Blog > ACH Payment Processing for Epicor: Lower-Fee Options

ACH Payment Processing for Epicor: Lower-Fee Options

If you manage payments inside Epicor, you already know that processing fees add up quickly. This is especially true in B2B environments where transaction sizes are larger, and margins matter. A small percentage on every payment can quietly become a significant expense over the course of a year.

Many Epicor users start with credit cards because they’re familiar and convenient. Over time, though, finance teams begin looking for ways to reduce costs without making it harder for customers to pay. That’s where ACH comes into the conversation.

This article is written for Epicor users who want practical guidance. We will look at how Epicor ACH payments work, why they are often a lower-fee option, and how to integrate them into Epicor ERP without slowing down collections or creating extra work.

Understanding ACH Payments in Epicor

ACH, or automated clearing house, is a network that moves money electronically between banks in the United States. An ACH transfer pulls funds directly from a customer’s bank account and deposits them into yours.

Epicor ACH processing typically involves connecting a payment tool to the ERP so payments can be initiated, posted, and tracked alongside invoices. When done properly, ACH payments behave like any other transaction in Epicor. They update invoice status, customer balances, and reports without manual intervention.

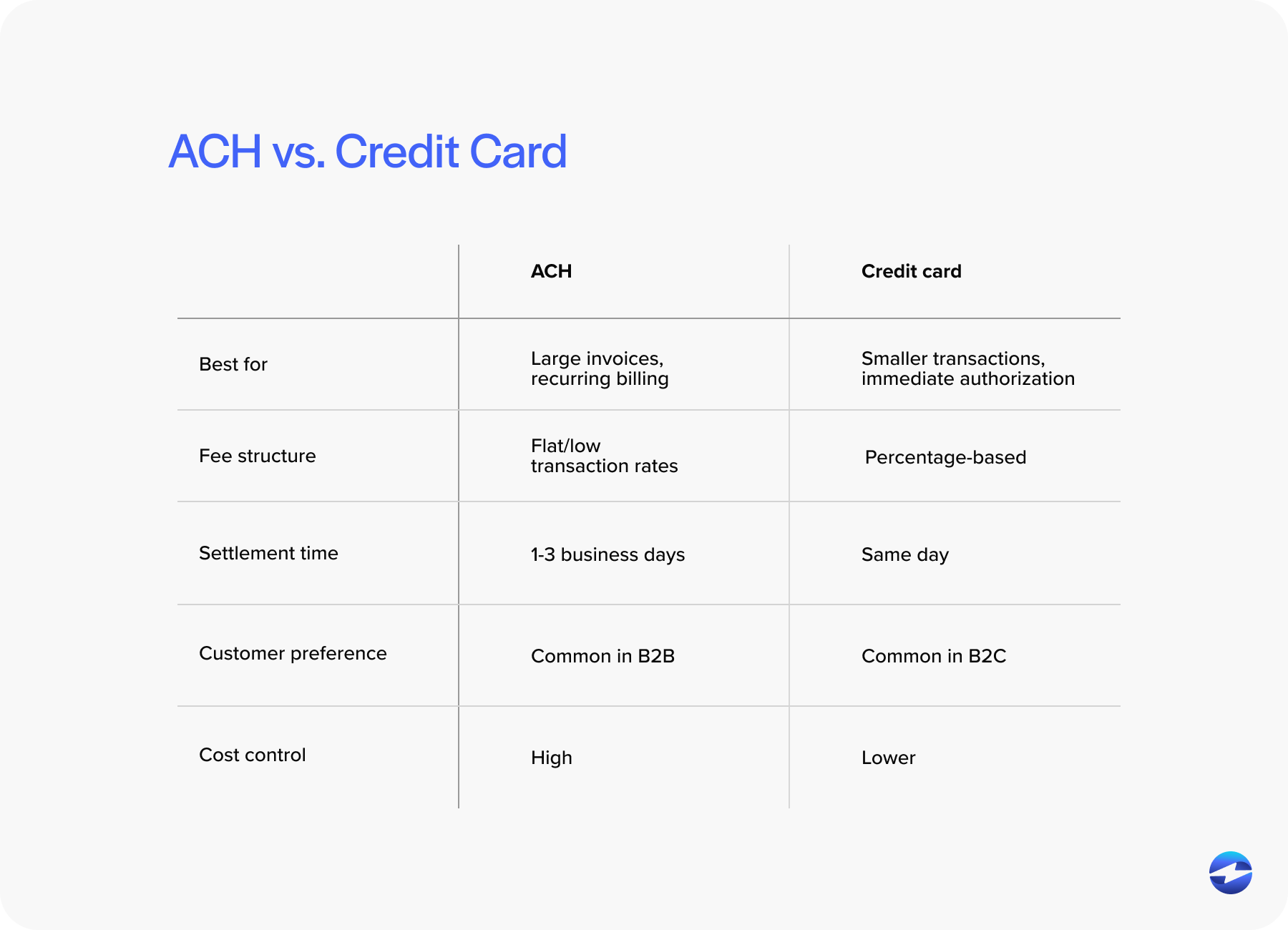

Compared to credit cards, ACH tends to be slower by a day or two. In many B2B scenarios, that tradeoff is acceptable given the cost savings and predictability ACH offers.

Why ACH Is a Lower-Fee Option for Epicor Users

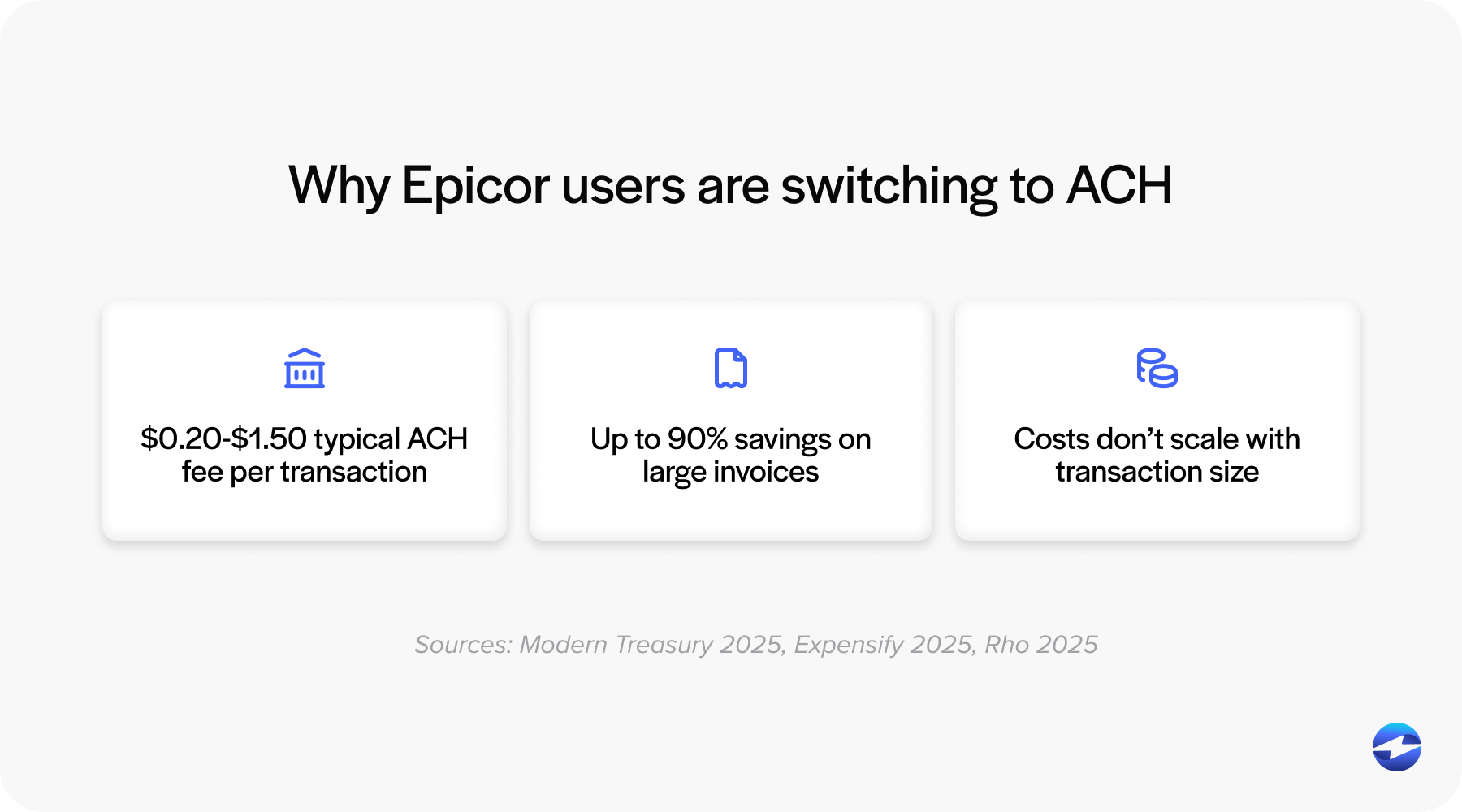

Processing fees are one of the biggest reasons Epicor users explore ACH.

Credit card fees are usually percentage-based. As transaction amounts increase, fees rise with them. ACH fees are typically flat or much lower per transaction.

Over time, the difference between card fees and Epicor ACH fees can be substantial. For companies processing high-dollar invoices, shifting even a portion of payments to ACH can noticeably reduce monthly expenses.

ACH also provides consistency. Instead of variable fees that fluctuate with transaction size, ACH costs are easier to predict and budget for.

Payment Processing Options for Epicor ERP Users

Epicor users generally have a few ways to handle payments.

Some rely on standalone tools that operate outside the ERP. These can accept ACH, but they often require manual posting and reconciliation.

Others use semi-integrated tools that send payment data back to Epicor after processing. This reduces some work, but delays can still occur.

The most efficient approach is a fully integrated payment processing solution that works directly within Epicor ERP. With this setup, ACH payments are initiated, processed, and posted in one continuous flow.

Choosing the right payment processor is critical here. Experience with Epicor software makes a real difference in how smoothly ACH fits into daily workflows.

ACH Payment Processing Integration Options in Epicor

Integration quality determines whether ACH actually delivers value.

Embedded integrations allow ACH payments to be initiated directly from Epicor screens. Users don’t need to leave the system to accept or apply payments.

API or middleware approaches can also work, but they often require more maintenance. Each Epicor upgrade needs to be tested carefully.

Strong Epicor integration ensures ACH payments post automatically, update invoices correctly, and support clean reconciliation.

ACH vs. Credit Cards in Epicor Payment Strategies

Credit cards are still useful for smaller transactions or situations where immediate authorization is required. For larger invoices, ACH often makes more financial sense.

Some Epicor users also rely on Level III credit card processing to reduce card fees on large B2B transactions. Even with Level III data, ACH usually remains the lower-cost option.

A balanced payment strategy gives customers choice while controlling processing expenses.

Automating Recurring ACH Payments in Epicor ERP

Recurring ACH payments are especially effective for predictable billing.

Service agreements, maintenance contracts, and subscription-style billing all benefit from automation. Customers authorize the payment once, and funds move automatically on a set schedule.

When recurring ACH is integrated into Epicor, payments post automatically and stay tied to the correct invoices. This improves cash flow predictability and reduces late payments.

Automation also reduces administrative effort for both customers and accounting teams.

Reducing Manual Work and Errors with ACH Automation

Manual entry is one of the hidden costs of poorly integrated payments.

When ACH payments post automatically, there’s no need to rekey data or manually match deposits. Fewer handoffs mean fewer mistakes, and reconciliation becomes a quicker, more straightforward task.

This improves confidence in accounts receivable data and reduces time spent fixing avoidable issues.

Automation turns ACH into a reliable part of daily operations rather than an exception process.

Security and Compliance Considerations for ACH Payments

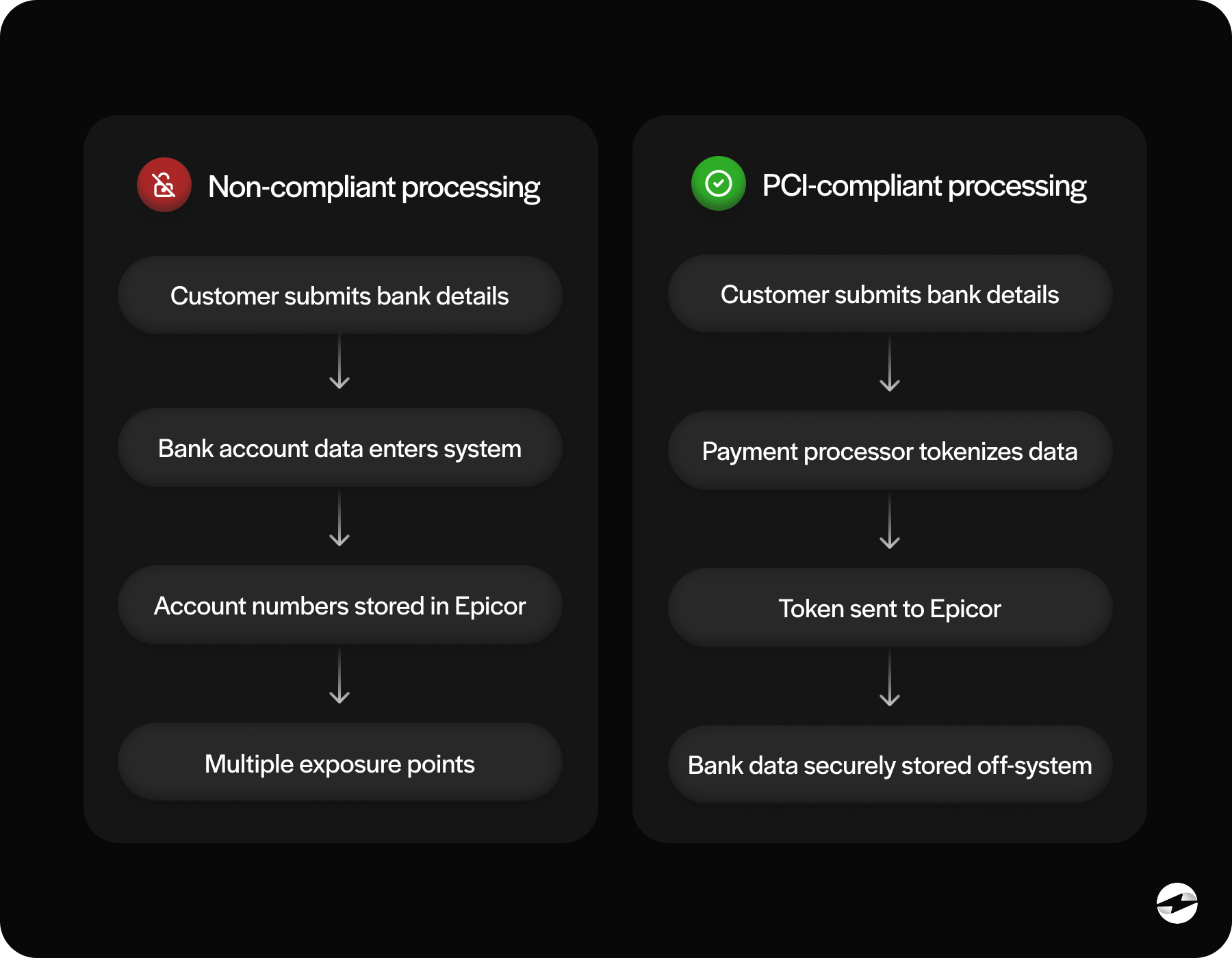

Handling bank account data requires care, especially when payments are moving directly between customer and business bank accounts.

A properly designed ACH setup uses tokenization so sensitive information is never stored in Epicor or exposed to internal users. Instead, bank details are securely handled by the payment system, reducing risk and limiting internal access to sensitive data. Compliance with automated clearing house rules and NACHA standards adds another layer of protection for both you and your customers.

Security is also about consistency and reliability. This is one of the reasons choosing an experienced payment processor matters, particularly one that understands how to handle ACH securely within Epicor workflows.

Choosing the Right ACH Payment Processing Partner for Epicor

Not every provider understands Epicor, and that gap shows up quickly once payments are live.

Epicor-specific experience helps avoid common integration issues like delayed posting, mismatched transactions, or reconciliation headaches. A provider that knows Epicor also understands how upgrades work and how payment workflows need to adapt over time, which makes changes easier to manage.

When evaluating partners, it helps to ask practical questions.

How do ACH payments post back into Epicor?

What does reconciliation look like day to day?

How does the solution handle higher volumes as the business grows?

Long-term reliability matters just as much as initial setup, especially for teams that want ACH to be a dependable, low-effort part of their payment strategy.

Reducing Payment Processing Fees in Epicor With EBizCharge

EBizCharge’s native Epicor integration is designed for Epicor users who want to control costs without complicating workflows.

It supports Epicor ACH payments alongside credit cards, allowing teams to route transactions in the most cost-effective way. Integrated Epicor ACH processing ensures payments post automatically inside Epicor.

By reducing reliance on high-fee cards and lowering overall Epicor ACH fees, EBizCharge helps teams build a more predictable payment strategy.

With a flexible payment processing solution, deep Epicor integration, and an experienced payment processor, EBizCharge gives Epicor users a practical path to lower fees without sacrificing visibility or control.