Blog > ACH Reversals vs. ACH Returns: What’s the Difference?

ACH Reversals vs. ACH Returns: What’s the Difference?

Every day, billions of dollars in transactions are processed around the world. While payment methods vary depending on location, merchant, and type of transaction, ACH payments are one of the most used electronic payment systems in the U.S.

This article will explore the processes involved in ACH payments, explaining how to distinguish returns vs. reversals and answering common questions such as what is an ACH return and can you reverse an ACH payment?

What is ACH?

ACH transfers refer to the electronic transfer of funds between banks through the ACH network. The most common transactions sent over ACH include electronic funds transfer (EFT), employee payroll direct deposits, and electronic bill payments.

Outside of commercial applications, ACH is also heavily used by the U.S. government to send payments such as tax refunds, Social Security benefits, and other government assistance programs. Many other countries have also created systems to mimic the ACH process.

As a business, it’s critical to understand how ACH transactions work and their associated challenges. Fortunately, the National Automated Clearing House Association (NACHA), the governing body over the ACH Network, has processes, procedures, and safeguards to protect consumers and merchants from transaction errors.

In 2022 alone, the Automated Clearing House (ACH) Network processed over 30 billion transactions, totaling more than $76 trillion. ACH transfers have become widely adopted as a fast, efficient, and cost-effective way to send and receive payments without physically handling cash or checks.

When an error occurs, the transaction is often resolved through one of two methods: ACH reversal or ACH return. While these terms are often used interchangeably, they differ in a few key ways.

What is an ACH return?

An ACH return occurs when a digital payment transaction can’t be processed. When this happens, the Receiving Depository Financial Institution (RDFI) automatically initiates a return of the funds to the Originating Depository Financial Institution (ODFI).

The average processing time for an ACH transfer is typically two banking days but can vary depending on the financial institution. Your financial institution should be able to provide an ACH processing time estimate or completion date.

What are the ACH return fees?

An ACH return fee is a charge you incur when an Automated Clearing House (ACH) transaction fails, similar to a bounced check fee. Typically ranging from $2 to $5, the bank charges this fee to cover the costs of processing the failed transaction.

A transaction might fail for several reasons, such as insufficient funds or incorrect account details. When this happens, the fee helps cover the additional work needed to handle the failure. The exact amount can vary by bank or payment processor, so checking with your provider and comparing fees is a good idea, as multiple failed transactions can add up quickly to impact your budget. Ensure your account information is accurate and that you have sufficient funds for transactions to keep these fees to a minimum.

So, what are some of the most common reasons for initiating a return? The following section will illuminate the most prominent reasons that ACH returns can be initiated.

6 reasons why ACH returns are initiated

ACH returns can be initiated whenever circumstances impede the transfer process’s completion.

Here are six common reasons why ACH returns are initiated:

- Insufficient funds: An ACH return will be initiated when there aren’t enough funds in the associated bank account to cover a transaction amount. For example, an ACH return will be triggered if a user tries to process a $3,000 payment, but the account only contains a balance of $1,500.

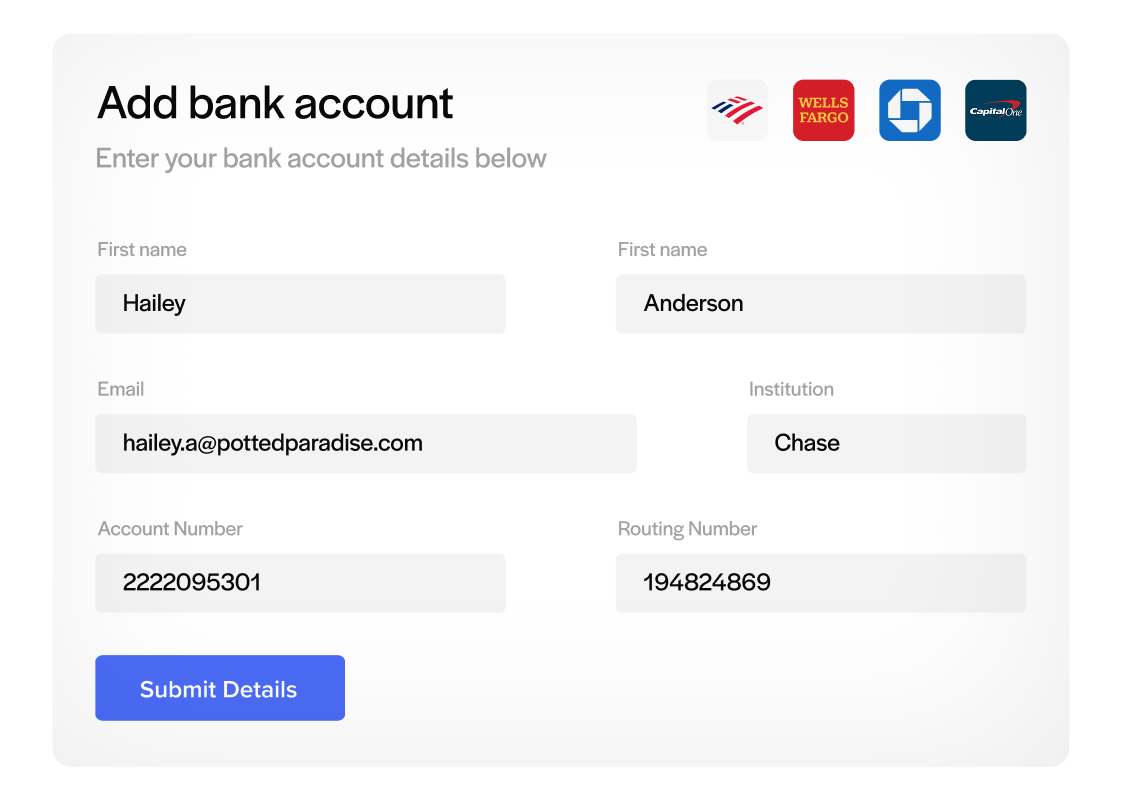

- Invalid account information: Invalid account information can consist of typos when entering account numbers or data in the wrong field.

- Mismatched legal name: It’s important for the legal name of the sending and receiving parties to be listed accurately and consistent with the records of the financial institution that’s processing the transaction.

- Unauthorized payment: Unauthorized payments occur when funds are withdrawn from an account without the account holder’s permission or authorization, such as phishing scams and fraud.

- Incorrect amount: Incorrect amounts can result from human error, such as adding an extra zero to the amount or a decimal point in the wrong location.

- Account closed: In some cases, an ACH payment may be linked to an account that’s been closed or no longer exists, prompting an ACH return.

There are numerous reasons for initiating an ACH return, from insufficient funds to unauthorized payment. By familiarizing yourself with these reasons, you can minimize the volume of returns and ensure seamless transactions.

In addition to common reasons for returns, it’s also good to familiarize yourself with how these returns work since understanding this process will expand your financial literacy.

How do ACH returns work?

An ACH return must go through a series of steps to return the funds to the ODFI once it meets the criteria for a return.

Here are the four steps of ACH returns:

- Payment failure: If an ACH payment fails, the transaction will be flagged for review in the ACH system.

- Review and ACH return initiation: The RDFI will evaluate the transaction and identify the specific issue before initiating the return. Once the return has been initiated, the ODFI will receive a return entry from the RDFI.

- User notification: Once the ACH return entry is processed, the ODFI will notify the account holder of the failed transaction.

- Account balance adjustment: Finally, the originator’s account will undergo an ACH payment adjustment to reflect the return of the failed payment.

Now that you understand how ACH returns work, you may wonder, can you reverse an ACH payment?

What is an ACH reversal?

If an ACH transaction is already being processed, the payment originator can initiate an ACH payment reversal to undo a mistake or error.

Even with proper safeguards in place, mistakes or human error can occur. Once an originator identifies the mistake, a request should be submitted within 24 hours to the RDFI to reverse all or part of the transaction amount.

So, how long does an ACH reversal take?

The ACH reversal time frame is typically short, as the process happens quickly and is limited to a strict timeline. No ACH reversals are permitted after five banking days after transaction settlement, making the ACH reversal time frame 1 to 5 days.

ACH reversals come with fees similar to those charged for ACH returns. These ACH reversal fees are sometimes a flat rate or percentage, often ranging between $2 and $5. The originator is responsible for paying these fees since the error happened due to their mistake.

By answering common questions like what is an ACH reversal and how long does an ACH reversal take, businesses can begin to equip themselves with the information they need to ensure they can navigate ACH reversals and, hopefully, eliminate them entirely.

Similar to ACH returns, there are common reasons for initiating an ACH reversal. While returns tend to be initiated due to discrepancies with the account, common reasons for initiating a reversal are typically associated with mistakes in transaction information.

6 common causes of ACH reversals

When initiating an ACH transaction, one should thoroughly review the ACH payment information to avoid the headaches and additional fees associated with reversed ACH transactions.

To help with this, here are six common causes of ACH reversals to be aware of:

- Duplicate payments: ACH payment reversals can rectify accidental or duplicate payments to correct unintended financial repetition and appropriately restore funds.

- Wrong payment recipient: If payment is directed to the wrong recipient, ACH reversal can be used to retrieve funds and redirect them to the intended party, correcting the recipient error.

- Incorrect payment amount: A reversed ACH can correct transactions where the amount transferred doesn’t align with the agreed-upon terms, providing a mechanism to adjust the financial value accurately.

- Payment date errors: If a payment is processed with an incorrect date, an ACH reversal can rectify the misalignment and ensure funds move in accordance with the correct payment schedule.

- Technical errors: In cases of system glitches or technical malfunctions leading to erroneous transactions, ACH reversals can correct the unintended financial actions caused by these errors.

- Fraudulent transactions: ACH reversals can correct unauthorized or fraudulent transactions to protect the financial integrity and security of the involved parties.

Now that you know the most common reasons for initiating an ACH reversal, you should familiarize yourself with its process. Understanding these processes will contribute to your financial knowledge and awareness, empowering you to make informed decisions.

Although these processes share similarities, ACH reversals carry a few extra steps.

How do ACH reversals work?

While the ACH payment reversal process is relatively straightforward, the originator and recipient should be well-informed to avoid miscommunication.

Here are seven steps to expect during an ACH reversal:

- Error identification: First, the payment originator identifies an error in a processed ACH payment. This can be due to duplicate payments, incorrect amounts or recipients, payment date errors, technical errors, etc.

- ACH reversal request: The payment originator contacts the financial institution to report the error and request an ACH reversal. This request includes details about the erroneous transaction, specifying the nature of the error and the corrective action required.

- Information transfer: The payment originator’s financial institution provides the necessary information to the RDFI, such as transaction details, the error, and the request for reversal.

- ACH reversal initiation: The ODFI initiates the ACH reversal process by transmitting a reversal entry to the ACH network and specifying the details of the original transaction that needs to be reversed.

- Recipient notification: The recipient’s financial institution receives the reversal entry and notifies the recipient of the reversal, indicating the funds from the original transaction will be deducted or adjusted.

- Adjustment of accounts: The RDFI processes the reversal, adjusting the accounts of the payment originator and recipient. Credited funds are then debited, or debited funds are now credited, and both accounts are brought back to their pre-transaction state.

- ACH reversal confirmation: Once the ACH reversal is complete, a confirmation is sent to both the payment originator to indicate the erroneous transaction has been successfully reversed and to the recipient to show an ACH payment adjustment has been made to the associated bank account.

Now that you understand how ACH return and reversal processes vary, you can learn more about other key differentiators between the two.

What’s the difference between ACH returns and reversals?

ACH returns and reversals are two sides of the same coin, each playing a crucial role in maintaining the integrity of digital financial transactions.

ACH returns and ACH reversals share fundamental characteristics, as they serve as corrective measures for electronic financial transactions initiated by financial institutions. Both play pivotal roles in addressing errors and ensuring the accuracy of digital payments by adjusting accounts, either by returning funds to the payment originator (in the case of a return) or by adjusting funds between the payment originator and the recipient (in the case of a reversal).

Despite these similarities, ACH returns and ACH reversals differ by initiator, purpose, timing, and notification processes.

ACH returns, typically initiated by the RDFI, are focused on correcting failed transactions and ensuring the accurate movement of funds. Whereas ACH reversals are initiated by the payment originator after an erroneous payment has been processed, with the purpose of rectifying errors such as incorrect amounts or duplicate payments.

The timing and notification process of ACH returns and reversals also differ.

ACH returns are initiated after the transaction has been processed, and ACH reversals are initiated before the transaction has been settled.

ACH returns involve the RDFI identifying the issue and notifying the payment originator. ACH reversals involve the payment originator identifying the error, initiating the reversal, and the ODFI notifying the service provider or recipient.

By understanding the distinction between ACH returns and reversals, businesses can minimize the volume of returns and reversals they face in their daily operations.

Minimizing ACH returns and reversals with EBizCharge

Understanding the nuances of ACH returns and reversals is vital for businesses and individuals navigating the digital financial landscape. Whether rectifying failed transactions or undoing erroneous payments, these processes ensure the smooth and secure movement of funds in the world of financial technology.

Businesses can work with reliable payment processors like EBizCharge for more seamless ACH transactions to mitigate and avoid ACH returns and ACH reversals altogether. With NetSuite payment processing and Sage Intacct credit card integration, EBizCharge validates payment details upfront and syncs every transaction to your accounting software automatically, reducing errors that lead to returns and eliminating manual reconciliation.