Blog > NetSuite SuiteCommerce B2B Payment Solutions: Streamlining Enterprise Transactions

NetSuite SuiteCommerce B2B Payment Solutions: Streamlining Enterprise Transactions

Handling payments in the business-to-business (B2B) world is never as straightforward as consumer transactions. Invoices are bigger, terms are longer, and the number of steps involved can multiply quickly. For many finance teams, the process is a constant balancing act between accuracy, compliance, and customer expectations.

That’s where NetSuite SuiteCommerce B2B payment solutions come into play. By pairing SuiteCommerce with the right payment processing solution, companies can simplify what has traditionally been one of the most complicated parts of enterprise operations. This article walks through the challenges B2B merchants face, the tools available within NetSuite SuiteCommerce, and how extensions and integrations—particularly with the right third-party payment processor—can transform the experience for both businesses and their customers.

Unique Challenges of B2B Payments

Unlike consumer transactions, B2B payments deal with higher stakes. Transaction values are often much larger, which naturally increases scrutiny and the need for secure processes. Businesses also tend to operate with extended payment terms, such as Net 30 or Net 60, which means finance teams track receivables long after an order is shipped.

Add to that the complexity of partial shipments, split orders, and custom pricing, and the accounting process quickly becomes more than a simple invoice-and-payment routine. Many organizations rely on purchase orders, credit terms, and approval hierarchies, all of which add additional layers of paperwork and coordination.

Global companies face further hurdles: multi-currency support, cross-border settlements, and international compliance rules. For any enterprise, the combination of scale, diversity, and compliance makes managing B2B payments a constant challenge.

Why SuiteCommerce Matters for B2B

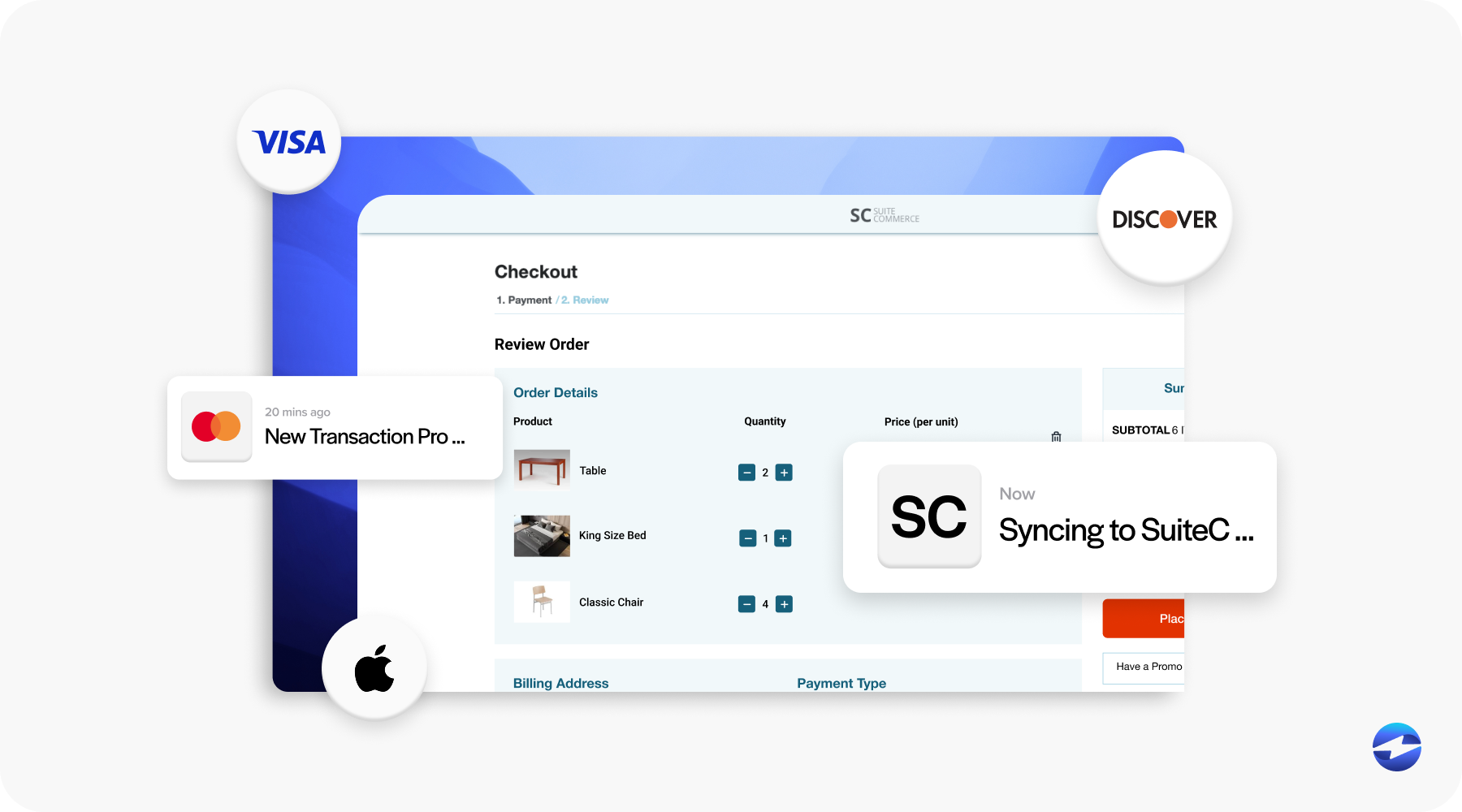

SuiteCommerce NetSuite serves as a unified commerce platform that connects the online storefront with the back-office enterprise resource planning (ERP) system. This linkage is key for B2B merchants. With SuiteCommerce, product catalogs, customer-specific pricing, and ordering workflows live in the same system as accounting and finance.

However, while SuiteCommerce brings strong foundations, businesses often need payment extensions or integrations to meet the specialized requirements of B2B transactions. For example, while NetSuite software provides visibility into orders and accounts, handling corporate cards, ACH, and Level 3 transaction data usually requires additional tools. This is where a strong NetSuite integration with a payment processor can make all the difference.

Core B2B Payment Capabilities Needed

To succeed in the enterprise space, merchants need more than just a checkout page. Essential features for B2B payment processing include:

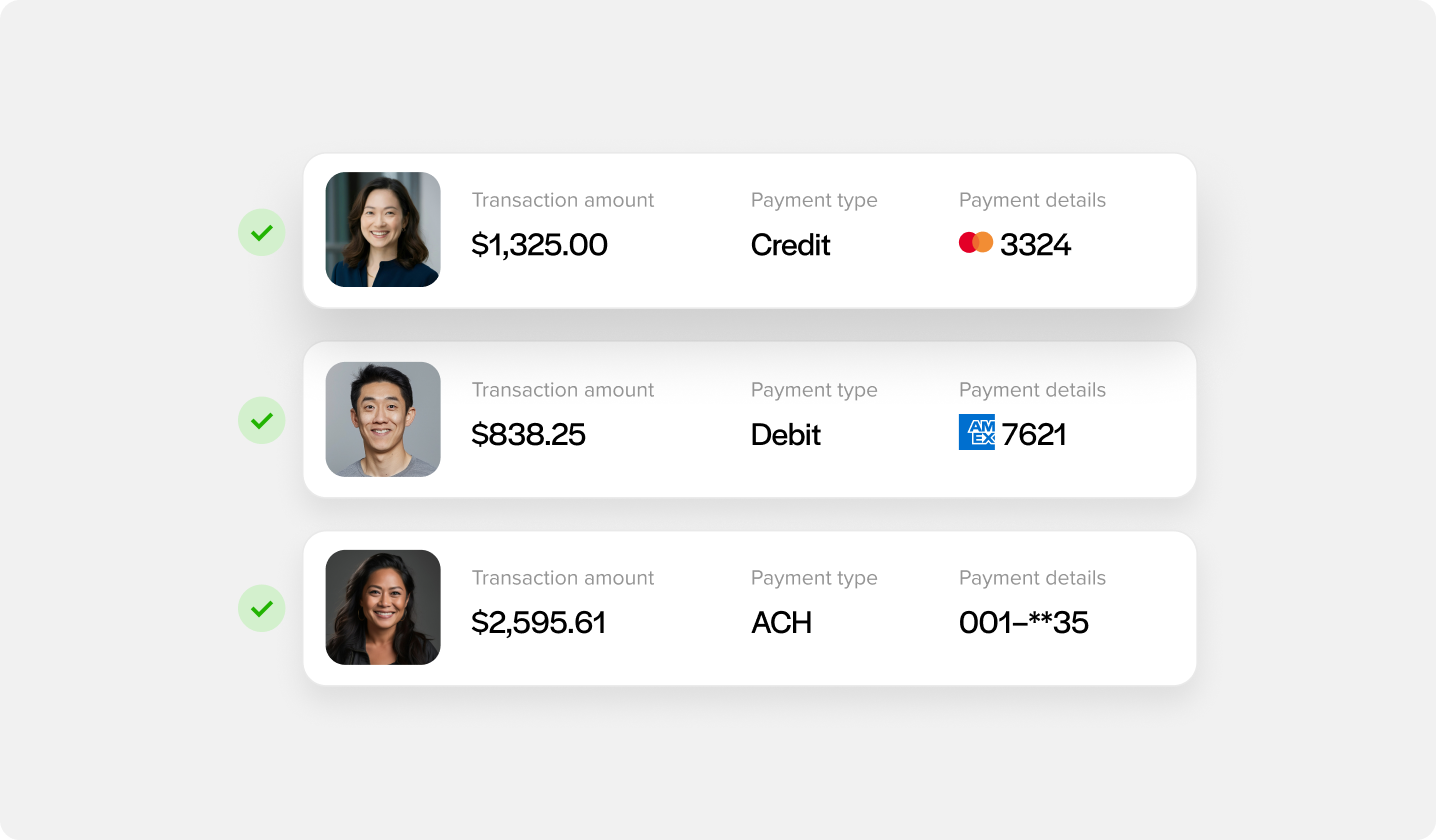

- ACH, wire, and corporate card support: Offering flexibility for clients who pay in different ways.

- Level 2/3 transaction data: Capturing detailed data to reduce interchange fees.

- Tokenization and vaulted profiles: Making repeat corporate purchases secure and efficient.

- Customer portals: Allowing buyers to view invoices and make payments online without calling or emailing your team.

- Multi-currency support: Handling international business without manual conversions.

- Automated reconciliation: Ensuring payments sync automatically into NetSuite software without manual adjustments.

These capabilities turn a payment tool into a true payment processing solution, one that not only moves money but also streamlines operations.

Payment Processing Extensions and Integrations

SuitePayments, the native option, provides a baseline for handling transactions. It works well for straightforward cases but often lacks the depth needed for B2B operations. Larger companies typically turn to third-party payment processor integrations.

Payment processing extensions and integrations play a critical role in filling gaps for B2B merchants. These tools simplify payment operations by adding capabilities such as customer portals, ACH and wire support, and Level 3 data handling for interchange optimization. They also provide features like fraud detection, tokenization, and advanced reconciliation.

The right integration depends on your business model, your customer base, and your existing operational challenges. Evaluating options through the lens of integration depth and usability often helps narrow the field.

Benefits of Streamlined B2B Payments in SuiteCommerce

When payments flow smoothly, businesses see improvements across the board. The benefits extend beyond faster transactions.

Here are just a few of the benefits:

- Faster reduction through automation: Money arrives sooner, directly improving cash flow.

- Error reduction through automation: Fewer mismatches mean finance teams spend less time on manual reconciliation.

- Better reporting and visibility: NetSuite SuiteCommerce integrations give leadership clearer insights into receivables and cash on hand.

- Enhanced security: PCI compliant features like tokenization and fraud detection reduce the risks that come with high-value transactions.

- Improved customer experience: Streamlined processes make payments easier, faster, and more transparent.

Together, these advantages show why optimizing B2B payments in SuiteCommerce matters. The payoff is a system that not only processes transactions but also supports growth, efficiency, and trust across the business.

Best Practices for Implementing B2B Payment Solutions

Rolling out a new payment processing solution requires planning and collaboration. Start by mapping out your current workflows and identifying the biggest pain points. Involve finance, operations, and IT teams early so everyone has input into requirements and testing.

Prioritize security and scalability—after all, the payment system you choose should handle not only your current volume but also where you expect to grow. Pilot new extensions with a few key accounts before launching company-wide. And remember that once live, ongoing monitoring and refinement are essential to keeping your payment processes running at their best.

Why EBizCharge Fits Well with SuiteCommerce

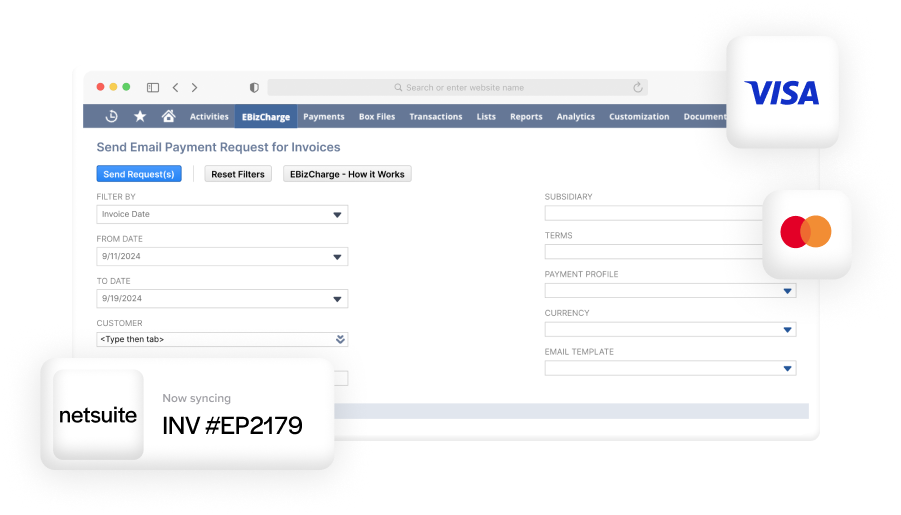

For many merchants, EBizCharge has proven to be an excellent fit for NetSuite SuiteCommerce B2B transactions. Its direct NetSuite integration ensures payments post automatically to the right records, cutting down on reconciliation time. Finance teams benefit from faster closings and fewer manual adjustments.

From a customer perspective, EBizCharge’s portals make it simple to pay invoices online, which reduces friction and helps speed up the invoice-to-cash cycle. Support for Level 3 transaction data, ACH, and multi-currency payments means it’s designed to handle the complexity of enterprise transactions. Built-in PCI compliance, tokenization, and fraud monitoring add a layer of security that B2B businesses require.

When you pair Oracle NetSuite software with a third-party payment processor like EBizCharge, you end up with a system that’s capable of processing payments and designed to make them more efficient, secure, and scalable. For organizations relying on SuiteCommerce, that combination helps transform payments from a challenge into a competitive advantage.