Blog > 8 Ways to Grow Your Business with Payment Analytics

8 Ways to Grow Your Business with Payment Analytics

In today’s competitive market, understanding customer behavior is essential for business growth. Thankfully, payment analytics are a powerful tool that provides actionable insights into customer transactions.

By analyzing transaction data, businesses can identify consumer payment trends and tailor marketing strategies to deliver personalized experiences that enhance customer satisfaction and loyalty.

This article will provide more in-depth information about payment analytics, the various statistics and figures they track, and how businesses can utilize them.

What are payment analytics?

Payment analytics, or transaction analytics, are data generated from customer transactions to derive insights. This information helps companies make informed decisions by using payment data to understand customer behavior and preferences.

Payment analytics allows merchants to track how customers pay, what they buy, and when they make purchases. These analytics consist of valuable insights into customer segments and can identify key performance indicators (KPIs) such as conversion rates and customer loyalty. Businesses can analyze this transaction data to improve customer experiences and satisfaction.

The following section will provide more insight into these trackable payment analytics.

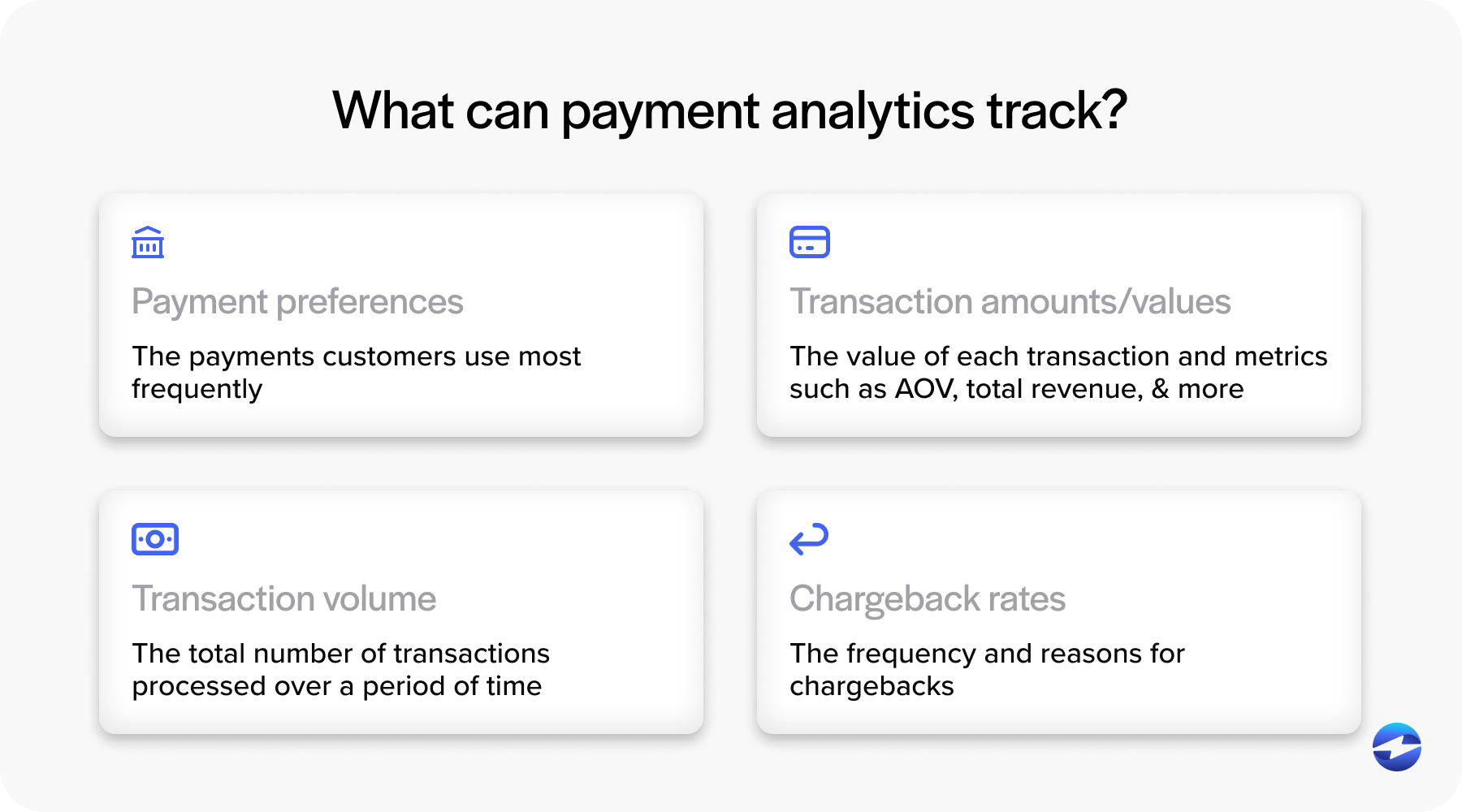

What can payment analytics track?

Payment analytics are vital assets businesses can leverage to generate strategic initiatives and marketing efforts that enable more growth and long-term success.

Payment analytics can include the following:

- Payment preferences: Payment analytics can track which payment methods customers use most frequently, such as credit and debit cards, Automated Clearing House (ACH)/eChecks, mobile wallets, and more. This data can identify customer preferences, allowing merchants to adjust their payment offerings accordingly.

- Transaction amounts and value: Payment analytics tools monitor the value of each transaction, calculating metrics like average order value (AOV), total revenue, and highest or lowest transaction amounts. This helps businesses understand spending behavior and spot trends in purchasing patterns.

- Transaction volume: Transaction volumes include the total number of transactions processed over a period of time. Payment analytics systems track daily, weekly, or monthly transaction counts to measure sales activity and identify peak or slow periods.

- Chargeback rates: Chargeback data is captured when customers dispute a transaction with their banks. Transaction analytics tracks the frequency and reasons for chargebacks, helping businesses identify recurring issues, reduce fraud, and improve the post-purchase experience.

Understanding how and which payment analytics to track can allow merchants to tailor their approaches to meet diverse needs and improve the overall user experience. A data-driven approach can yield better customer service, increased loyalty, and stronger business growth.

8 ways businesses can use payment analytics

From understanding customer preferences to forecasting cash flow and reducing fraud, payment analytics empower businesses to act with greater precision and agility.

The following sections explore eight ways businesses use payment analytics to gain a competitive edge and strengthen their financial performance.

1. Cash flow forecasting

Payment analytics can improve cash flow forecasting accuracy by providing actionable insights into transaction patterns.

By examining payment data, businesses can predict future cash inflows and outflows more precisely. This enables more accurate budgeting and financial planning. Merchants can avoid cash shortages and ensure they have enough funds to meet obligations. These payment insights can also help adjust strategies to prevent cash crunches.

2. Preferred payment methods

Payment analytics can identify customers’ preferred payment methods to enhance the user experience.

Identifying preferred payment methods can help businesses determine which payment options best meet their infrastructure and demographics. Tailoring payment methods can improve conversion rates and enhance the post-purchase customer experience. This personalization can increase customer loyalty and improve retention.

3. Customer trust and loyalty

Transaction analytics provide insights into consumer behavior that can help businesses improve customer service to generate more trust, brand loyalty, and long-lasting success.

Knowing the ins and outs of the customer journey can help businesses tailor a more personalized experience. Analytics can also reveal patterns indicating loyal customers. These insights enable companies to reward loyal customers, strengthening relationships.

4. Payment trends by location

Payment data analytics can identify payment trends across multiple channels and locations to help businesses optimize their operational strategies by understanding regional variations in payment methods.

By analyzing these payment trends, businesses can tailor marketing campaigns to suit local preferences, optimize marketing strategies, and align sales team efforts to ensure they resonate well with regional customer bases. Understanding local trends can also improve supply chain decisions.

5. Transaction failure rates and fraud prevention

Transaction failures and fraudulent transactions can harm customer experience and loyalty, so it’s essential to manage them. Payment analytics can track transaction failure rates and allow merchants to investigate the cause of failures to improve the overall transaction process.

Additionally, analyzing payment data analytics can help identify patterns indicative of fraud. Early detection can prevent financial loss, protect customers, increase trust, and reduce chargebacks.

6. Resource allocation

Payment insights can optimize resource allocation by revealing KPIs merchants can review and use to improve operational efficiency.

Businesses can analyze customer transaction patterns by pinpointing customer segments with higher engagement to manage marketing strategies effectively and allocate resources where they’re needed most. This ensures customer needs are met without overextending resources.

7. Increasing revenue and profit

Using payment analytics to boost revenue and profit involves understanding market trends and customer behavior. By examining payment data, businesses can identify opportunities for upselling and cross-selling.

Analytics offer insights into customer segments with potential growth, guiding marketing efforts. Additionally, advanced analytics can help lower transaction costs and enhance pricing strategies by identifying inefficiencies in payment processing, such as high-cost payment methods or redundant steps.

Payment analytics also enable businesses to analyze customer behavior and transaction trends to set more competitive and dynamic pricing strategies that align with market demand and customer willingness to pay.

This, combined with an improved customer experience, can lead to increased conversion rates and profitability.

8. Overall customer experience

Payment analytics can provide insights into operational gaps and areas needing improvement to enhance the user experience.

By examining the customer experience after a transaction is completed, businesses can find ways to enhance their service. Analytics can reveal feedback on transaction speed, security, and ease of use. Addressing these areas leads to an improved payment journey to encourage more return customers.

Overall, analytics play a vital role in shaping smarter business strategies. By effectively leveraging this data, companies can increase revenue, improve internal and external payment operations, and enhance their growth efforts to support more sustained success.

As digital payments continue to evolve, embracing payment analytics is no longer optional — it’s a critical advantage in today’s data-driven business landscape.

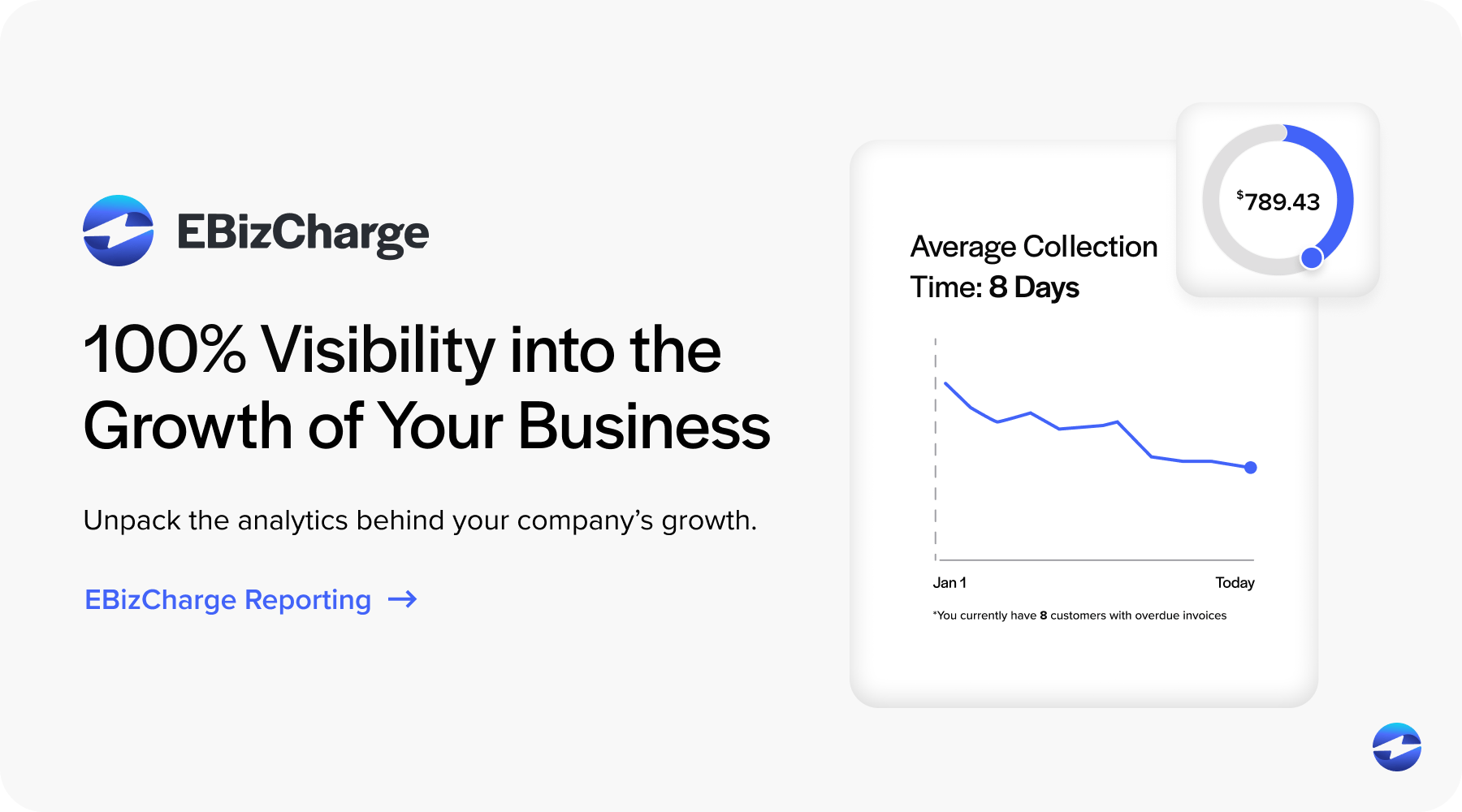

For in-depth payment analytics, payment solutions like EBizCharge offer numerous tools and features that extensively track KPIs.

EBizCharge delivers powerful payment analytics for merchants

EBizCharge is a payment processing solution that allows merchants to accept credit, debit, and ACH/eCheck payments directly within enterprise resource planning (ERP), accounting, eCommerce, and other business systems.

The top-rated EBizCharge payment solution offers powerful payment analytics tools designed to help companies grow by converting raw transaction data into meaningful insights and gaining real-time visibility into customer behavior and payment trends by tapping into KPIs. These insights empower businesses to tailor their strategies, improve conversion rates, and enhance customer satisfaction.

With its advanced analytics, EBizCharge delivers detailed reports on sales performance, transaction history, and chargeback rates. This information supports informed decision-making across marketing, operations, and supply chain management. Businesses can also use this valuable data to focus on customer segmentation to personalize experiences, strengthen loyalty, and provide better support.

EBizCharge’s suite of features includes real-time payment data to monitor customer journeys, fraud detection tools to identify and prevent suspicious activity, and customizable reports to support strategic goals. It also offers chargeback management capabilities to track, analyze, and reduce disputes.

EBizCharge equips merchants with the necessary tools to understand market trends, optimize the user experience, and maintain prolonged prosperity.