Blog > Top 10 Mistakes Merchants Make When Fighting Chargebacks

Top 10 Mistakes Merchants Make When Fighting Chargebacks

One of the most challenging parts of being a merchant is knowing how to handle cash flow and payment collections efficiently to ensure minimal disputes occur.

Unfortunately, every business has to deal with its share of complications when it comes to accepting payments from customers. Included in these complications are chargebacks which can majorly disrupt your revenue if not properly managed and addressed.

What are chargebacks?

Chargebacks occur when customers dispute a transaction which then leads to the charge amount being returned to the customer (back on the card used) and the business account being debited.

The video below goes some quick tips on over what chargebacks mean for merchants:

Typically, there are three types of chargebacks merchants should be aware of:

- Friendly fraud chargebacks: Friendly fraud occurs when a cardholder makes a purchase and files an illegitimate chargeback with their card company, claiming they didn’t initiate the transaction.

- True fraud chargebacks: True fraud occurs when a stolen card or account is used to purchase products or services without the cardholder’s permission. This results in the cardholder filing a charge for unauthorized use of his/her payment information.

- Merchant error chargebacks: Merchant error chargebacks are legitimate claims that can stem from issues involving technical errors, poor customer service, unwanted recurring payments, and more.

While chargebacks can be applied to both credit cards and debit cards for various reasons like fraud and poor product quality, merchants can fight chargebacks if they feel the reason is invalid or misrepresented.

That being said, businesses should be careful about what actions they take to fight chargebacks, as many common mistakes are made when handling these disputes.

The top 10 mistakes merchants make when fighting chargebacks include…

- Not communicating with customers

- Little or no knowledge of chargeback reason codes

- Failing to fight chargebacks altogether

- Wasting time

- Ignoring fraud trends and red flags

- Expending costs and valuable resources

- Only focusing on winning the dispute

- Not working with your processor

- Failing to collect chargeback metrics

- Neglecting fraud prevention tools

1. Not communicating with customers

Poor communication with consumers is one of the biggest mistakes a business can make when trying to prevent, manage, and reduce chargebacks.

Merchants that clearly communicate refund policies with their customers and have easily accessible information on their websites can mitigate or avoid chargebacks altogether. Providing thorough product descriptions and pictures, transaction statements, order details, and more, can also help you fight chargebacks.

Additionally, businesses that provide high-quality and responsive customer service can prevent chargebacks. A strong customer service team that addresses product and service issues, payment errors, and other related issues, in a timely and respectful manner, is essential in tackling these concerns before they turn into chargebacks.

If all else fails and your business is faced with a chargeback, you have 7-10 days to dispute it. During that time period, you can start a dialogue with the customer to find out the reasoning behind the chargeback to see if it can be resolved and undone.

2. Little or no knowledge of chargeback reason codes

To successfully fight a chargeback, it’s beneficial for merchants to have sufficient knowledge of, and be up-to-date on, chargeback reason codes.

Reason codes for chargebacks work as a classification system established by the card networks that consists of the chargeback types, chargeback reasons, and the required evidence needed to dispute the chargeback. This information is important for merchants to understand to build a strong defense against these claims during the representment process.

Chargeback reason codes often vary by the card network. Therefore, businesses should conduct routine research to ensure they’re up-to-date on the newest chargeback reason codes and representment requirements.

3. Failing to fight chargebacks altogether

Merchants that fail to investigate or fight chargeback claims are doing their business a great disservice.

While each chargeback is different and not all can be disputed, your business should thoroughly review every claim to make sure it’s accurate. If the chargeback is illegitimate, you’ll need to decide if it’s financially advantageous to fight it.

Chargeback disputes can be costly and in some cases, you may spend more money fighting the chargeback than you’ll get back from the original transaction. Therefore, it’s important to carefully evaluate each case to determine if winning a dispute will yield more returns.

Nonetheless, businesses should respond to every chargeback and pursue a chargeback representment if the win will guarantee a significant revenue.

4. Wasting time

Time is one of the most valuable resources when running a successful business, and fighting chargebacks is no different.

While it’s highly recommended to investigate chargebacks to see if they’re legitimate and worth fighting, merchants should be cautious of not spending too much time on these claims.

Before committing any time or resources to fight chargebacks, merchants should check if their acquiring bank has already initiated an automatic representment. More often than not, acquirers will handle this process on your behalf.

Businesses can save time by knowing which chargebacks are addressed by acquirers, as well as implementing an efficient chargeback flow system for claims they’re responsible for.

Chargeback flow systems should help you outline:

- How to detect a potential chargeback

- Step-by-step instructions to address chargebacks

- Representment guidelines

Having an efficient plan in place to fight chargebacks will help your business focus its time and resources on more pressing, high-priority tasks.

5. Ignoring fraud trends and red flags

Ignoring red flags involving your customers’ payments and chargebacks or trends involving fraud can result in a loss in revenue and legal ramifications for your business.

Therefore, it’s important to track payments, keep detailed transaction records, and actively monitor unusual activity and chargeback fraud trends. Merchants can achieve this by routinely reviewing payment analytics to identify any patterns — upticks in dispute frequency or commonly reported reasons— and stay up-to-date on chargeback reason codes.

By taking steps to identify red flags and chargeback fraud patterns early on, businesses can adjust their fraud prevention tactics and solutions accordingly to fight chargebacks and save more money.

6. Expending costs and valuable resources

Overspending and exhausting valuable resources on chargebacks can lead to major operational issues and financial hardship for your business.

According to the Digital Payments in 2021: Opportunities and Chargeback Risks survey, the top two challenges for respondents were a lack of experience with chargeback prevention and a lack of chargeback prevention strategies. When merchants aren’t prepared or knowledgeable enough to prevent or address these disputes, the cost of chargebacks can be very expensive.

Businesses can cut down on excessive costs, resource use, and time spent on chargebacks by creating an efficient chargeback management process — consisting of a strict budget, a dedicated chargeback team, and a set list of software and other resources to be used.

Payment processors may offer chargeback management and prevention tools in their software. Don’t forget to verify what payment services and chargeback features your payment processor provides to ensure you’re not paying for a third-party service that’s already included in this platform.

If chargebacks get to be too frequent or time-consuming, chargeback management software providers offer streamlined solutions which can allow your business to allocate extra costs and resources to other operations.

7. Only focusing on winning the dispute

While it’s important to analyze and factor in your win rate when fighting chargebacks, this shouldn’t be the only indicator of success for your business.

Chargeback win rates are the number of dispute wins your company achieves divided by the total number of chargebacks you dispute.

Keep in mind that a pre-arbitration chargeback win is not necessarily an overall win and should not be recorded as such. Chargeback disputes that move past this stage require merchants to re-submit claims and accept liability but are often ruled in the cardholders’ favor. Therefore, win rates should be accurately calculated by only including chargeback wins past the pre-arbitration, arbitration, and 2nd representment stages.

Despite the win rate being a great key performance indicator (KPI) of a company’s chargeback management and representment strategy, it’s not the only rate that should be measured.

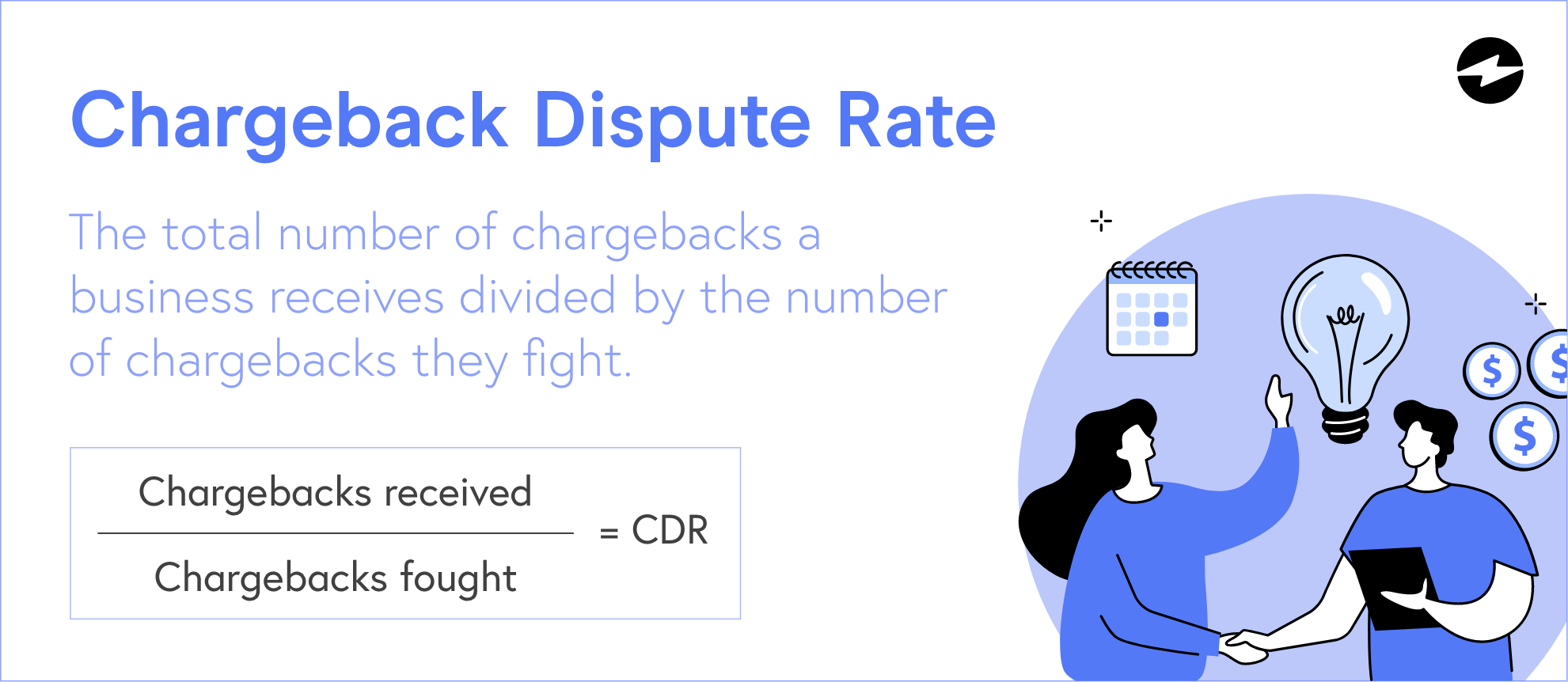

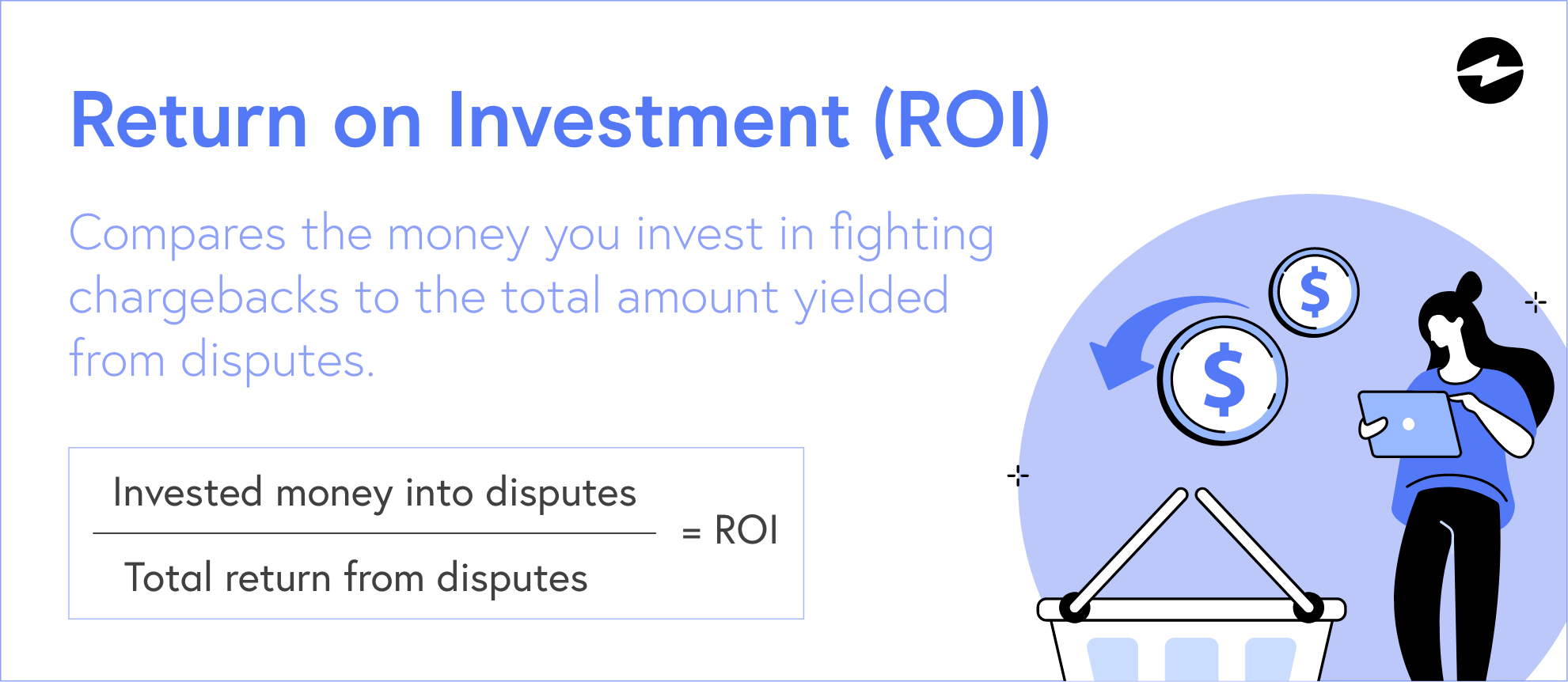

Merchants can gain a better picture of their success rate in fighting chargebacks by evaluating other KPIs like dispute rates and ROI:

- Chargeback dispute rates: The dispute rate is the total number of chargebacks a business receives divided by the number of chargebacks they fight. This means if a business has a high win rate but their dispute rate is below 20%, they’re only fighting a minimal amount of their chargebacks and could be missing out on a lot of revenue.

- ROI: Return on investment (ROI) compares the money you invest in fighting chargebacks to the total amount yielded from these disputes. In addition to reviewing ROI for previous chargebacks, businesses can estimate ROI before taking on a chargeback case to determine if the potential revenue from winning the dispute is more than the amount invested to fight it.

Calculating all of these KPIs will help merchants determine their chargeback success. If your win rate, dispute rate, and ROI are all showing positive metrics, you can assume that your chargeback representment process and management are efficient and profitable.

Lastly, it’s important to remember that the success of your business isn’t always determined by numbers. Chargeback disputes can result in other key benefits and opportunities like advanced security, an improved consumer payment experience, and long-lasting customer relationships.

8. Not working with your processor

Fighting chargebacks is stressful as is, so why make it harder on your business by not working with a team of experts that wants to see you win as well?

Credit card processors are a valuable resource when fighting chargebacks, as they often have a lot of experience and insight into these disputes, technology to prevent and manage them, and support teams to assist you.

Therefore, working with a trusted payment processor that offers built-in payment security, advanced reporting capabilities, and an efficient chargeback management process can help you successfully prevent, mitigate, and fight chargebacks.

9. Failing to collect chargeback metrics

Collecting and analyzing chargeback metrics also plays a vital role in developing a strong management process.

You should be actively collecting a variety of metrics like win rates, dispute rates, and ROI (explained above) as you fight chargebacks. Chargeback rates are also important for merchants to track, as they calculate the number of total transactions that result in chargebacks.

Chargeback rates will help you identify technical patterns or fraud spikes. If this rate increases above 1%, most credit card companies will categorize you as a high-risk merchant and enroll your business in a chargeback monitoring program that requires you to complete regular activity reports which can be costly.

10. Neglecting fraud prevention tools

Last but not least, businesses should never make the mistake of neglecting fraud prevention tools, as they’re necessary to fight fraudulent chargebacks and other threats.

Here are some common fraud prevention tools that aid in chargeback protection for merchants:

- Address verification service (AVS)

- Card security code verification

- 3-D Secure

- Device fingerprinting

- Fraud blacklists

- Fraud scoring

- Real-time alerts and notifications

Finding the most robust fraud prevention tools will help your business enhance its payment security and be more prepared to fight against fraudulent chargebacks.

Merchants can avoid these 10 mistakes to successfully fight chargebacks

It’s no secret that chargebacks can be a daunting and expensive process that can put a major strain on your business. Luckily, with the right strategies, software, and knowledge you can eliminate this stress altogether.

Merchants that avoid the 10 common mistakes included in this article will be better prepared to successfully fight chargebacks and save more time, resources, and money.