Blog > 10 Easy Ways to Collect Payments from Customers

10 Easy Ways to Collect Payments from Customers

In the modern business landscape, collecting payments efficiently is essential for maintaining a smooth operation and fostering customer loyalty. As technology advances, businesses have access to a variety of innovative payment solutions that can make the process quicker, more secure, and more convenient for all parties.

This article will explore ten straightforward methods for collecting payments from customers, highlighting the benefits and practical applications of each. Whether you’re looking to implement contactless payments, automate billing, or offer flexible payment plans, these strategies will help you enhance your payment collection process and improve overall business performance.

The importance of seamless payment collections

A seamless payment collection process is crucial for businesses as it ensures efficiency and customer satisfaction. Speed and convenience are primary benefits, as quick transactions lead to shorter lines and wait times. Ease of use is another factor; simple payment procedures require less effort from customers, enhancing their overall experience with the brand.

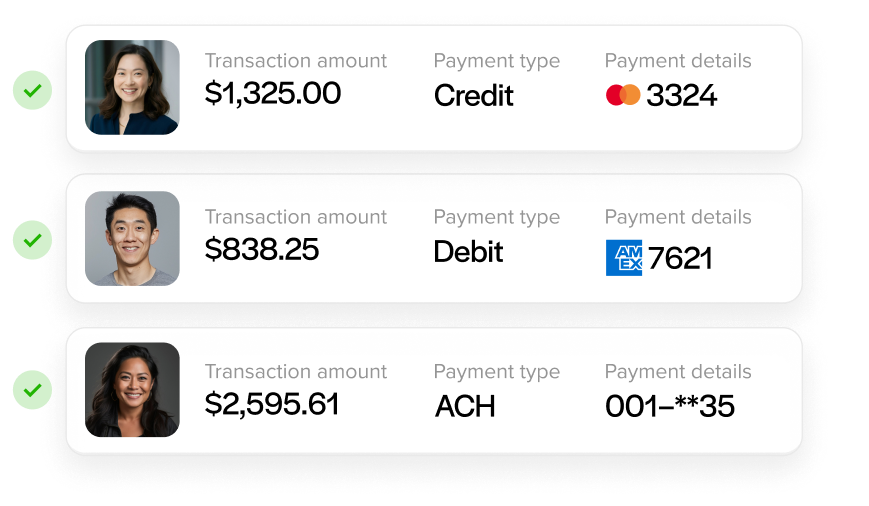

From a business perspective, a streamlined payment process reduces administrative burden, decreasing the chances of errors and delays in cash flow. It also enhances security, as modern contactless payment options like digital wallets and chip cards are equipped with advanced encryption, protecting sensitive customer information from potential fraud.

Lastly, offering various contactless payment methods, such as credit/debit cards, mobile devices, and digital wallets, caters to customer preferences, ensuring that different demographics can transact in the most comfortable manner available to them.

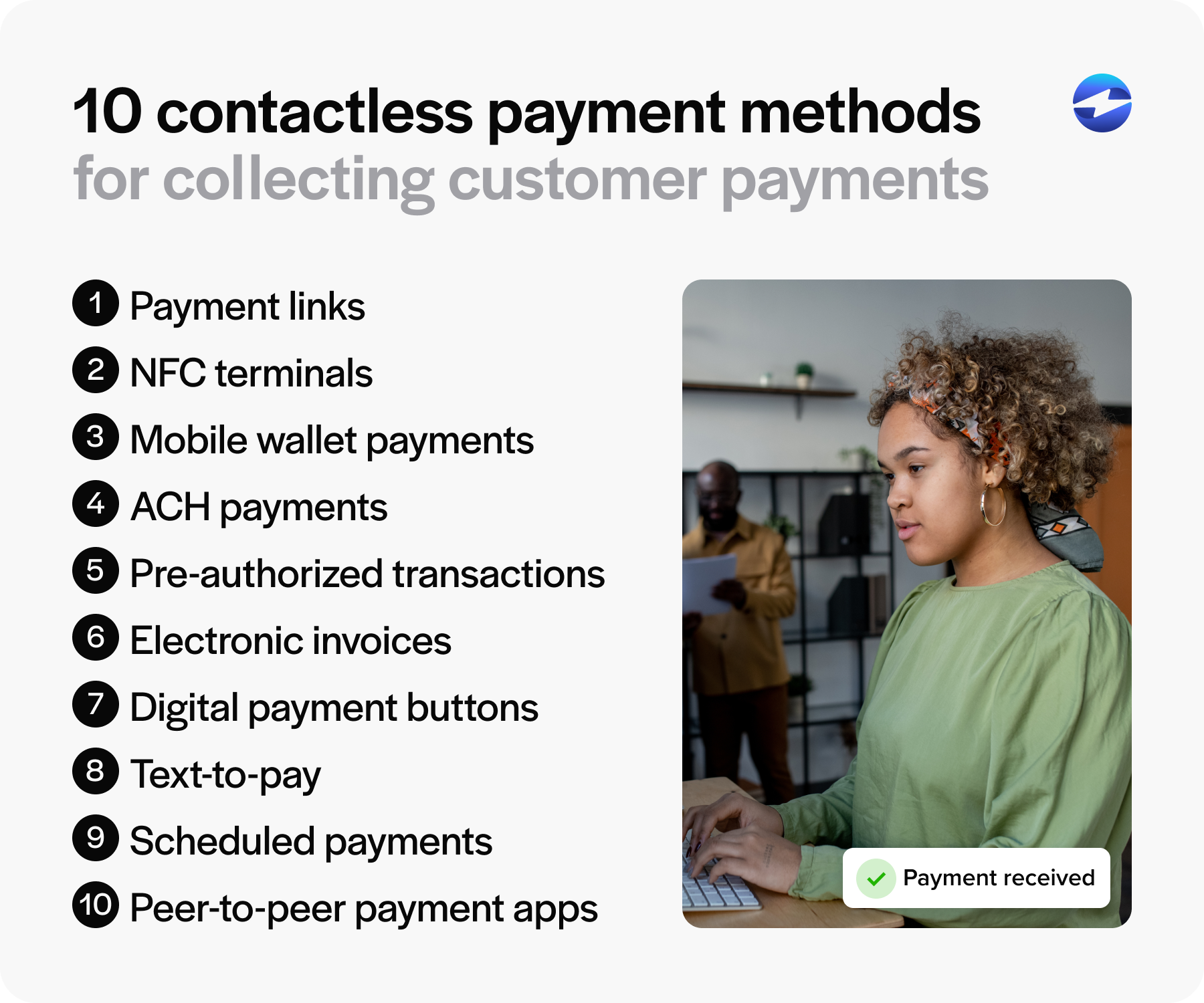

10 contactless payment methods for collecting customer payments

In the landscape of swiftly advancing technology, businesses are adapting to a variety of contactless payment methods to cater to customer preferences and streamline their payment processes. Contactless payments not only make transactions faster but also add a layer of security for both the business and the consumer. With the array of options available, companies can select those most suited to their operations and their customers’ comfort. Here is a breakdown of ten popular contactless payment methods that can be incorporated into any payment collection strategy.

1. Payment links:

Payment links are URLs that merchants can send to their customers to facilitate payments. They can be shared via email, SMS, or messaging apps and direct customers to a secure payment portal. Payment links eliminate the need for a physical card or point-of-sale (POS) system, making them versatile for remote billing or services. They’re an excellent option due to their convenience, reduced manual entry errors, and their ability to provide a quick payment solution for customers on the go.

2. NFC terminals:

Near Field Communication (NFC) terminals enable contactless card payments by using RFID technology. Customers with NFC-enabled debit or credit cards or mobile devices can initiate a payment by bringing them close to the terminal. NFC payments are fast and secure, as they don’t need physical contact. For higher transaction amounts, they typically require a PIN or biometric verification, offering enhanced consumer protection.

3. Mobile wallet payments:

Mobile wallets like Apple Pay and Google Wallet are digital versions of physical wallets. Customers can securely store their payment card information and use their smartphones for transactions. Mobile wallets are a popular choice due to their convenience, as they allow customers to pay with just a tap on an NFC-enabled terminal. They’re also protected by strong encryption and authentication measures, offering peace of mind for secure transactions.

4. ACH payments:

Automated Clearing House (ACH) payments are electronic payments made through the ACH network, an extensive system for moving money and data in the United States. These payments facilitate direct banking transactions, which means they’re efficient for recurring bills or subscription-based services once authorized via ACH form. ACH payments are considered a superior option due to their lower processing fees compared to credit card transactions and the ability to handle large volumes of payments reliably.

5. Pre-authorized transactions:

Pre-authorized transactions occur when a customer provides permission to a business to charge their payment method at regular intervals or when certain conditions are met. They’re ideally suited for ongoing services or memberships. They offer businesses the advantage of reliable cash flow and ease of billing while providing customers with the convenience of automated payment without needing to remember due dates.

6. Electronic invoices:

Electronic invoicing involves sending a digital bill to customers, usually via email or a secure portal. These invoices can often be paid with just a few clicks. Electronic invoices are beneficial as they accelerate the payment collection process, reduce paper waste, and often include direct payment links, simplifying the customer experience.

7. Digital payment buttons:

Digital payment buttons are clickable buttons embedded in websites or apps that facilitate fast payments. They’re usually integrated with payment services such as EBizCharge. These buttons provide a frictionless customer experience, enabling instant checkout without having to manually enter payment details, boosting conversion rates, and streamlining the purchasing process for both the merchant and the consumer.

8. Text-to-pay:

Text-to-pay services allow customers to make payments through SMS. Businesses can send a text message with a payment link to their customers, who can then complete the transaction on their mobile devices. The advantage of text-to-pay is its accessibility since nearly all modern mobile phones can receive texts, expanding the customer base that can be reached through this method.

9. Scheduled payments:

Scheduled payments are automated payments set up to occur on a fixed schedule, such as weekly, monthly, or yearly. They’re ideal for managing recurring charges. This method assures businesses of consistent payments while providing customers with the convenience of “set it and forget it” billing, eliminating payment scenarios.

10. Peer-to-peer payment apps:

Peer-to-peer (P2P) payment apps, like Venmo or Cash App, allow users to transfer money directly to others. Businesses can use these apps to collect payments quickly and efficiently. P2P apps are becoming a favored option due to their widespread usage, especially among younger consumers, easy-to-use interfaces, and immediate fund transfers.

By exploring and adopting these contactless payment methods, businesses can modernize directly to others. Businesses can use these apps to collect payments quickly and efficiently.

Best practices for collecting customer payments

Businesses should adopt best practices that streamline the payment process and address customer preferences to collect customer payments effectively. Here are a few best practices to keep in mind:

Optimize invoice management.

Optimizing invoice management is a critical step for businesses aiming to enhance the efficiency of collecting payments from customers. Efficient invoice management facilitates timely payment processing and can significantly affect cash flow, a vital aspect of maintaining a healthy business. By streamlining the invoice process, businesses can reduce the likelihood of late payments, often due to unclear or inaccurate billing.

Offer multiple payment methods.

Offering multiple payment methods is pivotal to enhancing customer experience and promoting timely payments. When businesses provide various options, such as credit cards, debit cards, online payments, and flexible payment options, they cater to different customer preferences. This flexibility enables clients to choose their preferred payment method, which can lead to faster payments and a healthy cash flow for the business.

Clearly state your preferred payment methods.

Clearly stating your preferred payment methods significantly influences the efficiency of collecting customer payments. When customers know in advance how businesses wish to receive funds, the payment process becomes streamlined, reducing confusion and administrative strain. This approach contributes directly to a healthy cash flow, which is crucial for maintaining any business’s operations.

Provide different payment plans.

Providing various payment plans can be instrumental in collecting customer payments efficiently. When businesses offer flexible payment options, they acknowledge their customers’ diverse financial situations and preferences.

Utilize digital payment gateways.

Digital payment gateways significantly enhance the efficiency of collecting customer payments. These gateways facilitate a seamless transfer of funds, ensuring timely payments, which is vital for maintaining a healthy cash flow in any business.

Automate invoice reminders.

Automating invoice reminders plays a pivotal role in streamlining the process of collecting customer payments. This aspect of the collection process ensures timely communication with customers regarding their debt obligations. By utilizing automated systems, businesses can consistently send customers reminders without the need for manual intervention, thereby reducing the likelihood of late payments.

Use compliant payment processing solutions.

Compliant payment processing solutions play a crucial role in collecting customer payments efficiently and securely. Compliance means adhering to industry standards and regulations, such as the Payment Card Industry Data Security Standards (PCI DSS), ensuring that credit card data is handled safely. This helps maintain customer trust, which is key to fostering positive relationships and encouraging timely payments.

From optimizing invoice management to offering multiple payment methods and utilizing digital payment gateways, these strategies can significantly enhance the efficiency of payment collection processes. In addition to these best practices, businesses should also stay updated on ways to minimize late payments.

Tips for avoiding late payments

Late payments can result in cash shortages, hinder business growth, and increase administrative costs due to additional follow-ups. To avoid these unwelcome scenarios and maintain a smooth payment process, businesses should adopt strategies that encourage on-time payments from customers.

Incentivize early payments

Providing incentives for early payments is an effective strategy to encourage customers to pay before the deadline. These incentives can take various forms, such as discounts on the invoice amount, loyalty points, or access to special offers. For instance, a business might offer a 2% discount on the total invoice for payments received within ten days. This not only benefits the customer but also boosts the business’s cash flow and can reduce the time and resources spent on managing accounts receivable.

Penalize late payments

While incentives can attract prompt payments, penalties can deter tardiness. Imposing a late fee or interest on overdue invoices can motivate customers to pay on time to avoid additional charges. This should be clearly communicated in the payment terms and agreed upon at the start of the business relationship to ensure transparency. For example, a late payment fee could be a fixed amount or a percentage of the invoice for each week of the delay.

Clearly state your payment terms

Clear communication of payment terms sets clear expectations for when and how payments should be made. Each invoice should include the due date, acceptable forms of payment, any incentives for early payments, and penalties for late payments. Providing multiple payment options, such as contactless methods or online portals, can also facilitate timely payments. By eliminating ambiguity and making it easier for customers to pay, businesses can significantly reduce the incidence of late payments.

Utilize comprehensive payment solutions

Incorporating comprehensive payment solutions streamlines the payment collection process, making it easier for customers to pay on time and for businesses to manage their receivables efficiently. EBizCharge is a notable example of a payment solution that integrates with various business systems for seamless and secure transactions. It offers features such as automatic payment reminders, online payment options, and the ability to accept various payment methods. These features minimize late payments by providing customers with an effortless and flexible payment experience.

For example, small businesses can streamline their collections with QuickBooks payment processing that automatically matches incoming payments to open invoices and posts them to the correct accounts. Larger organizations running NetSuite can do the same with a NetSuite credit card integration that lets customers pay directly from emailed invoices while syncing every transaction back to the ERP. Both options reduce the manual follow-up that leads to late payments and help keep your cash flow on track.

Maintaining a healthy cash flow with seamless payment collections

For business owners, the collection of customer payments is a critical component of maintaining a healthy cash flow and ensuring business stability. A balance between empathy and professionalism is crucial when dealing with overdue payments to avoid customer alienation while protecting your business’s financial interests. By leveraging solutions like EBizCharge, businesses can provide a smooth and convenient payment experience for their customers, helping to maintain positive customer relationships while securing timely payments.