Blog > Sage Intacct API Integration for Payment Processing: Developer Guide

Sage Intacct API Integration for Payment Processing: Developer Guide

When you’re building or managing financial systems, a reliable API integration can make all the difference. The Sage Intacct API gives businesses and developers the ability to automate complex payment processes, improve accuracy, and reduce the amount of manual work required to keep accounting records up to date. This guide is meant for those who live in the details – developers, IT teams, and finance professionals who want to understand how to make their Sage Intacct integration efficient, scalable, and secure.

Why API Integration Matters for Payment Processing

Finance today runs on automation. Every transaction – from customer payments to vendor bills – needs to move through your system quickly, accurately, and securely. That’s where the Sage API integration shines. It connects your payment processor directly to Sage Intacct ERP, allowing invoices, reconciliations, and reports to update automatically without the usual manual work.

But the value of the Sage Intacct API goes beyond just speed. It keeps your data cleaner, reduces errors, and gives finance teams more time to focus on what actually matters instead of chasing down mismatched numbers. For developers, it provides a flexible framework to build on – whether you’re customizing payment workflows, setting approval automation, or syncing live data across systems. Compared with legacy systems like Sage 100 API integration, Sage’s cloud-first design makes integration smoother, more secure, and far easier to maintain.

Understanding the Sage Intacct API and Its Core Capabilities

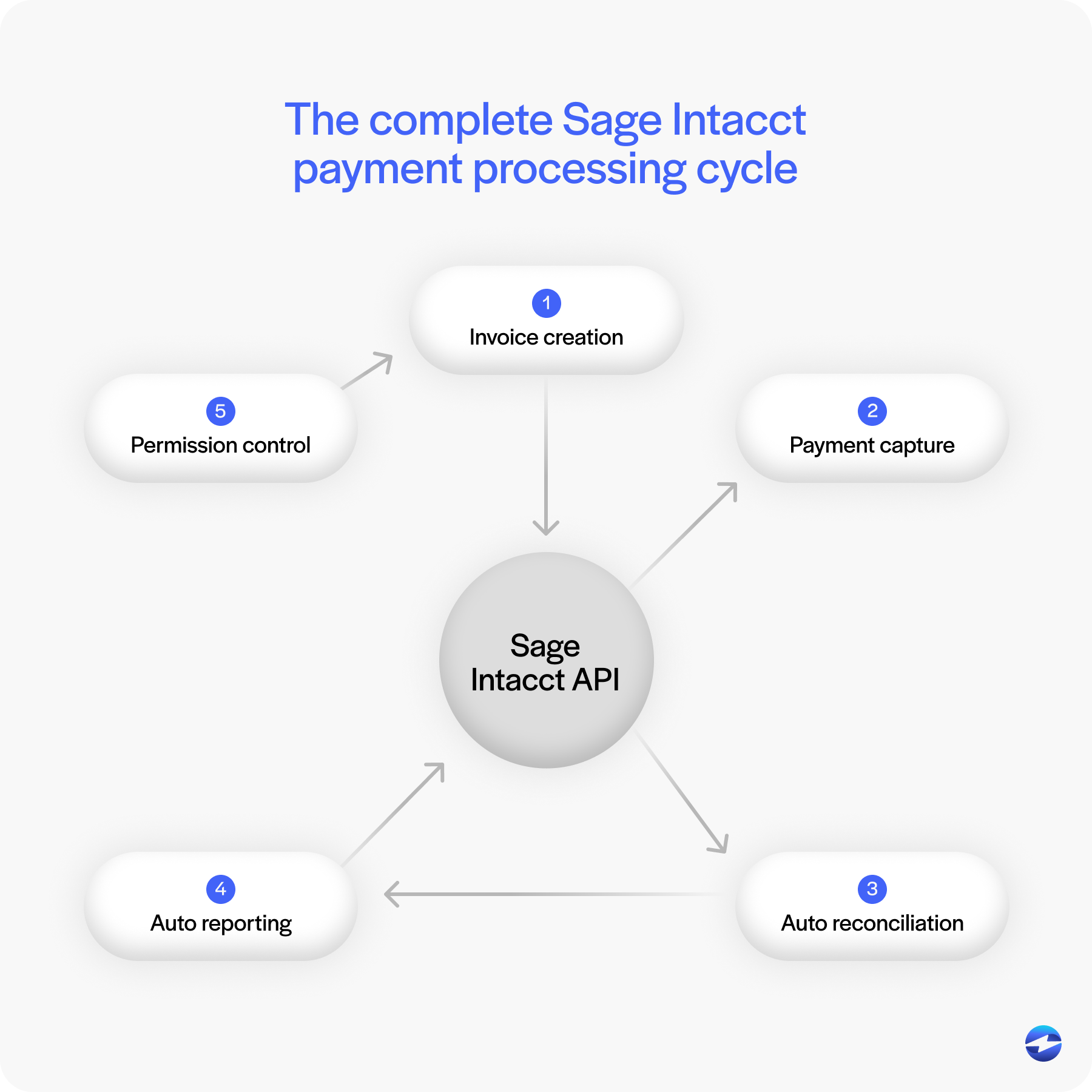

At its core, the Sage’s application programming interface (API) serves as the communication layer between Sage and external applications. It allows data to move securely between systems – so invoices, payments, and reports stay aligned without manual effort. This flexibility is what makes Sage Intacct integrations so powerful for payment processing.

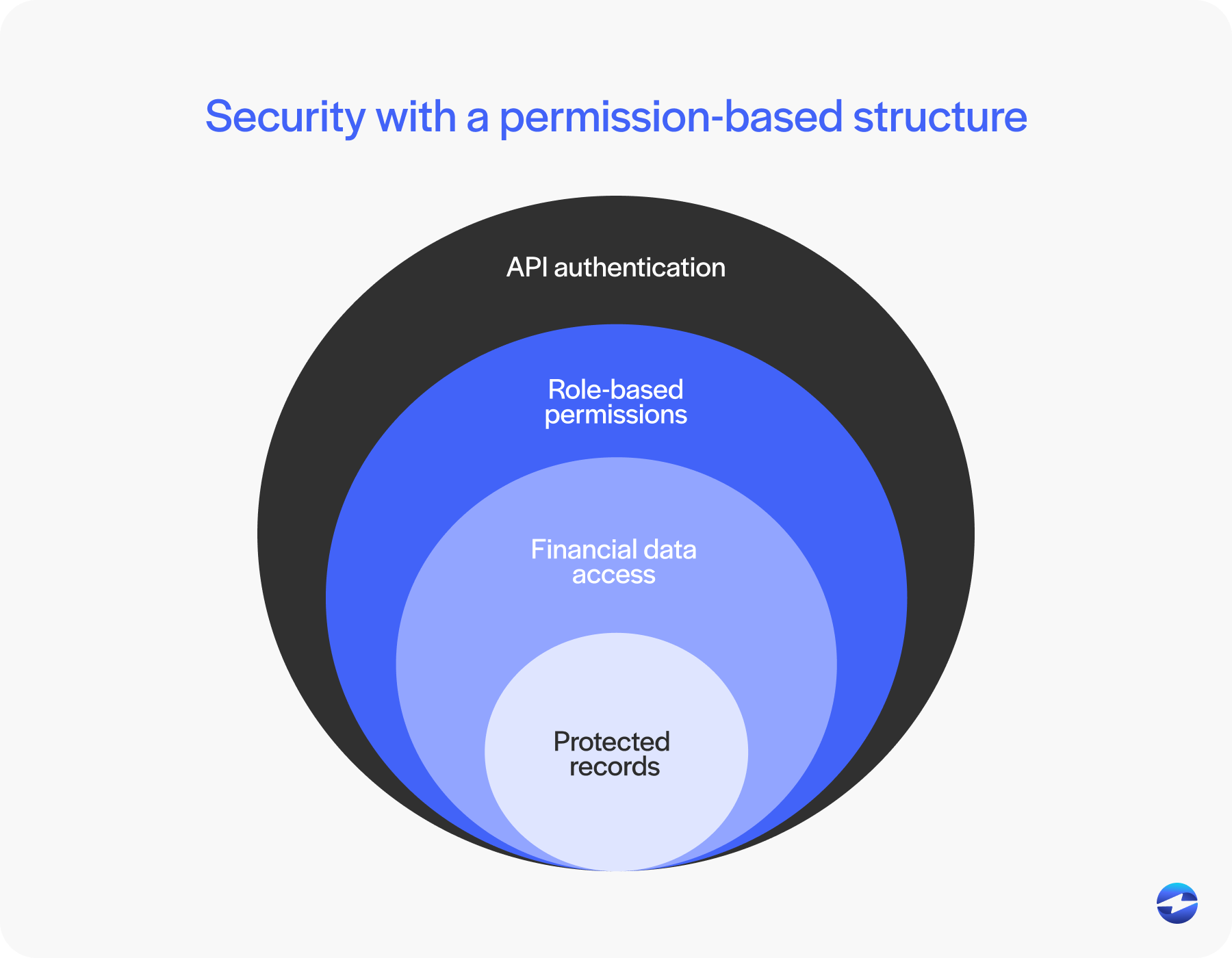

Developers can use the API to automate nearly every step of the Sage Intacct payment processing cycle: from invoice creation and payment capture to reconciliation and reporting. Each API call follows strict authentication rules, ensuring security while maintaining transparency. The system’s permission-based structure means you can limit access to only the areas needed for specific functions – keeping sensitive financial data protected at every step.

Because of its modular design, Sage Intacct ERP seamlessly connects with multiple gateways or payment processing solutions, giving organizations the freedom to choose the systems that work best for their business model.

Sage Intacct REST API: What Developers Need to Know

Sage Intacct uses an XML-based API as its primary integration method, which is different from the REST APIs that many modern platforms use. That said, Sage has been expanding its REST-based capabilities through the Sage Intacct Marketplace API and newer endpoints designed for third-party app development.

For developers coming from REST-heavy environments, the adjustment is mostly about formatting. The XML API uses HTTPS POST requests with XML payloads rather than JSON, but the core patterns of authentication, CRUD operations, and response handling are familiar. Sage provides detailed API documentation through its developer portal, including object definitions, function references, and sample request/response structures. If you’re building a payment integration, the key objects to focus on are AR invoices, AR payments, and cash receipts, since those are where payment data flows in and out.

Setting Up Sage Intacct API Integration

Before you start building, take a moment to set up a clean and secure environment. Begin by generating API credentials and assigning roles that match each user’s responsibilities. The Sage Intacct API is designed with strict permissions, so only approved systems and users can view or modify financial data. Think of this authentication step as your first line of defense, keeping your integration safe and under control.

It’s also good to work in two environments: one sandbox for testing and another for live production data. This setup allows you to experiment, fine-tune workflows, and test automation safely before rolling out any changes. As you configure your system, double-check your API endpoints, connection limits, and any custom fields your business might rely on.

Sage Intacct API Limits, Authentication, and Security

Sage Intacct enforces rate limits on API calls to protect system performance. The specific limits depend on your subscription tier, but developers should build their integrations with throttling in mind. Batch operations where possible, space out large sync jobs, and always check response headers for rate limit status before queuing the next request.

Authentication uses a session-based model. You send your credentials (sender ID, sender password, company ID, user ID, and user password) to generate a session, then use that session ID for subsequent calls. Roles and permissions control what each session can access, so a payment integration user should only have access to AR and payment-related modules. Rotate your API credentials on a regular schedule and avoid hardcoding them into your application. Environment variables or a secrets manager are the safer approach.

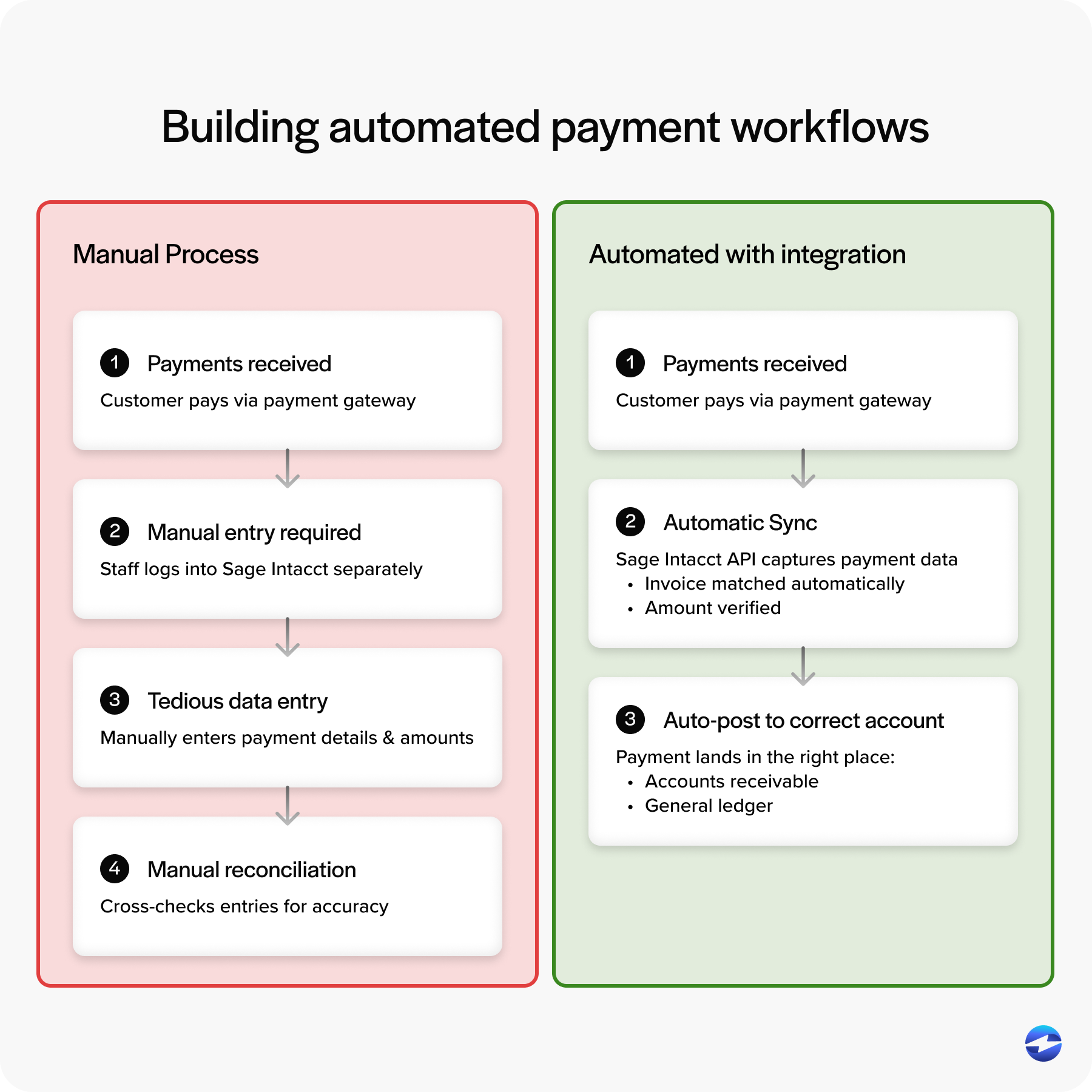

Building Automated Payment Workflows

The real advantage of the Sage Intacct integration shows when payments start moving on their own. Automation takes over the tedious tasks and keeps your books accurate with minimal hands-on work. The Sage Intacct API links your payment gateway directly with your accounting modules so that every payment automatically lands where it belongs, whether it’s in accounts receivable or the general ledger.

For businesses with recurring billing or subscription models, this automation is a game-changer. Invoices are generated on schedule, payments are posted as soon as they’re processed by your payment processor, and everything stays in sync. ACH transfers, credit card payments, and refunds can all move through the same automated loop, keeping cash flow clear and up to date in real time.

Compared to manual systems or older setups like Sage 100 API integration, Intacct’s automation streamlines everything. It cuts down on duplicate entries, reduces timing issues, and helps you close the books faster with far fewer end-of-month surprises.

How to Process Payments Through Sage Intacct

Processing payments through Sage Intacct typically follows one of two paths: manual entry inside the platform, or automated processing through an integrated payment gateway.

For manual processing, you create an AR payment record, apply it to the corresponding invoice, and post the transaction. This works for low-volume operations, but it requires someone on your team to enter each payment by hand and reconcile it against your bank records.

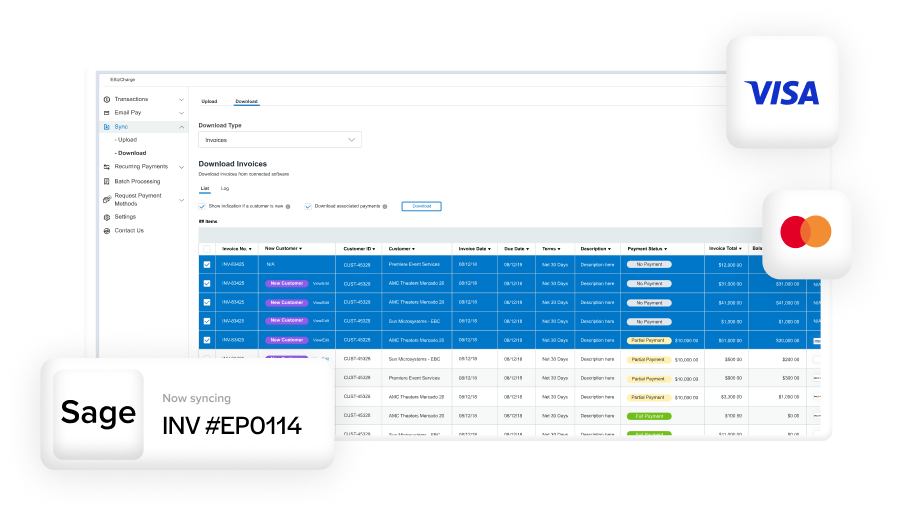

The more efficient path is connecting a payment gateway like EBizCharge that processes credit card and ACH payments and posts them directly to the correct invoice in Sage Intacct. The customer pays through a portal, email link, or virtual terminal, and the payment record is created automatically with no double entry. For businesses processing any real volume, this approach saves hours of manual reconciliation each week and keeps your AR current in real time.

Sage Intacct Virtual Terminal

A virtual terminal lets you process payments manually through a web browser without needing a physical card reader. For Sage Intacct users, a virtual terminal connected to your ERP means you can key in a credit card or ACH payment while on the phone with a customer and have it post directly to the open invoice.

This is especially useful for B2B businesses that take payments over the phone or receive payment details via email. With EBizCharge, the virtual terminal lives inside Sage Intacct, so your team doesn’t need to switch between systems. The payment processes, the invoice updates, and the records sync automatically. It’s a simple tool, but for teams that handle phone payments regularly, it eliminates a lot of manual steps.

Error Handling and Maintenance

Even the best APIs will occasionally run into errors, and knowing how to manage them is what keeps things running smoothly over time. When working with Sage Intacct payment processing, it’s smart to build in safeguards that automatically retry failed requests, double-check data before it’s sent, and record each transaction for easy auditing later.

Most issues stem from simple things like connection timeouts, incorrect login details, or missing data fields. Keeping an eye on these responses helps your team fix small problems before they grow into something bigger. Good long-term maintenance also means keeping documentation current, tracking updates to the Sage API integration, and regularly reviewing your logs so nothing slips through the cracks.

Best Practices for a Successful Integration

Like any integration, the success of your Sage Intacct API setup comes down to consistency and attention to detail. Adopting a few steady habits can make all the difference:

- Monitor performance: Keep track of call limits, response times, and error logs to identify small issues before they turn into real problems.

- Test regularly: Always try changes in a sandbox first to avoid surprises in your live system.

- Stay updated: Ensure your setup keeps pace with the latest Sage Intacct ERP releases and API updates, so your integration doesn’t fall behind.

- Document clearly: Write down endpoints, field maps, and key workflows so that anyone joining your team can pick up where you left off.

- Keep security tight: Rotate API tokens frequently and double-check user permissions to ensure access remains limited and secure.

These simple habits go a long way toward keeping your integration healthy, scalable, and dependable as your Sage Intacct integrations grow with your business.

Choosing the Right Integration Partner

For many organizations, working with a Sage-certified partner simplifies the entire process. Sage Intacct integration partners help design, implement, and support complex payment workflows without requiring your team to manage every technical detail. Choosing the right partner depends on your goals – whether that’s advanced automation, cost reduction, or support for specific payment methods.

Prebuilt connectors offer a faster setup, while custom Sage API integration solutions give you more control. The best partners maintain compliance, provide ongoing updates, and offer responsive support when your system needs adjustments.

EBizCharge for Sage Intacct

EBizCharge is a great option for teams that want automation without adding complexity. This trusted payment processing solution connects directly to Sage Intacct ERP and uses the Sage Intacct API to automate everything from credit card payments to invoice reconciliation. Once a payment is processed, it posts instantly inside Sage – no double entry, no waiting, and no manual cleanup later.

EBizCharge handles the repetitive work. It handles recurring payments, refunds, and real-time updates while maintaining full PCI compliance and tokenized security. It’s built-in interchange optimization helps lower processing costs automatically, which is a major plus for both finance leaders and developers. Additionally, transparent reporting gives businesses a clear view of their Sage Intacct payment processing activity at any time.

Setup is straightforward, even for developers. Because it’s a native Sage Intacct integration, there’s little to no custom coding required, and deployment is quick. Finance teams see immediate benefits with faster reconciliation and smoother workflows. Whether your company processes thousands of transactions or simply wants a reliable payment processor, EBizCharge strikes a balance between automation, security, and cost efficiency that makes it an excellent fit for growing organizations.

Building Better Payment Connections

Building a strong API connection isn’t just a technical project – it’s the foundation for smoother financial operations. The Sage Intacct API provides the flexibility and reliability developers need to create seamless payment workflows that serve real business needs. Combined with a dependable payment processing solution like EBizCharge, businesses can simplify complexity, reduce manual errors, and focus on growth instead of system maintenance.

With the right Sage Intacct integrations, every payment becomes a little faster, cleaner, and easier to manage – exactly how modern accounting systems should work.

Frequently Asked Questions

Does Sage Intacct have an API?

Yes. Sage Intacct provides a web services API that allows developers to integrate external applications, automate workflows, and sync data across systems. It supports operations across all core modules including accounts receivable, accounts payable, general ledger, and cash management.

Is the Sage Intacct API REST or XML?

The primary Sage Intacct API is XML-based, using HTTPS POST requests with XML payloads. Sage has been expanding REST capabilities through newer endpoints and marketplace APIs, but most core ERP integrations still use the XML API.

What are Sage Intacct API rate limits?

Rate limits vary by subscription tier. Developers should build integrations with throttling in mind by batching operations, spacing out sync jobs, and monitoring response headers for rate limit status.

How do I process credit card payments in Sage Intacct?

You can process credit card payments by connecting a payment gateway like EBizCharge to Sage Intacct. Payments are processed through a customer portal, email pay link, or virtual terminal and post directly to the corresponding invoice in your ERP.

What is the difference between Sage 100 API and Sage Intacct API?

Sage 100 uses an older, on-premise API architecture that requires local server access. Sage Intacct is cloud-native with a web services API that’s easier to integrate, maintain, and scale. For new integrations, Intacct’s API offers more flexibility and better documentation.

Can I automate reconciliation in Sage Intacct?

Yes. When payments are processed through an integrated gateway, they post directly to the matching invoice in Sage Intacct. This eliminates manual reconciliation and keeps your AR records current in real time.

- Why API Integration Matters for Payment Processing

- Understanding the Sage Intacct API and Its Core Capabilities

- Sage Intacct REST API: What Developers Need to Know

- Setting Up Sage Intacct API Integration

- Building Automated Payment Workflows

- Error Handling and Maintenance

- Best Practices for a Successful Integration

- Choosing the Right Integration Partner

- EBizCharge for Sage Intacct

- Building Better Payment Connections

- Frequently Asked Questions