Blog > Advanced NetSuite Payment Reporting and Cash Flow Management

Advanced NetSuite Payment Reporting and Cash Flow Management

If you’ve ever tried to close the books at month-end without reliable payment data, you know how painful it can be. For finance leads, controllers, and NetSuite administrators, having a clear view of incoming payments is more than a nice-to-have; it’s a necessity.

Good NetSuite payment reporting allows you to understand where your cash is, what’s coming in, what’s delayed, and why. That level of NetSuite revenue management visibility isn’t just useful—it’s foundational to smarter decisions, more confident forecasting, and fewer unpleasant surprises.

This article breaks down how to get better reporting out of NetSuite, connect the dots with your cash flow, and create systems that scale with your business.

Overview of NetSuite Payment Reporting Tools

NetSuite includes a variety of tools that help you monitor payments. From standard financial reports to customizable dashboards and saved searches, the building blocks are all there—you just have to know how to use them effectively.

At the core is the accounts receivable (AR) module, where most NetSuite payment reporting originates. You can track customer payments, view aging balances, and even follow payment statuses across different methods. NetSuite billing records also provide context on what was invoiced, what’s overdue, and what’s been partially paid.

Dashboards give quick updates using key performance indicators (KPIs) like overdue invoices or unapplied payments. With the right filters, you can drill into reports to segment by location, customer tier, payment method, or sales rep.

Common Payment Reporting Challenges

Even with NetSuite’s solid reporting capabilities, many finance teams run into issues that limit how useful the data actually is. These challenges often stem from how payment data is captured and processed in daily operations. If you’re not trying to build accurate reports or predict future cash flow, these roadblocks can create real inefficiencies.

Here are some of the most common challenges:

- Data lag from non-integrated systems: If your payment processor isn’t connected to NetSuite, you may rely on manual data entry or delayed batch uploads. This slows down your reporting and leaves room for error.

- Limited payment detail segmentation: Without proper tagging or data fields, it’s harder to filter payments by method (ACH vs credit card), status (pending, settled, failed), or origin (web portal, email link, manual entry). That lack of detail reduces NetSuite payment visibility.

- Manual reconciliation bottlenecks: When payment records don’t align perfectly with bank statements or are bundled across multiple deposits, your team can spend hours chasing down discrepancies.

- Forecasting gaps: Without real-time payment updates, NetSuite cash flow forecasting becomes guesswork. Payment timing rarely matches invoice due dates exactly, making it harder to rely on AR reports alone.

These challenges can be frustrating, especially for finance teams trying to close the books quickly or explain variances in executive meetings. The good news? With the right setup and integrations, many of these pain points can be eliminated or significantly reduced.

Building Better Reports with Saved Searches and KPIs

To get more out of NetSuite payment reporting, start with saved searches. These can be configured to track everything from recently received payments to unapplied deposits to delayed settlements.

Set filters that help you segment by customer group, payment type, or transaction date. Add custom fields if needed – for example, to tag payments from your ecommerce platform versus those collected in-person or via a hosted payment link.

Once saved searches are in place, surface them on dashboards as KPIs. You can create visualizations for key metrics: average days to payment, top outstanding invoices, or percentage of payments collected via credit card. The goal is not just reporting, but actionable insights.

Improving Cash Flow Forecasting in NetSuite

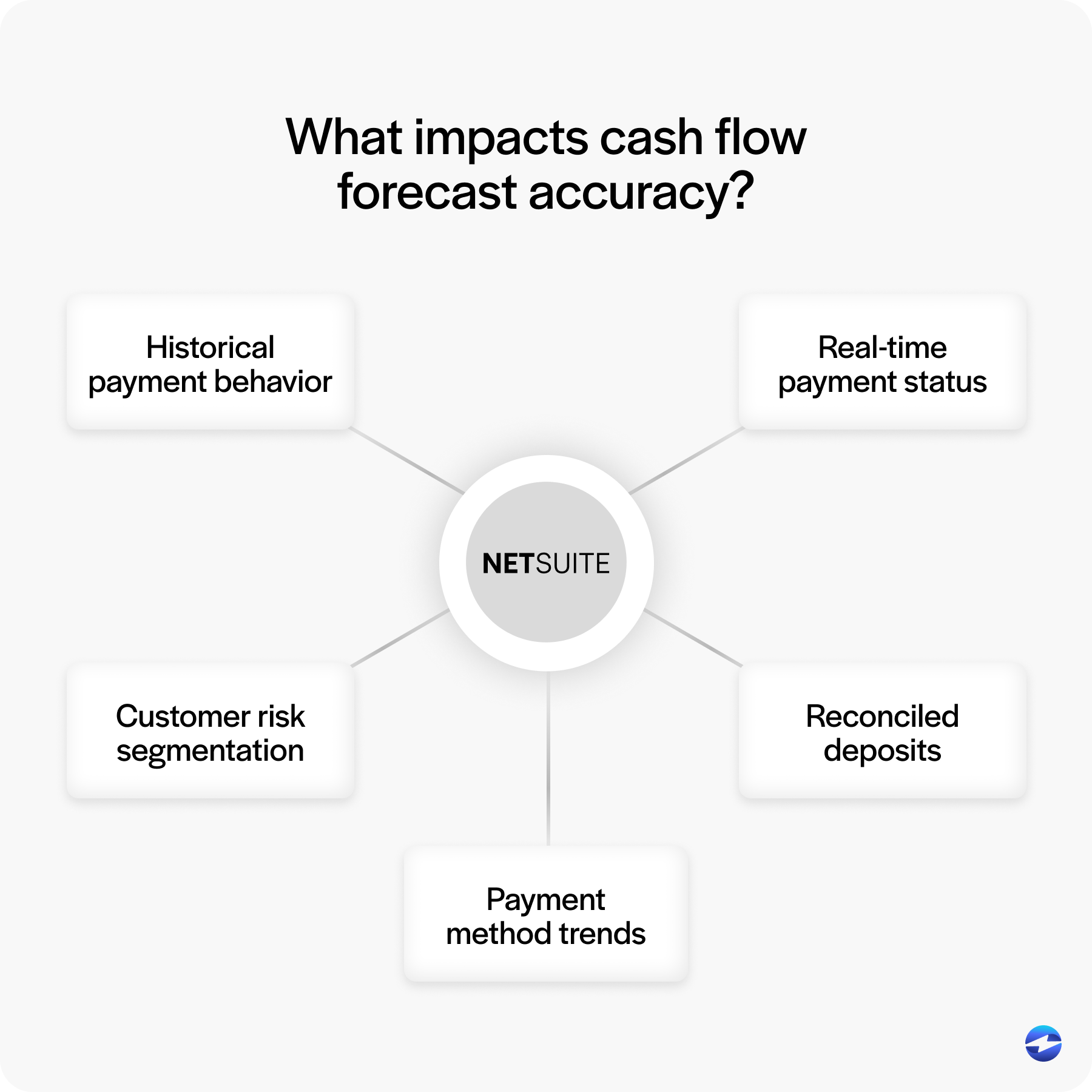

Reliable payment data feeds directly into NetSuite cash flow forecasting. If you’re forecasting based on invoice due dates alone, you’re missing the reality of when customers actually pay.

Use your payment history to spot trends. Some customers always pay early. Others consistently delay. Build your NetSuite cash flow forecast models around this behavior—either in NetSuite or using connected reporting tools.

You can also schedule reports that compare projected collections to actual cash received. This variance analysis helps you refine your forecast over time and identify which customers or channels are causing cash flow drag.

Integrating Payment Processors for Real-Time Reporting

One of the most impactful changes you can make is integrating your payment processor with NetSuite. Without that connection, you’re relying on stale or incomplete data. With a proper NetSuite integration, you gain real-time insight into every transaction.

This applies across payment methods—credit card, ACH, payment links, or mobile wallets. When a customer pays, the system updates, and your team can see it reflected in NetSuite payment reporting.

A good payment processing solution will reduce reconciliation headaches and eliminate the need for redundant data entry. You’ll also be able to track declines, partial payments, and fee breakdowns more easily, contributing to better NetSuite billing clarity and smoother financial ops.

EBizCharge Integration for Enhanced Reporting

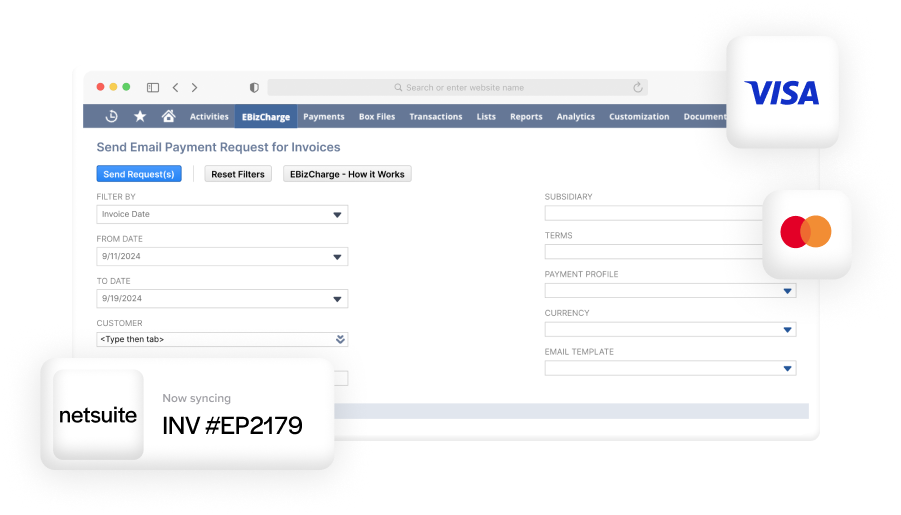

If you’re looking for a plug-and-play payment processing solution that enhances NetSuite payment visibility, EBizCharge is a strong option. It integrates directly into NetSuite and syncs payment activity in real time, giving your finance team a consistently up-to-date view of cash inflows .

With EBizCharge, every payment—whether credit card, ACH, or through a payment link—is captured instantly and logged in the right place. It supports full NetSuite credit card processing and allows you to track failed or delayed payments, apply payments to specific invoices, and reconcile deposits without jumping between systems.

One of the biggest benefits of this integration is the elimination of manual workarounds. Instead of waiting for batch updates or relying on email notifications from standalone processors, teams get immediate clarity. This enables faster exception handling and cleaner books at month-end.

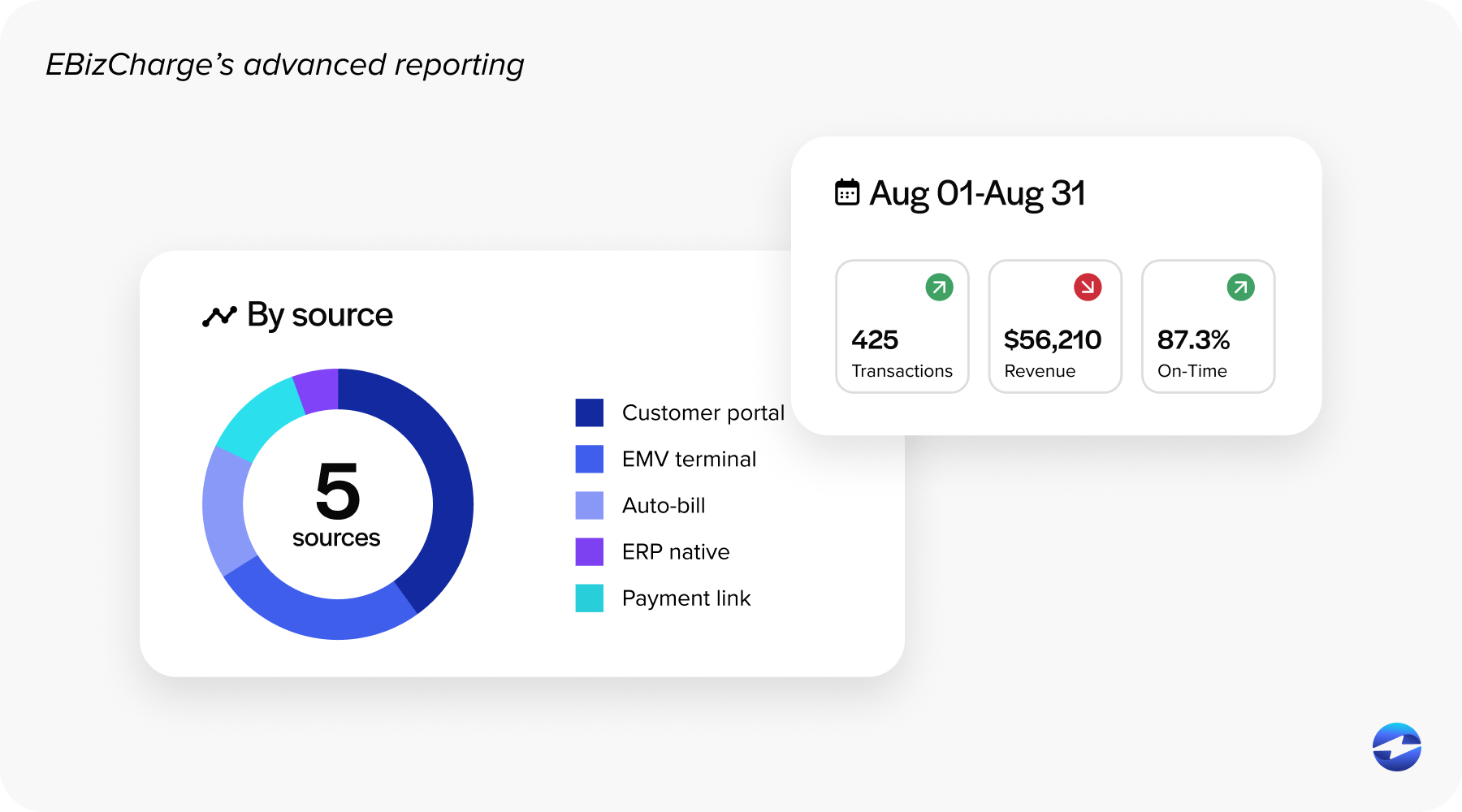

You can create custom dashboards for tracking settlement times, credit card acceptance rates, or customer-level payment history. These reports directly feed your NetSuite cashflow models, giving you more control and fewer surprises.

From Insight to Impact: Putting Better Reporting into Practice

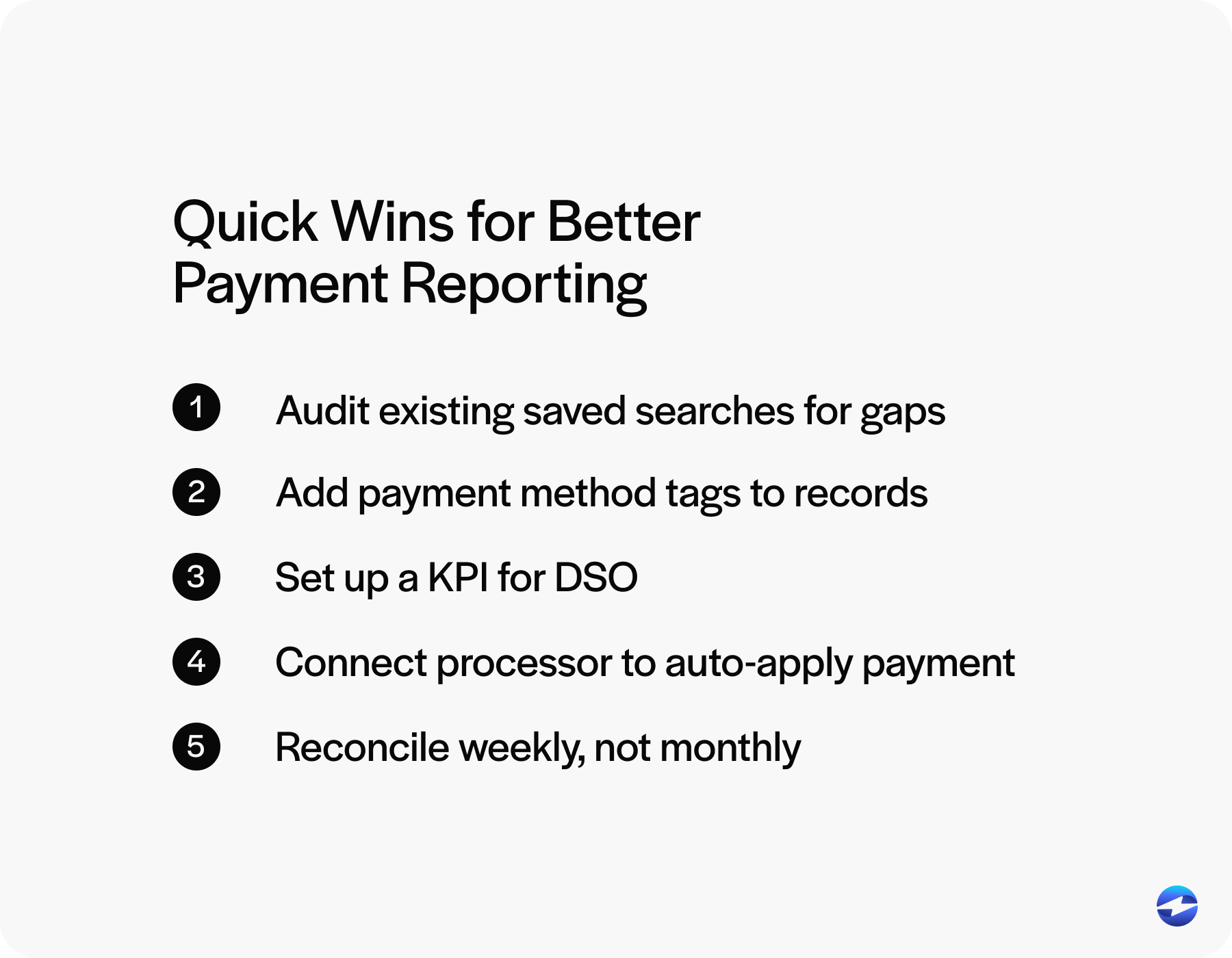

Improving your NetSuite payment reporting doesn’t require an overhaul—just a clear focus on what matters: accuracy, visibility, and automation.

By building saved searches, using KPIs effectively, and integrating with a payment processor like EBizCharge, you get the real-time insights you need to build stronger NetSuite cash flow forecasts and make smarter business decisions.

Start by auditing your current reports and looking for gaps. Ask yourself: Are we seeing payment activity in real time? Can we trust our forecasts? Are we spending too much time reconciling?

The answers to these questions will guide you toward a more reliable, scalable system—one that keeps you in control of your cash and confident in your numbers.

- Overview of NetSuite Payment Reporting Tools

- Common Payment Reporting Challenges

- Building Better Reports with Saved Searches and KPIs

- Improving Cash Flow Forecasting in NetSuite

- Integrating Payment Processors for Real-Time Reporting

- EBizCharge Integration for Enhanced Reporting

- From Insight to Impact: Putting Better Reporting into Practice