Blog > Sage Intacct Payment Solutions for SaaS Companies

Sage Intacct Payment Solutions for SaaS Companies

For SaaS companies, managing revenue isn’t just about sending invoices or collecting payments — it’s about keeping everything flowing smoothly across recurring subscriptions, renewals, and customer accounts. A small disruption in the process can ripple through billing, cash flow, and financial reporting. That’s why more SaaS teams are turning to automation and modern ERP tools to manage these moving parts efficiently. The Sage Intacct ERP system has become a reliable choice for businesses that need structure, transparency, and scalability in their financial operations.

So, what is Sage Intacct? Think of it as a financial management platform built for growing companies that rely on consistent and recurring billing. It goes beyond basic accounting — connecting billing, reporting, and payments into one ecosystem. And when paired with the right Sage Intacct Payment Solutions, it becomes a complete system that automates payment processing, improves accuracy, and gives teams a real-time view of business health.

Understanding Sage Intacct Payment Solutions for SaaS

In SaaS, recurring revenue is everything. Customers subscribe once but expect a seamless billing experience every month or quarter. Sage Intacct payment processing was designed for exactly that — a system that manages renewals, subscription changes, and usage-based billing without requiring teams to constantly intervene.

Sage Intacct for SaaS centralizes billing and payments, meaning every transaction is automatically recorded in the same environment as your general ledger and revenue recognition modules. This automation saves time, reduces human error, and improves reporting accuracy. Finance teams can see which customers have paid, which accounts are overdue, and how upcoming renewals affect cash flow — all from one dashboard.

The real strength of Sage Intacct SaaS lies in its adaptability. Whether you’re managing ten clients or ten thousand, the system scales with you. Combined with automation, it helps finance teams focus on strategy instead of reconciliation.

Automating Recurring Payments and Invoicing in Sage Intacct

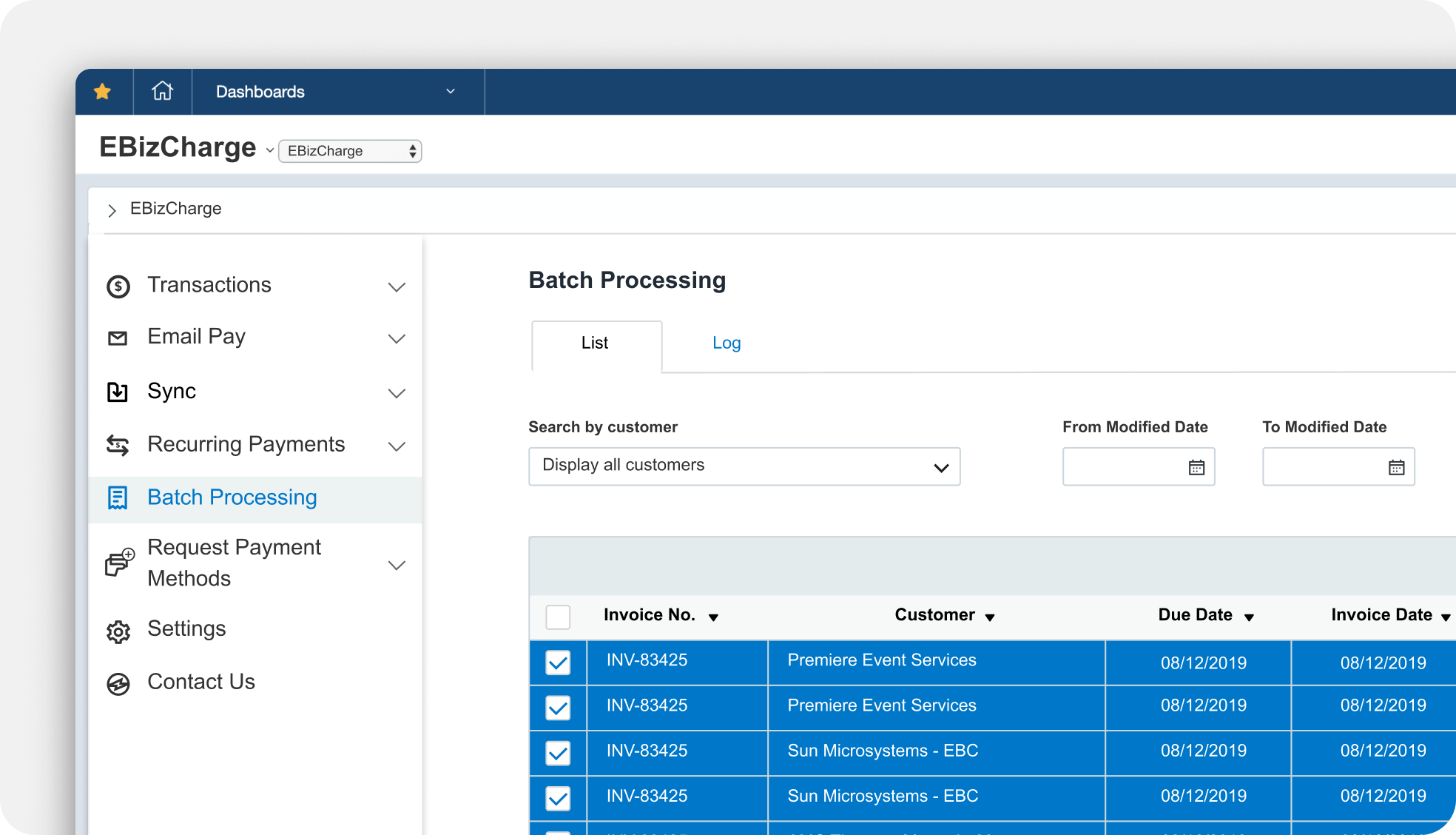

Automation is the backbone of SaaS billing. The Sage Intacct ERP system simplifies recurring invoicing and payment collection with tools that automatically generate invoices, apply payments, and post transactions. Once configured, invoices are sent on schedule, payments are processed immediately, and everything is updated in real-time.

With Sage Intacct automated payments, you can reduce the manual work of billing cycles, customer reminders, and data entry. The Sage Intacct API plays a crucial role here, allowing businesses to connect their subscription management tools, CRMs, or customer portals directly to Intacct, ensuring all systems share the same information. This integration keeps financial data consistent and eliminates the risk of mismatched billing records.

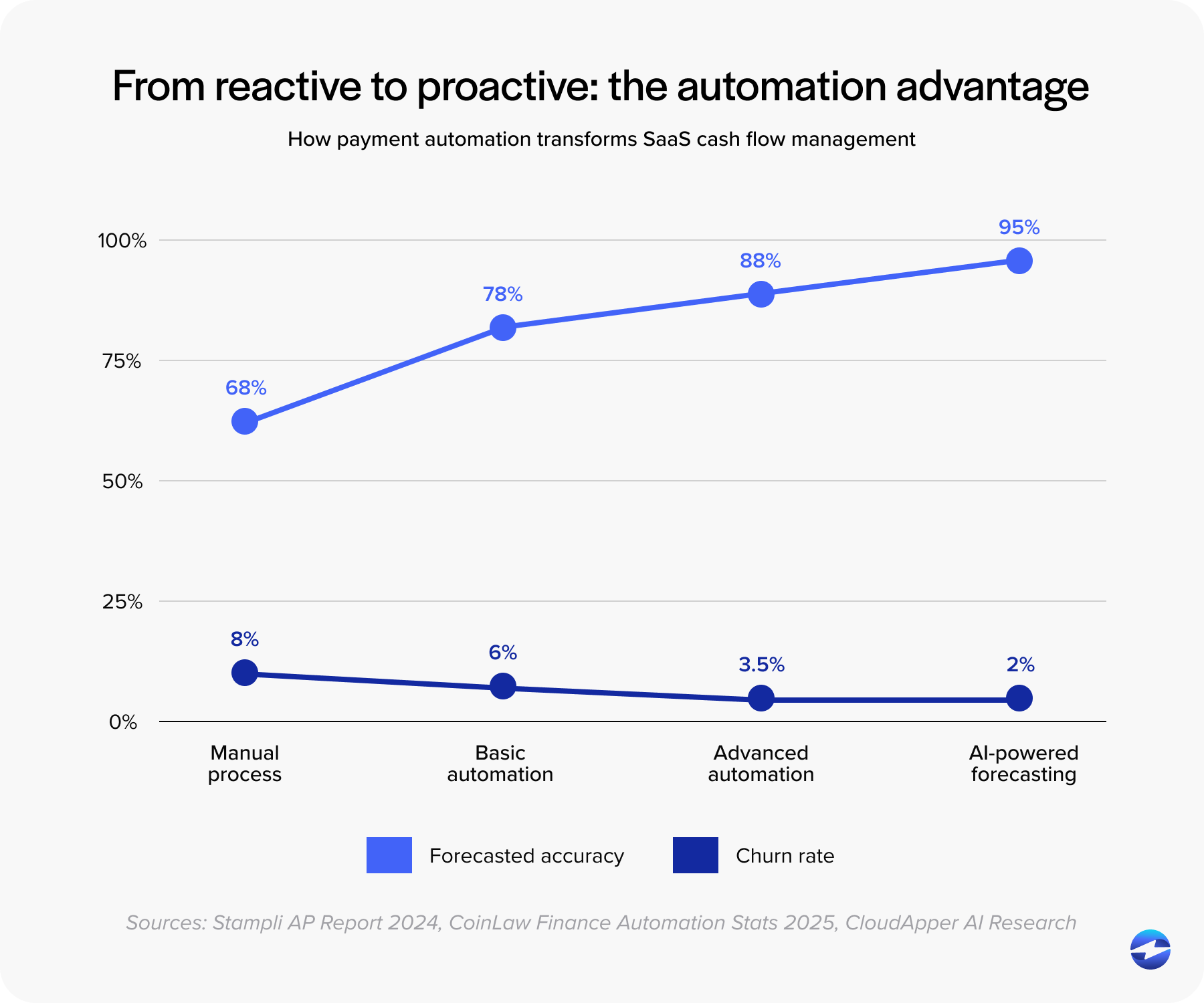

Over time, automation helps SaaS companies move from reactive cash management to proactive forecasting. Instead of chasing down failed payments, teams can see payment trends, identify churn risks, and adjust strategies before they affect revenue.

Processing Credit Cards and ACH Payments in Sage Intacct

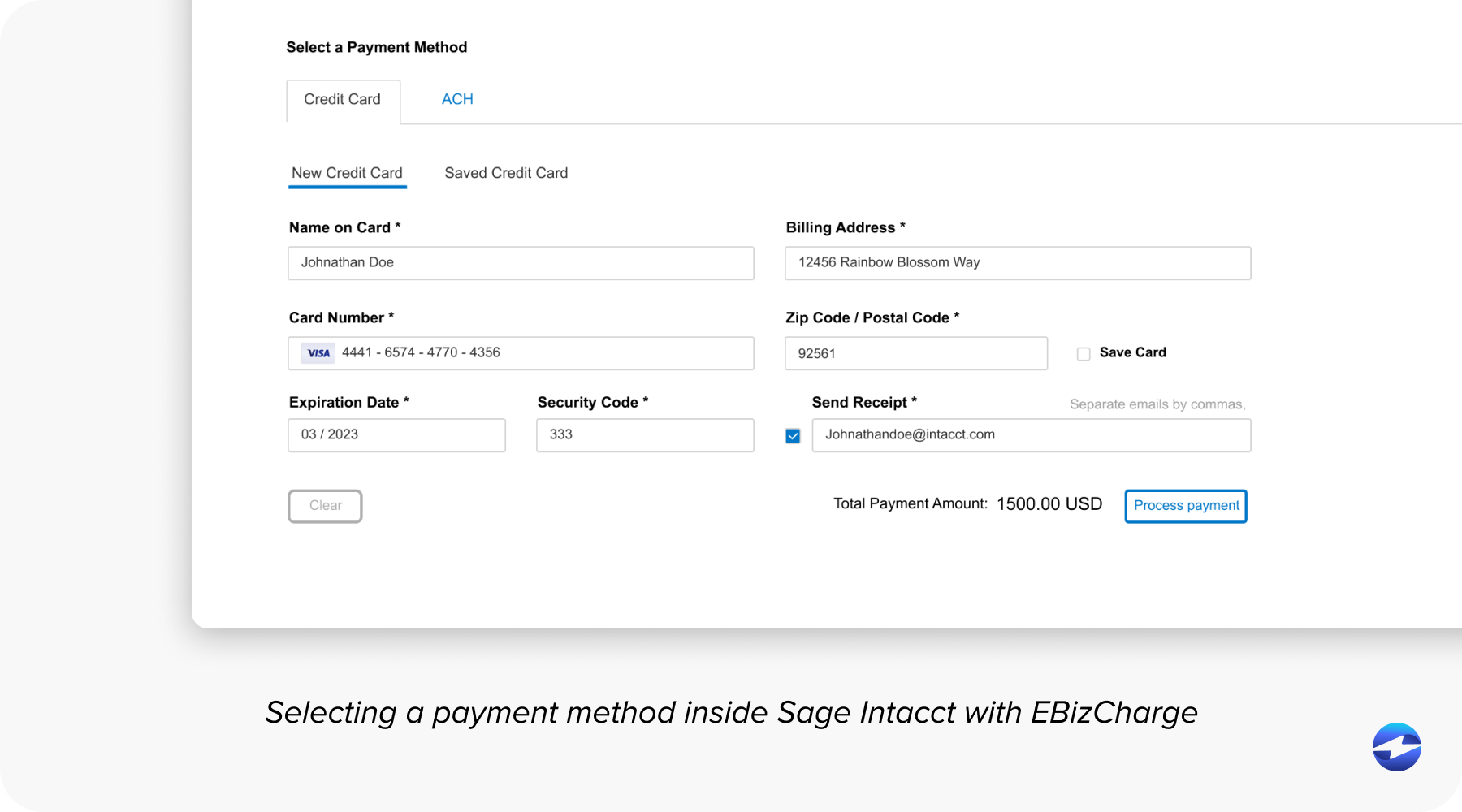

For SaaS companies, credit card and ACH payments are the lifeblood of recurring revenue. Sage Intacct credit card processing makes it easy to handle these transactions securely and efficiently. Payments post automatically to the right accounts, invoices are marked as paid, and reconciliation happens without delay.

Security is built into the process. Tokenization replaces sensitive data with encrypted tokens, and PCI compliance ensures that payment data never lives in your internal system. This is especially important for SaaS businesses that process large transaction volumes — automation helps reduce risk while maintaining a consistent customer experience.

When integrated with a reliable payment processor, Sage Intacct payment processing also accelerates cash flow. Payments are captured faster, fees are easier to track, and refunds can be managed directly within the same system. The result is a workflow that feels effortless but delivers precision behind the scenes.

Industry Comparison: What SaaS Can Learn from Other Sectors

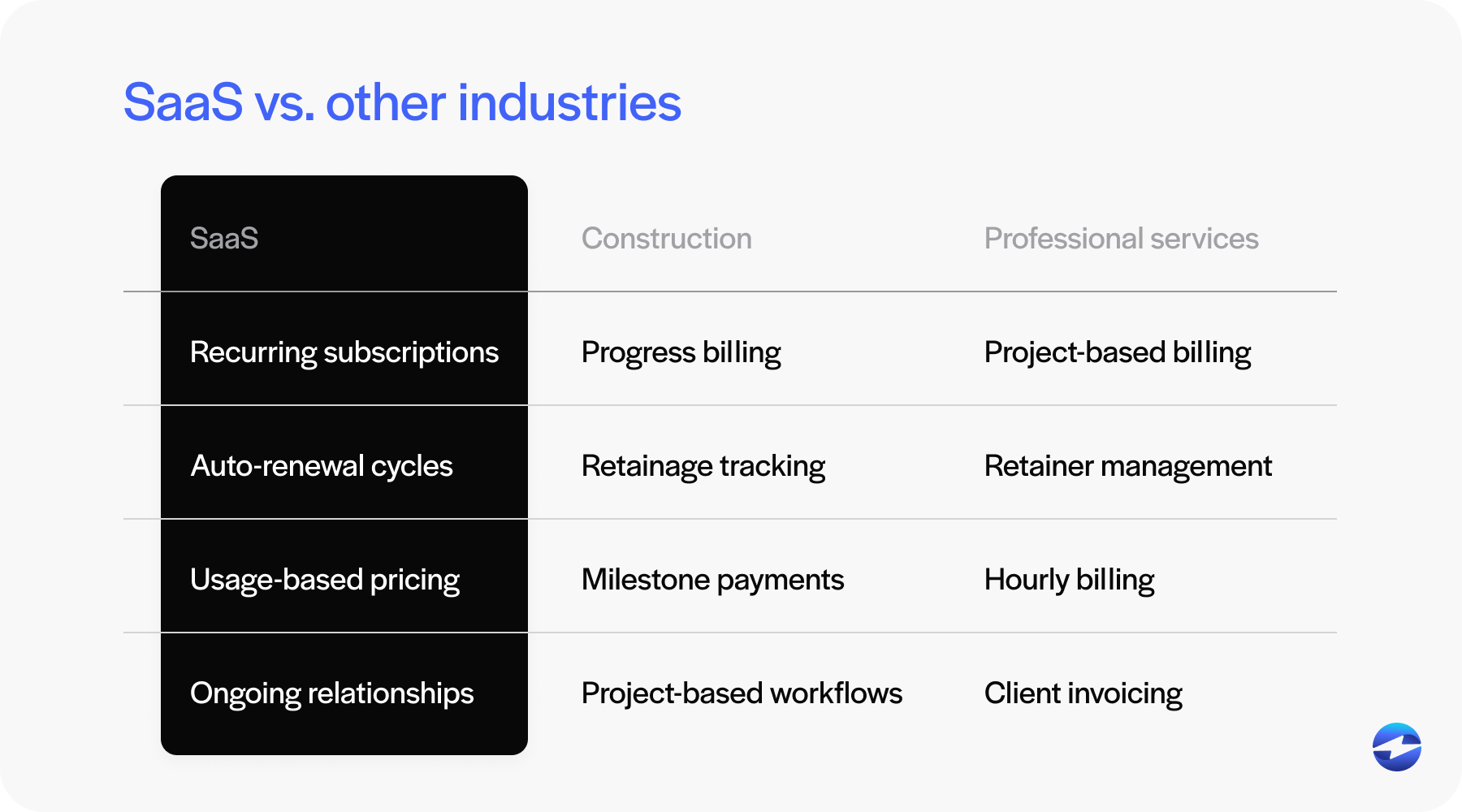

While SaaS companies rely heavily on automation for recurring payments, other industries use Sage Intacct Payment Solutions in different ways. In construction, for instance, Sage Intacct ERP supports progress billing, retainage tracking, and vendor payments — workflows centered around project milestones rather than subscriptions.

Professional services firms use Sage Intacct integration to automate client invoicing, manage retainers, and bill for project hours. In both cases, automation cuts down on manual steps and creates visibility across the financial process. But SaaS stands apart with its constant renewal cycle. Each subscription represents an ongoing relationship that must be maintained automatically. The ability of Sage Intacct for SaaS is so valuable.

Integration and Expansion Through Sage Intacct

The ability to connect tools seamlessly is a major reason SaaS companies choose Sage. The Sage Intacct API allows businesses to integrate with CRMs, analytics platforms, and payment gateways without building everything from scratch. This flexibility lets teams tailor workflows to fit their business model — whether that’s complex subscription billing, usage-based pricing, or high-volume transactions.

Strong Sage Intacct integration also makes it easier to adopt new tools without disrupting existing workflows. As SaaS companies scale, they often need to add customer support systems, reporting tools, or even new payment gateways. The open design of Sage Intacct integrations makes that possible, keeping data accurate and up to date across every platform.

For growing SaaS organizations, integration isn’t just a convenience — it’s what keeps the financial engine running smoothly as the business evolves.

Why EBizCharge Is a Strong Fit for SaaS Payment Automation

Among all available integrations, EBizCharge stands out as a trusted payment processing solution that complements Sage Intacct for SaaS perfectly. It connects directly with Sage Intacct ERP, using the Sage Intacct API to post transactions instantly to invoices, accounts, and customer records. That means no manual entry, no delayed posting, and no need for outside reconciliation tools.

EBizCharge simplifies recurring billing, automates payment retries, and handles refunds and ACH transfers with ease. Its interchange optimization feature automatically routes each transaction through the lowest-cost rate category, saving SaaS companies money on processing fees without extra effort.

For teams concerned about security, EBizCharge includes tokenization and PCI-compliant encryption — the same standards trusted across enterprise-level platforms. And because it’s a native Sage Intacct integration, setup is quick, and workflows remain consistent within Intacct’s environment.

EBizCharge also provides transparent reporting, giving teams visibility into payment activity, transaction fees, and reconciliation status. For SaaS businesses managing hundreds or thousands of recurring payments, this kind of insight turns billing into a predictable and scalable process. It’s a payment processor that balances automation, security, and savings — all within the tools finance teams already use every day.

Building a Scalable Payment Framework for SaaS Growth

Running a SaaS company means managing countless moving parts — but your payments don’t have to be one of them. With the right Sage Intacct Payment Solutions, you can build a system that automates recurring billing, accelerates collections, and keeps every transaction accurate from end to end.

By combining the power of Sage Intacct ERP, the flexibility of the Sage Intacct API, and a trusted payment processing solution like EBizCharge, SaaS teams can turn what used to be an administrative burden into a strategic advantage. Whether you’re processing credit cards, ACH transfers, or subscription renewals, automation ensures payments stay reliable and predictable.

In the end, efficiency is what drives growth. With Sage Intacct for SaaS, businesses gain more than just a billing tool — they gain a foundation for scalable, data-driven success that grows right alongside their customers.