Blog > What is an eCommerce Payment Gateway?

What is an eCommerce Payment Gateway?

As the eCommerce market continues to expand and online retailers reach record sales, using a payment gateway to facilitate online sales has become a necessity for many industries.

With the global eCommerce market projected to reach nearly $5 trillion this year, having the peace of mind knowing your credit card transactions are being processed without a hitch can be the driving force in the growth of your business.

What is an eCommerce payment gateway?

An eCommerce payment gateway is a software used by merchants to accept, manage, and process credit or debit card transactions online.

In simple terms, an eCommerce payment gateway is a middleman between online merchants and their customers and the checkout portal you see on online stores

Payment gateway vs. merchant account vs. payment processor

Merchants sometimes confuse the different terms involved in the credit card processing industry, but it’s important to know what each one means. Here’s a breakdown of three common terms:

A merchant account is a business bank account that authorizes merchants to accept and process electronic payments. All eCommerce stores are required to have a merchant account to operate their online business. Merchant accounts can be obtained through your bank, payment processor, or payment gateway provider.

A payment gateway is software that allows merchants to accept and authorize credit card transactions in person or online. The gateway sends transaction data to the payment processor and authorizes card-not-present payments.

An eCommerce payment gateway is in charge of relaying transaction information from a merchant’s online store to the payment processor. Merchants can obtain an eCommerce payment gateway through their payment processor or a third-party service.

A payment processor is a financial institution that provides payment processing services to merchants. The processor transmits the payment data provided by the payment gateway to the credit card network (Visa, Mastercard, Discover, American Express, etc.) to authorize the transaction and then back to the merchant.

How eCommerce payment gateways work

An eCommerce payment gateway is one of the key players in the world of credit card processing, as it facilitates, transfers, and protects sensitive credit card transactions.

Let’s break down how a payment gateway works into six steps:

- The customer places an order and enters his or her credit card information into the checkout page on a merchant’s website.

- Once the card information is captured, the payment gateway encrypts it and sends it to the payment processor.

- The payment processor then sends the transaction data to the credit card network (Visa, Mastercard, Discover, American Express) to validate the charge and issue an interchange rate based on the risk level of the transaction.

- The credit card association reviews the charge to make sure there are enough funds present to fulfill the purchase and approve the transaction. If there are inadequate funds, the association rejects the transaction.

- The transaction is authorized or denied and the issuing bank sends a response back to the payment processor, to the eCommerce payment gateway, and, finally, to the merchant.

- After the transaction is approved and completed, it takes 24 to 48 hours for the funds to be available in the merchant’s account. The payment gateway stores and records all these daily transactions to be batched and invoiced at the end of the business day.

Although this seems like a complicated process, most of these steps (except for #6) take place within seconds.

Why your online store needs a payment gateway

Unlike a physical storefront, eCommerce merchants operate solely on card-not-present transactions, which means they need a secure payment gateway to process these payments.

In addition to processing credit cards, an eCommerce payment gateway can improve your online store’s overall security. By using a secure gateway, businesses can mitigate or eliminate fraud risks, reduce chargebacks, and protect customers’ credit card data from hackers. Because of this increased security, payment gateways are essential for online businesses.

By safely processing these transactions, eCommerce payment gateways can avoid security threats to provide customers with a smoother user experience and merchants with a better brand reputation and more efficient operations.

How to choose the right gateway for your business

While there are a variety of eCommerce payment gateways to choose from, they’re not all equal. First and foremost, you need to evaluate your business model to determine what your needs are. Many factors will play a role in deciding which gateway is right for you, such as the size of your business, transaction volumes, the design of your website, security needs, and more.

Although there are universal characteristics you’ll find with every gateway, there are also unique features to look for that can greatly benefit your online business.

8 features to look for in your eCommerce payment gateway

For the most successful credit card processing, merchants should look for eCommerce payment gateways that include these features, as they will yield the best results:

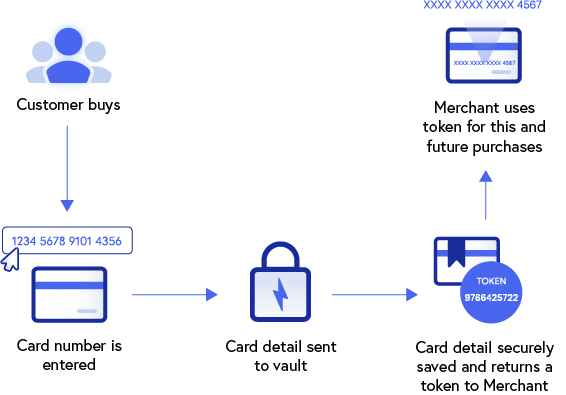

Tokenization

Tokenization is a crucial security feature during the transaction process, as it replaces sensitive credit card information with a unique string of numbers that cannot be deciphered by hackers. If an eCommerce payment gateway doesn’t have this feature, run!

Security: PCI compliance, fraud prevention

Every eCommerce merchant would be wise to better secure their online store, especially since their entire reputation relies on the strength (or weakness) of their security. Using a PCI-compliant payment gateway can help you increase security and better protect sensitive credit card information. Merchants can check a gateway’s compliance on their own by viewing the PCI Security Standards Council’s latest requirements.

Additional security measures to look out for when choosing an eCommerce payment gateway are built-in fraud prevention tools like data encryption, card verification value (CVV) validators, address verification service (AVS), off-site data storage, and device identification.

Seamless checkout experience

Ensuring your eCommerce payment gateway offers a seamless checkout experience is crucial in encouraging repeat sales and long-term success. Consumers want a fast, easy, and secure checkout — without it, they’re more likely to abandon their cart and not return.

When shopping for an eCommerce payment gateway, some checkout features to look for include mobile optimization, user-friendly navigation, multiple payment options, one-step checkout, and reputable credit card logos and security seals to build trust with customers.

Cost-effective pricing and transparent contracts

One of the biggest driving factors in choosing an eCommerce payment gateway is, of course, pricing. With many different options available, businesses can overcharge on processing fees and rates. Merchants should shop around to find the gateway that best fits their business needs. You can also compare the rates and fees of several third-party service providers to see which is the most fairly priced. Some of the unnecessary costs to look out for are monthly minimums and registration, transaction, and setup fees.

Payment gateways use different pricing models to charge their customers. The three main pricing models are interchange plus, flat rate, and tiered — make sure the gateway service you choose carries the desired model for your business.

Lastly, online merchants will need to decide whether a month-to-month or annual contract is right for them. Once this decision is made, you should review your contract to make sure it’s transparent and includes the same details and pricing previously agreed upon.

24/7, in-house customer support

Customer service is huge in the eCommerce payment gateway industry, as routine system updates are necessary. Finding an efficient solution that meets your needs is only half the battle. Every gateway should come with a team that fully supports your business and handles any issues that arise.

The best eCommerce payment gateways will offer in-house, 24/7 support teams to assist you. Some benefits of strong customer service include an easier installation and setup process, instant responses to any questions or concerns, and a clear line of communication that nurtures more trust. Steer clear of providers that don’t offer these services.

Growth capabilities

The main goal for most merchants is to scale their business, which means implementing the necessary tools and software to support this initiative. Online stores should choose an eCommerce payment gateway that has the capabilities to fulfill their growth needs.

To determine if an eCommerce payment gateway is geared toward growth, merchants should look for innovative providers that factor in current payment trends, scheduled updates and upgrades, large transaction volume capabilities, the ability to accept all relevant card types, and the ability to support multiple payment methods.

Integrations to invoicing systems

An important feature to look for in your payment gateway is the ability to sync payment data back to your accounting system. Check the payment gateways’ current eCommerce integrations to see how they will be able to work with your current processes. This will save countless hours of manual reconciliation.

Customization options

Customizing your eCommerce payment gateway is a great way to allow it to blend in with the design of your other web pages. Customization features also allow merchants to alter their checkout to meet their customers’ unique needs.

Some common customization options include relevant field displays tailored to customer needs, branded customer portals, and the ability to accept recurring payments, track disputes, and provide a variety of payment options (popular credit cards, mobile wallets, etc.).

Additional eCommerce payment gateway features to look for include:

- Unlimited batch history

- Virtual terminal

- Mobile payments

How to add a payment gateway to your eCommerce website

To add an eCommerce payment gateway to an online store, here are the steps merchants must follow to ensure their system runs seamlessly:

1. First, you must register a merchant (bank) account to be able to accept funds. This account must be approved by the bank before proceeding.

2. Merchants must then decide how the gateway will pair best with their business. Two of the most common ways to use eCommerce payment gateways include:

- Hosted payment gateways: Once a customer clicks the “pay now” button, they’re redirected to a third-party gateway site to complete the transaction.

- API/integrated payment gateways: Customers complete their transactions directly on the eCommerce site’s checkout page and payments are processed using APIs.

3. After choosing the best payment gateway for your online store, the gateway provider will prompt you to follow a setup process. Sometimes the installation can be done using plugins or extensions offered by your eCommerce platform.

4. Once your eCommerce payment gateway is fully installed, it’s important to conduct testing to make sure your system is operating properly and there are no gaps in security. Ensure you’re using strong encryption and tokenization and secure channels to prevent sensitive card information from being exposed.

Once you complete these steps, your eCommerce site is ready to accept, manage, and process payments.

The eCommerce boom and its impact on payment gateways

As online shopping trends show no signs of stopping post-pandemic, it’s never been more important to ensure your website is securely and efficiently processing payments.

With online transactions seeing a dramatic increase, the eCommerce boom has had a direct impact on the payment gateway market. To meet growing demand, your payment gateway should be able to withstand high transaction volumes, offer a variety of payment methods, and accept all major credit and debit cards.

Merchants should also stay up to date on consumer behaviors, relevant industry data, and eCommerce and payment processing trends.

Conclusion

Payment gateways are a vital tool for all merchants to successfully keep up with the growing virtual shopping industry. By evaluating your needs and growth goals to choose the best eCommerce payment gateway for your business, you can leverage this software to save money, increase profits, and yield long-term success to outlast your competition.

Summary

- What is an eCommerce payment gateway?

- Payment gateway vs. merchant account vs. payment processor

- How eCommerce payment gateways work

- Why your online store needs a payment gateway

- How to choose the right gateway for your business

- How to add a payment gateway to your eCommerce website

- The eCommerce boom and its impact on payment gateways

- Conclusion

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge