Blog > Best Practices for Ensuring PCI Compliance in NetSuite

Best Practices for Ensuring PCI Compliance in NetSuite

With cyberattacks on the rise, businesses must prioritize achieving PCI compliance to protect both their customers and their reputation. Yet, many still grapple with the complexities of maintaining this compliance in their systems.

This article will explore best practices for ensuring PCI compliance within NetSuite, including NetSuite’s PCI-compliant tools as well as best practices for maintaining compliance.

What is PCI Compliance?

PCI compliance refers to the Payment Card Industry Data Security Standards (PCI DSS), a set of guidelines designed to protect credit card information during financial transactions. These standards help businesses implement secure payment processes and prevent unauthorized access to sensitive data.

Key aspects of PCI compliance include establishing robust security policies to safeguard cardholder information, using strong encryption to secure electronic payment methods, and implementing two-factor authentication to add an additional layer of protection.

Additionally, role-based access controls are essential for limiting who can view and manage sensitive payment data, ensuring that only authorized personnel have access.

Compliance with these standards is essential for businesses looking to take payments.

The importance of PCI compliance in NetSuite

With the rise of cyber threats, protecting payment card data has never been more crucial. NetSuite users can enjoy a secure payment environment by implementing PCI compliance measures.

NetSuite PCI compliance helps streamline payment workflows and supports smooth financial processes. It also aids in maintaining accurate financial reporting. By being PCI-compliant, you not only safeguard sensitive payment information but also adhere to regulatory requirements. This compliance brings peace of mind to your business and its customers, ensuring secure payment transactions.

The consequences of non-compliance

PCI-compliance is mandatory but legally required. That said, failing to comply with PCI DSS standards in NetSuite can lead to severe consequences.

Noncompliance can lead to:

- Unauthorized access to sensitive payment information, increasing the risk of fraudulent activities.

- Loss of customer trust, which can damage a company’s reputation long-term.

- Hefty fines and penalties imposed for failing to meet compliance standards.

- Disruptions to business operations, affecting daily financial transactions.

- Potential legal actions and lawsuits, leading to additional financial and operational burdens.

- Increased scrutiny from regulatory authorities, resulting in stricter oversight and compliance requirements.

Although compliance is crucial for businesses accepting payments, it’s important to note that maintaining compliance can come with challenges.

3 challenges with staying compliant

Although compliance is crucial, businesses can face various challenges in maintaining it. Understanding these challenges helps in implementing effective solutions and achieving peace of mind.

1. Managing Third-party payment gateways

One major challenge is managing third-party payment gateways. These gateways process credit card transactions and must follow PCI DSS. However, trusting third parties with sensitive payment information can be risky. Ensuring these gateways are PCI-compliant is essential to prevent unauthorized access and fraudulent activities. Regular audits and a clear security policy can help manage these third-party interactions effectively.

2. Staying updated with PCI DSS changes

Another challenge is staying updated with PCI DSS changes. Industry standards and regulatory requirements evolve to address new cyber threats. Businesses must keep abreast of these changes to maintain a secure payment environment. Regular training sessions and staying informed through official PCI DSS updates can help businesses adapt to NetSuite PCI compliance requirements.

3. Handling legacy data

Handling legacy data poses its own set of challenges. Older data may not be stored securely by today’s strong encryption standards. This data can become a target for unauthorized access and payment card fraud. Businesses should consider data migration strategies and employ role-based access controls to secure sensitive information. Encrypting legacy data and integrating it with current payment workflows can also ensure a secure line of defense against potential breaches.

By tackling these issues head-on, businesses can protect against cyber threats and ensure safe, compliant financial transactions.

The following section will provide you with best practices for maintaining this compliance.

Best practices for maintaining PCI compliance in NetSuite

Understanding and practicing PCI compliance in NetSuite is crucial. It protects credit card data a nd prevents unauthorized access to sensitive cardholder info. These practices help businesses align with PCI DSS, ensuring secure financial operations and reducing fraud risk.

Configure secure payment gateways: Configuring secure payment gateways is essential for PCI compliance in NetSuite. A secure gateway ensures safe credit card data transfer, preventing cyber threats during payment transactions. These setups create a secure payment environment, protecting both the business and its customers.

Enable two-factor authentication: Two-factor authentication adds an extra layer of security, making it a vital practice for PCI compliance. Verifying user identity with two steps reduces the risk of fraudulent activities and unauthorized access to sensitive information within NetSuite.

Limit user access and permissions: Limiting user access and permissions is key. Role-based access controls in NetSuite ensure only authorized users handle sensitive payment processes. This prevents unauthorized access, helping maintain a secure environment for financial transactions.

Regular security audits: Conducting regular security audits helps maintain PCI compliance. These audits check for vulnerabilities and unauthorized access, allowing businesses to address security issues promptly. Regular checks ensure financial operations align with compliance requirements, minimizing risks.

Update and patch NetSuite regularly: Regularly updating and patching NetSuite is crucial. It ensures the latest security features are in place, protecting against new cyber threats. Staying updated helps businesses maintain compliance and secure sensitive cardholder data effectively.

Train employees on PCI best practices: Training employees on PCI best practices is an essential step. Educated staff can identify potential security risks and follow protocols to protect sensitive info. This proactive approach supports a secure payment environment, ensuring all operations meet PCI compliance standards.

Implement secure integrations: Implementing secure integrations within NetSuite is important for a cohesive strategy. Secure integrations ensure all business processes, including payment workflows, operate smoothly and safely, adhering to PCI compliance requirements and protecting cardholder data.

NetSuite also provides you with PCI compliant tools and features that make maintaining compliance easier.

NetSuite’s tools for PCI compliance

NetSuite offers various tools to help businesses maintain PCI compliance. These tools ensure the safe processing of credit card data and protect sensitive cardholder information.

Here are some key tools NetSuite provides:

- Tokenization: NetSuite offers tokenization to replace sensitive credit card information with a unique identifier or token. This ensures that raw card data isn’t stored in your system, reducing the risk of breaches and simplifying PCI compliance.

- Encryption: NetSuite ensures sensitive payment data is encrypted in transit and at rest. It uses industry-standard encryption protocols to secure data and prevent unauthorized access, a critical requirement of PCI compliance.

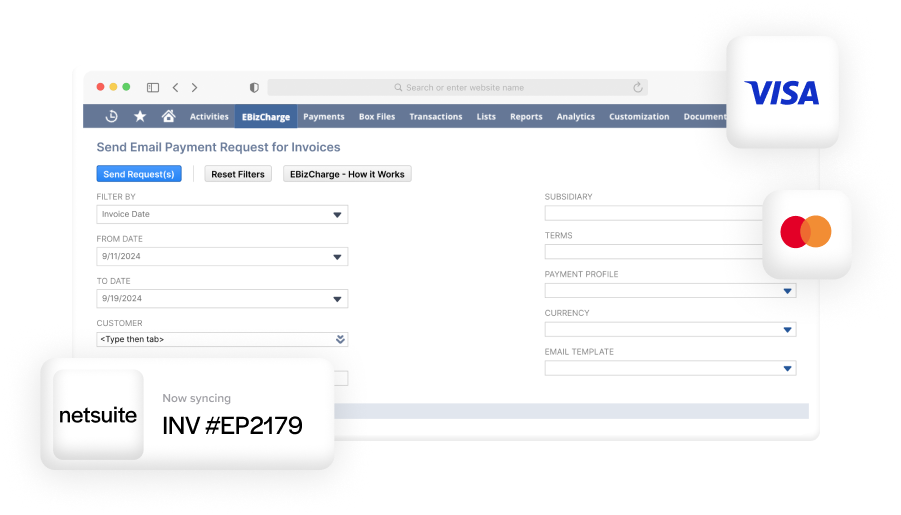

- Payment gateway integrations: NetSuite integrates with PCI-compliant payment gateways like EBizCharge. These gateways handle payment processing externally, minimizing the handling of sensitive card data within the NetSuite system.

- Role-based access control: NetSuite allows organizations to configure role-based access controls. This ensures that only authorized personnel can access payment and customer data, reducing internal risks and meeting PCI requirements for data access.

- Audit trails and logging: NetSuite provides robust audit trail features, logging all changes to financial data and transactions. This allows organizations to monitor suspicious activity and provide evidence during PCI compliance audits.

- Secure Sockets Layer (SSL) certification: NetSuite enforces SSL encryption for all online communications, ensuring that sensitive cardholder data is securely transmitted between customers, merchants, and payment gateways.

- Integrated fraud prevention: NetSuite partners with payment gateways and fraud detection tools to provide real-time fraud prevention features. This includes tools for monitoring transactions, detecting unusual activity, and flagging potentially fraudulent transactions.

- Two-factor authentication: To further enhance security, NetSuite supports two-factor authentication, which adds an additional layer of protection for user accounts that access sensitive payment information.

- Regular security updates: NetSuite ensures the platform is updated regularly to address vulnerabilities and align with the latest PCI DSS. These updates keep the system compliant with evolving regulations.

Although these tools are PCI-compliant, it’s important to adhere to best practices to ensure ongoing compliance.

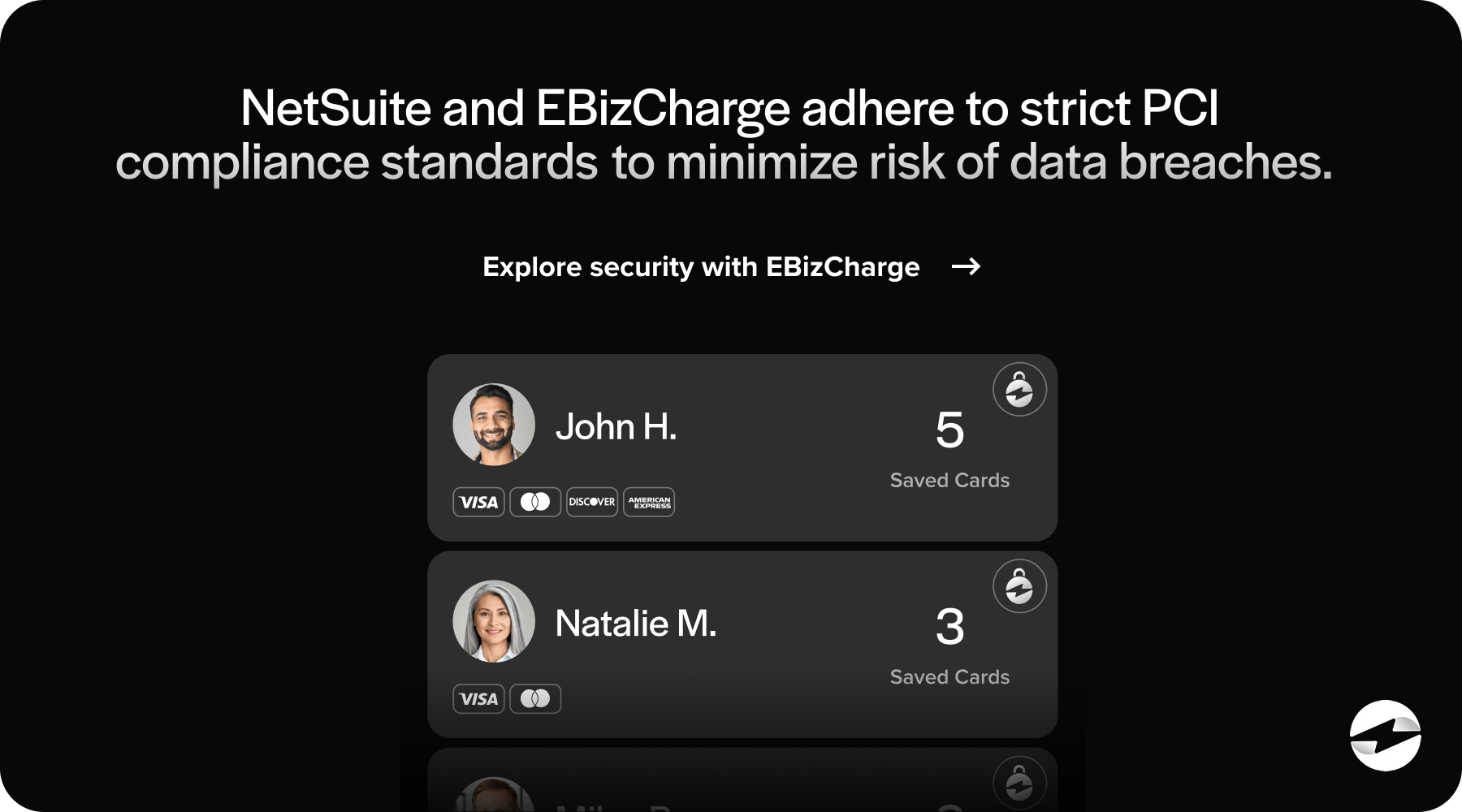

Although NetSuite makes it easy to stay PCI-compliant, it’s important to integrate with payment processors that show the same commitment to PCI standards.

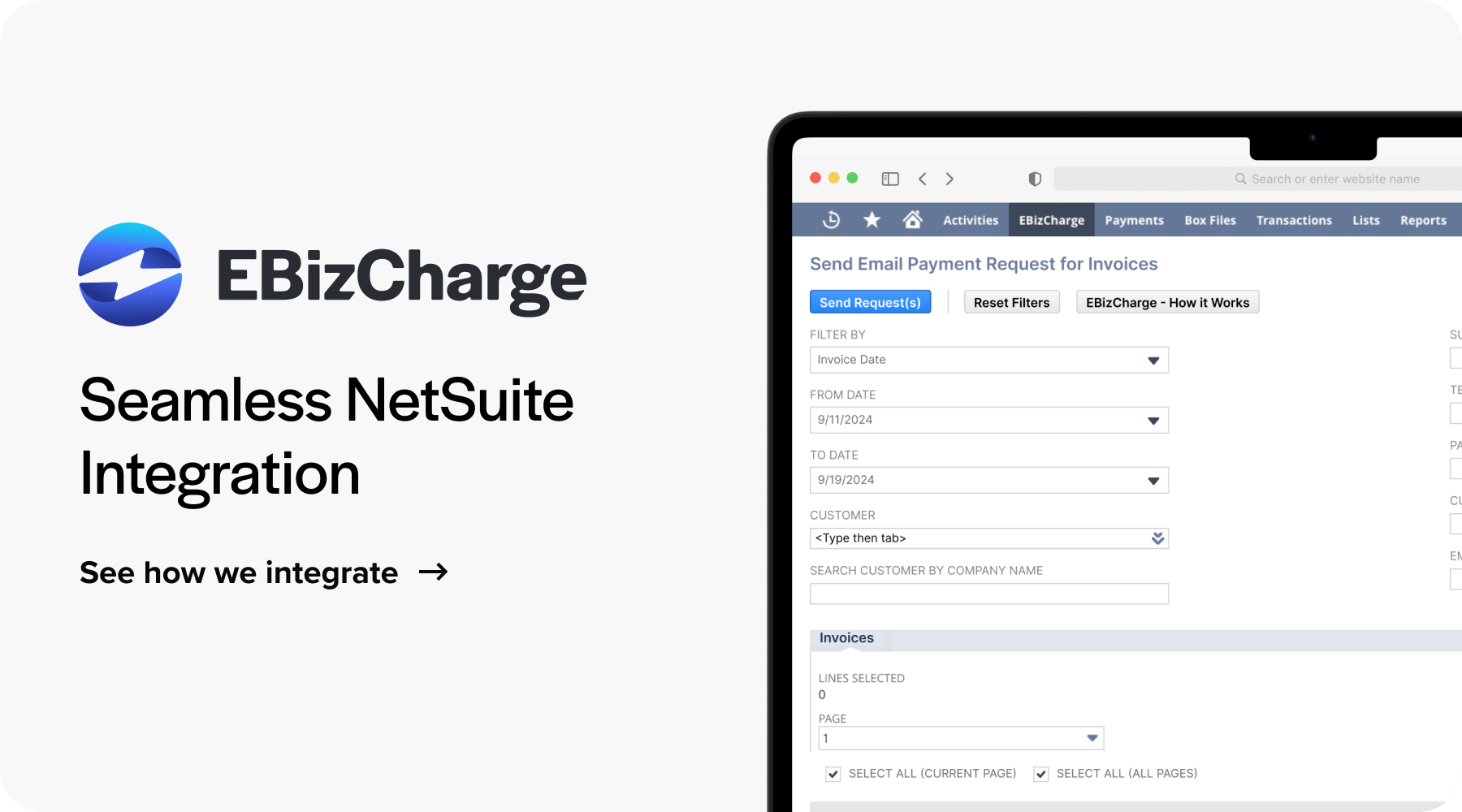

A PCI-compliant integration

EBizCharge integrates seamlessly with NetSuite to provide businesses with a PCI-compliant solution for accepting payment efficiently and securely. The integration is designed to work within NetSuite’s interface, eliminating the need for external systems and ensuring a smooth payment process that aligns with PCI DSS requirements. This streamlined approach allows users to manage payments, invoices, and reconciliation directly within NetSuite while maintaining full compliance with regulatory standards.