Blog > Payment Processing for Discrete Manufacturers Using Epicor

Payment Processing for Discrete Manufacturers Using Epicor

Discrete manufacturing is rarely simple; orders are custom, pricing changes from job to job, and payment terms are often negotiated rather than standardized. All of that makes payment processing more complicated than it is in high-volume, repeat-transaction industries.

If you work in manufacturing finance or operations, you already know this. You might be dealing with deposits on custom builds, progress payments tied to milestones, or partial billing as jobs move through production. In that environment, payments are tightly connected to how work actually gets done.

This is where Epicor ERP plays an important role. Epicor software is designed to support discrete manufacturers by connecting jobs, sales orders, invoices, and accounts receivable in one system. But payment processing doesn’t always fit neatly into that picture without the right approach.

This article is written for teams managing discrete manufacturing payments inside Epicor. The goal is to walk through real-world payment challenges, explain how Epicor supports manufacturing workflows, and outline what to look for in a payment strategy that actually works for discrete manufacturers.

Understanding Payment Challenges in Discrete Manufacturing

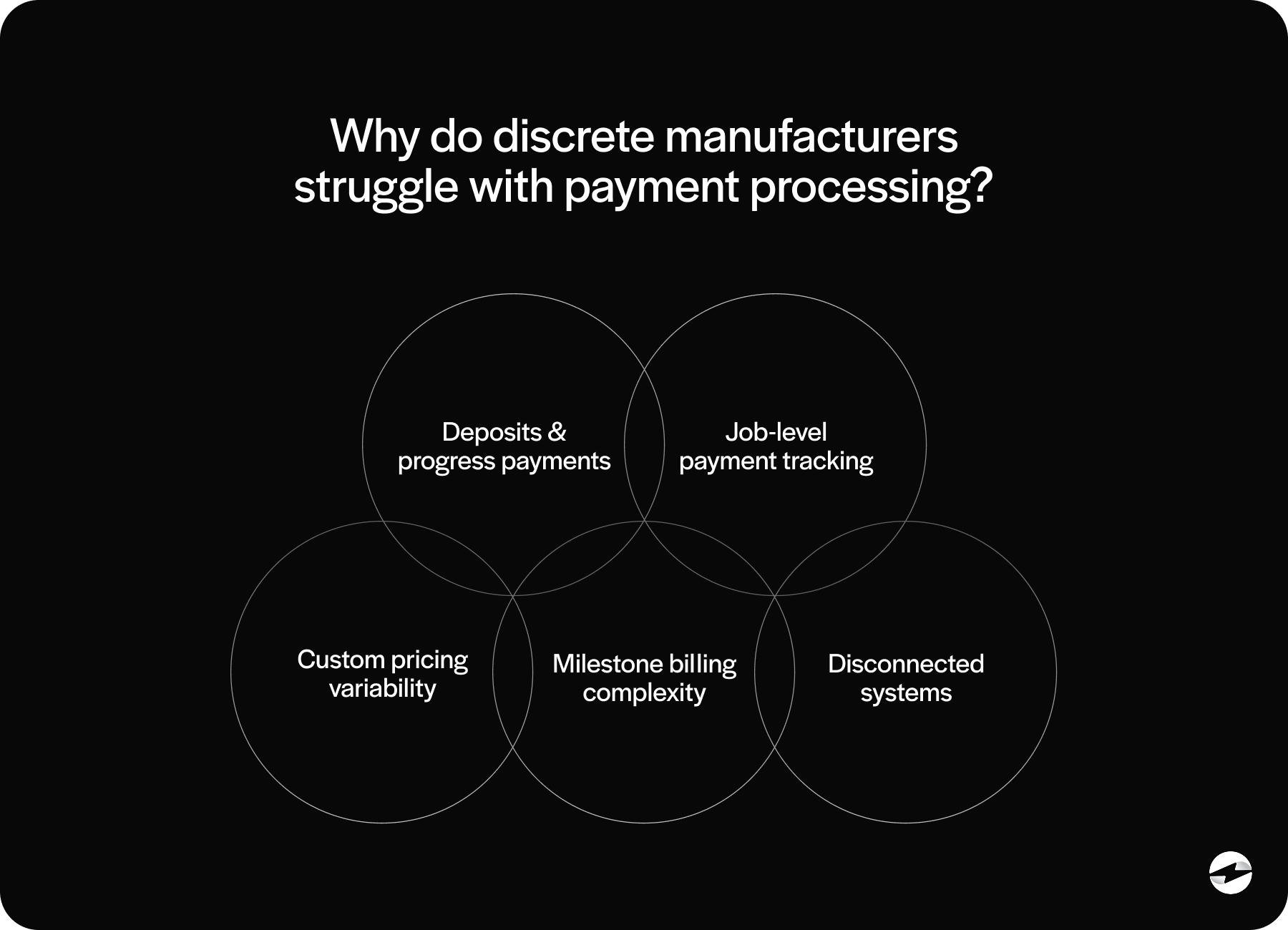

Payment challenges in discrete manufacturing usually stem from variability.

Jobs are often custom or engineered to order. That means pricing is rarely fixed upfront. Customers may be asked for deposits before work begins, progress payments during production, and final payment upon delivery.

These realities make make-to-order payment processing more complex than standard invoicing. Payments need to be applied correctly across jobs, invoices, and customer accounts. Mistakes create confusion quickly.

Generic payment tools struggle here. They’re built for simple transactions, not for deposits, milestone billing, or partial payments tied to production stages. That’s why many discrete manufacturers feel friction when payments are handled outside Epicor.

How Epicor Supports Payment Workflows for Discrete Manufacturers

Epicor is well-suited for discrete manufacturing because it connects operational and financial data.

Sales orders link to jobs, jobs link to invoices, and invoices flow into accounts receivable. This structure makes Epicor manufacturing payments possible without relying on spreadsheets or disconnected systems.

Payment processing fits into this flow by closing the loop. When payments are properly integrated, invoice status updates automatically, and financial reporting stays up to date.

Without strong Epicor integration, however, payments can become disconnected from jobs and orders. That’s when delays, errors, and manual work begin to pile up.

Payment Processing Options for Epicor ERP Users

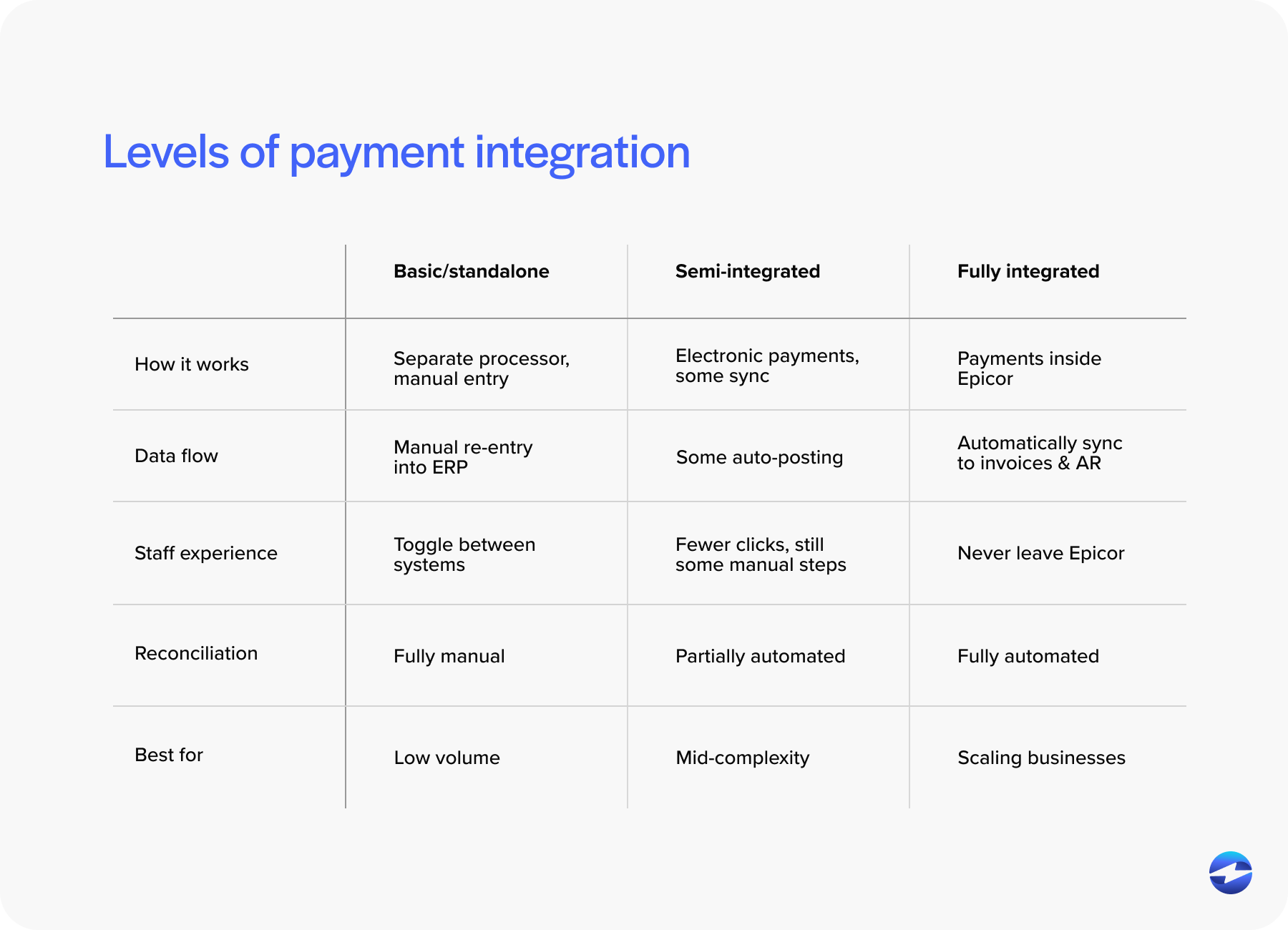

Epicor users typically have three broad payment processing options.

Some rely on standalone tools that operate outside the ERP. These tools can accept payments, but posting and reconciliation usually require manual effort.

Others use semi-integrated tools that pass data back to Epicor after processing. This reduces some work, but delays and exceptions are common.

The most effective approach for discrete manufacturers is a fully integrated payment processing solution that works directly within Epicor ERP. Payments are initiated, processed, and posted in a single workflow, which is critical when dealing with complex billing scenarios.

Choosing the right payment processor matters just as much as choosing the right integration approach.

Integrating Payments Into Epicor Manufacturing Workflows

In discrete manufacturing, payments aren’t an afterthought. They’re part of the job lifecycle.

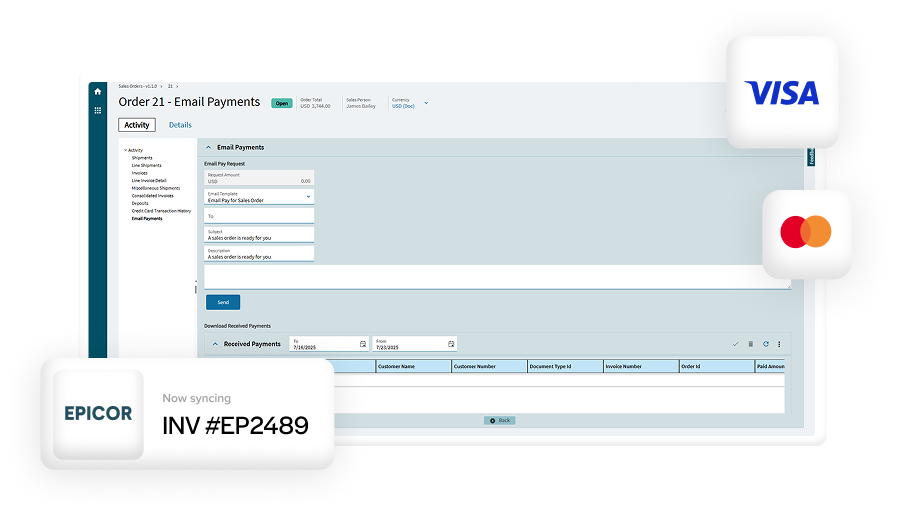

Tight Epicor integration ensures payments can be accepted and applied directly within Epicor screens. This reduces manual entry and keeps job-level financials accurate.

Embedded payment processing works especially well in make-to-order environments, where each transaction may be unique. When payments are tied directly to jobs and invoices, finance teams spend less time fixing issues and more time managing cash flow.

Supporting Deposits, Progress Payments, and Partial Billing

Deposits and progress payments are common in discrete manufacturing.

Epicor supports these workflows by allowing multiple invoices and payments to be associated with a single job. The challenge is making sure payments are posted correctly and remain visible.

A strong payment setup allows deposits to be recorded against jobs, progress payments to be applied as milestones are reached, and partial payments to be tracked without confusion.

This level of accuracy is essential for discrete manufacturing payments, where timing and visibility matter as much as total value.

Payment Processing Considerations for Job Shops Using Epicor

Job shops face a unique mix of payment challenges.

Order sizes vary. Customers may be repeat buyers or one-time clients. Payment expectations can change from job to job.

For job shops using Epicor Kinetic, flexibility is key. Payment processing needs to be fast without sacrificing accuracy. Integrated tools help job shops accept payments quickly while keeping records clean.

Well-designed Epicor manufacturing payments workflows allow job shops to move quickly without losing control.

Payment Processing for Industrial Equipment Manufacturers on Epicor

Industrial equipment manufacturers often deal with large-ticket transactions and long sales cycles.

Payments may involve ACH, credit cards, or alternative methods depending on customer preference and transaction size. Security and accuracy are critical.

In these environments, a disconnected payment system creates risk. A tightly integrated payment processing solution ensures payments remain aligned with invoices and jobs throughout the lifecycle of the sale.

Epicor Kinetic Payment Processing Integration Considerations

Many manufacturers are transitioning from Epicor 10 to Epicor Kinetic.

Payment workflows can differ slightly between versions, but the underlying need for integration remains the same. Choosing solutions that support Epicor Kinetic helps protect long-term investments.

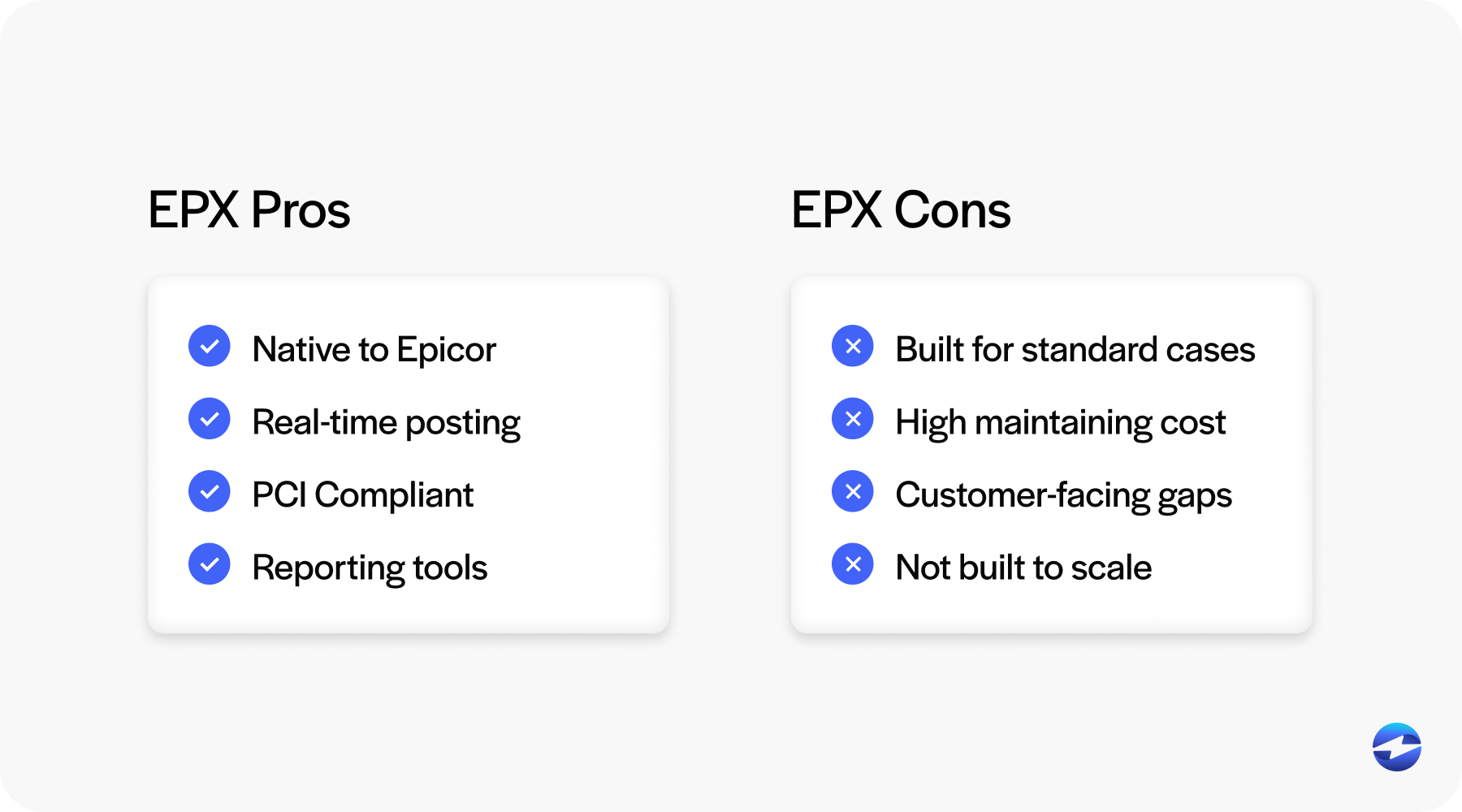

Some manufacturers start with Epicor Payment Exchange because it’s built into Epicor. While it can work for basic scenarios, many teams outgrow it as payment complexity increases.

Maintaining consistency across Epicor versions requires payment tools that evolve with the ERP.

Improving Cash Flow and Visibility for Discrete Manufacturers

Cash flow predictability matters in manufacturing.

Integrated payments improve visibility by reducing delays between invoicing and posting. Finance teams know what’s been paid and what’s outstanding without chasing information.

This clarity strengthens planning and reduces surprises. Over time, well-integrated discrete manufacturing payments support healthier cash flow.

Key Features to Look for in a Payment Processing Solution for Epicor

Not all payment tools are built for manufacturing, and that difference becomes clear once payments are tied to real jobs and production timelines.

Look for a solution that feels native to Epicor and aligns with how manufacturing teams actually work. Support for deposits, partial payments, and progress billing is essential, since those scenarios are common in discrete environments. PCI-compliant security and audit trails should be built in as part of the core design, not added later as an afterthought.

Equally important is the experience of the payment processor supporting the integration. Epicor-specific knowledge helps prevent posting issues, reduces risk during upgrades, and improves overall reliability as transaction volume and complexity grow.

Why EBizCharge Is a Great Fit for Discrete Manufacturers Using Epicor

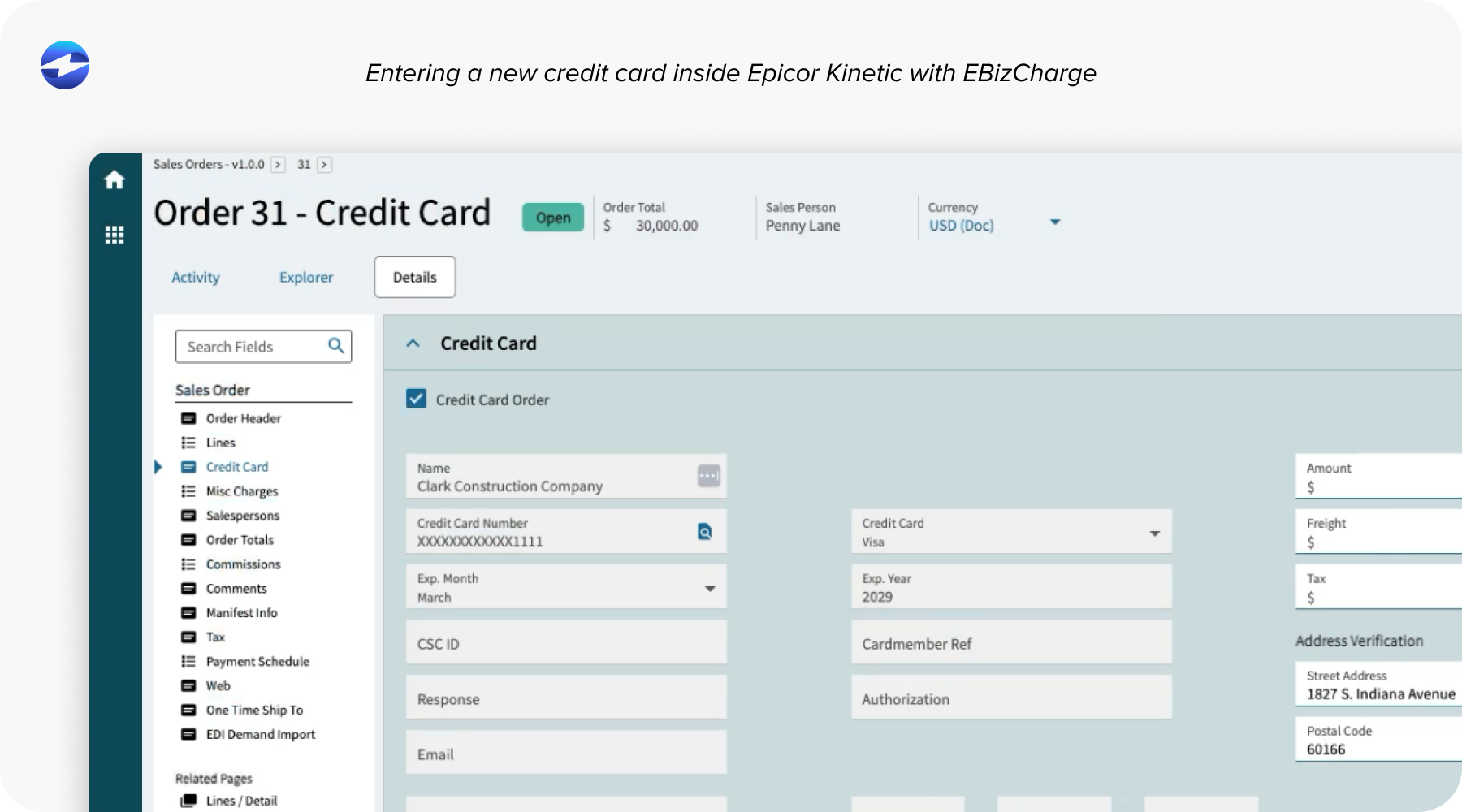

EBizCharge is designed for manufacturers who need payment tools that match the realities of discrete production.

It integrates directly with Epicor ERP, embedding payment processing into job and invoice workflows. This reduces manual work and keeps financial data accurate.

EBizCharge supports deposits, progress payments, and large transactions without disrupting operations. Flexible payment methods align with both job shops and industrial equipment manufacturers.

With deep Epicor integration, support for Epicor Kinetic, and an alternative to Epicor Payment Exchange for more complex needs, EBizCharge helps manufacturers build payment workflows that fit how they actually work.