Blog > PCI Compliance for Epicor Payment Processing

PCI Compliance for Epicor Payment Processing

If your team accepts credit cards through Epicor, PCI compliance isn’t something that lives only in annual checklists or audit paperwork. It shows up in how payments are taken, how information moves between systems, and how much risk the business carries day to day.

Manufacturers, distributors, and service organizations using Epicor handle sensitive payment data as part of normal operations. Invoices go out, payments arrive through multiple channels, and customers expect the process to be quick and easy, while card brands and regulators expect consistent controls behind the scenes.

This article is written for Epicor users who want a clear, practical understanding of Epicor PCI compliance.

What PCI Compliance Means for Epicor Users

PCI compliance refers to the Payment Card Industry Data Security Standards, a set of requirements created by the major card brands to protect cardholder data.

For Epicor users, Epicor PCI DSS compliance isn’t about the ERP itself being certified. It’s about how card data is handled anywhere in your payment process. That includes payment terminals, online forms, integrations, customer portals, and even how employees interact with payment information during day-to-day work.

A common misconception is that using Epicor automatically makes a business PCI compliant. In reality, Epicor provides the framework for processing transactions, but responsibility for compliance depends on how payments are configured and who touches the data.

This distinction matters. Two companies can use the same version of Epicor and have very different PCI risk profiles based on how payments are accepted, where card data flows, and whether sensitive information is ever stored or exposed internally. Understanding this is the first step toward building sustainable Epicor PCI compliance.

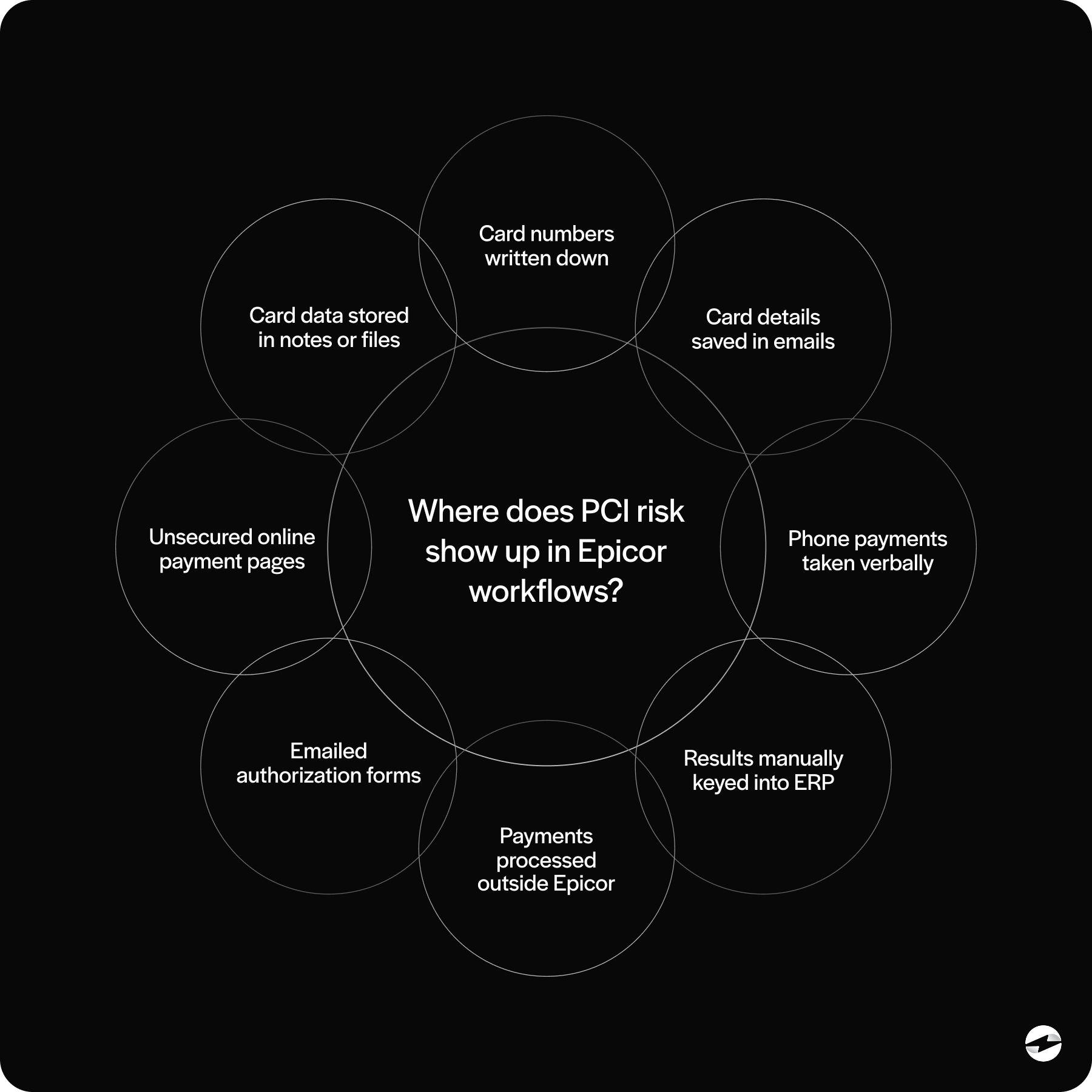

Where PCI Risk Typically Appears in Epicor Payment Workflows

Most PCI risk tends to show up in the same areas, especially in busy Epicor environments where teams are balancing speed and accuracy.

Manual card handling is one of the biggest contributors. Writing card numbers down, saving them in emails, or entering them into non-secure systems creates risk almost immediately. These habits usually start with good intentions, often when teams are trying to move quickly or accommodate a customer.

Disconnected payment tools add another layer of exposure. When payments are processed outside Epicor and then manually entered back in, card data can pass through multiple systems or people. Each extra step increases PCI scope and makes compliance harder to manage.

Customer-facing processes also play a role. Phone payments, emailed authorization forms, and poorly designed online payment pages can quietly expand PCI risk if they’re not handled carefully.

Strong Epicor payment security focuses on limiting how often card data is seen, stored, or touched by internal teams. Fewer touchpoints mean fewer risks and a much easier path to compliance.

Payment Processing Options for Epicor ERP Users and PCI Impact

Epicor users generally have a few different payment processing setups available, and each one affects PCI scope differently.

Standalone tools operate outside Epicor. They can be secure on their own, but they often require manual posting and reconciliation. This increases internal handling of sensitive data and expands PCI responsibility.

Semi-integrated solutions pass some data back into Epicor after processing. These reduce efforts compared to standalone tools, but teams may still touch card data depending on how payments are initiated.

Fully integrated options embed payments directly into Epicor workflows. A well-designed payment processing solution in this category minimizes exposure by ensuring card data never lives inside the ERP.

From a compliance standpoint, integration depth matters as much as functionality. Tighter Epicor integration typically means fewer risks and simpler audits.

Epicor Payment Exchange vs. Third-Party Payment Solutions from a PCI Perspective

Epicor Payment Exchange, or EPX, is often the default starting point for Epicor users.

EPX handles basic payment processing and provides a baseline level of security. For some organizations, that’s enough. As payment complexity grows, however, limitations around flexibility and visibility can become more noticeable.

Third-party solutions built specifically for Epicor often take a different approach. Deeper Epicor integration allows sensitive data to be handled entirely outside the ERP while still keeping payment records synchronized.

From a PCI perspective, the key difference is scope. Solutions that reduce internal access to card data generally make compliance easier to manage.

Using Customer Payment Portals to Reduce PCI Scope in Epicor

Customer payment portals are one of the simplest and most effective ways to reduce PCI exposure in Epicor environments, especially as payment volume grows.

When customers enter their card information directly through a secure portal, internal teams never see or handle sensitive data. Payments post back into Epicor ERP without storing card details, which significantly reduces PCI scope and limits internal risk.

Portals also introduce consistency. Instead of relying on phone calls, emails, or paper authorization forms, customers follow the same secure process every time. That consistency reduces errors and removes the need for informal workarounds that often create compliance gaps.

Configuration still matters. Portals need to be properly connected so payment data flows securely while invoices and customer records remain accurate and up to date.

When implemented correctly, payment portals improve the customer experience, speed up collections, and strengthen Epicor PCI compliance at the same time.

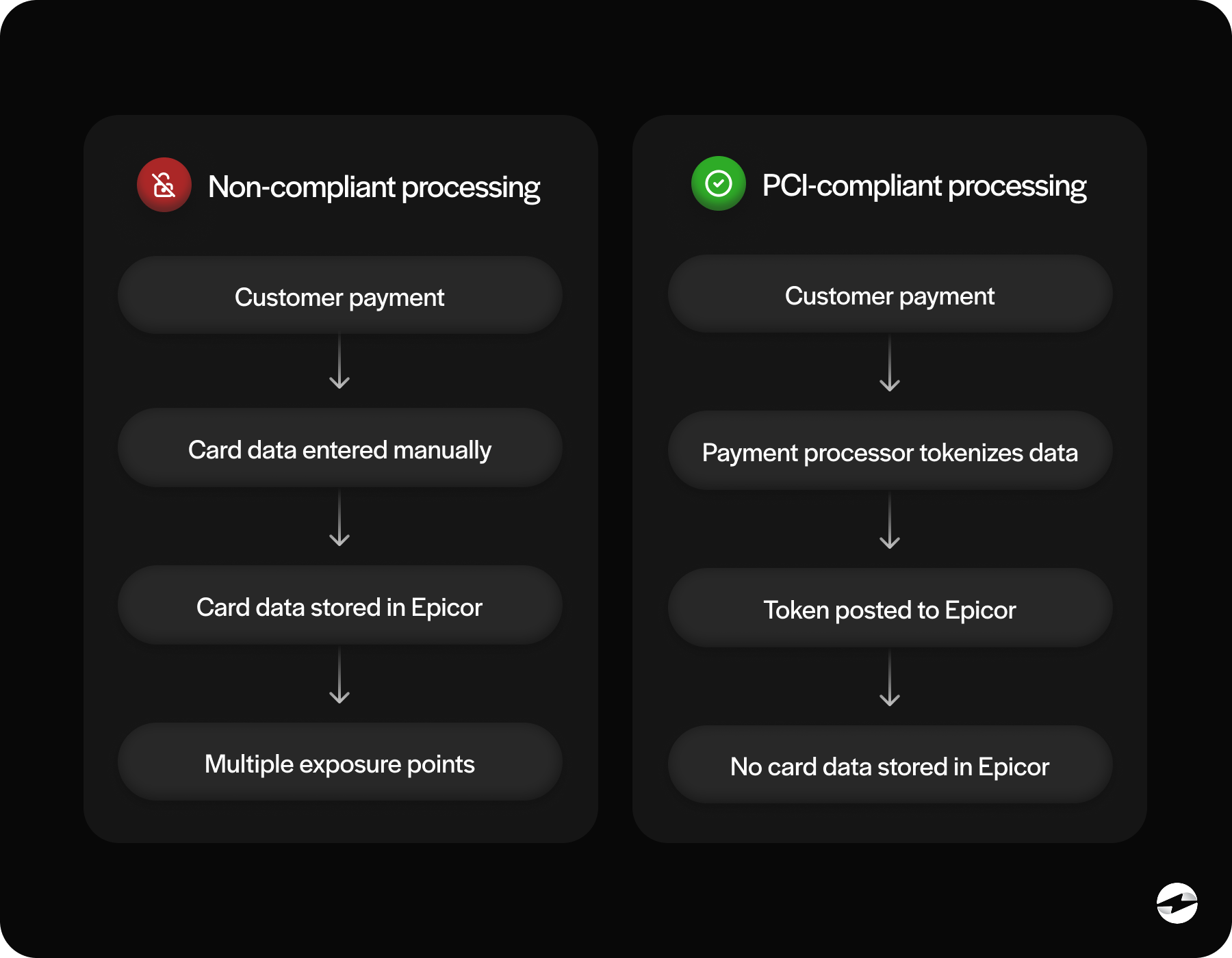

Tokenization, Encryption, and Secure Payment Handling in Epicor

There are two concepts that are imperative for secure payments: tokenization and encryption.

Tokenization replaces actual card numbers with a secure reference value, often called a token. That token can be safely stored and used for future transactions, such as repeat billing or customer portals, without ever exposing the real card data. Even if a system were accessed improperly, the token itself would be useless outside the payment platform.

Encryption focuses on protecting data while it’s moving between systems. It scrambles payment information during transmission, so it can’t be read or intercepted as it travels from Epicor to the payment processor.

Together, these tools form the backbone of modern Epicor payment security. They allow payments to move quickly through workflows while keeping sensitive information protected at every step.

Any PCI compliant Epicor payment setup should rely heavily on both tokenization and encryption to minimize risk and reduce compliance scope.

Day-to-Day PCI Compliance Responsibilities for Epicor Teams

Even with secure integrations in place, Epicor users still carry important day-to-day PCI responsibilities.

Annual PCI self-assessments are required, along with maintaining internal policies that define how payment data is handled. Staff training plays a critical role here. Employees need to know what’s allowed, what’s not, and why those rules exist.

Consistency is key. Clear procedures reduce mistakes, limit exceptions, and make audits far less disruptive.

When teams understand their role in protecting payment data, Epicor PCI DSS compliance becomes manageable instead of stressful.

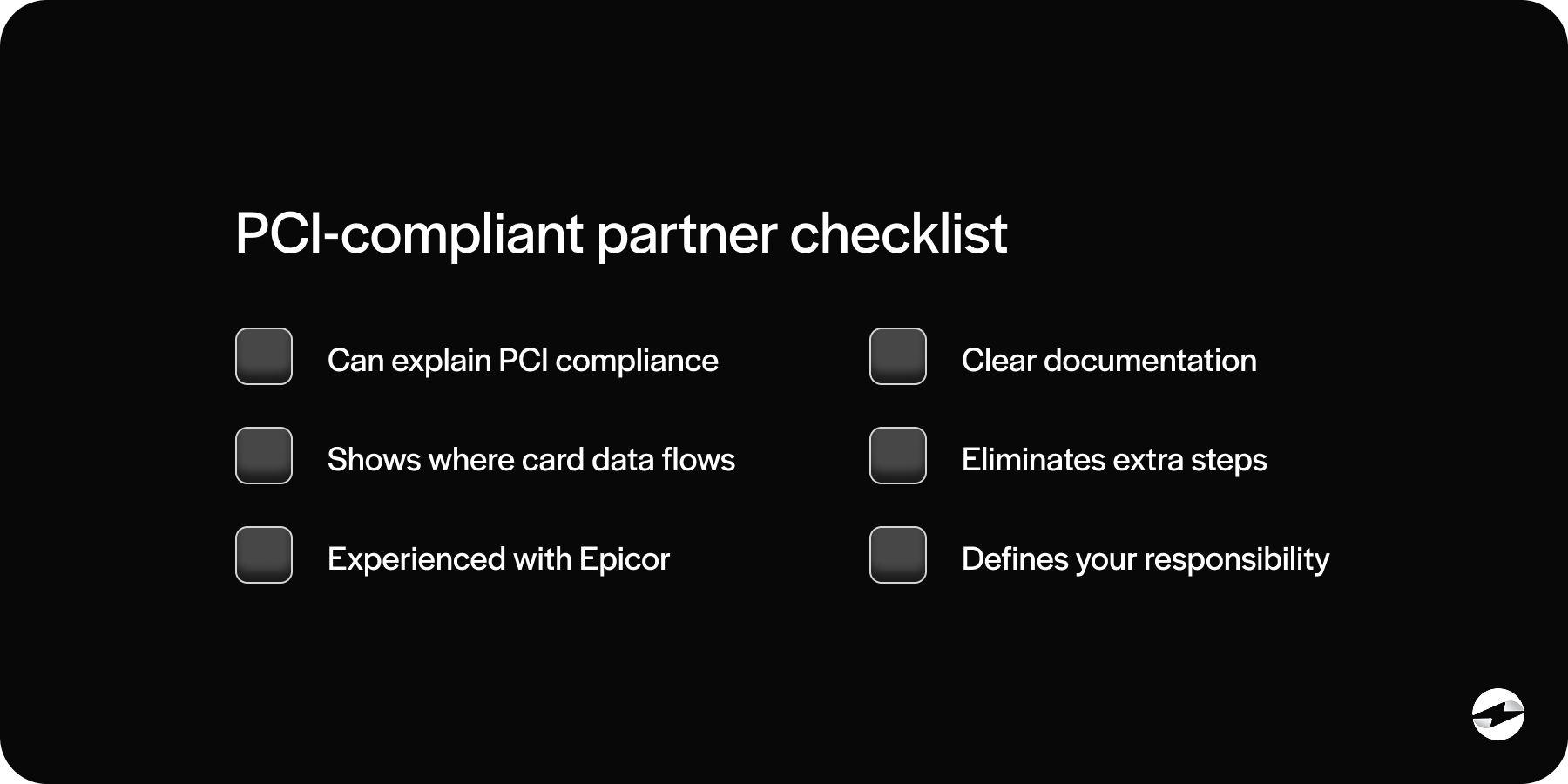

Choosing a PCI Compliant Payment Processing Partner for Epicor

Not every provider understands Epicor, and that gap can create unnecessary risk over time.

A strong payment processor should be able to clearly explain how PCI scope is reduced, where payment data flows, and what responsibilities still sit with your internal team. That clarity matters when questions come up during audits or internal reviews.

Experience with Epicor software also plays a big role. Payment setups need to stay secure through Epicor upgrades, workflow changes, and business growth without forcing teams to rethink compliance every time something changes.

The right partner helps you stay compliant in a practical way, supporting secure payments without slowing down daily operations or adding extra administrative work.

Why EBizCharge Is a Great Fit for Epicor Users Seeking a PCI Compliant Solution

EBizCharge’s native Epicor integration is built for Epicor users who want payment security to feel like part of normal operations, not an added burden.

Instead of letting sensitive card data touch Epicor ERP, EBizCharge uses tokenization and encryption to keep that information protected outside the system. Payments post back automatically through deep Epicor integration, so records stay accurate without exposing card details to internal teams.

Secure invoice payments, customer payment portals, and controlled workflows make it easier to meet Payment Card Industry Data Security Standards while keeping day-to-day processes efficient and predictable.

For organizations looking for a top-rated, PCI compliant payment processing solution purpose-built for Epicor, EBizCharge offers a practical way to balance security, usability, and ongoing compliance.