Blog > ACH vs eCheck: Are They the Same or Different?

ACH vs eCheck: Are They the Same or Different?

ACH and eChecks at a first glance are identical and, in fact, the terms are often used interchangeably. The ACH, or Automated Clearing House, network is the technology and process that allows money to move electronically between banks. ACH payments work within the ACH network and are electronic payments that are composed of direct deposits and direct payments. An eCheck, or electronic check, is a type of ACH payment that works by transferring money from the payer’s bank account to the payee’s checking account. Since an eCheck is a type of ACH payment, the difference lies in the terminology. This will all be discussed in more detail in the following sections.

eChecks

An eCheck, or electronic check, is a payment that is electronically withdrawn from the payer’s checking account and transferred over to the payee’s bank account. The eCheck is, simply, a digital version of a paper check and less likely to become outdated in the future. eChecks process much faster than paper checks because it takes away the manual labor associated with depositing a physical check. It typically takes 24-48 hours to process an eCheck.

eChecks are also termed electronic checks, online checks, internet checks, and direct debits. eChecks are created through the Automated Clearing House (ACH) network, which allows funds to be transferred between bank accounts. To accept an eCheck, a merchant must work with a payment processing company that has the capability to accept eChecks.

Steps of how eChecks work

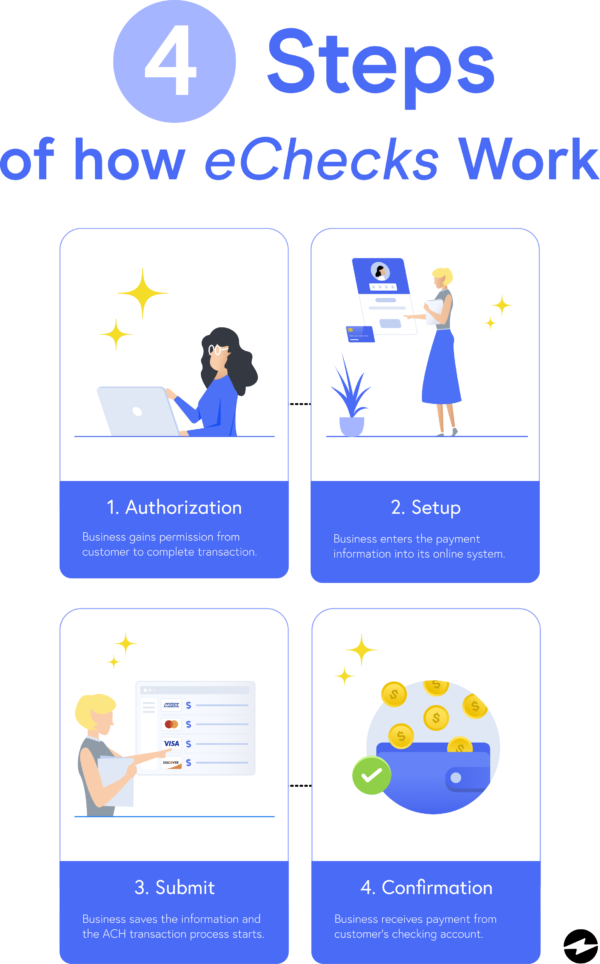

Because eChecks are processed solely electronically, the process is slightly different than with paper checks. However, eChecks are easier to process than paper checks and help limit paper waste from paper checks. There are four steps to processing an eCheck:

- Request Authorization: The first step requires the business to gain permission from the customer to complete the transaction.

- Payment Setup: After the customer authorizes the payment, the business enters the payment information into its online payment system.

- Finalize and Submit: Once all of the information is entered correctly into the online payment software, the business saves the information, and the ACH transaction process starts.

- Payment Confirmation and Funds Deposited: Finally, the customer’s checking account will automatically withdraw the payment. After the payment is withdrawn, the business’s software sends a receipt to the customer. Then, the business’s bank account receives the payment. Lastly, the merchant account will receive the deposit, typically three to five days after the initial ACH payment.

Automated Clearing House (ACH)

An Automated Clearing House (ACH) payment is a type of electronic payment between banks completed through the ACH network. The ACH network is responsible for processing electronic funds transfers for consumers, businesses, and federal, state, and local governments. It’s also the network that allows eChecks to be processed.

The two main categories of ACH payments are direct deposits and direct payments. Direct deposits include payroll, employee expense reimbursement, government benefits, tax and other refunds, and interest payments. Direct payments cover the transportation of funds for making payments by individuals or businesses.

What is the difference?

The difference between an eCheck and an ACH payment is, simply, the categorization. An eCheck is a type of ACH payment because it is considered a direct deposit. ACH payments encompass many types of electronic payment methods, and an eCheck falls under the category of being one of those ACH payment methods.

However, the ACH network is the process that allows ACH payments and eChecks to work properly between financial institutions such as banks. Without the ACH network, electronic transactions would not be possible and eChecks and ACH payments wouldn’t exist.

Finalizing the confusion

While eChecks and ACH payments can generally be used to describe the same type of transaction, there are differences in the categorization of the terms. eChecks are categorized under ACH payments and both can occur because of the ACH network.

Regardless of which term you use, the important thing is having a payment processor that handles both seamlessly. EBizCharge processes ACH and eCheck payments in one platform and offers payment processing for NetSuite and Sage Intacct payment processing, so every transaction syncs directly to your accounting software without manual entry.

Frequently Asked Questions

What is the difference between ACH and autopay?

ACH and autopay are different concepts. ACH (Automated Clearing House) is a network for electronic money transfers and direct deposits between banks. Autopay refers to the automated scheduling of payments, which can use various methods, including ACH, credit cards, or debit cards.

Is an eCheck a wire transfer?

No, an eCheck is not a wire transfer. They are distinct methods of electronic funds transfer with different characteristics and processing mechanisms. An eCheck is a digital version of a traditional check processed through the ACH network, commonly used for online payments. In contrast, a wire transfer is a faster and more immediate method of transferring funds from one bank to another, often involving higher fees. It can be used for both domestic and international transactions.