EBizCharge: A Comprehensive GunBroker Payment Gateway

EBizCharge: A Comprehensive GunBroker Payment Gateway

EBizCharge is a firearm-friendly gateway that keeps you compliant, lowers fees, and protects your business.

The best payment gateway for GunBroker is EBizCharge, a firearm-friendly gateway designed to help GunBroker sellers operate smoothly, reduce processing costs, and stay compliant in a highly regulated environment.

In recent years, firearm sales in the U.S. have experienced a significant surge, fueled by a combination of shifting consumer interests, legislative discussions, and growing demand for personal protection and outdoor recreational activities.

As the market continues to grow, GunBroker has emerged as one of the most trusted and widely used online platforms for buying and selling firearms, ammunition, and accessories. With its auction-style format and focus on legal & compliant transactions, GunBroker provides an essential space for firearm enthusiasts, collectors, and licensed dealers to connect.

As the volume of online firearm transactions increases, so does the need for reliable, secure, and firearm-friendly payment solutions. In this article, you’ll learn what high-risk merchant accounts for the firearms industry entail, the common challenges GunBroker users face, and why EBizCharge is the most optimal payment gateway for these users.

What is GunBroker?

GunBroker is an online auction platform designed specifically for firearms, hunting gear, and related outdoor accessories. Established as a traditional firearms marketplace platform, it provides a comprehensive and user-friendly platform for individuals and businesses to legally purchase and sell firearms, ammunition, and accessories.

GunBroker acts as a bridge between buyers and licensed firearms dealers or Federal Firearm License (FFL) holders, ensuring all transactions comply with applicable laws and regulations. It’s especially popular among gun enthusiasts and collectors due to its vast selection and competitive pricing.

Whether you’re a seasoned collector or a first-time buyer, GunBroker provides a streamlined listing process and a straightforward account checkout process, making it a trusted and reliable platform in the firearm industry.

Since the nature of GunBroker involves firearms sales, it operates within a high-risk industry, meaning there are certain hurdles to overcome before you can start selling.

How to Get Paid on GunBroker

If you’re new to selling on GunBroker, here’s a quick overview of how the payment process works:

- Set up your seller account. Verify your identity, provide your business information, and upload your FFL documentation if you’re a licensed dealer.

- Choose your accepted payment methods. Select which options you’ll accept when creating a listing, such as GunBroker Pay, money orders, cashier’s checks, or a third-party payment gateway.

- Complete the sale. Once a buyer wins your auction or purchases at your fixed price, they submit payment through the agreed-upon method.

- Ship the item and provide tracking. For GunBroker Pay transactions, funds are held in escrow until you enter a valid tracking number. Firearms must ship to the buyer’s designated FFL dealer.

- Receive your funds. After delivery confirmation, GunBroker releases payment to your bank account. Using an external gateway with same-day funding can significantly speed up this timeline.

What Is GunBroker Pay and How Does It Work?

GunBroker Pay is the platform’s built-in payment system that lets buyers pay for items directly through GunBroker using a credit card, debit card, or bank transfer. When a sale is completed, GunBroker Pay collects the buyer’s payment and holds it in escrow until the seller ships the item and provides tracking. Once delivery is confirmed, funds are released to the seller’s bank account, usually within 3 to 5 business days.

It’s a solid option for casual sellers, but higher-volume merchants often run into limitations. The fees can add up quickly, and there’s limited flexibility when it comes to reporting, payment customization, or syncing with your accounting and ERP systems. That’s why many active GunBroker sellers pair the platform with a dedicated third-party payment gateway for lower rates, faster payouts, and deeper integration with their existing tools.

Challenges facing GunBroker sellers

GunBroker sellers may face some challenges that can impact their ability to effectively manage and grow their businesses.

GunBroker sellers may find it difficult to navigate the complex regulations associated with selling firearms. This includes adhering to federal, state, and local laws, which can vary significantly and require careful attention to details, such as licensing and background checks.

It may also be challenging to find suitable payment processing solutions, as many traditional payment processors steer clear of firearms transactions. This can make it tough for sellers to find reliable and gun-friendly credit card processing services that offer competitive rates and comprehensive security features.

Luckily, EBizCharge works closely with merchants in high-risk industries (like firearms) to streamline payment operations and offset high processing fees.

What is a high-risk merchant account?

If you operate in the firearm industry, you know how challenging it can be to secure reliable payment processing. That’s where a high-risk merchant account comes in.

A typical merchant account is a type of business account that enables you to accept and process credit card payments in person, online, or over the phone. In contrast, a high-risk merchant account is a specialized payment processing account designed for businesses operating in industries with elevated risk factors, such as those with high chargebacks, regulatory scrutiny, or reputational concerns.

High-risk merchant accounts are specifically designed to support businesses in regulated sectors, such as those involved in the sale of firearms. These accounts offer the flexibility to accept a wide range of payment types, manage large transaction volumes, and handle occasional chargebacks – all while staying compliant with industry regulations. Best of all, they open the door to greater opportunities by allowing you to reach more customers and expand your market.

For firearm businesses, a high-risk merchant account is crucial, as traditional banks and payment processors often avoid industries with complex regulations and higher perceived risks.

With a high-risk merchant account in place, the next step is to ensure you have the best software to efficiently and securely process transactions. This is where choosing the right gateway becomes essential, especially when selling on platforms like GunBroker, where speed, security, and compliance directly impact your ability to convert sales and grow your business.

GunBroker Credit Card Fees: What Sellers Should Expect

Credit card processing fees are one of the biggest ongoing costs for GunBroker sellers, and the pricing model you’re on makes a real difference.

GunBroker Pay uses a flat-rate model, meaning you pay the same percentage on every transaction regardless of card type. That’s simple, but it also means you’re overpaying on debit cards and lower-cost card categories. An interchange-plus model, which is what EBizCharge uses, bases your fee on the actual interchange rate set by the card networks plus a small markup. For B2B sellers processing purchasing cards or government cards, Level 2 and Level 3 data processing can reduce those rates even further.

| Fee Type | Flat-Rate (Typical) | Interchange-Plus |

|---|---|---|

| Credit card transactions | 2.5% – 3.5% + per-transaction fee | Interchange rate + small markup |

| Debit card transactions | Same flat rate | Lower interchange (often under 1%) |

| B2B / Purchasing cards | Same flat rate | Reduced with Level 2/3 data |

| Chargeback fees | $15 – $35 per incident | Competitive, with fraud prevention tools |

Sellers processing $10,000 or more per month can often save hundreds annually just by switching to interchange-plus pricing.

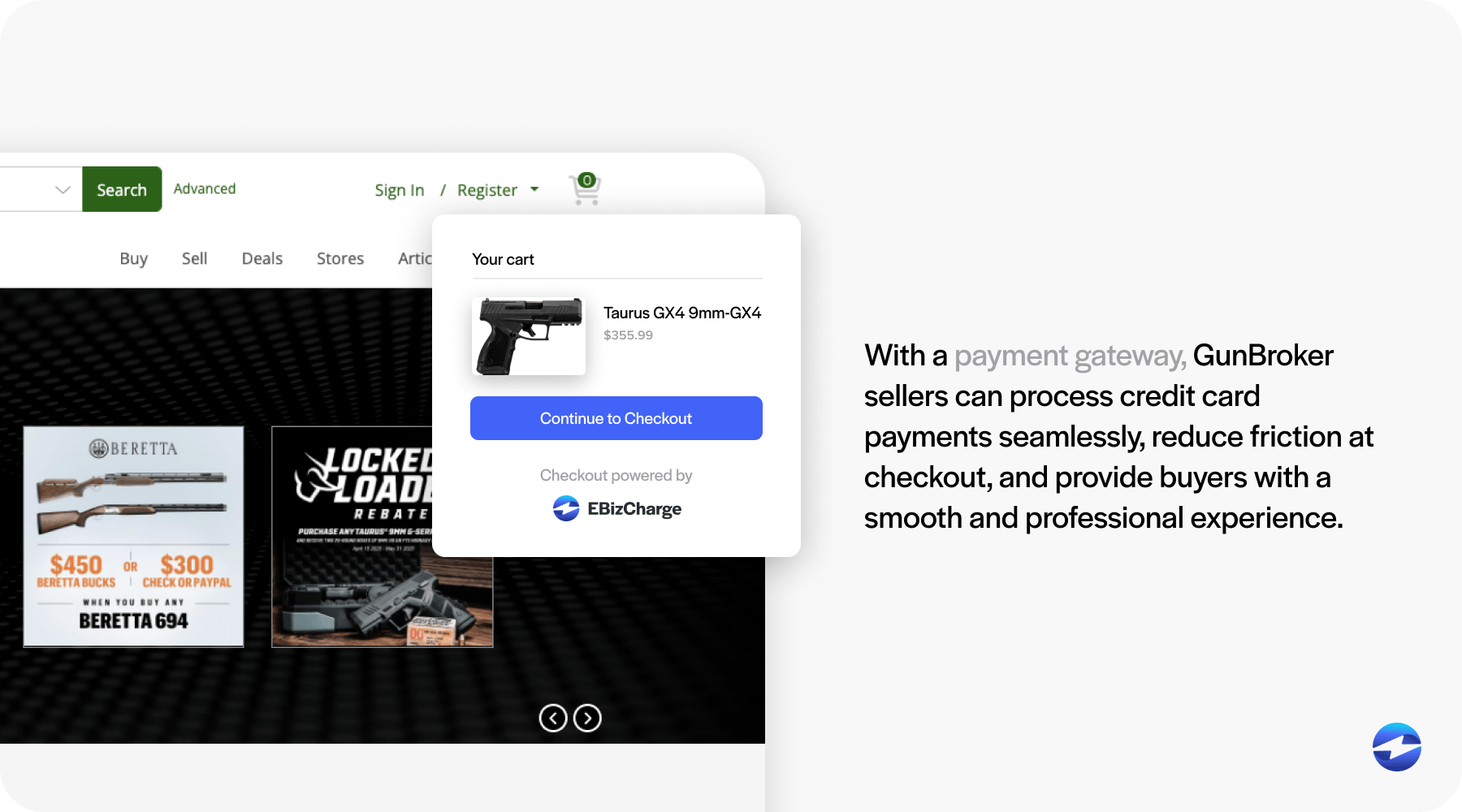

The importance of a payment gateway

GunBroker connects merchants with a large, active customer base, but closing a sale doesn’t stop at listing your inventory. GunBroker merchants must have a reliable payment gateway.

A payment gateway is a technology that securely captures your customer’s payment information and authorizes the transaction. For GunBroker sellers, this means you can process credit card payments seamlessly, reduce friction at checkout, and provide buyers with a smooth and professional experience.

More importantly, a firearm-friendly gateway ensures compliance with federal and state regulations while offering protections against fraud and chargebacks – critical concerns in this high-risk space.

To complete their transactions successfully, GunBroker businesses need a payment gateway that’s not only fast and dependable but also tailored to the unique needs and regulatory challenges of the firearm industry.

Without a dedicated payment gateway, you risk delayed payments, transaction failures, or even account shutdowns due to processor restrictions.

Using a gateway built for the firearm industry enables you to accept payments confidently, scale your business, and maintain your presence on GunBroker without the fear of being dropped by your provider. It’s not just convenience – it’s a competitive advantage.

Finding the best payment gateway for GunBroker

Many of the biggest names in payment processing either restrict or outright prohibit firearm-related transactions. If you’ve ever had an account shut down or an application denied because of your industry, you know the frustration. Not all payment gateways are equipped to handle the specific requirements of the firearm industry, so it’s important to select a gun-friendly credit card processor that understands your business and is authorized to support firearm-related transactions.

Start by looking for a gateway that specializes in high-risk industries, particularly firearms and ammunition. These providers are more likely to have established relationships with acquiring banks that accept gun-related transactions and understand the regulatory landscape you operate in.

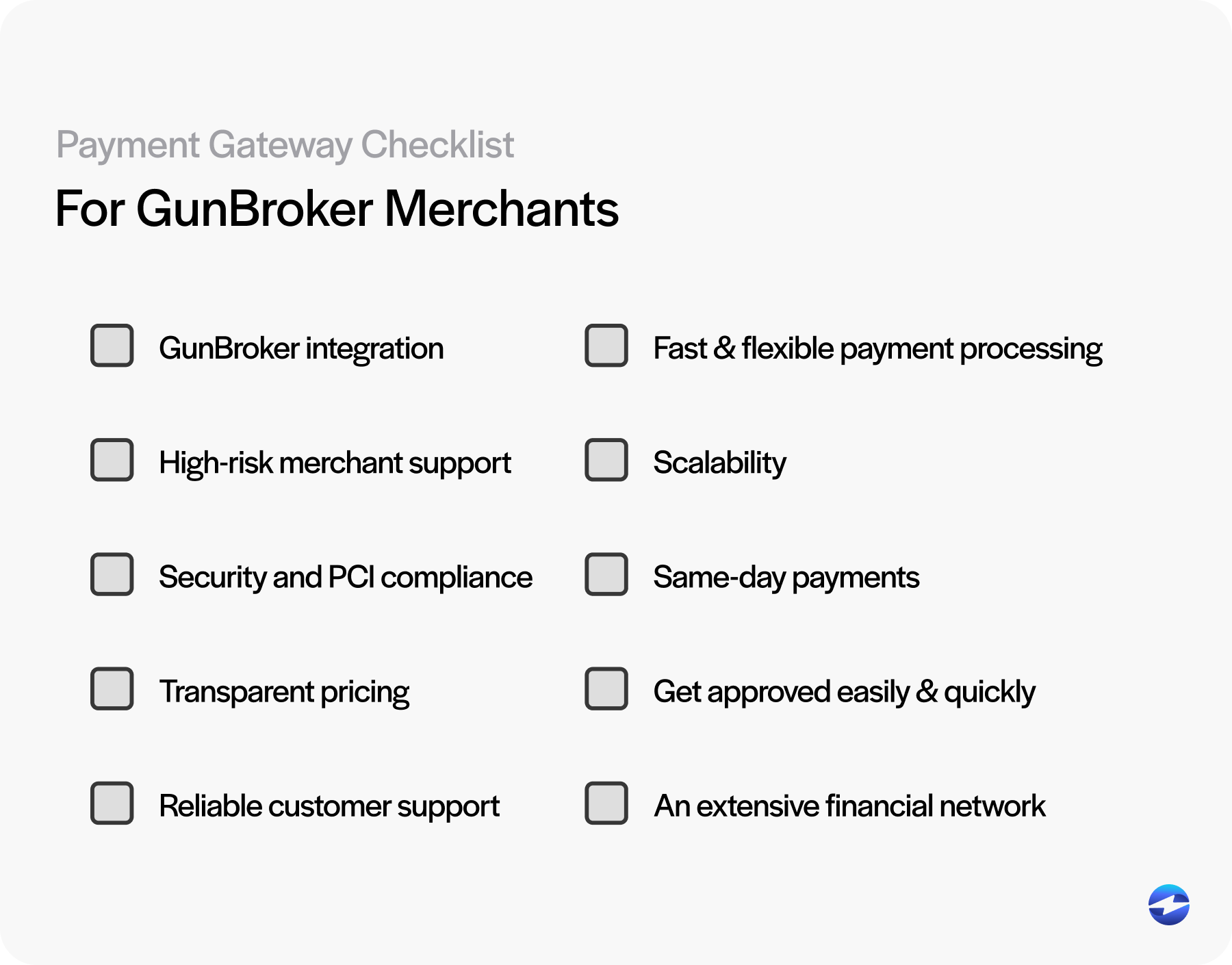

GunBroker merchants should also look for these ten features when choosing a payment gateway:

- GunBroker integration: Your payment gateway should integrate smoothly with the GunBroker platforms to improve and accelerate checkout and payment processing operations. If you sell on multiple platforms, it should also be compatible with other eCommerce systems.

- High-risk merchant support: Look for a provider that specializes in serving high-risk merchants. These gateways are better equipped to handle the challenges firearm businesses face and can offer tailored solutions to meet your needs.

- Security and PCI compliance: Ensure the gateway is compliant with Payment Card Industry Data Security Standards (PCI DSS) and offers comprehensive security features, such as encryption, tokenization, and fraud prevention tools. This helps protect both your business and customers’ sensitive payment information.

- Transparent pricing: Choose a provider that offers clear, upfront pricing with no hidden fees. You should receive competitive rates that reflect your industry’s risk level and easy-to-understand billing statements.

- Reliable customer support: Your payment gateway provider should offer responsive, U.S.-based customer support with a quick setup process and extensive experience in the firearm space. Gateway support teams should be available via phone, email, or chat and provide onboarding and technical assistance when needed.

- Fast and flexible payment processing: Your payment gateway should offer flexible payment options and support for major credit cards, as well as Automated Clearing House (ACH)/eCheck payments. It should also provide fast deposit times, allowing you to maintain a healthy cash flow.

- Scalability: Choose a gateway that can scale with your business as it grows. Whether you’re a small seller or managing a large operation, the solution should adapt to your evolving needs without disruptions.

- Same-day payments: Your payment gateway should offer same-day funding or expedited payment options. With same-day payments, GunBroker merchants can access their funds faster, reduce reliance on credit, and reinvest in their operations without delay.

- Get approved quickly and easily: A top-tier payment gateway will offer a streamlined approval process tailored for high-risk merchants, minimizing delays and paperwork. Look for providers that offer fast underwriting and responsive onboarding teams who understand the firearm industry’s nuances.

- An extensive financial network: A firearm-friendly payment gateway should provide access to a broader financial network of acquiring banks and payment partners that support high-risk industries. This network helps merchants maintain a reliable merchant account, even if other providers turn them away.

By selecting a payment gateway that checks all these boxes, your business will ensure faster, more efficient, secure, and compliant payment processing, leading to long-term success in a high-risk industry.

6 benefits of using the EBizCharge payment gateway for GunBroker

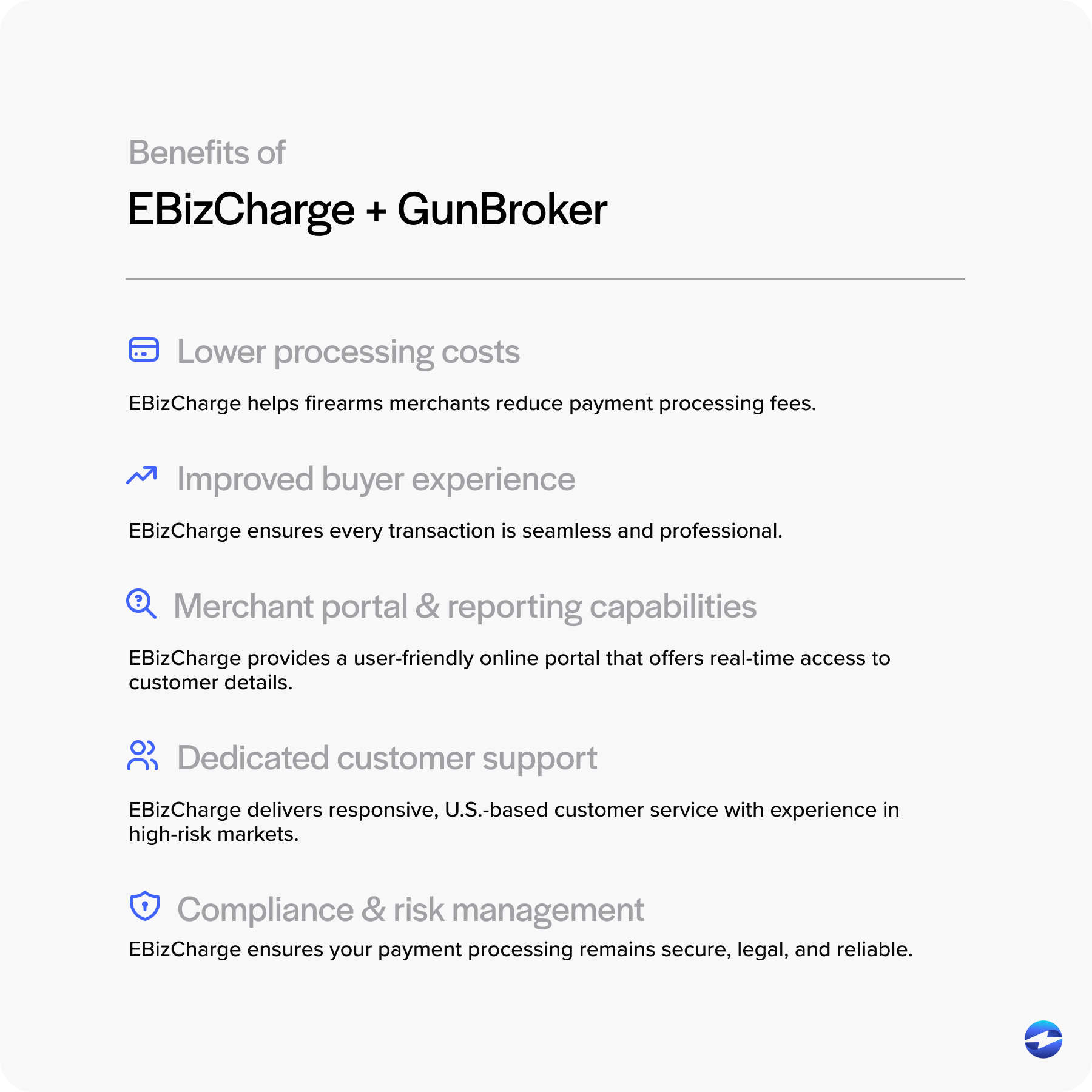

For firearm merchants operating on GunBroker, EBizCharge offers a powerful, all-in-one payment solution designed to meet the unique challenges of the industry.

Here are six ways EBizCharge transforms payment processing for GunBroker users:

- Lower processing costs: EBizCharge helps firearms merchants reduce their payment processing fees through powerful interchange optimization and level 2 and 3 processing capabilities. These features enable merchants to include enhanced transaction data, such as tax, invoice, details, and line-item breakdowns, which qualifies them for lower interchange rates set by card networks. This means more revenue stays in your pocket without sacrificing quality or service. EBizCharge offers competitive rates specifically tailored to firearm businesses.

- Improving buyer experience: Whether purchasing directly through GunBroker or via your own website, EBizCharge ensures that every transaction is seamless and professional. This ensures the best user experience, boosting customer trust and increasing repeat purchases.

- Merchant portal and reporting capabilities: EBizCharge provides a user-friendly online portal that offers real-time access to transaction history, settlement reports, chargeback details, and customizable analytics. This level of visibility helps you stay in control of your finances and make informed business decisions with ease.

- Dedicated customer support: When issues arise, you need support from a team that understands your industry. EBizCharge delivers responsive, U.S.-based customer service with experience in high-risk markets, such as firearms. From onboarding to ongoing technical support, you’ll have a dedicated team ready to help every step of the way.

- Compliance and risk management: Operating in the firearm industry means staying compliant with complex laws and regulations. EBizCharge supports your business with built-in PCI compliance tools, fraud prevention features, and risk mitigation strategies tailored to high-risk merchants. This ensures your payment processing remains secure, legal, and reliable.

- GunBroker Integrations: QuickBooks, WooCommerce, and More: EBizCharge integrates natively with over 100 ERP, accounting, and eCommerce platforms. For sellers using QuickBooks Online or Desktop, payment records, invoices, and settlement data sync automatically. If you’re also selling through WooCommerce, Shopify, BigCommerce, or Magento, EBizCharge connects there too, giving you a single gateway across all your sales channels. Larger FFL dealers running Sage, NetSuite, or Microsoft Dynamics get the same direct integrations, tying payment processing into existing workflows without the manual reconciliation.

From cost savings to compliance and customer support, EBizCharge empowers merchants with the tools they need to sell confidently, securely, and efficiently.

GunBroker Payment Options Compared

GunBroker sellers have several ways to accept payment, and each comes with trade-offs in terms of fees, speed, and security.

| Payment Method | Processing Fees | Payout Speed | Buyer Protection | Accounting/ERP Integration | Best For |

|---|---|---|---|---|---|

| GunBroker Pay | Standard per-transaction fee | 3-5 business days after delivery | Yes (escrow-based) | Limited | Casual or low-volume sellers |

| EBizCharge Gateway | Optimized interchange rates with Level 2/3 processing | Same-day or next-day funding available | Yes (PCI-compliant, fraud tools) | Yes (QuickBooks, ERPs, eCommerce) | High-volume sellers and FFL dealers |

| Money Order / Cashier’s Check | No processing fee | 7-14 days (mail + clearing) | Minimal | None | Buyers without credit cards |

| Personal Check | No processing fee | 10-21 days (mail + clearing + hold) | Low (bounce risk) | None | Not recommended |

| Wire Transfer | Bank fees vary ($15-$45 typical) | 1-2 business days | Moderate | Manual reconciliation | Large single transactions |

For sellers processing more than a handful of transactions per month, a dedicated payment gateway typically pays for itself through lower fees and faster access to funds.

EBizCharge transforms payment processing for GunBroker merchants

In a space where compliance, trust, and operational efficiency are non-negotiable, your choice of payment solution can either be a liability or a long-term asset.

As the firearms industry continues to evolve and expand in the digital marketplace, sellers on platforms like GunBroker need more than just a way to accept payments – they need a partner that understands the stakes, simplifies the process, and scales with their business.

EBizCharge doesn’t just meet those demands — it exceeds them by combining industry expertise with powerful technology and unwavering support. Whether you’re looking to improve profitability, reduce risk, or create a seamless checkout experience, EBizCharge offers the foundation you need to grow with confidence.

Frequently Asked Questions

What is the best payment gateway for GunBroker?

The best payment gateway for GunBroker is one that specializes in high-risk merchant processing, offers firearm-friendly support, and integrates with your existing business tools. EBizCharge is designed specifically for this, offering lower processing fees through interchange optimization, same-day funding options, and native integrations with QuickBooks, WooCommerce, and over 100 other platforms.

How does GunBroker Pay work?

GunBroker Pay is the platform’s built-in payment system. When a buyer completes a purchase, GunBroker Pay collects the payment and holds it in escrow until the seller ships the item and provides a tracking number. Once delivery is confirmed, the funds are released to the seller’s bank account, typically within 3 to 5 business days.

What are GunBroker’s credit card processing fees?

GunBroker Pay charges a processing fee on each transaction, usually following a flat-rate model. Sellers using third-party gateways like EBizCharge can often reduce their fees by offering competitive pricing and qualifying for Level 2 and Level 3 processing rates on B2B and government card transactions.

Can I use QuickBooks with GunBroker?

Yes. While GunBroker itself doesn’t have a native QuickBooks integration, using a payment gateway like EBizCharge allows you to sync your GunBroker payment data directly with QuickBooks Online or QuickBooks Desktop. This eliminates manual data entry and keeps your accounting up to date automatically.

Is it hard to get a merchant account for firearms?

It can be. Many traditional banks and payment processors classify firearms businesses as high-risk and either decline applications or impose restrictive terms. Working with a payment provider that specializes in high-risk industries, like EBizCharge, simplifies the approval process and gives you access to a network of acquiring banks that support firearm-related transactions.

What payment methods can GunBroker sellers accept?

GunBroker sellers can accept payments through GunBroker Pay (credit/debit cards and bank transfers), money orders, cashier’s checks, wire transfers, and third-party payment gateways. Offering multiple payment options helps sellers reach a wider audience and close more sales.

How do I get paid faster on GunBroker?

The fastest way to receive funds from GunBroker sales is to use a payment gateway that offers same-day or next-day funding. GunBroker Pay typically takes 3 to 5 business days after delivery confirmation. External gateways like EBizCharge can significantly reduce that timeline, keeping your cash flow healthier.

What is a gun-friendly payment processor?

A gun-friendly payment processor is a payment company that accepts and supports businesses in the firearms industry. These processors maintain relationships with banks that allow gun-related transactions, understand FFL and compliance requirements, and won’t shut down your account for selling legal firearms products.

GunBroker Pay vs. EBizCharge: What’s the difference?

GunBroker Pay is the platform’s native payment tool with basic processing capabilities and escrow-based payouts. EBizCharge is a full-service payment gateway that offers lower interchange rates, same-day funding, fraud prevention, chargeback management, and integrations with QuickBooks, ERPs, and eCommerce platforms. For sellers doing moderate to high volume, EBizCharge offers more control and lower costs.