Blog > Salesforce B2B Commerce Payment Gateway: Complete Integration Guide

Salesforce B2B Commerce Payment Gateway: Complete Integration Guide

In B2B eCommerce, the checkout process is often more complex than in consumer retail. Customers may place bulk orders, request extended payment terms, or rely on purchase orders instead of cards. For IT managers and eCommerce teams working with Salesforce, handling these scenarios without friction is critical. That’s where a Salesforce B2B Commerce payment gateway comes into play. By integrating payments directly into Salesforce, businesses can streamline order-to-cash workflows, reduce manual reconciliation, and provide buyers with the flexibility they expect.

This guide offers a practical roadmap to help you navigate payment gateway integration in Salesforce B2B Commerce. It will highlight the unique requirements of B2B transactions, explain how Salesforce Commerce Cloud payments fit into the bigger picture, and explore enterprise-grade features that make a difference at scale. The aim is to provide clear, field-tested guidance rather than abstract theory.

Understanding B2B-Specific Payment Requirements

Unlike consumer sales, B2B transactions typically involve higher stakes. Invoices can be large, billing cycles may stretch over weeks or months, and different buyers within the same organization may need customized terms. For example, one customer may want to pay via ACH transfer, while another prefers a corporate credit card with Level 3 data reporting.

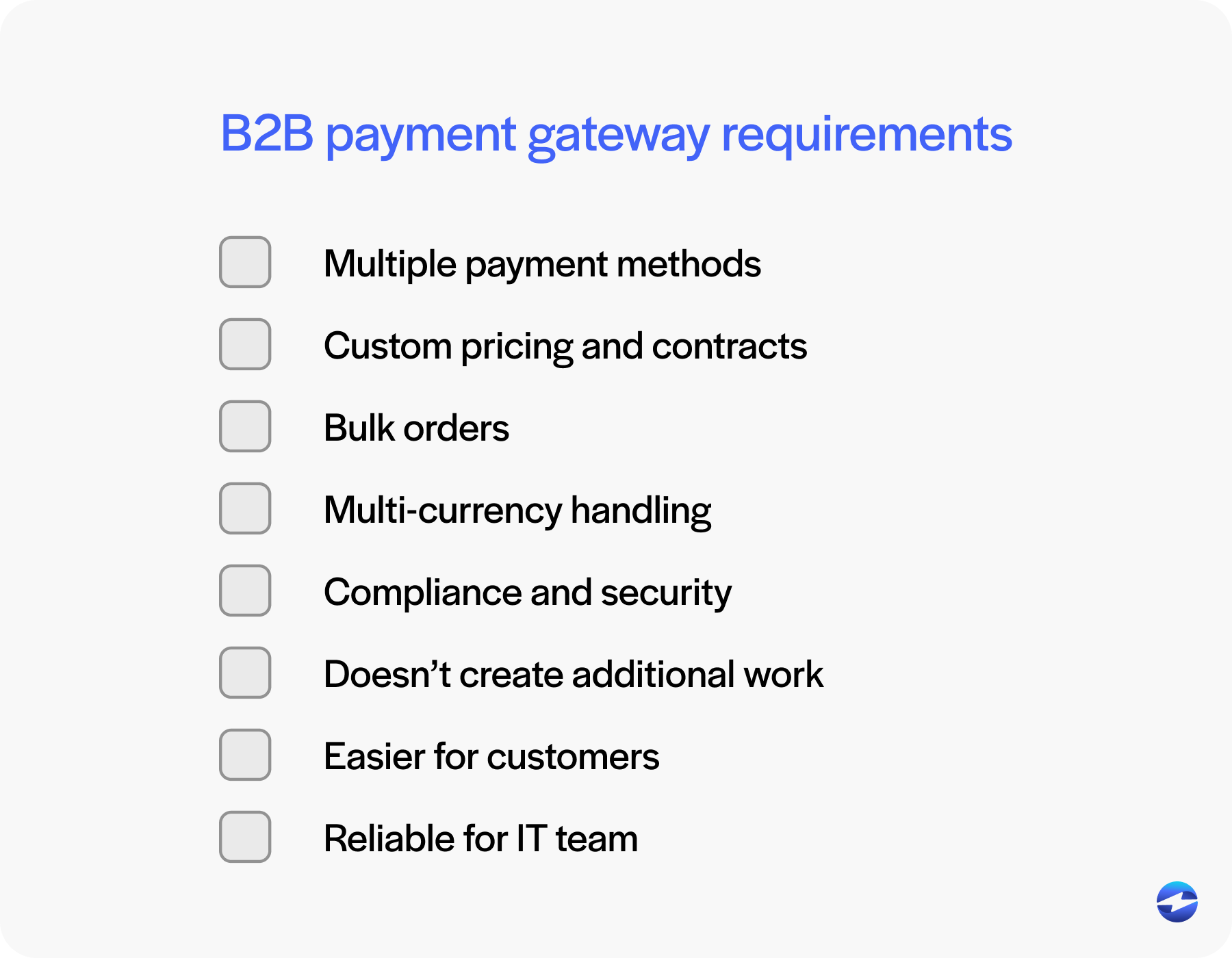

Key requirements include:

- Multiple payment methods: ACH, wire transfers, credit cards, and purchase orders must all be supported.

- Custom pricing and contracts: B2B buyers often operate on negotiated terms rather than one-size-fits-all pricing.

- Bulk orders: A single transaction may include dozens of line items across multiple product categories.

- Multi-currency handling: For international customers, the payment gateway must manage different currencies and tax rules.

- Compliance and security: Sensitive financial data must be handled in line with Payment Card Industry Data Security Standards (PCI DSS) and other regulations.

When choosing a payment processing solution, it’s important to ensure it can handle these complexities without creating additional work for finance teams. The right gateway reduces friction for customers while giving finance and IT a reliable system for managing payments.

Salesforce B2B Commerce and Commerce Cloud Integration

Salesforce B2B Commerce is designed to help enterprises create digital storefronts for wholesale buyers. It comes with account hierarchies, negotiated price books, and the ability to support complex ordering processes.

The role of Salesforce payment gateways is to connect the order process with the Salesforce billing platform. When an order is placed in Commerce Cloud, it’s tied directly to the right account and contract in Salesforce. From there, invoices can be generated automatically and matched with payments as they come in. Finance teams gain the advantage of seeing payment data in the system they already use to track quotes and orders.

When the integration is implemented properly, IT managers no longer have to rely on batch imports or spreadsheets. Instead, payments move seamlessly from the storefront into Salesforce, keeping everything synchronized and reliable.

Choosing the Right Payment Gateway for B2B Commerce

The choice between a native Salesforce payment gateway and a third-party tool is one of the most important decisions in the integration process. Each option has tradeoffs:

- Native integration: Payments are initiated and recorded directly inside Salesforce. This reduces manual work, improves reconciliation, and lowers the risk of errors.

- Third-party payment processor: These often support global markets and alternative payment methods but require more integration effort. Payment data usually syncs back into Salesforce later, which can create timing issues.

When evaluating options, look for features such as:

- Scalability to handle large invoices and bulk orders.

- Multi-currency support.

- Strong application programming interfaces (APIs) or prebuilt connectors.

- Enterprise-grade security and compliance features.

The best choice often depends on where your revenue is generated. If most transactions start in Salesforce B2B Commerce, a native gateway usually simplifies operations. If your company operates across multiple platforms, a third-party payment processor might still make sense.

Integration Process and Best Practices

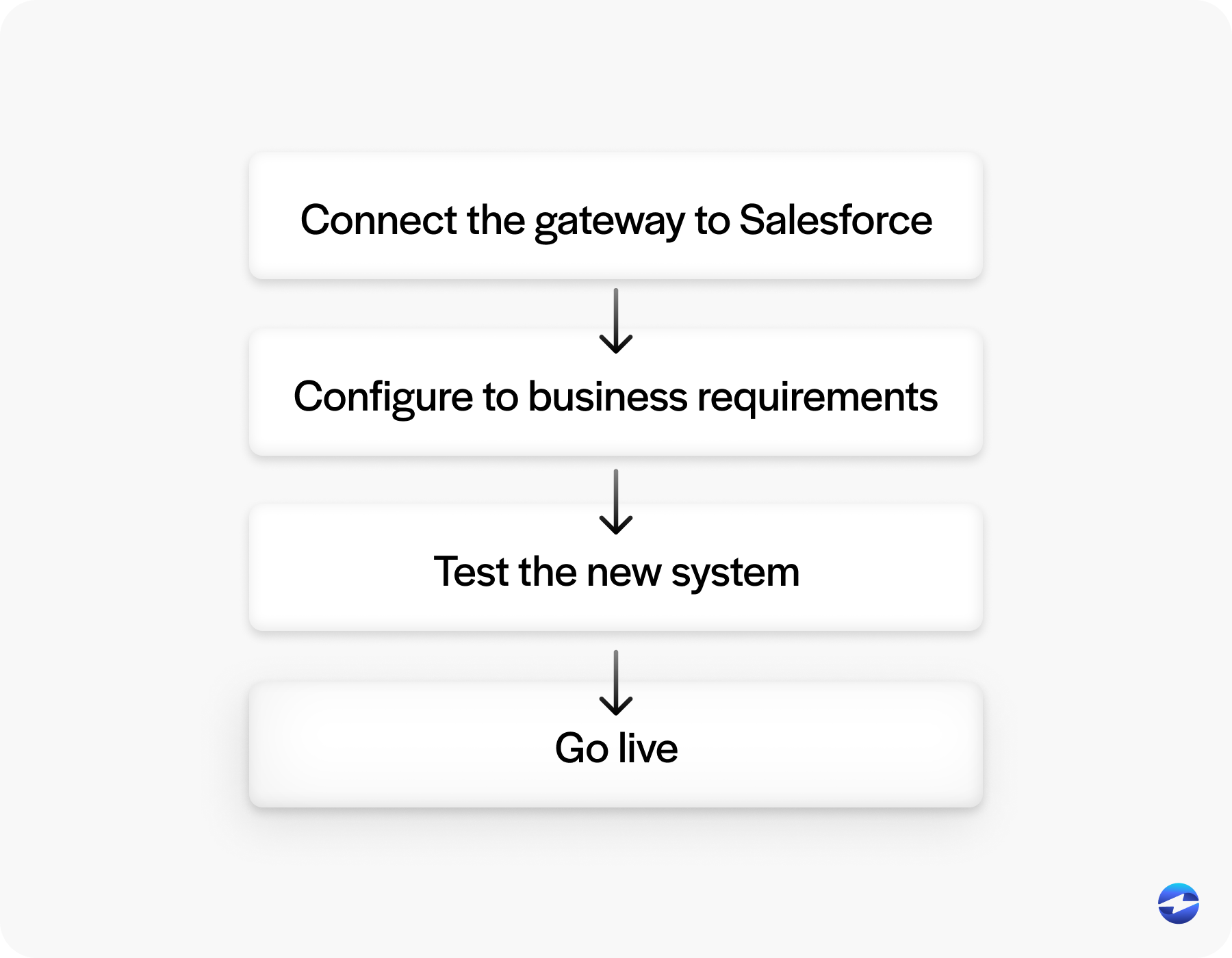

Integrating a Salesforce B2B Commerce payment gateway involves more than flipping a switch. It requires alignment between IT, finance, and eCommerce teams.

The integration process typically unfolds in several stages. It begins with connecting the payment gateway to Salesforce so that account hierarchies are properly recognized and transactions can be applied accurately across accounts. Once the connection is established, the next step is configuration. At this point, billing cycles, payment methods, and exception handling are set up to reflect the company’s unique business requirements.

The process doesn’t end there. Rigorous testing is essential. Teams should validate both straightforward transactions, like credit card payments, and more complex cases, such as ACH transfers, bulk orders, or contract-based discounts. This extra context ensures the system behaves as expected before going live and reduces the risk of costly errors later on.

Once the foundation is in place, best practices come into play.

- Map account structures carefully to ensure parent and child accounts link up correctly so payments apply without confusion.

- Configure billing cycles thoughtfully to support B2B customers who rely on recurring charges, installment plans, or milestone-based invoicing.

- Test beyond simple credit card payments, including ACH transfers, purchase orders, bulk orders, and contract-specific discounts.

- Plan for exceptions in advance, since credit limits, refunds, and disputes are inevitable in large-scale B2B operations.

By treating integration as a process rather than a one-time setup, IT managers can reduce issues during go-live and avoid manual workarounds later.

Enterprise Features for Scaling B2B Payments

As order volume grows, so do the demands on your payment processing solution. Enterprise-grade features can make or break the efficiency of your billing process.

Important features include:

- Tokenization: Securely storing payment credentials for repeat transactions.

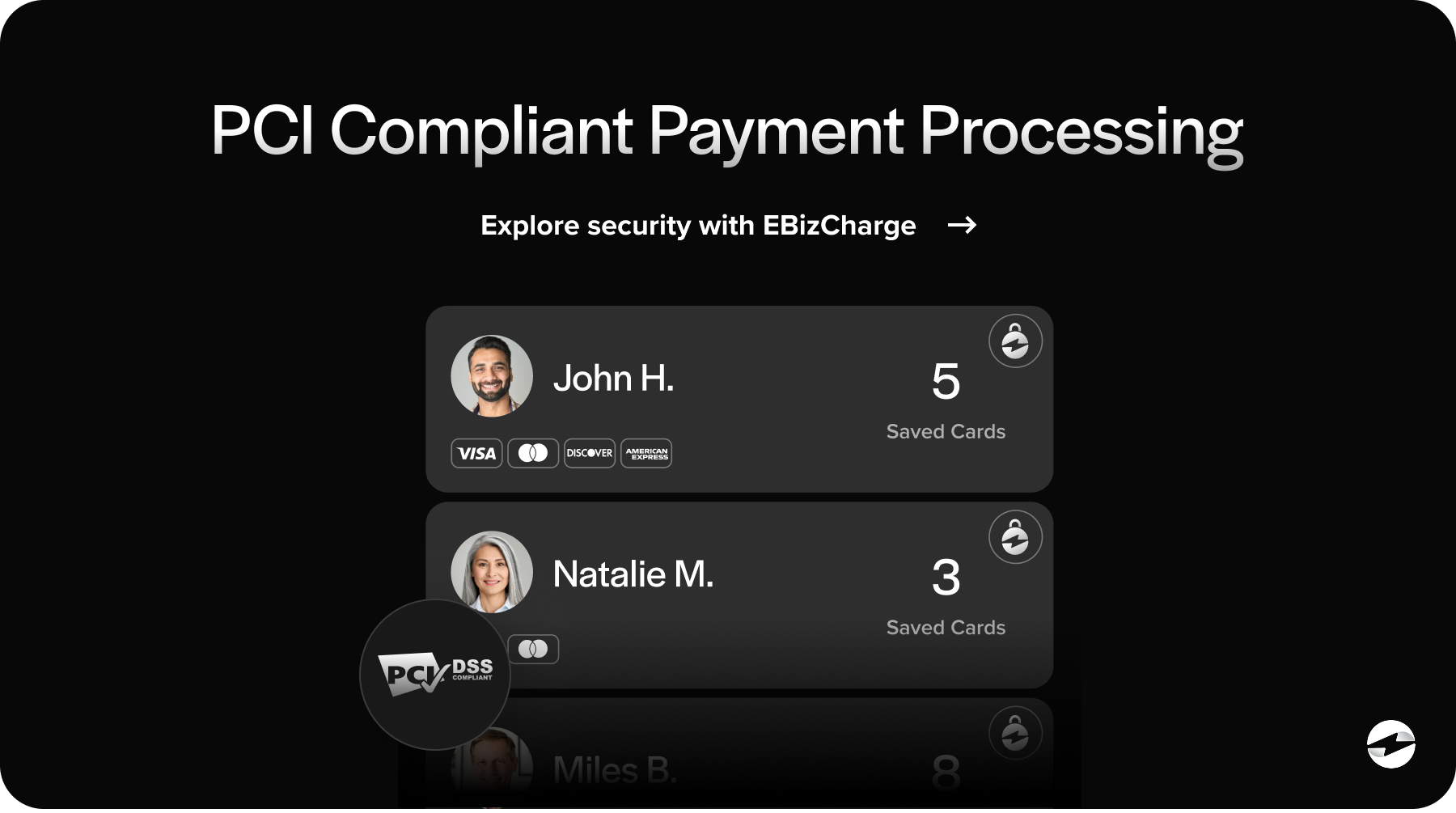

- PCI compliance: Keeping sensitive data out of your systems.

- Fraud detection: Identifying risky transactions before they settle.

- Level 2/3 data support: Lowering interchange fees on corporate card payments.

- Automated workflows: Handling refunds, credits, and collections without manual intervention.

By building on the Salesforce billing platform, these features ensure that payments are not just secure but also cost-effective. For IT and finance teams, this translates into fewer manual checks and a smoother audit process.

Security and Compliance in B2B Transactions

Every payment brings compliance obligations. Whether using a native Salesforce payment gateway or a third-party processor, you must meet industry standards. Three areas deserve close attention. First is PCI DSS compliance. Tokenization and secure handling of payment details help reduce your PCI scope and limit exposure. Second are privacy regulations like General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA). These laws shape how you store, manage, and eventually delete customer data. Third is auditability. Enterprises need the ability to trace who made changes to invoices and payments, creating a reliable trail for oversight and accountability.

Native solutions often simplify this by keeping payment data within Salesforce. Third-party tools can still be compliant, but they introduce more systems into the mix, which increases oversight requirements.

Best Practices for Ongoing Optimization

Integration isn’t the finish line—it’s the starting point. Once your Salesforce Commerce Cloud payments are running, you need to keep improving.

Suggestions for optimization:

- Monitor transaction success rates and resolve failures quickly.

- Use analytics to identify bottlenecks in the payment process.

- Continuously update fraud rules and compliance checks.

- Regularly test integrations as new Salesforce updates roll out.

For eCommerce teams, ongoing optimization means fewer disruptions during peak order cycles. For IT managers, it means a system that’s stable and predictable.

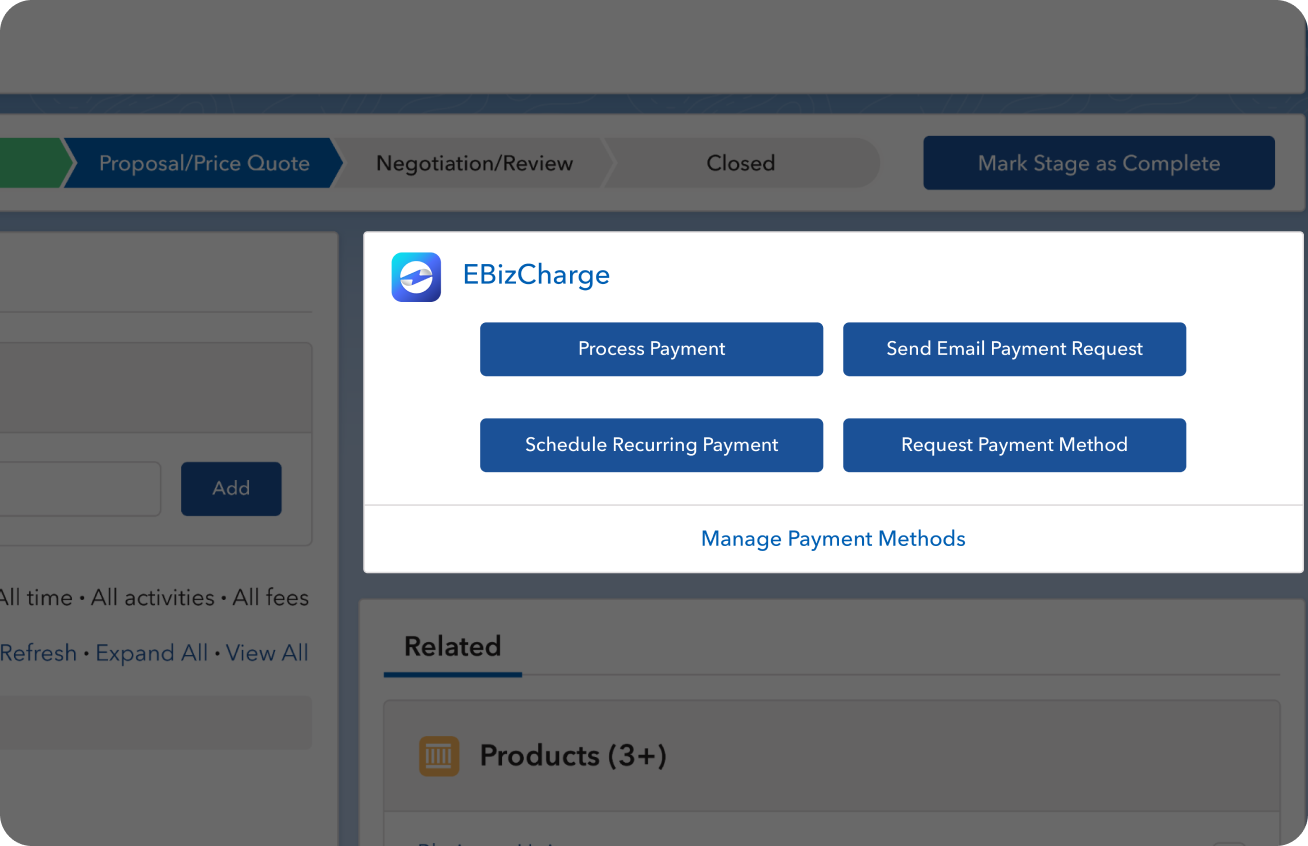

Why EBizCharge is a Strong Fit for Salesforce B2B Commerce

Among the available options, EBizCharge stands out as a strong fit for Salesforce integration. It is a native Salesforce payment gateway that posts payments directly to invoices and accounts without manual reconciliation, which reduces the burden on finance teams and keeps payment data accurate in real time.

Its set of tools makes it particularly effective for B2B needs. Customer portals allow buyers to pay invoices online securely, supporting account hierarchies common in enterprise sales. Multi-currency and ACH support ensure that companies with global reach can handle transactions smoothly. Level 2/3 data reporting helps reduce costs on large corporate card payments. Tokenization and PCI compliance features protect sensitive data without adding extra overhead. Fraud monitoring tools add another layer of protection by detecting unusual activity before it becomes a problem.

Taken together, these capabilities make EBizCharge more than just a payment processor—they turn it into an operational advantage. For organizations relying heavily on the Salesforce billing platform, EBizCharge simplifies payment operations and supports sustainable growth.

Scaling B2B Payments with the Right Gateway

B2B commerce introduces unique payment challenges that can’t be solved with consumer-grade tools. By integrating a reliable Salesforce B2B Commerce payment gateway, businesses can handle large invoices, complex account hierarchies, and diverse payment methods without adding friction.

Whether you choose a native solution or a third-party payment processor, the decision should align with your business model and technical capacity. Native solutions often provide tighter alignment with Salesforce billing, while third-party options may offer broader coverage.

For many enterprises, EBizCharge provides the best of both worlds: the convenience of a native integration and the enterprise features needed for global operations. Choosing the right payment processing solution ensures your payments flow as smoothly as your sales, giving IT managers and finance leaders the confidence to scale.

- Understanding B2B-Specific Payment Requirements

- Salesforce B2B Commerce and Commerce Cloud Integration

- Choosing the Right Payment Gateway for B2B Commerce

- Integration Process and Best Practices

- Enterprise Features for Scaling B2B Payments

- Security and Compliance in B2B Transactions

- Best Practices for Ongoing Optimization

- Why EBizCharge is a Strong Fit for Salesforce B2B Commerce

- Scaling B2B Payments with the Right Gateway