Blog > Choosing the Right NetSuite Payment Processor: A Comprehensive Evaluation

Choosing the Right NetSuite Payment Processor: A Comprehensive Evaluation

Choosing the right payment processor isn’t just about handling credit card transactions—it’s about ensuring your entire finance system runs efficiently. For businesses using NetSuite, this decision is especially important. The right NetSuite payment processor can improve billing accuracy, automate receivables, and reduce hours of manual work every month.

This guide is for finance teams, IT leads, and NetSuite admins evaluating NetSuite payment processing partners. We’ll walk through what to look for, common pain points to avoid, and how to select a provider that fits your team’s day-to-day needs.

What Makes a Payment Processor NetSuite-Compatible

Not every payment provider plays well with NetSuite. True NetSuite payment partners support deeper functionality than simply processing transactions—they connect directly into your enterprise resource planning (ERP) workflows.

Here’s what compatibility should look like:

- A native or certified NetSuite payment processor integration (or support through a reliable connector)

- Real-time syncing of payments, refunds, fees, and deposits into the NetSuite ledger

- Payment Card Industry (PCI) compliant storage and tokenization to protect sensitive cardholder data

- Support for NetSuite billing cycles, payment schedules, and credit memos

These features ensure your NetSuite payment processing workflows stay tight, auditable, and easy to maintain.

Key Evaluation Criteria

Choosing between different NetSuite payment processors can be overwhelming if you don’t have a structured way to compare them. Each has unique strengths, and your choice will drive everything from how quickly payments get posted to how easily your employees can run reports. A clear evaluation framework leads you through what matters most – how the solution fits into your existing process and complements your finance goals.

When evaluating NetSuite payment processors, these criteria help separate the helpful from the headaches:

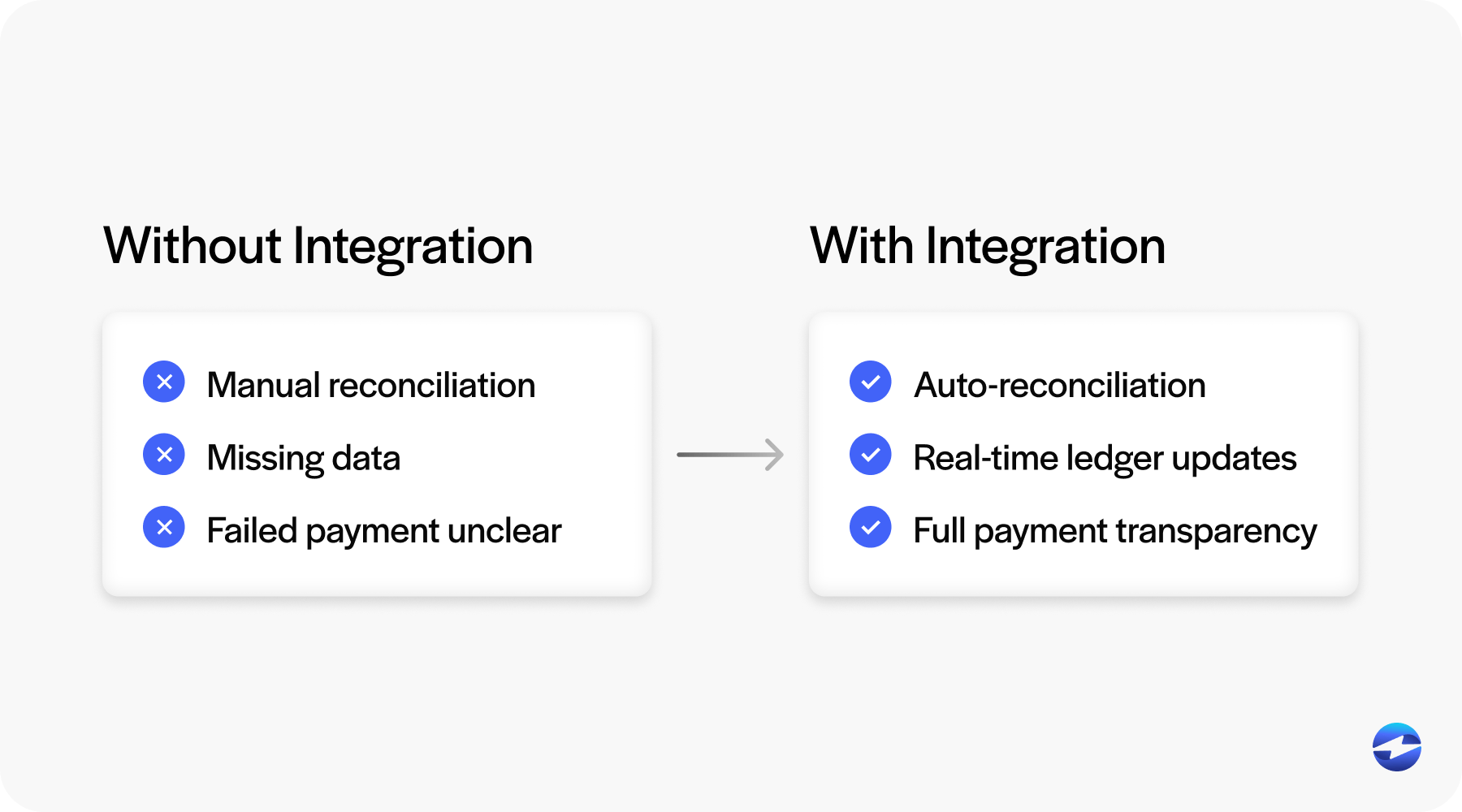

- Integration depth: Does it embed into NetSuite or operate externally? Embedded options reduce clicks and streamline reconciliation.

- Supported payment methods: Look for ACH, NetSuite credit card processing, eChecks, and international support if needed.

- Automation features: Automatically apply payments, reconcile deposits, and send reminders.

- Security and compliance: Ensure the solution is Payment Card industry Data Security Standards (PCI-DSS) compliant, supports tokenization, and has audit logs.

- Customer experience: Does it offer click-to-pay links, portals, or autopay options?

- Reporting and dashboards: Can you see payment status inside NetSuite in real time?

- Customer support: Look for onboarding help and ongoing support from the provider.

These criteria are more than just a checklist; they represent the operational backbone of how well your NetSuite payment processor will work in practice. The better the alignment, the smoother your daily AR processes will run.

Common Pain Points to Avoid

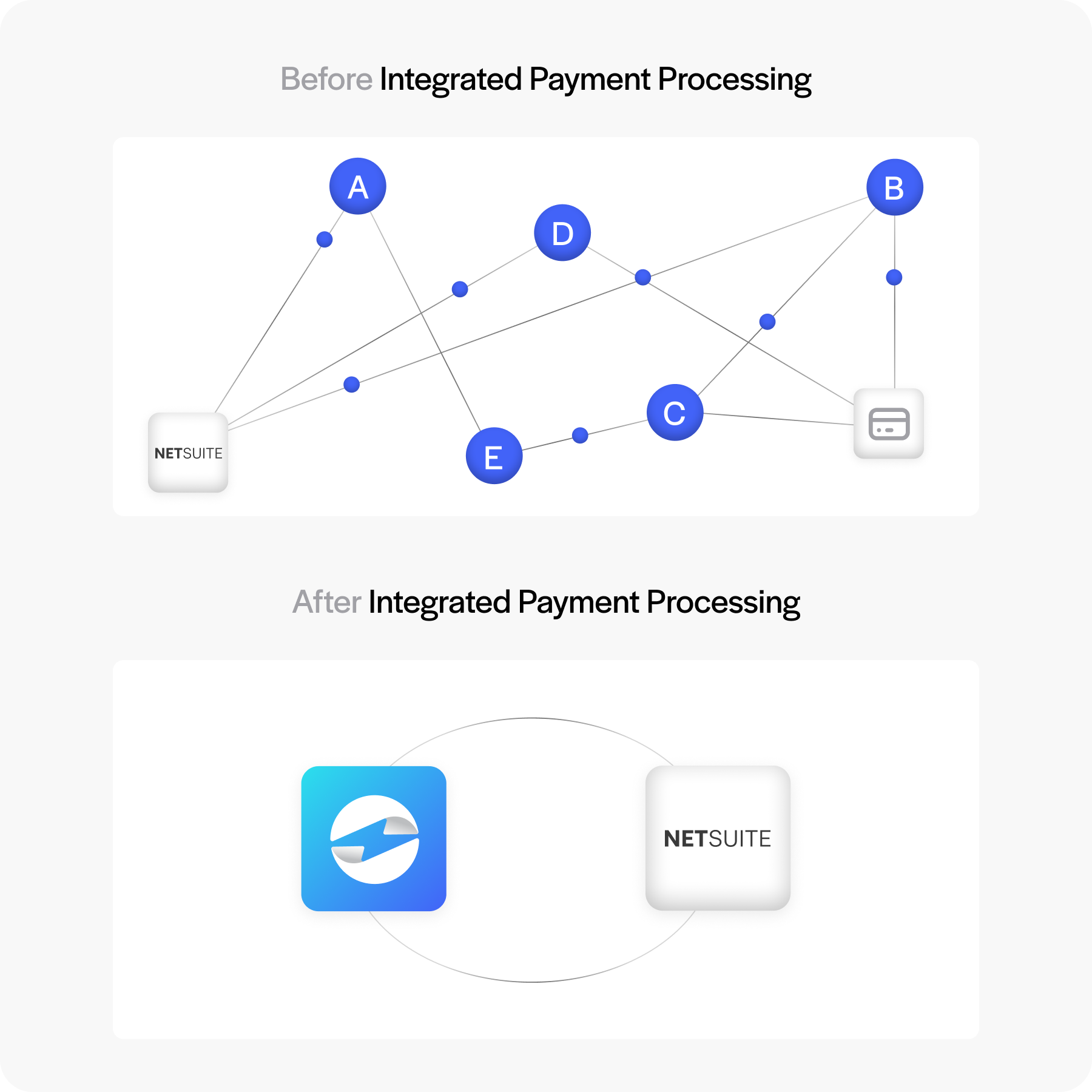

Even the best ERP systems can become a source of frustration if payments don’t flow smoothly through them. NetSuite is powerful, but without the right NetSuite payment processing solution, teams often find themselves compensating with manual workarounds and disconnected processes. These inefficiencies can creep in over time, especially as your transaction volume increases or your billing models become more complex.

Here are a few common pain points to avoid:

- Payment data that takes hours, or even days, to show up in NetSuite

- Manual reconciliation for every card deposit

- Lack of transparency when a payment fails or gets disputed

Connectors that break with every NetSuite update or lack proper documentation

These issues cost time and create reporting headaches. A reliable payment processing solution should help solve – not add to – your finance challenges. Taking the time to identify and avoid these pitfalls early will help you build a more stable and scalable foundation for your receivables process.

Decision Framework for Choosing the Right Fit

When choosing from available NetSuite payment processing partners, start by mapping your workflows. Where are the bottlenecks? What do your teams spend the most time managing? Once you have clarity on those pain points:

- Identify must-have features (real-time sync? self-service options? batch processing?)

- Book demos with your top 2–3 providers

- Ask about sandbox testing or trials

- Compare not just subscription cost, but total time savings over manual work

Ultimately, the best NetSuite payment processor will minimize friction while scaling with your business.

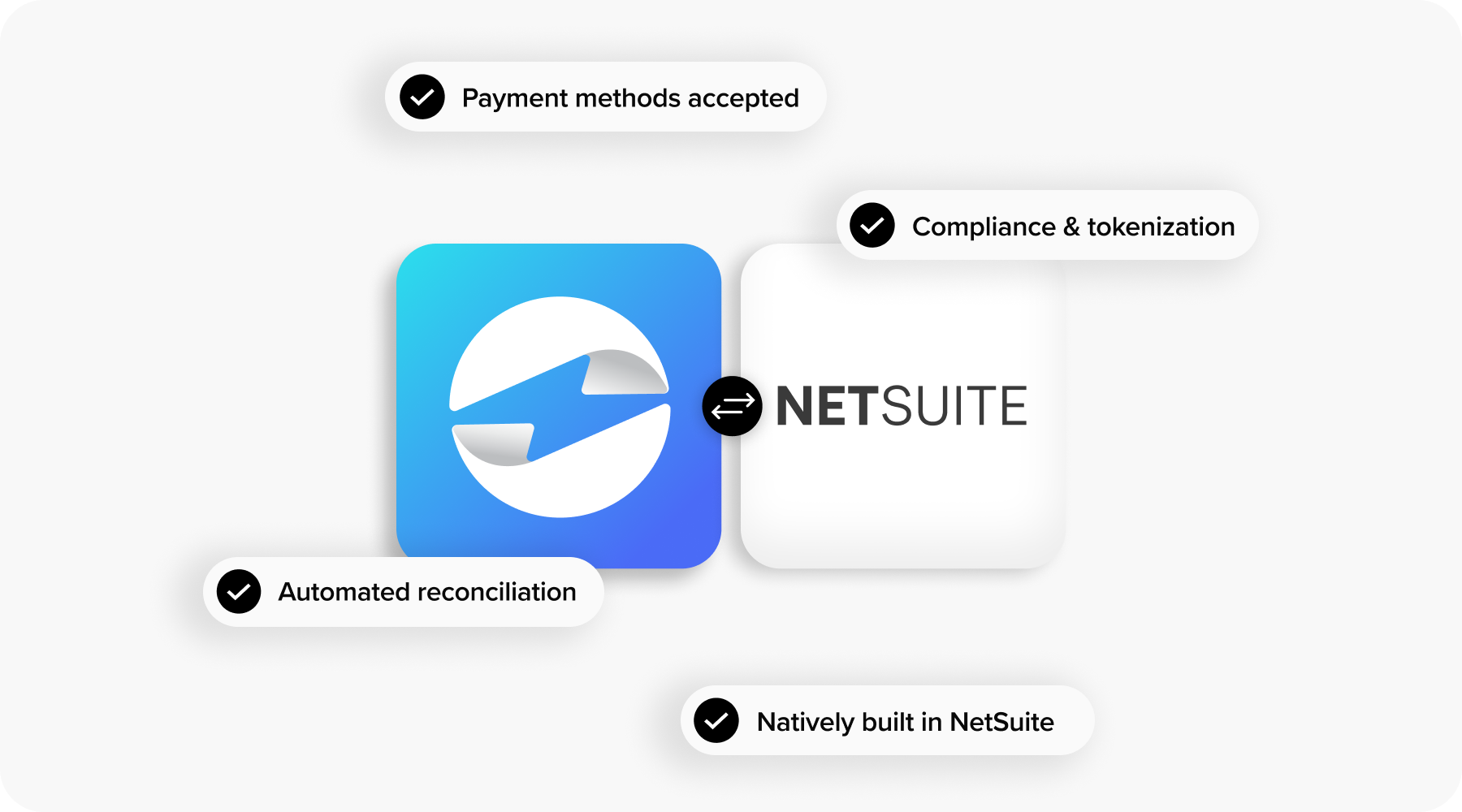

Why EBizCharge is a Strong Option

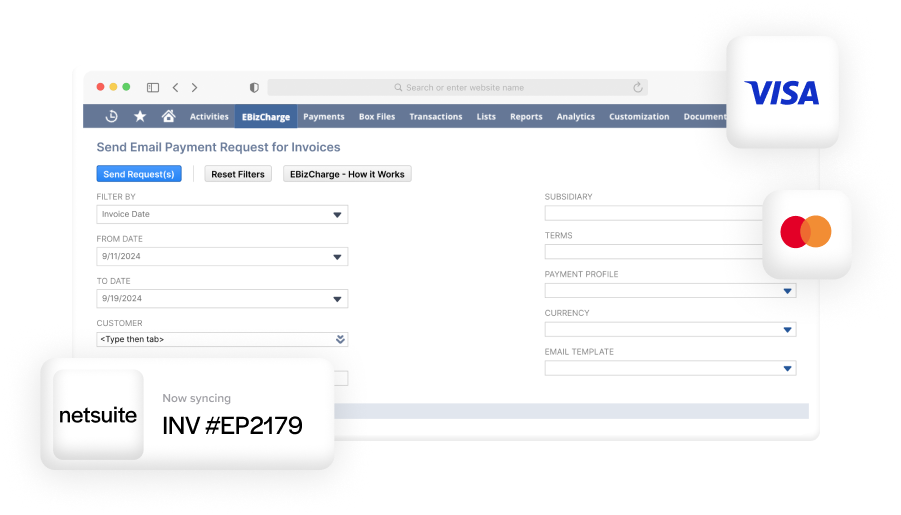

EBizCharge stands out among Oracle NetSuite merchant services providers because of its deep, native NetSuite integration. That means fewer moving parts and better control over the entire AR process, without having to rely on third-party connectors that can break or add complexity. For teams looking to simplify their day-to-day payment operations, EBizCharge offers both reliability and flexibility.

It supports all major payment methods, including ACH and credit cards, and handles NetSuite billing cycles with ease – making it an ideal choice for businesses with high-volume invoicing, recurring payments, or subscription models. It also provides features like real-time payment application, batch reconciliation, tokenization, and custom workflows that can fit the way your team already works. These capabilities reduce manual intervention and give finance teams more time to focus on high-level reporting and strategic tasks.

As one of the most established NetSuite merchant services providers, EBizCharge prioritizes usability and visibility, offering click-to-pay links, self-service portals, and embedded reporting. It’s designed to be a drop-in payment processing solution that helps teams automate collections without compromising control while improving the customer experience at the same time.

Choosing the NetSuite Payment Partner That Works for You

Whether upgrading from a legacy gateway or rethinking your finance stack, choosing the right NetSuite payment processing partner is crucial. The ideal payment processing solution won’t just process payments—it will eliminate roadblocks, improve visibility, and free your team to focus on more strategic work.

The key is to look for NetSuite payment partners that understand how to support AR automation, reporting accuracy, and day-to-day usability. From Oracle NetSuite merchant services to third-party apps, your team deserves a solution that works as hard as they do.

Start with the right questions. Prioritize usability. And find a partner that can keep up with your pace.