Level 3 credit card processing are all supported. This flexibility is especially important for discrete manufacturers, job shops, and industrial manufacturers using Epicor, where billing terms and customer expectations often differ from one order to the next.

Rather than forcing teams to adapt their processes to the limits of the system, flexible payment capabilities allow payment workflows to align more closely with how customers actually prefer to pay.

Fees, Cost Control, and Optimization

Fees often become the tipping point in an Epicor payment processor comparison.

EPX offers limited visibility and optimization options around processing costs. As transaction size and volume increase, Epicor users often start asking harder questions about fee structure and long-term cost impact.

EBizCharge provides more flexibility in how transactions are routed and processed. Support for Level 3 data, ACH payments, and alternative methods gives Epicor users more tools to manage fees intentionally.

Over time, that control can have a meaningful impact on margins. For organizations processing high-dollar B2B payments, cost optimization is a major reason EBizCharge is considered the best Epicor payment solution.

Cash Flow, DSO, and Automation Outcomes

Cash flow is often where the difference between payment tools becomes impossible to ignore.

With EPX, payments can post later than expected, which means finance teams end up following up manually just to confirm what’s already been paid. That delay creates a gap between when an invoice goes out and when accounts receivable reflects reality, slowing down collections in the process.

EBizCharge takes a more automated approach. Payments post quickly and consistently through tight Epicor integration, giving teams clearer, real-time visibility into payment status. Automated payment entry, customer payment portals, and recurring billing all work together to help reduce days sales outstanding (DSO) without adding extra steps.

For finance teams working inside the Epicor ERP system, this shift from reacting to payment issues to managing a predictable process can significantly change how time and attention are spent day to day.

Security, PCI Compliance, and Risk Management

Security is a critical part of payment processing in any Epicor environment, not something that can be treated as an afterthought.

Both EPX and EBizCharge support PCI compliance, but they take different approaches to managing risk. EPX provides baseline protections that can be sufficient in simpler setups with lower volume and fewer payment scenarios.

EBizCharge is designed to reduce PCI scope as much as possible. Through tokenization, encryption, and secure payment portals, card data never needs to live inside the Epicor ERP. That reduces exposure and makes compliance responsibilities easier for internal teams to manage.

For organizations handling higher transaction volumes or more complex payment workflows, this approach to security tends to scale more smoothly and remain easier to maintain over time.

Why Manufacturers Switch from Epicor Payment Exchange

Most manufacturers don’t switch payment systems on a whim. The decision usually follows a series of frustrations. Manual posting volumes increase, payment workflows feel rigid, fees become harder to justify, and reporting lacks clarity when issues arise.

As discrete manufacturers, job shops, and industrial manufacturers scale inside Epicor software, payment processing becomes too important to tolerate inefficiency. That’s when EBizCharge enters the conversation.

The move is less about replacing EPX and more about choosing a payment processor that aligns with how the business has evolved.

Finding The Right Fit for Your Business

Choosing between Epicor Payment Exchange and EBizCharge comes down to long-term fit.

EPX can work well for basic payment needs, especially early in an Epicor lifecycle. As complexity increases, deeper integration, automation, and cost control become more important.

For Epicor users evaluating the best Epicor payment solution, EBizCharge stands out for its deep Epicor integration, flexible payment capabilities, and focus on automation across the Epicor ERP system.

The right choice depends on where your organization is today and where it is headed next. For many growing Epicor users, EBizCharge represents a payment strategy built for the future rather than a workaround for the present.