Blog > SuiteCommerce Payment Gateway Integration: 5 Steps to Seamless Processing

SuiteCommerce Payment Gateway Integration: 5 Steps to Seamless Processing

For merchants running on SuiteCommerce, payments are more than just the final step at checkout. They connect directly to back-office accounting, reporting, and customer experience. When the payment side of things feels clunky, customers may abandon carts, and finance teams end up cleaning up reconciliation errors. That’s why it’s worth asking: How can integration with payment gateways be streamlined for SuiteCommerce? Getting this right means smoother operations, fewer mistakes, and happier customers.

This article breaks down five clear steps to streamline payment gateway integration inside SuiteCommerce. Whether you’re handling high-volume B2C sales, complex B2B orders, or somewhere in between, these steps help ensure your payments flow seamlessly into NetSuite software without creating extra work for your team.

Step 1: Assess Your Business Needs

Before you even choose a gateway, start by looking at your current payment setup. What’s slowing you down? Are you struggling with limited payment options, frequent reconciliation mismatches, or reporting gaps? For some businesses, the challenge is volume—processing thousands of transactions every day. For others, it’s about offering customers what they want, whether that’s ACH, credit cards, digital wallets, or Buy Now, Pay Later.

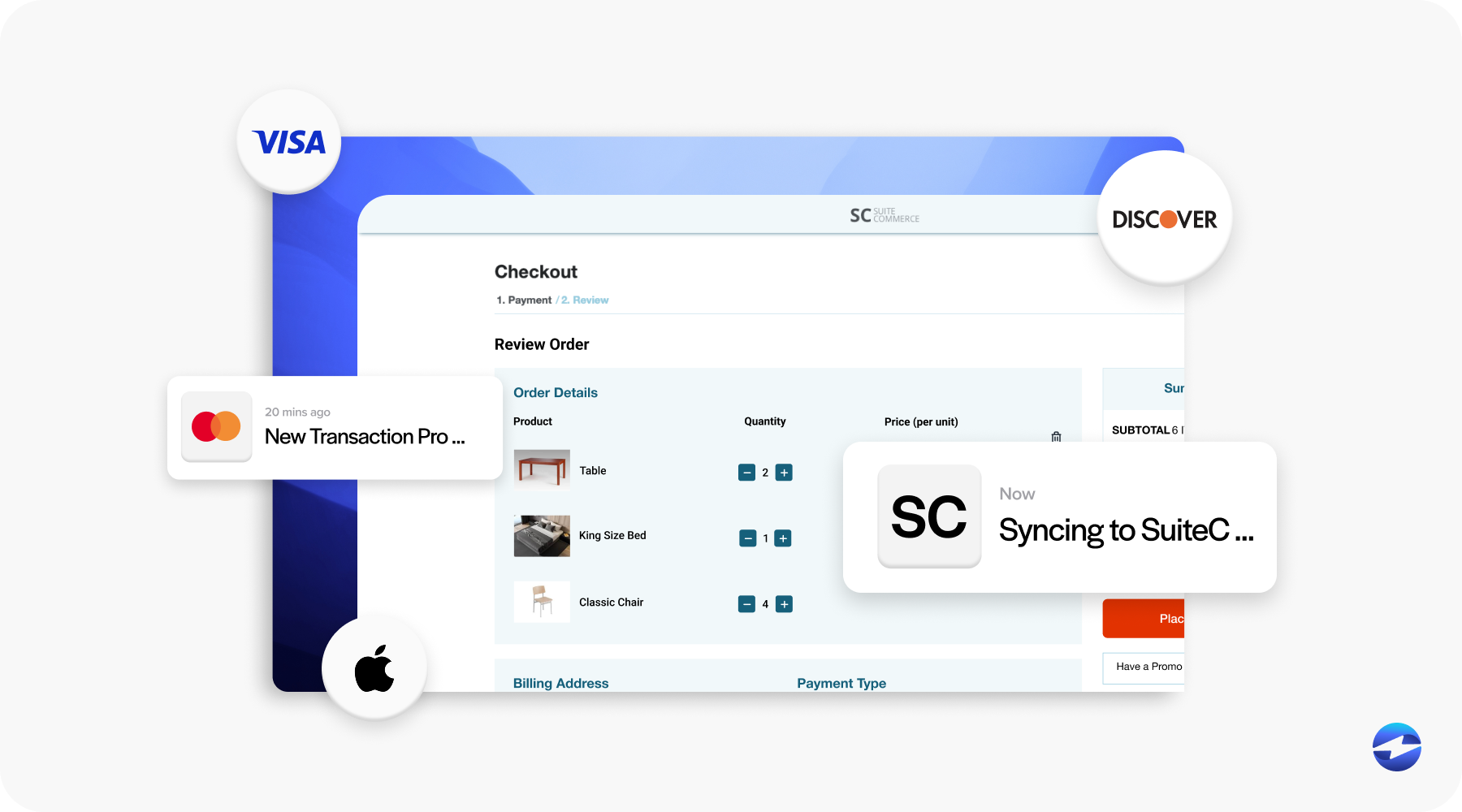

This stage is also where B2B and B2C merchants may differ. A B2C store running on SuiteCommerce NetSuite needs mobile-friendly payments and saved cards, while a B2B organization may care more about ACH, invoicing, and Level 3 data for corporate cards. By assessing your needs carefully, you’ll have a clear picture of what features your payment gateway must deliver.

Step 2: Choose the Right Payment Gateway

Next comes the big decision: which gateway to use. SuitePayments, the native option, covers basic needs, but many businesses quickly find themselves needing more. This is where a third-party payment processor can make all the difference.

When comparing options, pay close attention to what each payment processor supports. Do they handle multiple payment types? Is PCI compliance built in? How strong are their fraud prevention tools? If you’re selling internationally, do they support multi-currency transactions without causing headaches? And perhaps most importantly, how well do they connect with NetSuite software?

The right choice isn’t just about checking boxes. It’s about selecting a payment processing solution that will grow with your business and stay tightly aligned with your finance operations.

Step 3: Configure Integration with SuiteCommerce

Once you’ve selected a gateway, the next step is to configure it within SuiteCommerce integrations. This is where the technical side comes in, but it doesn’t have to be overwhelming.

Using application programming interface (API) connections gives you the flexibility to connect your storefront with the gateway. Webhook management helps ensure real-time updates for things like successful payments, refunds, and chargebacks. That way, your system isn’t just receiving data after the fact—it’s reacting as transactions happen.

Another important part of configuration is testing synchronization. You’ll want to confirm that every payment posts correctly into Accounts Receivable and the General Ledger within NetSuite integration. Skipping this step often leads to headaches later, so thorough testing is worth the effort.

Step 4: Optimize for Customer Experience

Even with the most secure and advanced system, payments can fall short if the customer experience isn’t smooth. One of the best things you can do is design your checkout flow to minimize friction. Embedded payments, where the customer never leaves your site, tend to perform better than redirect models.

Features like tokenization, saved payment methods, and one-click checkout can make repeat purchases effortless. For B2C merchants, mobile optimization is non-negotiable—most buyers will complete their orders on phones or tablets. For B2B, secure invoicing portals integrated with SuiteCommerce give customers a simple way to view and pay invoices on their own time. These may seem small, but they’re powerful drivers of trust and loyalty.

Step 5: Monitor, Test, and Refine

Payment integration isn’t something you “set and forget.” Once it’s live, you’ll want to monitor performance regularly. SuiteCommerce NetSuite dashboards can track errors, abandoned carts, and settlement times, giving you visibility into where the process may need adjustment.

Periodic audits are also a best practice. They ensure compliance is being maintained and help identify fraud or inefficiencies early. As your business grows, your integration should scale alongside it. That might mean adding more supported payment types, tightening fraud controls, or refining how reconciliation flows into NetSuite.

The key is to treat monitoring as an ongoing discipline. This commitment ensures your payment processing solution continues to work seamlessly long after implementation.

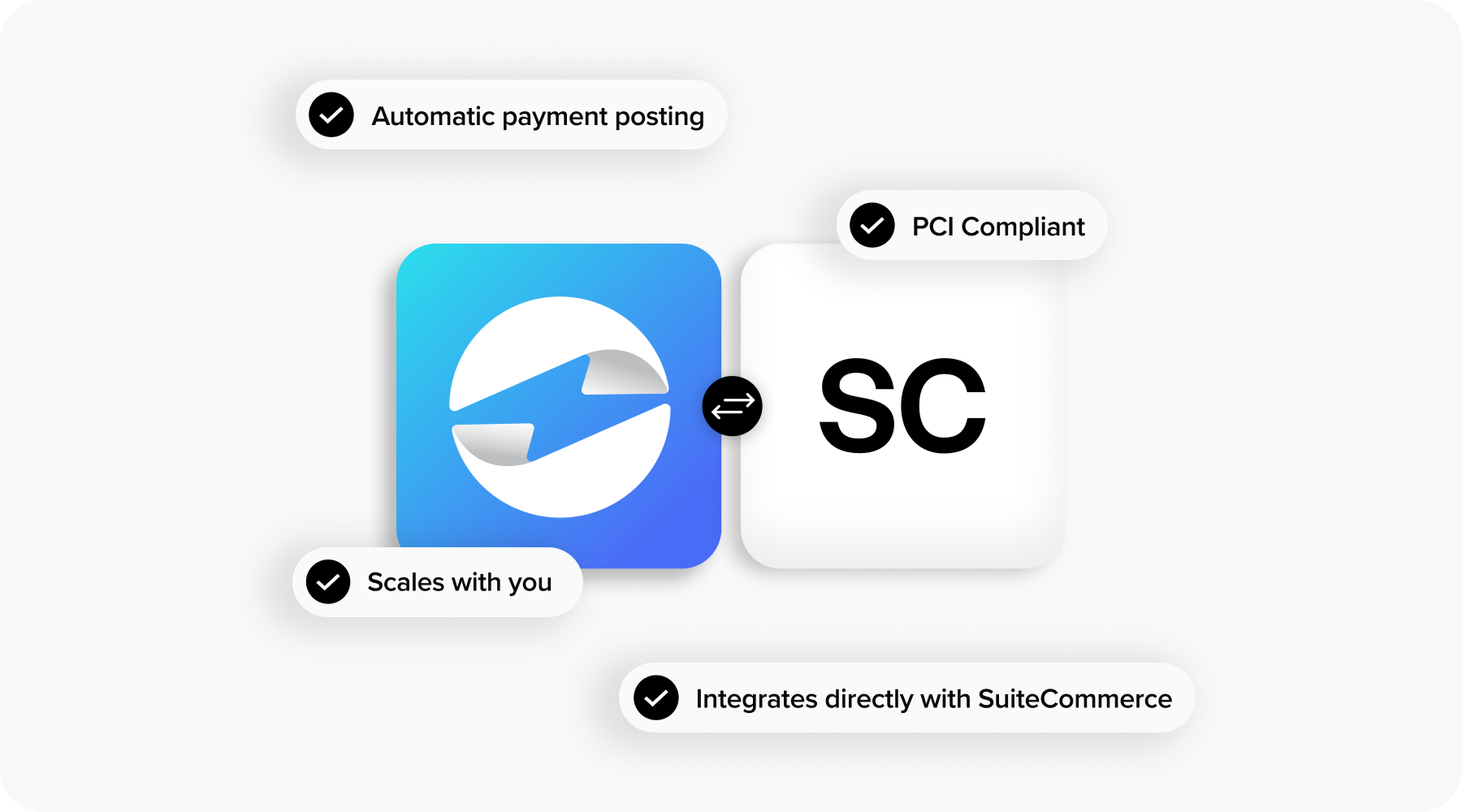

Why EBizCharge is a Great Choice for SuiteCommerce

Among the many options available, EBizCharge has become a go-to for businesses wanting to streamline payment gateway integration. What sets it apart is its direct SuiteCommerce NetSuite integration, which ensures payments are posted automatically into accounts receivable and the general ledger. That means finance teams spend less time reconciling and more time analyzing data.

From a security perspective, EBizCharge includes PCI compliance, tokenization, and fraud monitoring built right in. For customers, its portals provide a safe and easy way to pay invoices online. And for businesses that expect to grow, the platform scales smoothly, handling higher volumes without creating new bottlenecks.

In short, EBizCharge doesn’t just act as a payment processor—it functions as a complete payment processing solution for SuiteCommerce merchants. By combining robust features with direct integration, it helps businesses run more efficiently while delivering the kind of payment experience customers expect.

Scaling SuiteCommerce with Secure, Seamless Payments

So, how can integration with payment gateways be streamlined for SuiteCommerce? By following these five steps: assess your needs, choose the right gateway, configure carefully, optimize the customer experience, and monitor continually. Each piece builds on the other, creating a payment flow that’s efficient, secure, and reliable.

For NetSuite SuiteCommerce merchants, payments aren’t just about moving money—they’re about accuracy, compliance, and customer trust. When paired with a trusted third-party payment processor like EBizCharge, SuiteCommerce becomes more than just a storefront. It becomes a powerful system where sales, finance, and customer experience all work in sync.

By investing the time to get integration right, you’ll not only reduce errors and abandoned carts—you’ll also lay the groundwork for growth. A seamless payment processing solution gives you the confidence to scale, knowing your payments will keep up every step of the way.