Blog > Salesforce Subscription Billing: Automating Recurring Payments

Salesforce Subscription Billing: Automating Recurring Payments

Managing subscriptions isn’t just for software companies anymore. From SaaS to memberships to services, recurring revenue models are everywhere. But while subscriptions may seem simple to customers, the backend process can get messy fast. Manual recurring billing is error-prone, time-consuming, and often leads to frustrated finance teams and unhappy customers. This is where Salesforce subscription billing comes into play. By automating recurring invoices and payments within Salesforce, businesses can simplify revenue operations and build trust with customers who expect a seamless experience.

In this article, you’ll see how Salesforce handles different subscription models, how automation works for collections, why dunning management is critical, and how integrations with CPW, billing automation, and payment processing tie everything together for long-term growth.

Understanding Subscription Models

Subscriptions come in all shapes and sizes. Some companies stick with fixed recurring charges, like a monthly or annual flat fee. Others use tiered pricing, where the amount depends on the plan or features a customer selects. Then there’s usage-based billing, where charges are tied to metrics such as API calls, data usage, or number of seats. Each of these approaches has its place, and the right model often depends on your industry and customer base.

The real advantage of flexible subscription models is customer retention. When customers can scale their usage up or down without leaving your platform, they’re more likely to stay. For finance teams, flexibility also means more predictable revenue streams. Salesforce recurring billing supports these models by tying them into CPQ billing and the broader Salesforce billing platform. Once a quote is configured and closed, Salesforce ensures the terms carry forward into automated invoices and scheduled charges. This consistency reduces errors and keeps every department aligned.

Subscription models also impact how businesses plan for growth. Predictable revenue from subscriptions makes forecasting easier, which helps leadership teams allocate resources more confidently. Instead of unpredictable one-time sales, subscription billing creates stability. This makes it easier to secure funding, hire strategically, and scale operations without overextending.

Automated Collection and Recurring Payments

One of the biggest benefits of Salesforce recurring payments is automation. Instead of chasing customers every month, invoices and charges are triggered automatically. The system schedules recurring runs, posts payments as they clear, and updates account records in real time. This reduces manual work for finance teams and gives IT managers fewer fires to put out.

The integration with a Salesforce payment gateway makes the process even smoother. Customers can use their preferred Salesforce payment options—credit card, ACH transfer, or digital wallets—and the payment posts directly to the corresponding invoice. Pair that with a reliable payment processing solution, and you have fewer failed payments and faster cash flow. For businesses relying on recurring revenue, this kind of reliability is critical.

Automation also improves the customer experience. When billing is consistent and error-free, customers feel confident in continuing their relationship with your business. No one wants to call customer support because their subscription was suspended due to a billing error. Automation helps avoid those painful conversations.

Dunning Management and Failed Payments

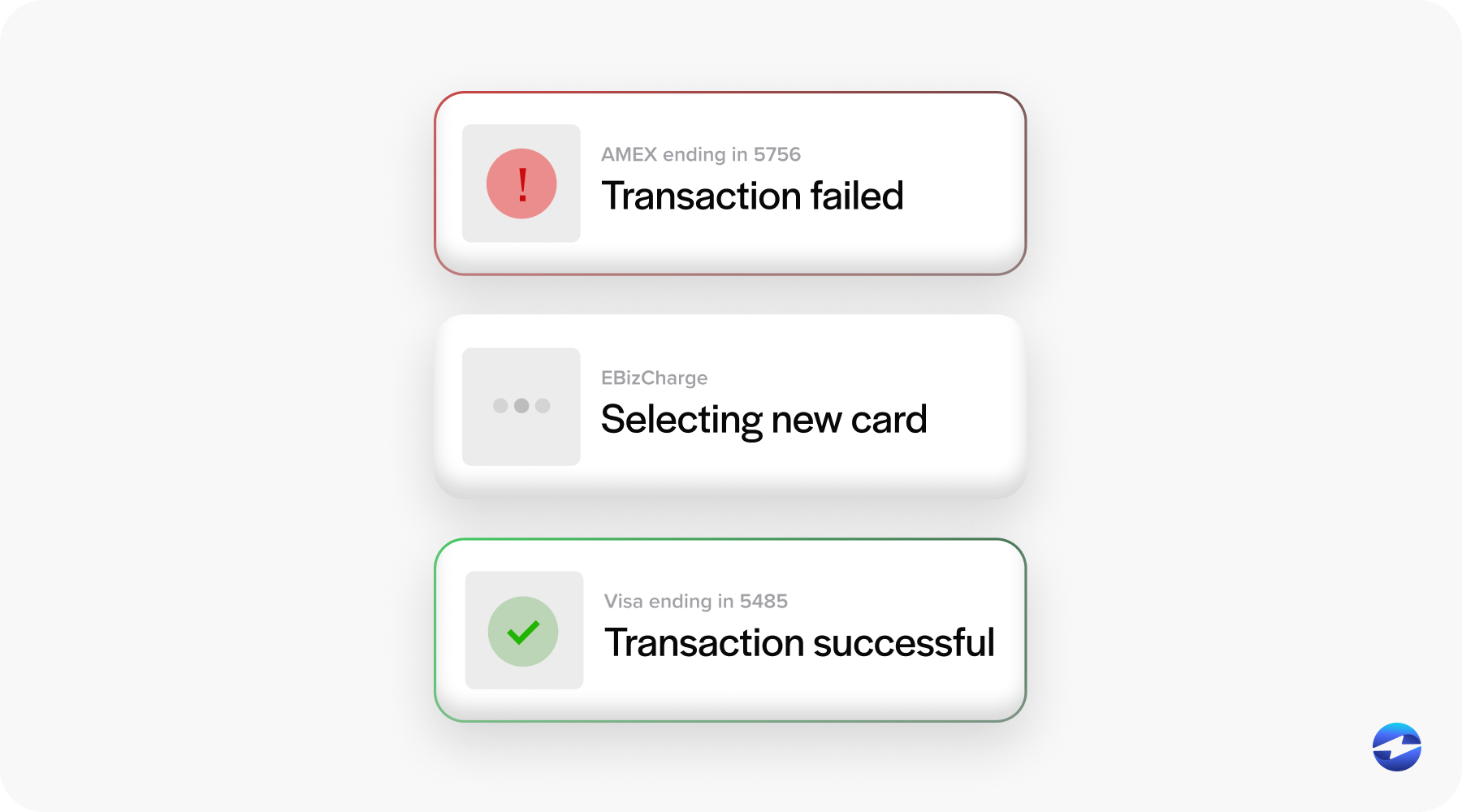

Even the best subscription setup runs into failed payments. Cards expire, accounts run out of funds, or network glitches get in the way. Left unmanaged, these failures add up to revenue leakage and churn. That’s where dunning management comes in.

Salesforce subscription billing provides tools to handle retries, send automated notifications to customers, and escalate unresolved issues. Instead of losing revenue to an expired card, the system retries the payment and alerts the customer. Finance teams don’t need to manually chase down every issue because the workflows handle it.

When combined with billing automation, dunning management turns a potential weak spot into a safeguard. It reduces churn, preserves customer relationships, and helps ensure recurring revenue flows smoothly.

Some businesses also add strategy to their dunning workflows. For example, sending a reminder email before a card expires can prevent failed payments altogether. Layering in customer portals where users can update their payment methods gives them even more control, further reducing payment failures.

Integration with CPQ and Payment Processing

The real power of Salesforce integration comes when CPQ billing and payment processing are connected. CPQ generates quotes and contracts, while Salesforce subscription billing ensures those terms flow naturally into invoices and recurring charges. This is the heart of quote-to-cash continuity: quote, contract, invoice, and finally payment.

A tight integration with a payment processor ensures that once invoices are generated, payments are collected automatically. It also keeps records consistent across ERP and accounting systems. With billing integration, finance teams don’t need to reconcile numbers from multiple platforms. Instead, Salesforce becomes the single source of truth for the entire revenue cycle.

Integration also supports advanced features like revenue recognition and compliance tracking. With everything in one place, finance teams can match revenue to contracts more easily, ensuring compliance with accounting standards. For leadership, this integration creates cleaner reporting and more accurate insights.

Best Practices for Subscription Billing in Salesforce

Successful Salesforce recurring billing doesn’t happen by accident. It requires planning and coordination across teams. Clean, accurate customer and contract data is the first step—bad data leads to billing headaches. Testing is equally important. Run through scenarios like mid-cycle upgrades, downgrades, and proration to confirm the system behaves as expected.

Alignment across sales, finance, and IT teams is another key. If sales can sell a subscription that finance can’t bill correctly, you’ll end up with bottlenecks and frustrated customers. Monitoring is the last piece. Using Salesforce dashboards to track KPIs like churn, monthly recurring revenue (MRR), and days sales outstanding (DSO) gives teams the visibility they need to improve over time.

It’s also a good practice to revisit your workflows periodically. As your business grows, your billing needs evolve. Subscription tiers, global expansion, and new payment methods can all create complexity. Periodic audits of your Salesforce subscription billing setup ensure that the system continues to support growth rather than becoming a bottleneck.

Why EBizCharge Fits Salesforce Subscription Billing

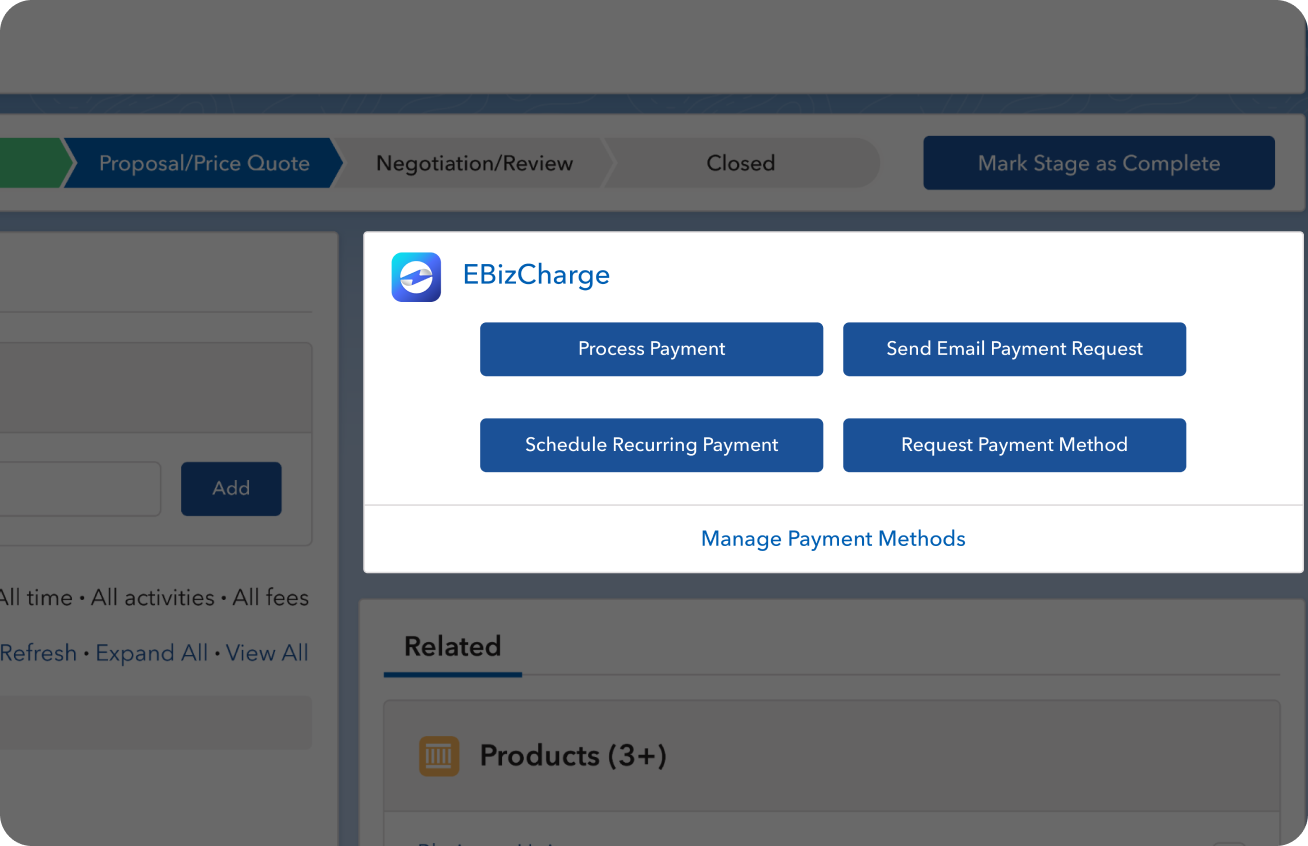

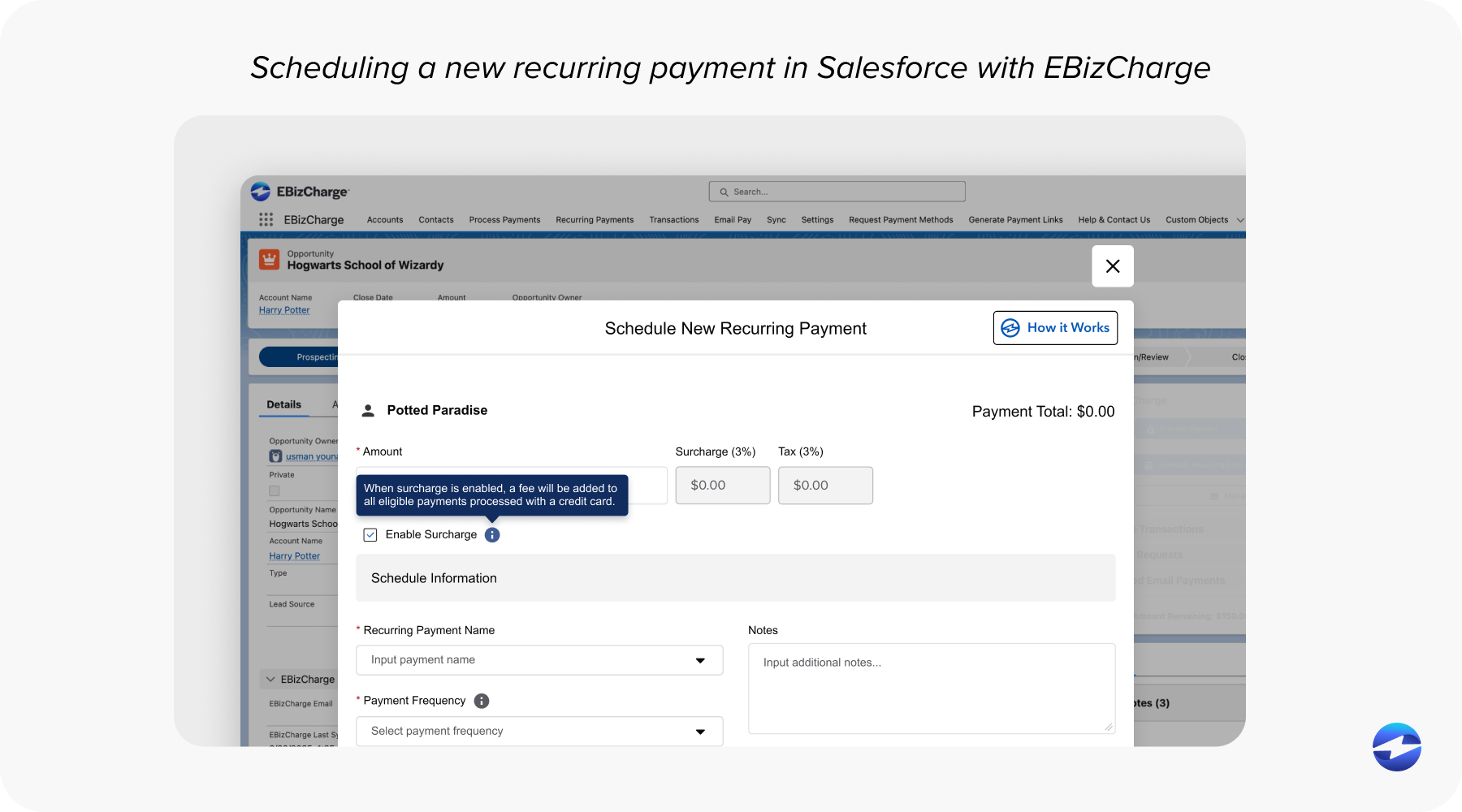

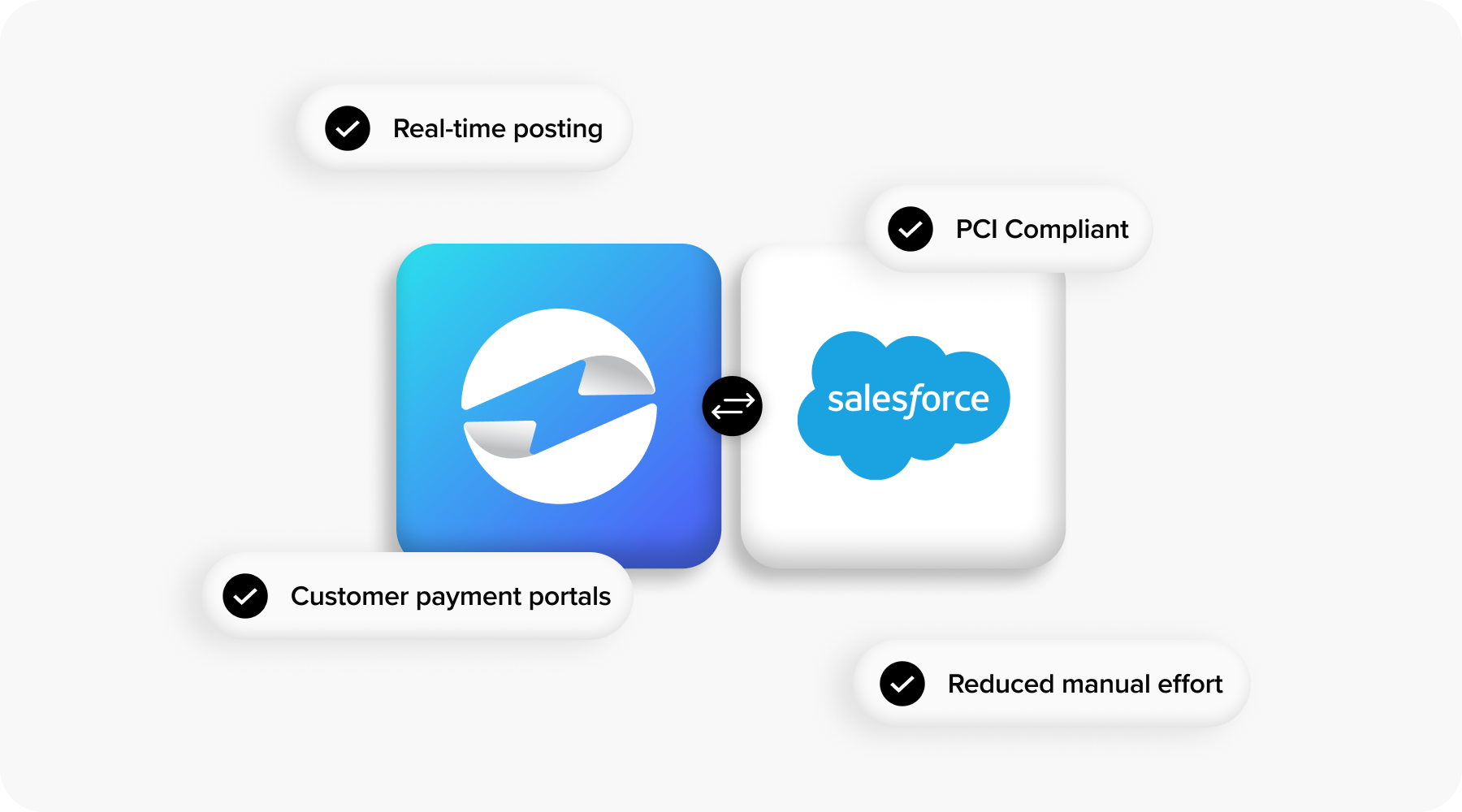

Choosing the right payment solution can determine how well the subscription strategy works in practice. EBizCharge is a natural fit for Salesforce subscription billing because its native Salesforce integration. Payments are posted directly to invoices in real time, so finance teams don’t need to spend hours reconciling records, and IT managers have fewer systems to maintain.

EBizCharge makes life easier for customers, too. It supports common Salesforce payment options like ACH, credit cards, and digital wallets, while also adding PCI-compliant safeguards like tokenization, encryption, and fraud monitoring. Customer portals give buyers a simple and secure way to pay online, which cuts down on support requests and speeds up collections.

Another strength is its approach to dunning. Failed payments automatically trigger retries and customer notifications, keeping revenue flowing with less manual follow-up. Combined with its native Salesforce integration, EBizCharge helps turn recurring billing into a dependable process rather than a recurring hassle.

On top of that, EBizCharge offers useful reporting features that help finance teams track payment trends, success rates, and transaction costs. These insights give businesses a clearer picture of how their billing strategy is working and where they can make improvements over time.

Automating Recurring Payments for Long-Term Growth

At its core, Salesforce subscription billing is about building predictable, reliable revenue. Automating Salesforce recurring payments reduces friction for customers, minimizes manual work for teams, and ensures compliance through tokenization and secure processing.

Pairing the Salesforce billing platform with the right payment processing solution is what makes it all come together. Whether you’re an IT manager, finance professional, or eCommerce leader, the payoff is clear: faster cash flow, fewer disputes, and stronger customer trust. With the right Salesforce payment gateway and tools like EBizCharge, subscription billing becomes more than just a process—it becomes an engine for long-term growth.

When teams invest in automation, they’re not just solving today’s billing problems. They’re setting the stage for sustainable scaling, smoother audits, and better customer retention. Over time, these gains compound, turning Salesforce recurring billing into a cornerstone of business growth.

- Understanding Subscription Models

- Automated Collection and Recurring Payments

- Dunning Management and Failed Payments

- Integration with CPQ and Payment Processing

- Best Practices for Subscription Billing in Salesforce

- Why EBizCharge Fits Salesforce Subscription Billing

- Automating Recurring Payments for Long-Term Growth