Blog > Epicor Payment Solutions: Complete Implementation and Integration Guide

Epicor Payment Solutions: Complete Implementation and Integration Guide

Getting paid efficiently is one of the most important parts of running a business, but many companies still struggle with slow, manual processes. If you’re using Epicor ERP, you’ve already invested in software designed to bring your business operations together. The question is: are your payments working as smoothly as the rest of your system?

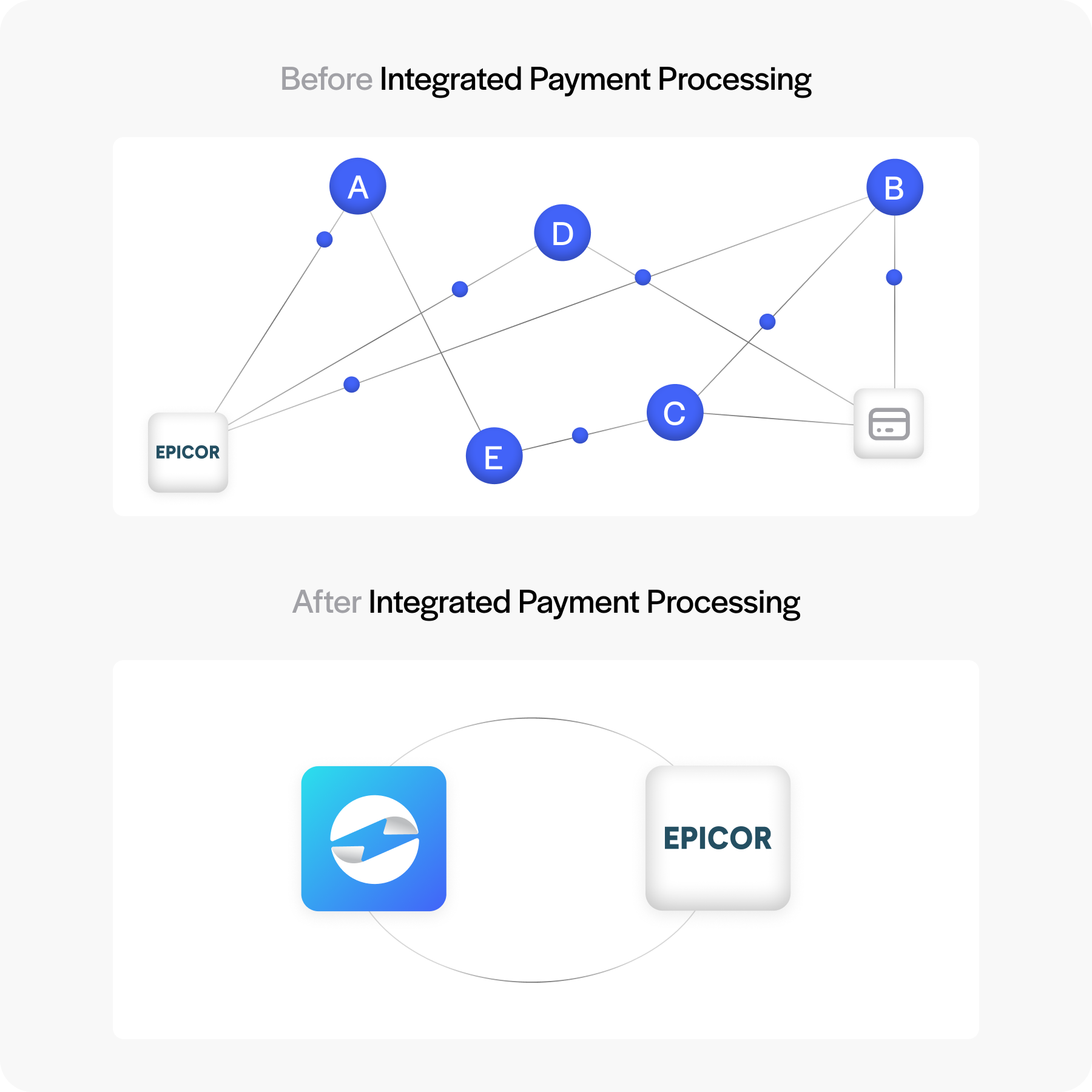

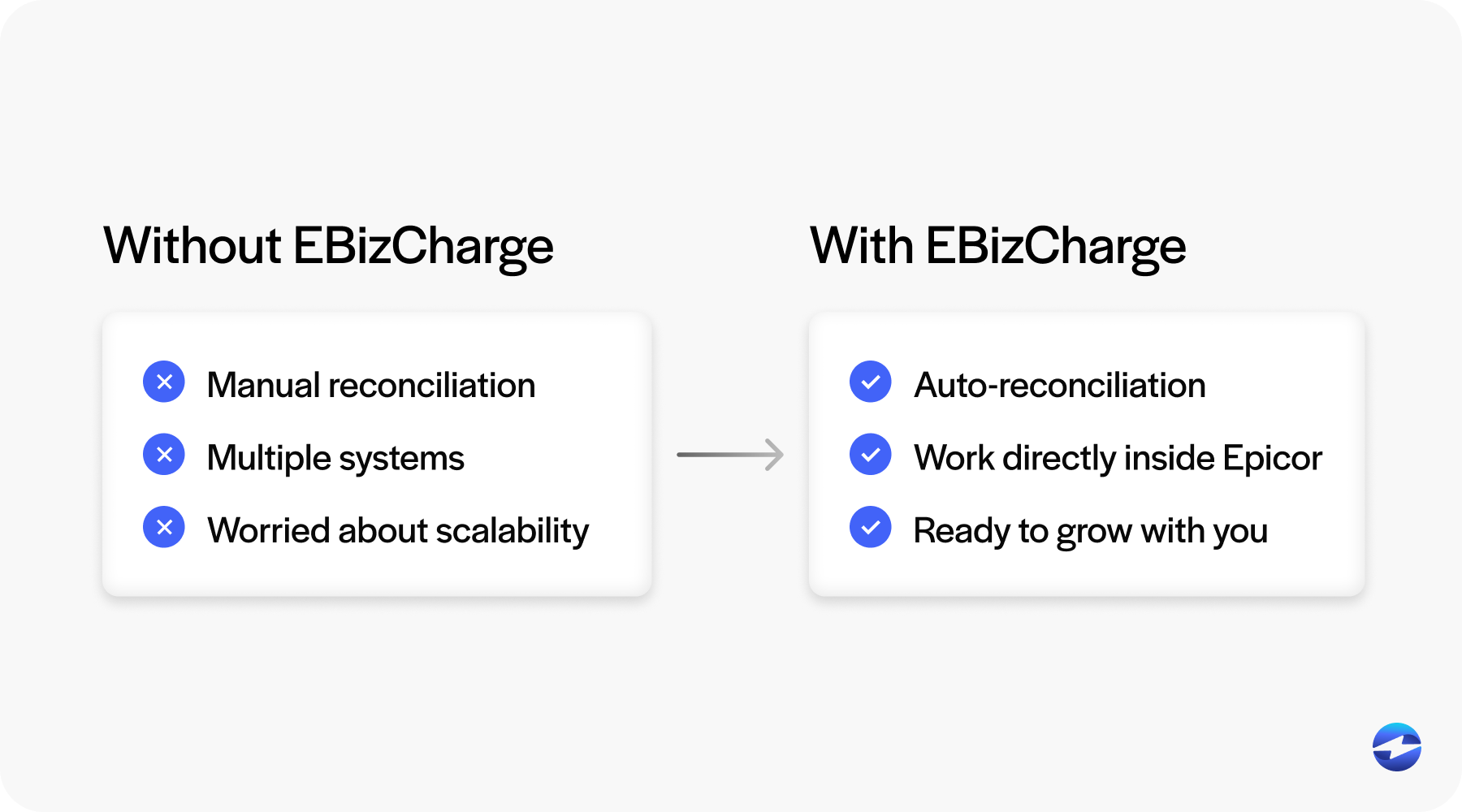

Disconnected workflows—like manually entering card payments or reconciling data from outside platforms—don’t just waste time. They create errors, slow cash flow, and frustrate customers. That’s where Epicor payment solutions step in. When implemented properly, they tie payments directly into your enterprise resource planning (ERP) system, creating a system that’s accurate, efficient, and easy to use.

This guide walks you through the essentials of Epicor payment processing, from what the tools are to how to set them up and optimize them. Whether you’re looking to streamline EPX credit card processing or integrate with a third-party payment processor, the goal is the same: payments that just work.

Understanding Epicor Payment Solutions

Epicor offers several payment tools, including Epicor Payment Exchange (EPX), designed to fit directly into the ERP environment. These solutions allow companies to process transactions without the need for third-party add-ons. The result is fewer moving parts and tighter alignment between sales, finance, and reporting.

When we talk about Epicor credit card processing, we’re talking about a system built into the workflows you already use. Instead of running transactions through an external platform and re-entering the data into Epicor software, EPX allows everything to flow in one place.

Still, some businesses choose to connect with a third-party payment processor for specialized needs. Whether you stick with EPX or explore other providers, the benefit of using an Epicor payment gateway is clear: payments that are fast, secure, and integrated into your financial reporting.

Preparing for Implementation

Before you dive into setup, take a look at your current payment processes. Where are the bottlenecks? Is manual entry slowing you down? Do reconciliation issues keep popping up at month-end? Answering these questions will help you design the right approach for Epicor integration.

It’s also important to review your system prerequisites. Do you have the necessary Epicor modules and licenses? Is your infrastructure ready to support real-time posting and secure connections? Preparing on the front end ensures the implementation won’t stall halfway through.

Finally, talk to your finance and IT teams. They’ll have insights into the Epicor payment methods that should be supported—whether that’s credit cards, ACH, or recurring billing setups. Getting alignment early makes the rollout smoother.

Implementation Steps

Rolling out Epicor payment solutions takes more than flipping a switch. To make the transition smooth, it helps to follow a structured approach that addresses both the technical setup and the practical needs of your finance team.

System Setup

The first step is ensuring your environment is ready. This means installing the Epicor modules that support payment workflows and confirming that your infrastructure is configured for secure connectivity. A reliable system base will prevent interruptions once payments start flowing.

Payment Method Configuration

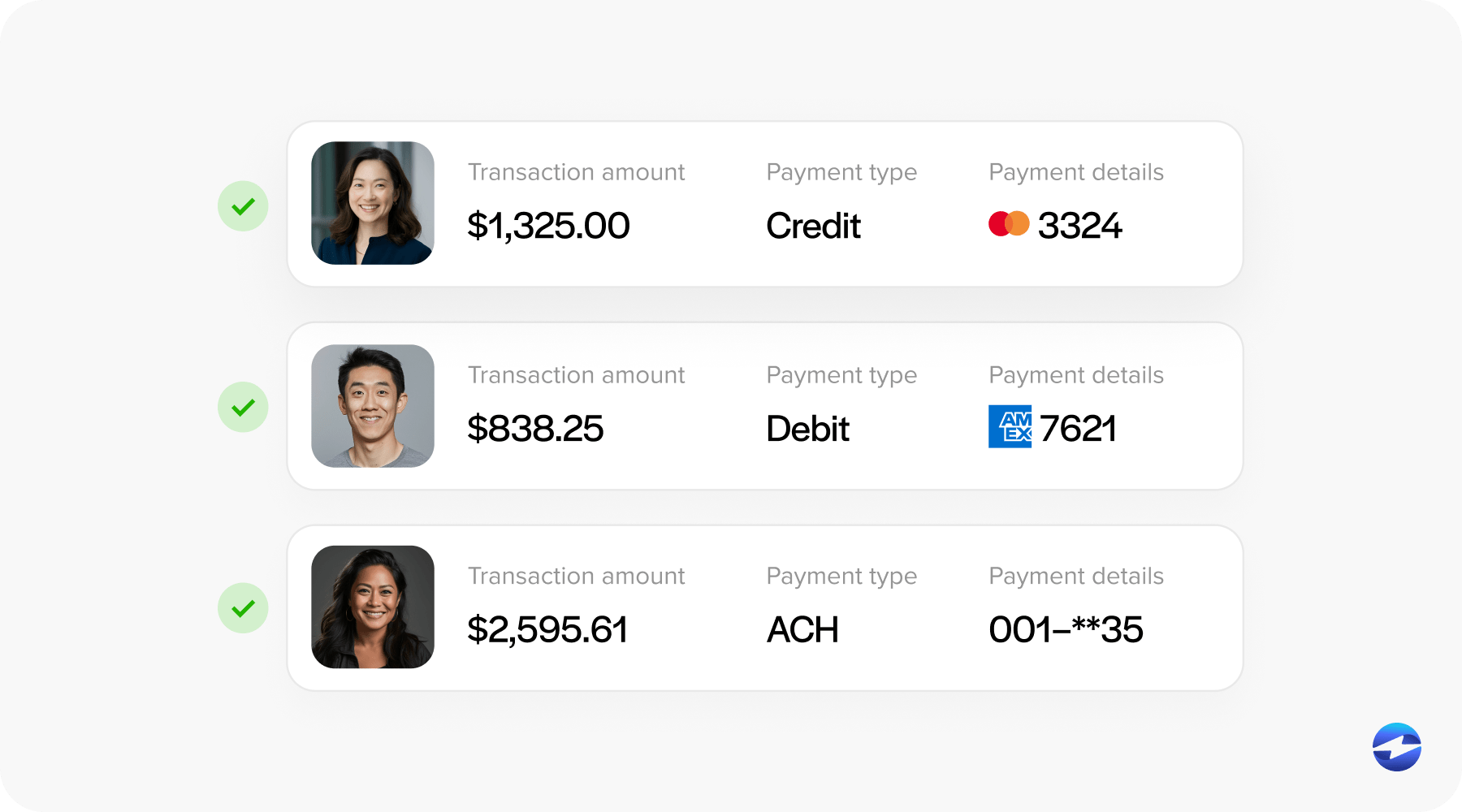

Next, you’ll configure the Epicor payment methods that make the most sense for your business. For most businesses, that means enabling credit cards and ACH transfers, but you can also include digital wallets or recurring billing if they fit your model. The strength of Epicor payment solutions is that they can be tailored for both B2B and B2C transactions, giving you the flexibility to match how your customers actually prefer to pay.

Processor Integration

Choosing the right payment processor is one of the most important steps in the setup. Epicor-native options like EPX make life easy because they’re built for the system and reduce the need for manual work. That said, some businesses prefer a third-party payment processor if they need extra features or better pricing. When weighing your options, consider how well the processor works with Epicor ERP, what the fees look like, whether it can grow with your business, and how strong the support is. The best payment processing solution should feel like a natural part of your ERP rather than something bolted on from the outside.

Testing and Validation

Once the system is configured, test it thoroughly. Run sample transactions to confirm they post correctly into accounts receivable and the general ledger. Ensure reconciliation is clear and check that your reports reflect payments accurately. Testing is where you confirm that Epicor payment processing works as promised before you roll it out to all customers.

Taken together, these steps create a roadmap for smoother implementation. Investing the time upfront reduces the chance of errors, minimizes disruption, and ensures your team can rely on the system once it’s live.

Best Practices for Integration Success

Successful integration isn’t just about setup—it’s about how you use the tools day to day.

- Automate wherever possible. Use Epicor’s features to automate recurring payments, reminders, and reconciliations. Automation is especially helpful in subscription models where EPX credit card processing ensures payments happen on time.

- Train your teams. Finance staff should be comfortable using dashboards and running reports. The more familiar they are with Epicor software, the fewer errors and delays you’ll face.

- Monitor trends. Regularly review transaction data to identify late payments, unusual activity, or customer preferences. Insights like these can inform your overall collections strategy.

- Stay secure. Payment data is sensitive, so stay on top of PCI compliance and software updates. Security isn’t just a box to check—it’s essential for customer trust.

By making these best practices part of your routine, you’ll not only keep your Epicor payment processing running smoothly but also strengthen the foundation for long-term efficiency and reliability.

Enhancing Customer Experience

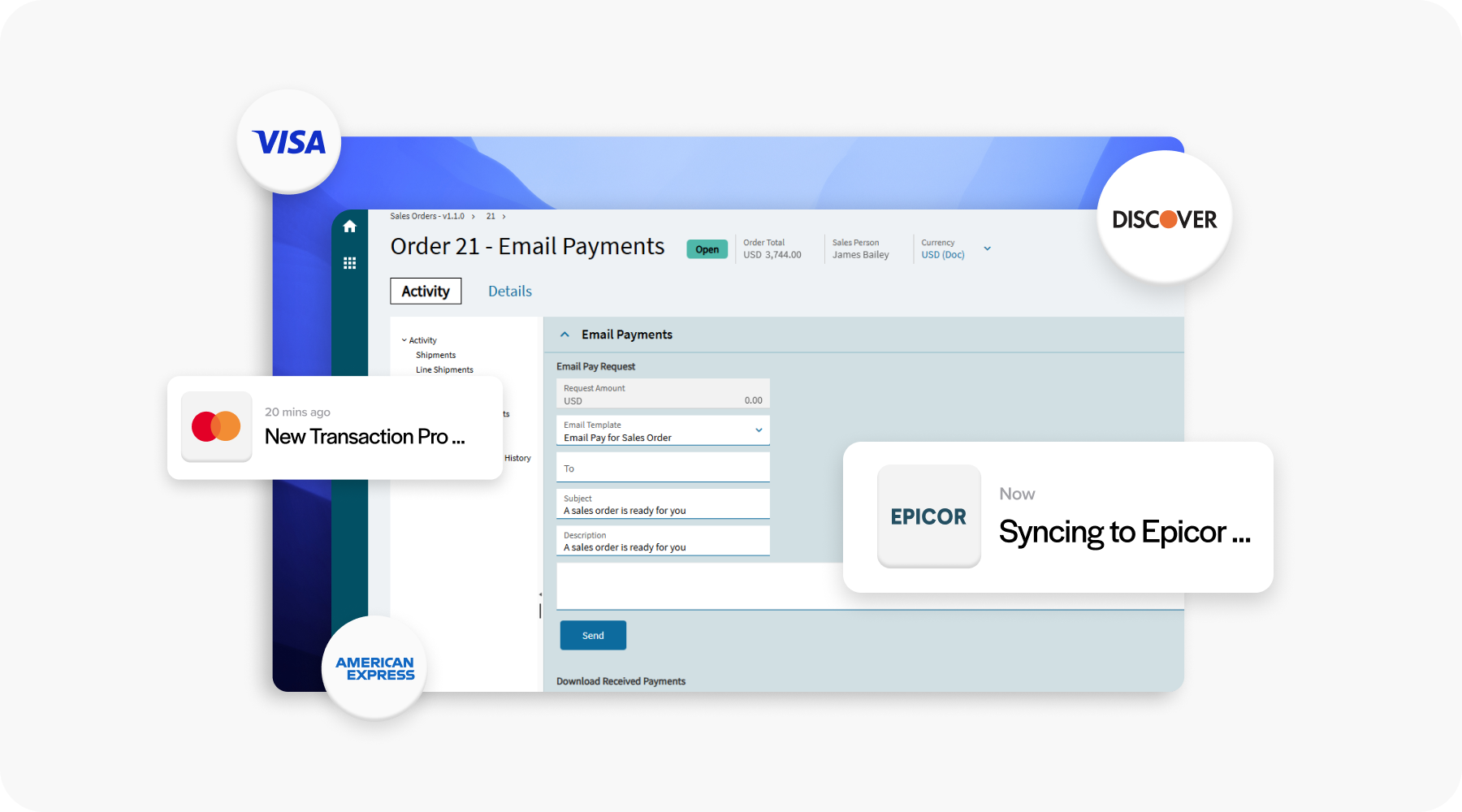

While a lot of payment integration is focused on internal efficiency, don’t forget the customer side of the equation. Offering flexible Epicor credit card processing and ACH options makes it easier for clients to pay you on time. Adding an online Epicor payment gateway or portal lets them manage invoices and payments at their convenience.

Receipts, confirmations, and quick posting also build confidence. No one likes waiting days to see if a payment went through. With real-time posting in Epicor ERP, customers know instantly that their payment has been received.

Ultimately, smoother payments improve customer relationships. If paying you is fast and painless, you remove friction that could otherwise hurt your brand.

Leveraging EBizCharge with Epicor

Epicor’s native tools provide a strong foundation, but some businesses need more. That’s where a solution like EBizCharge comes in. As a third-party payment processor, EBizCharge integrates directly with Epicor ERP, offering advanced reporting, customer portals, and lower processing costs.

Instead of bouncing between systems, payments flow seamlessly into your financial modules. This strengthens your Epicor integration and reduces manual work. For businesses that handle high volumes of transactions, the scalability of EBizCharge can be a major advantage.

Pairing Epicor payment solutions with EBizCharge is often the best of both worlds: native simplicity plus enhanced functionality.

Maximizing the Value of Epicor Payment Solutions

Implementing and integrating Epicor payment processing isn’t just about installing software —it’s about creating a reliable system that supports healthy cash flow and keeps customers happy. When you take the time to prepare properly, configure the right Epicor payment methods, and select a solid payment processing solution, you’re setting yourself up for long-term success.

You might choose to stay with EPX for Epicor credit card processing or add a third-party payment processor like EBizCharge for extra features. Either way, the goal is to make sure payments are quick, secure, and fully connected to your financial workflows. When that happens, Epicor payment solutions can reshape how your business handles transactions and give your teams more time to focus on growth instead of chasing down payments.