Blog > 10 Effective Strategies for Boosting Cash Flow for Manufacturers

10 Effective Strategies for Boosting Cash Flow for Manufacturers

Understanding how to improve cash flow is crucial for businesses in the manufacturing industry, as it can be the determining factor in maintaining operational costs, healthy revenue, and successful growth initiatives in the future.

The importance of healthy cash flow

Healthy cash flow is vital for manufacturing businesses to preserve financial stability and facilitate smooth business operations.

For manufacturers, cash flow is not only about the amount of money coming in and out; it’s a measure of their ability to maintain production processes, manage business expenses, and invest in capital management.

Cash flow ensures manufacturers can cover their operating expenses, from raw materials to labor costs. It also enables them to invest in new technology and equipment, bolstering efficiency and competitiveness.

With consistent cash flow, manufacturers can avoid cash shortages that may require them to take out expensive lines of credit and sustain their business without incurring additional debt.

Common cash flow challenges for manufacturers

Given the nature of their industry, manufacturers often face complex financial challenges that can impact cash flow and disrupt the delicate balance between incoming and outgoing funds.

Factors such as market volatility, customer demand fluctuations, supply chain disruptions, and the long-term nature of production cycles make cash flow management particularly demanding in the manufacturing industry.

Common cash flow challenges include unpredictable forecasting, elevated operational expenses, slow customer payments, inventory management difficulties, and more. Addressing these issues is essential to maintaining operations and financial solvency.

Unpredictable cash flow forecasting

Unpredictable markets can drastically impact cash flow forecasting for manufacturing businesses.

Factors such as seasonal demand, changes in market trends, or unexpected interruptions in the supply chain can lead to a mismatch between the anticipated and actual cash inflow.

Accurate forecasting is critical for informed decisions, yet the dynamic nature of the manufacturing industry often complicates this process, making it difficult to predict future cash flow and plan accordingly reliably.

Elevated operational expenses

Manufacturing companies frequently grapple with the rising costs of materials and labor, which can squeeze profit margins and affect cash flow.

Market prices for raw materials can be volatile, and there may be periods when costs spike due to scarcity or increased demand. Additionally, labor costs can escalate due to competitive wages or the need for specialized skills.

As operational expenses climb, they can place a heavier burden on cash reserves, making it more challenging to maintain positive cash flow.

Slow customer payments

Customer payment collections can often be a challenge for manufacturers, especially if they experience frequent delays or missed payments.

When payment terms extend beyond standard periods or customers don’t adhere to payment deadlines, manufacturers are left with outstanding invoices that tie up capital needed for daily operations or investment opportunities.

These late payments can disrupt a business’s cash cycle and necessitate measures to bridge the gap, such as borrowing or adjusting production schedules.

Inventory management issues

Effective inventory management is crucial for manufacturers, as excess stock ties up capital and insufficient inventory levels can halt production, both of which negatively affect cash flow.

Manufacturing businesses typically accumulate significant capital tied to fixed assets like equipment. While necessary for production, these assets are not liquid, and their value doesn’t directly translate to cash in the short term. This immobile capital can limit the ability to respond to immediate cash flow needs or invest in opportunities that may arise, creating financial pressures for the business.

Maintaining the right amount of inventory to meet customer demands without oversupply requires precise planning and forecasting. Mistakes can lead to cash being held for unsold products or lost opportunities due to stockouts, impacting cash flow and business operations.

Inefficient production methods

Inefficient production methods that fall behind industry standards can pose challenges for manufacturers, such as higher production costs, longer lead times, and slower cash cycles since the time taken to turn raw materials into finished goods and then into cash is prolonged.

Streamlining production methods is thus essential for enhancing cash flow efficiency.

By understanding how to improve cash flow and implementing strategic measures, manufacturers can tackle these challenges head-on, bolster their cash position, and secure financial resilience.

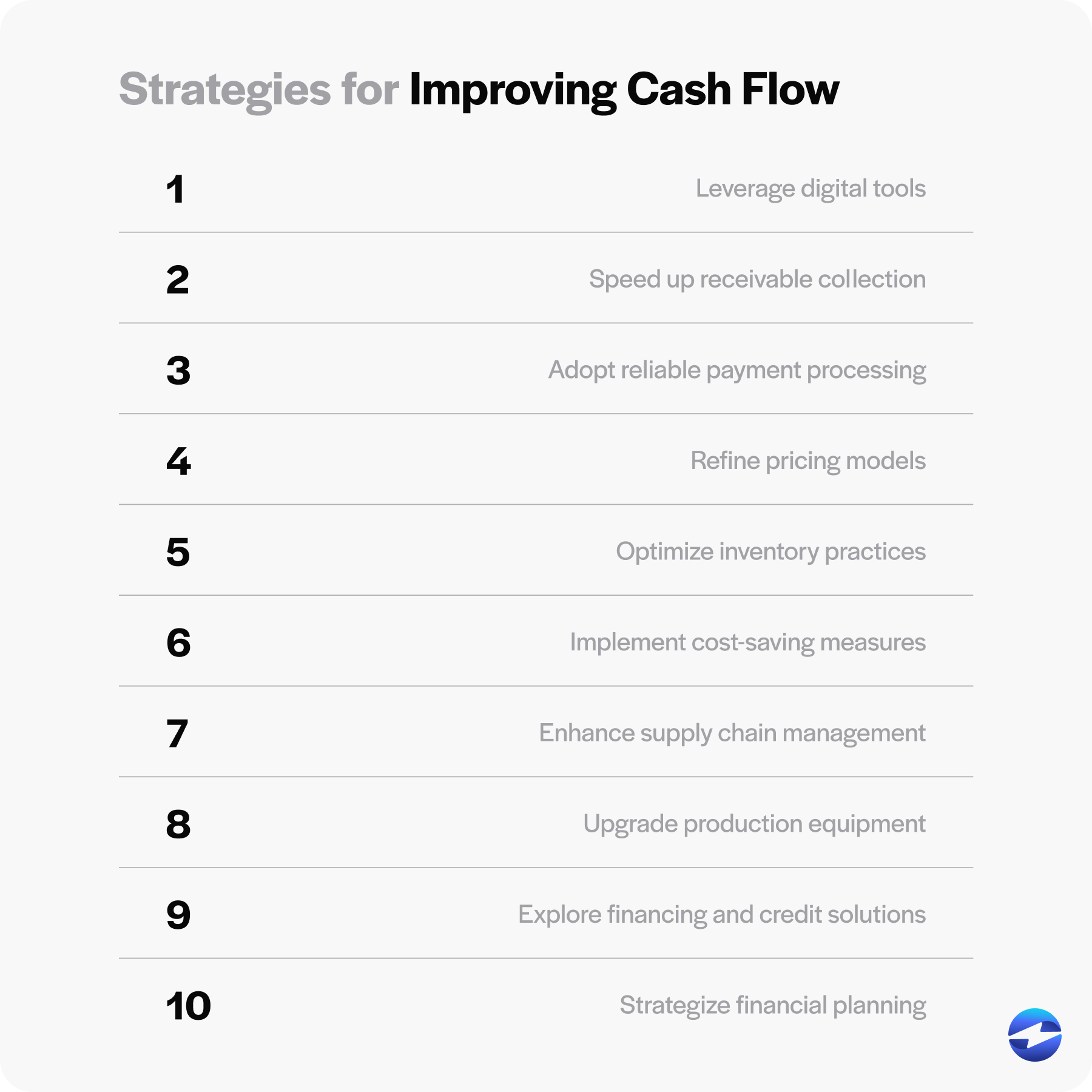

10 strategies for improving cash flow

Manufacturers must navigate the complexities of cash management and familiarize themselves with numerous strategies to improve cash flow and amplify their financial standing.

Here are ten strategies for improving cash flow:

- Leverage digital tools for financial efficiency. Strategic investments in technology and automation can uncover hidden ways to improve cash flow while enhancing productivity. Cash flow can be improved by implementing solutions such as enterprise resource planning (ERP) systems, AI, and machine learning that provide real-time insights into cash flow statements, accurately forecast future cash flow, and promote more informed capital management decisions. These tools automate mundane tasks, minimizing errors and allocating valuable time to focus on strategic initiatives that drive cash flow.

- Speed up receivable collection. Solutions like EBizCharge integrate directly with ERP or accounting software to simplify and accelerate customer payments. By providing easier payment options and automating reminders for outstanding invoices, manufacturers can reduce the timeline from billing to cash collection, thus improving their cash cycle and reducing the likelihood of cash shortages due to delayed payments.

- Adopt reliable payment processing systems. Integrating reliable payment processing systems like EBizCharge enhances cash flow by maximizing the speed and ease of transaction processing. Such systems reduce manual labor and payment errors and disputes, ensuring that incoming revenue is timely and accurate.

- Refine pricing models. Adopting pricing models that reflect current market conditions, cost of goods, and customer demand can lead to cash flow improvement. Manufacturers can employ strategies to improve cash flow, such as tiered pricing, volume discounts, or premium pricing for specialized products to enhance profitability. Regularly reviewing and adjusting pricing models ensures that manufacturers aren’t leaving money on the table and can respond to market changes swiftly.

- Optimize inventory practices. Using systems that enable accurate demand forecasting and just-in-time (JIT) inventory practices helps minimize excess stock and associated holding costs. Better inventory control translates to decreased cash outflows for stock that isn’t immediately needed, increasing cash flow.

- Implement cost-saving measures. Continuously identifying and implementing cost-saving measures is key to sustaining healthy cash flow. Cost-saving measures can include renegotiating supplier contracts, seeking out less expensive raw materials, investing in energy-efficient technologies, or streamlining operations to reduce waste. These initiatives can significantly reduce operating expenses, increasing cash flow.

- Enhance supply chain management. Businesses can discover practical approaches on how to increase cash flow by negotiating improved terms with suppliers and optimizing payment cycles. Strengthening supplier relationships through strategic sourcing and close collaboration can improve pricing, quality, and delivery performance. This collaborative approach facilitates better communication, shared forecasts, and joint problem-solving, leading to enhanced supply chain management.

- Upgrade production equipment. Investment in modern, high-quality production equipment may require upfront capital but can lead to long-term cash flow improvement. Upgraded equipment typically operates more efficiently, incurs lower maintenance costs, and reduces production bottlenecks, thus speeding up the cash conversion cycle.

- Explore financing and credit solutions. Exploring options like lines of credit or invoice factoring can offer immediate cash flow relief. These solutions provide manufacturers with the necessary funds to bridge short-term cash gaps without disrupting business operations, allowing them to maintain a positive cash flow even during periods of financial strain.

- Strategic financial planning. Lastly, strategic financial planning is indispensable for healthy cash flow. Cash flow can be improved by regularly reviewing cash flow forecasts and statements to anticipate future needs and variances. This foresight can help you make proactive decisions, like deferring non-essential expenditures or securing extra funding to prepare for potential financial setbacks.

In addition to implementing these strategies, manufacturing companies can also work with a trustworthy payment processing solution to navigate cash flow challenges and maintain a healthy financial standing.

How EBizCharge can improve cash flow for manufacturing businesses

EBizCharge offers an array of tools and features that can significantly improve cash flow for businesses in the manufacturing industry.

By seamlessly integrating with ERP and accounting systems, EBizCharge automates invoice collections, reduces manual processes, and transforms the customer payment experience. Its advanced payment collection tools, such as email payment links and customer payment portals, facilitate quicker invoice settlements and accelerate cash flow. This top-rated platform also includes features like recurring billing, which ensures timely customer payments, and secure storage of customer payment information, which speeds up future transactions.

Furthermore, EBizCharge provides robust reporting and analytics capabilities, giving manufacturers real-time insights into their cash flow and helping them make informed financial decisions.

By leveraging comprehensive payment solutions like EBizCharge, manufacturers can improve cash flow management, reduce operational costs, and maintain the financial agility necessary for sustainable growth and competitiveness in today’s market.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.