Blog > ACH Check Processing: Understanding ACH Fees

ACH Check Processing: Understanding ACH Fees

ACH fees may not seem like much, but they can make a big difference for even the most prominent businesses. While ACH transactions are everywhere these days, understanding these fees can still feel like navigating a maze.

This article will shed some light on ACH check processing fees, explaining each type and how they could affect your financial transactions.

What is ACH?

Automated Clearing House (ACH) refers to an electronic network used for financial transactions in the United States. This system enables the movement of money between bank accounts through direct deposits and payments. The National Automated Clearing House Association (NACHA) governs the ACH network, setting rules and standards for ACH transactions. NACHA ensures the reliability and security of these transactions, providing a backbone for the financial industry, where millions of payments are processed daily, ranging from payroll deposits to bill payments.

What are ACH processing fees?

ACH processing fees are charges for processing electronic payments and transfers between bank accounts. These fees cover the costs of moving funds securely and efficiently through the ACH network.

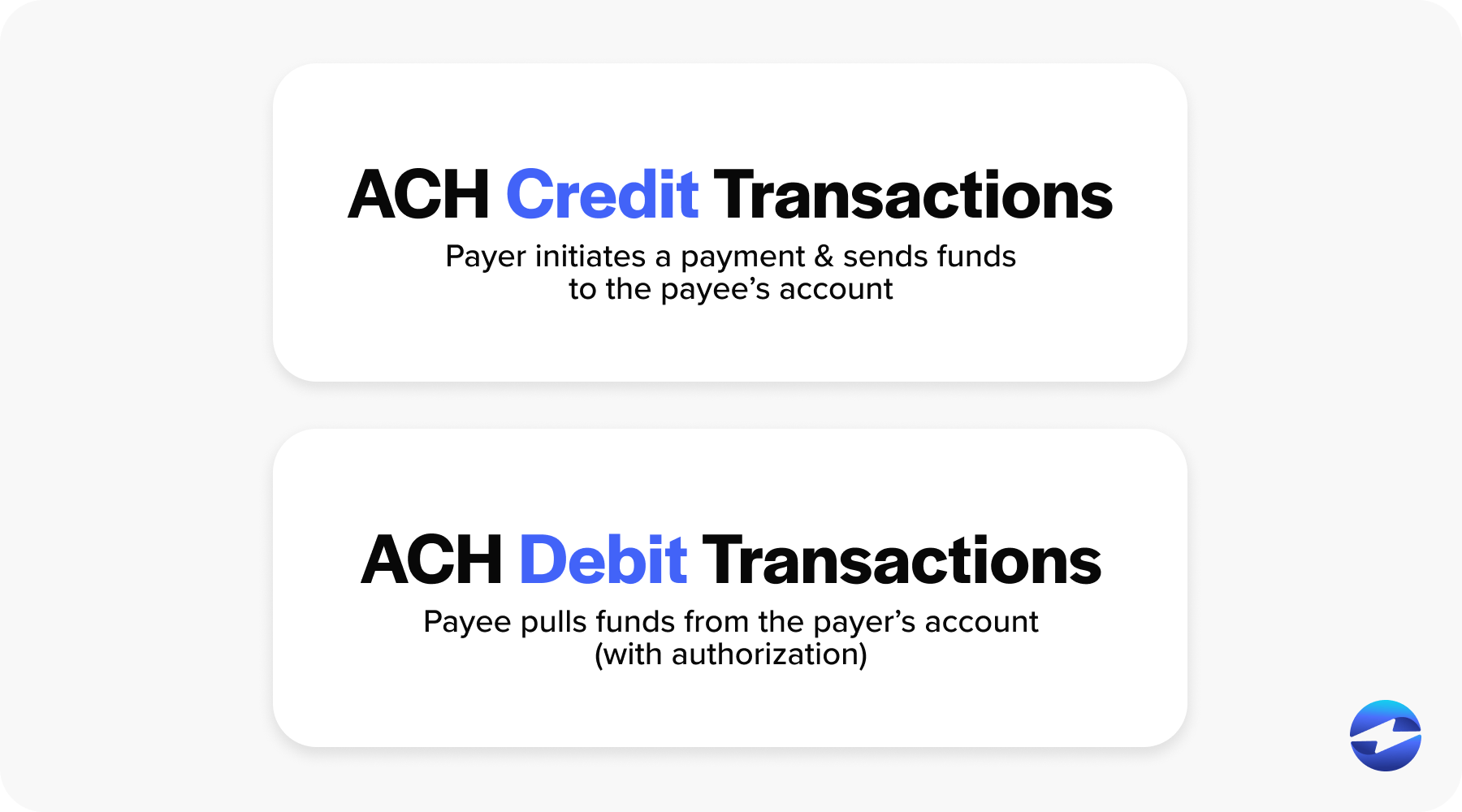

ACH credit vs. ACH debit

ACH transactions come in two main varieties: ACH credit transactions and ACH debit transactions.

ACH Credit Transactions: These transactions involve the payer initiating a payment and sending funds to the payee’s account. For example, an employer may use an ACH credit transaction to deposit payroll directly into an employee’s bank account. The hallmark of ACH credit is that it allows the sender to push funds into another account.

ACH Debit Transactions: Conversely, ACH debit transactions allow the payee to pull funds from the payer’s account with the payer’s authorization. This is commonly seen in monthly bill payments, where the biller regularly requests funds from the customer’s account.

These transactions carry fees with varying costs that depend on a few different factors.

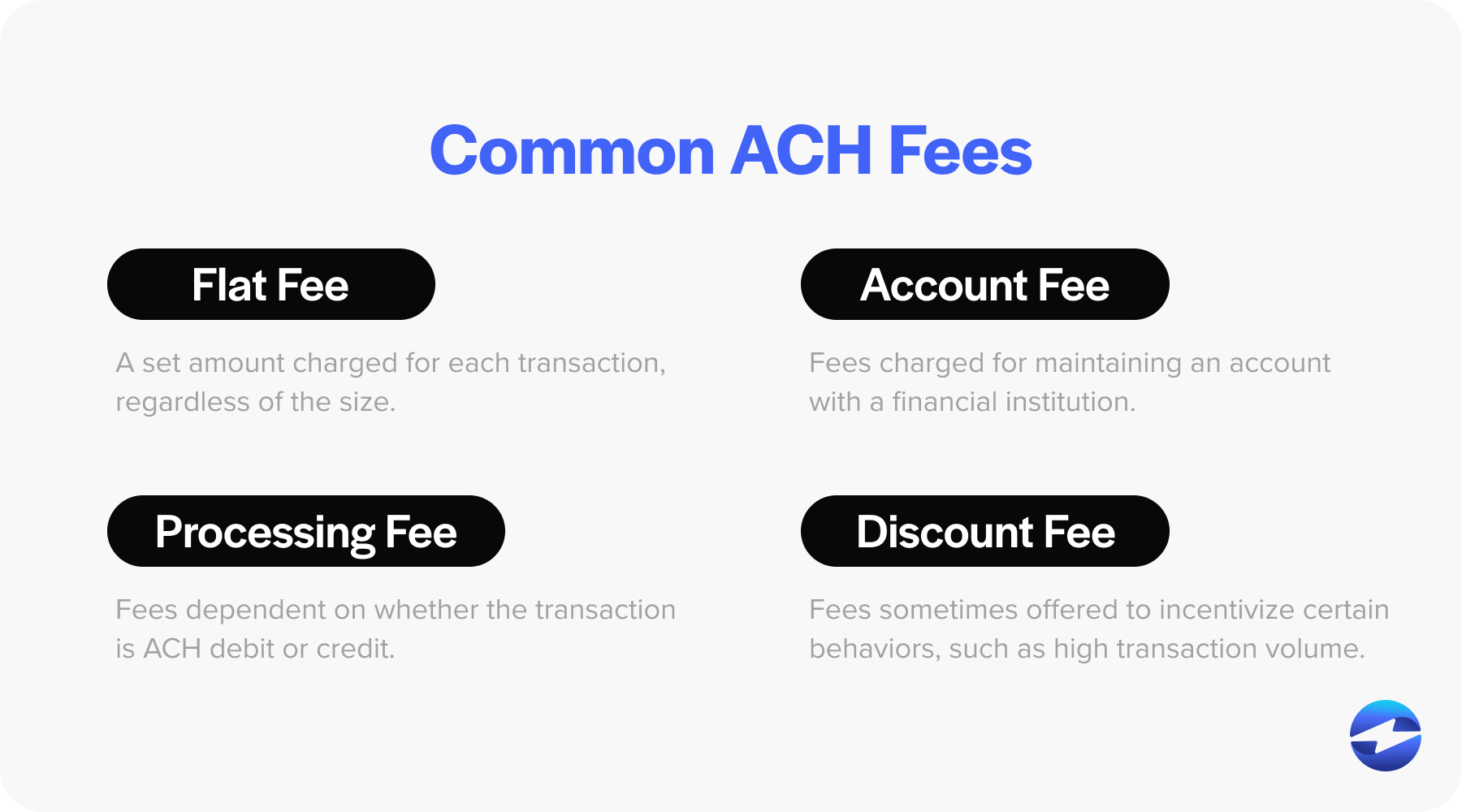

4 types of ACH fees and their costs

ACH transactions are known for their cost-effectiveness compared to other forms of payment processing. However, ACH transactions are not without their own set of fees, which vary depending on the financial institution, the nature of the transaction, and the specific payment processes involved. Here are some of the different types of ACH transaction fees businesses and individuals may encounter:

- Flat fee: A flat fee is a set amount charged for each transaction, regardless of the size. As a simple and predictable fee structure, flat fees make it easy for a business owner and accounting software to forecast expenses connected to ACH payments. For instance, a company might be charged a $0.50 flat fee whether it processes a $100 or a $10,000 transaction. This fee model is often attractive to businesses with a high volume of transactions, as it allows for simple reconciliation with minimal variations in processing costs.

- Account fee: Financial institutions charge an account fee for maintaining an account that participates in ACH transactions on accounts with ACH capabilities. This fee isn’t necessarily tied to individual transactions but is more a cost of enabling ACH functionality within an account.

- Processing fee: Processing fees depend on whether the transaction is an ACH credit or an ACH debit. Typically, ACH credit transactions can be more expensive for the initiating party, as they are pushing funds to another account, which is common in payroll. On the other hand, ACH debit processing fees may be lower for the initiator since they are pulling funds, common in subscription or monthly payment models. Financial institutions vary in how these fees are structured, and it’s essential to compare both flat fee amounts and percentage-based fees to determine what is most cost-effective, particularly where both large and small transactions are frequent.

- Discount fee: Some institutions or payment processors may offer discount fees on ACH transactions to incentivize certain behaviors, such as maintaining a minimum balance, high transaction volumes, or setting up specific payment terms or payment plans with customers. Discount fees reduce standard processing costs and can be a critical factor for businesses in managing their cash flow or negotiating payment options with their customers.

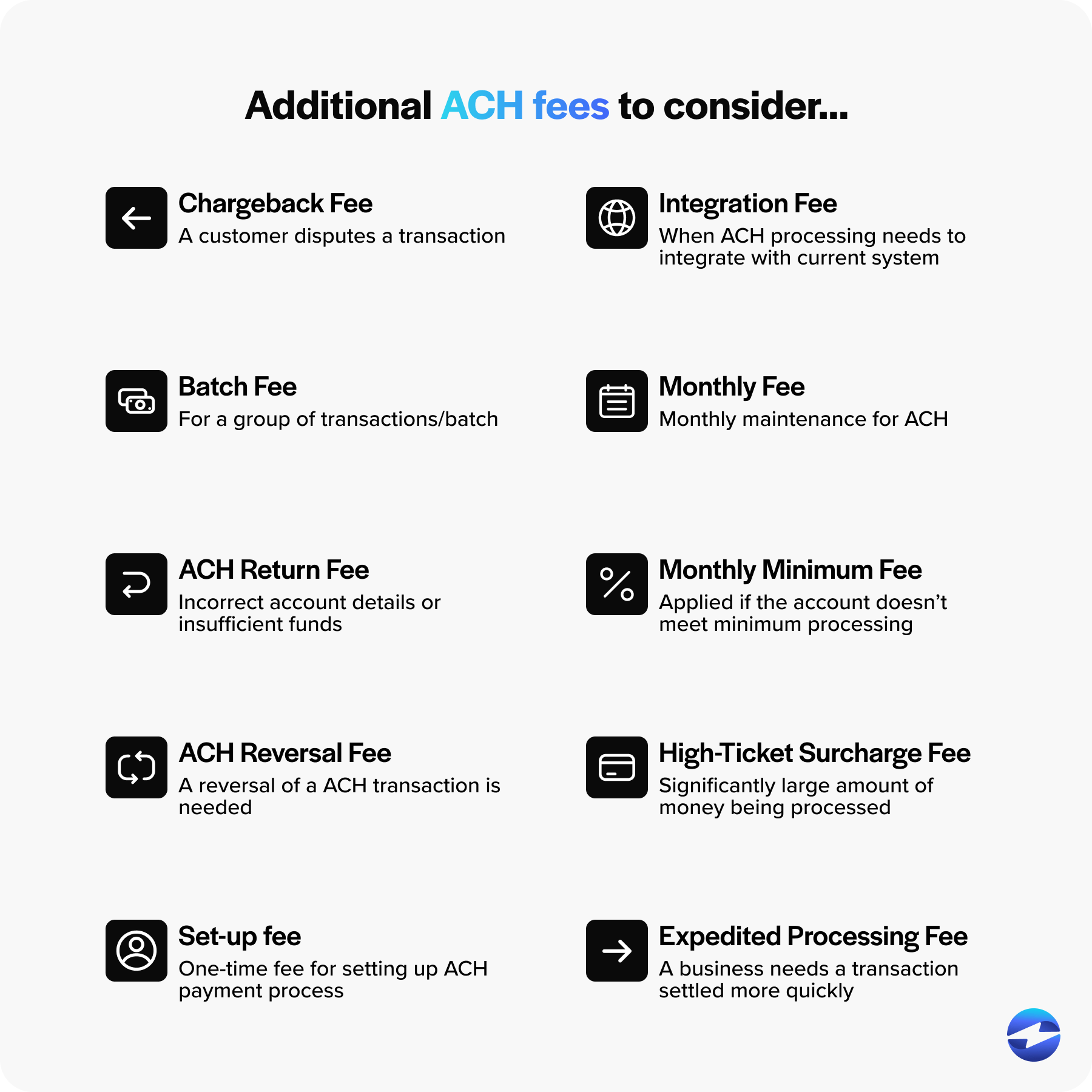

Additional fees to consider:

- Chargeback fee: Chargeback fees are incurred when a customer disputes a transaction and requests the funds be reversed. Within the ACH process, the amount is returned to the customer if a dispute is successful, and the business is charged a fee for this reversal. Chargeback fees represent not only a financial loss in the form of reversed funds but also the added costs imposed by the financial institution for processing the dispute.

- Batch fee: ACH transactions are commonly processed in batches rather than individually to enhance efficiency. A batch fee is a charge for each group of transactions processed together. This fee is generally nominal but can add up for businesses handling numerous ACH transactions daily, as each batch sent for processing may carry a separate charge.

- ACH return fee: Occasionally, an ACH transaction can’t be completed due to incorrect account details or insufficient funds. In these cases, the transaction is returned, and the party initiating the transaction charges an ACH return fee also known as an ACH reject fee. This fee compensates the financial institution for the additional processing work in handling the return.

- ACH reversal fee: An ACH reversal fee is a charge imposed by financial institutions for processing the reversal of an ACH transaction. When an ACH transaction is reversed, the financial institution involved may levy a fee for handling the reversal process. The amount of the reversal fee can vary depending on the institution’s policies and the specific circumstances of the reversal.

- Set-up fee: A business may incur a one-time set-up fee when establishing ACH payment processing capabilities. This charge often covers the administrative costs of creating and configuring the merchant’s account for ACH transactions.

- Integration fee: Businesses that require ACH check processing to integrate with their existing accounting software or payment systems may face an integration fee. This fee accounts for the technical services provided for the implementation and configuration necessary to ensure system compatibility.

- Monthly fee: Some financial institutions or payment processors might charge a monthly maintenance fee for ACH services. This recurring charge ensures that accounts are kept open and ACH functionalities remain available, irrespective of transaction volume.

- Monthly minimum fee: A monthly minimum fee is applied if the account does not meet a set minimum level of transaction processing activity. This fee ensures that the service provider covers costs even when transaction volumes are lower than anticipated.

- High-ticket surcharge fee: A high-ticket surcharge may be imposed for ACH transactions involving a significantly large amount of money, known as high-ticket items. This fee compensates the processor for the increased risk and handling of large sums.

- Expedited processing fee: Standard ACH transactions can take a few business days to process. However, if a business needs an ACH transaction settled more quickly, an expedited processing fee can be paid for this priority service. This fee reflects the additional effort required to fast-track processing outside the normal batch schedule.

Understanding these additional ACH transaction fees can empower businesses and individuals to negotiate better payment terms and select the most appropriate payment options. Although ACH transactions can harbor a multitude of different fees, there are many benefits to this digital platform.

Why are eChecks more efficient than paper checks?

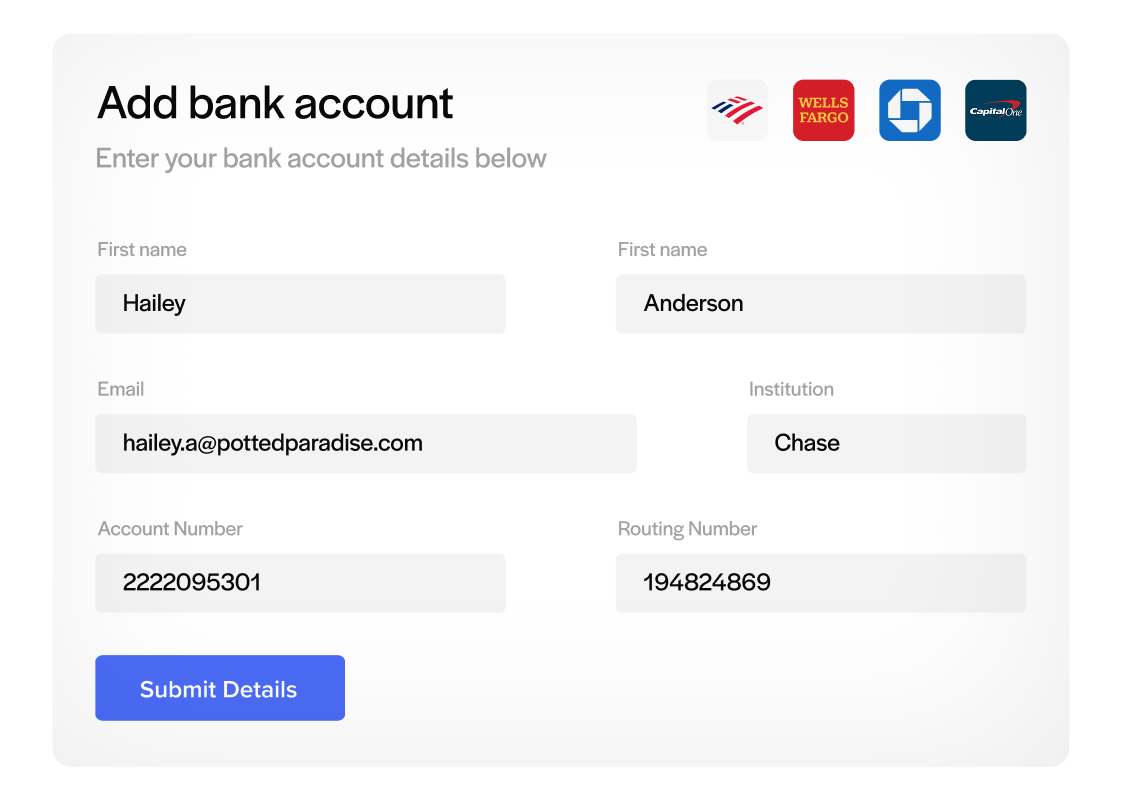

EChecks, or electronic checks, offer a modern twist on the traditional payment method by leveraging the efficiency of the ACH network. This digital approach to financial transactions simplifies the payment process, providing a smooth and streamlined experience for both the payer and the payee.

The inherent efficiency of eChecks can be attributed to their cost benefits, speed, reduced propensity for human-related errors, and overall convenience.

Costs

When it comes to financial operations, minimizing costs is a top priority for businesses and individuals alike. EChecks are a cost-effective alternative to paper checks due largely to reduced material and processing costs.

Without the need for physical checks, envelopes, or postage, businesses save on supplies and mailing expenses. Moreover, handling and processing fees tend to be lower with eChecks because there’s no need for manual entry or physical transportation, reducing labor and banking fees. The integration with accounting software further cuts down on administrative overhead and potential costs linked to human error or delays.

Speed

In a world where timing can be as crucial as the transaction itself, eChecks excel by offering markedly faster processing times compared to their paper counterparts.

With eChecks, the information travels digitally through the ACH network, significantly reducing the waiting period typically associated with mailing and bank handling of paper checks. Funds can become available within a few business days, which expedites the cash flow for businesses and provides quicker access to funds for individuals. This acceleration of the payment cycle enhances operational efficiencies for businesses reliant on timely payments and supports better financial planning.

Reduced errors

The process of manually writing, mailing, and processing paper checks is ripe with human error. EChecks mitigate these issues by utilizing digital forms and automated processing.

Data entered for eChecks can be preset or auto filled, validated for accuracy through accounting software, and sent without the risk of misplacement or damage that physical checks face during transit. These safeguards significantly reduce the likelihood of errors and simplify the deduction management process for receivable teams dealing with invalid reasons or honest mistakes.

Convenience

The convenience of eChecks is unparalleled, especially in an increasingly mobile and digital work environment. Users can initiate and receive payments from anywhere with an internet connection without the need for physical check handling, visits to the bank, or waiting for the mail.

This virtual approach to payments also offers greater flexibility in managing cash flow, enabling businesses and individuals to promptly handle short-paid invoices, partial payments, and overdue payments. The convenience of eChecks extends to the receivable department and collections teams, as electronic invoicing and payments simplify the tracking and reconciliation process, leading to more efficient operations and timely payments.

Optimizing financial operations with electronic payments

From flat fees to account maintenance charges, each aspect impacts financial transactions differently. Therefore, comparing the efficiency of ACH and eChecks to traditional paper checks will highlight the advantages of embracing digital payment methods.

Understanding these nuances and harnessing the benefits of electronic transactions enables businesses and individuals to optimize their financial operations, streamline processes, and enhance their overall revenue.