Blog > Sage Billing: Features, Configuration, and Optimization

Sage Billing: Features, Configuration, and Optimization

Billing isn’t just about sending an invoice—it’s the heartbeat of your business’s cash flow. If you’re already running a Sage ERP system, whether that’s Sage 100, Sage 50, Sage 500, or Sage Intacct, you know how important it is to keep billing accurate, timely, and easy to manage. That’s where Sage billing comes into play.

This article will break down what Sage billing software offers, how to configure it properly, and some practical ways to get the most out of it.

Understanding Sage Billing

Before diving into features and setup, it’s important to understand what Sage billing is at its core. Sage billing is the built-in or add-on functionality within Sage ERP platforms that handles everything from invoicing to payment tracking. It’s designed to simplify your workflow so you don’t have to juggle multiple systems to keep your finances in check.

For businesses already invested in Sage ERP, this isn’t just a convenience—it’s an extension of what you’re already doing. Whether you’re in manufacturing, distribution, services, or retail, Sage billing can remove much of the manual hassle from your revenue cycle.

In short, it’s about giving you a centralized, reliable way to keep track of who owes you what, when, and how they’ll pay. And when implemented well, it becomes a quiet but powerful part of keeping your business running smoothly.

Core Features of Sage Billing

Before optimizing or tweaking anything, you need to know what’s on offer. These core features are the foundation of Sage billing software and play an important role in making your Sage ERP system work harder for you.

Automated Invoicing: Instead of manually creating every invoice, you can set up recurring billing for repeat customers. This saves time, reduces errors, and allows for consistent, branded templates.

Payment Processing Integration: With built-in connections to Sage credit card processing and Sage payment processing, you can collect payments directly from your invoices—no extra systems or logins needed.

Tax and Compliance Management: Automatic tax calculations keep you compliant across different regions, which is especially helpful for companies working in multiple jurisdictions.

Reporting and Analytics: Go beyond basic tracking. Sage billing software provides insights into overdue accounts, payment patterns, and cash flow trends so you can make data-backed decisions.

When all these features work together, they form a streamlined process that keeps billing from becoming a bottleneck. They allow you to spend less time chasing invoices and more time focusing on your core business.

Configuring Sage Billing

Getting Sage billing up and running isn’t complicated, but doing it thoughtfully can make a big difference. The setup process is your opportunity to align the software with how your business operates, your team’s workflow, and your customers’ payment habits. This is where you lay the foundation for efficiency – cutting down on manual fixes later.

Initial Setup

First, check that your Sage ERP system is compatible with the billing module. For those using Sage 100, Sage 50, Sage 500, or Sage Intacct, installation is typically straightforward. Still, it’s worth confirming that your current infrastructure (including your payment gateway setup) is ready to support it without hiccups.

Customization Billing Settings

Take time to set your billing frequency, payment terms, and late fee policies. This isn’t just about preference – it’s about creating a consistent rhythm for both your accounting team and your customers. The more accurately you define these, the smoother your invoicing process will be and the easier it will be to predict cash flow.

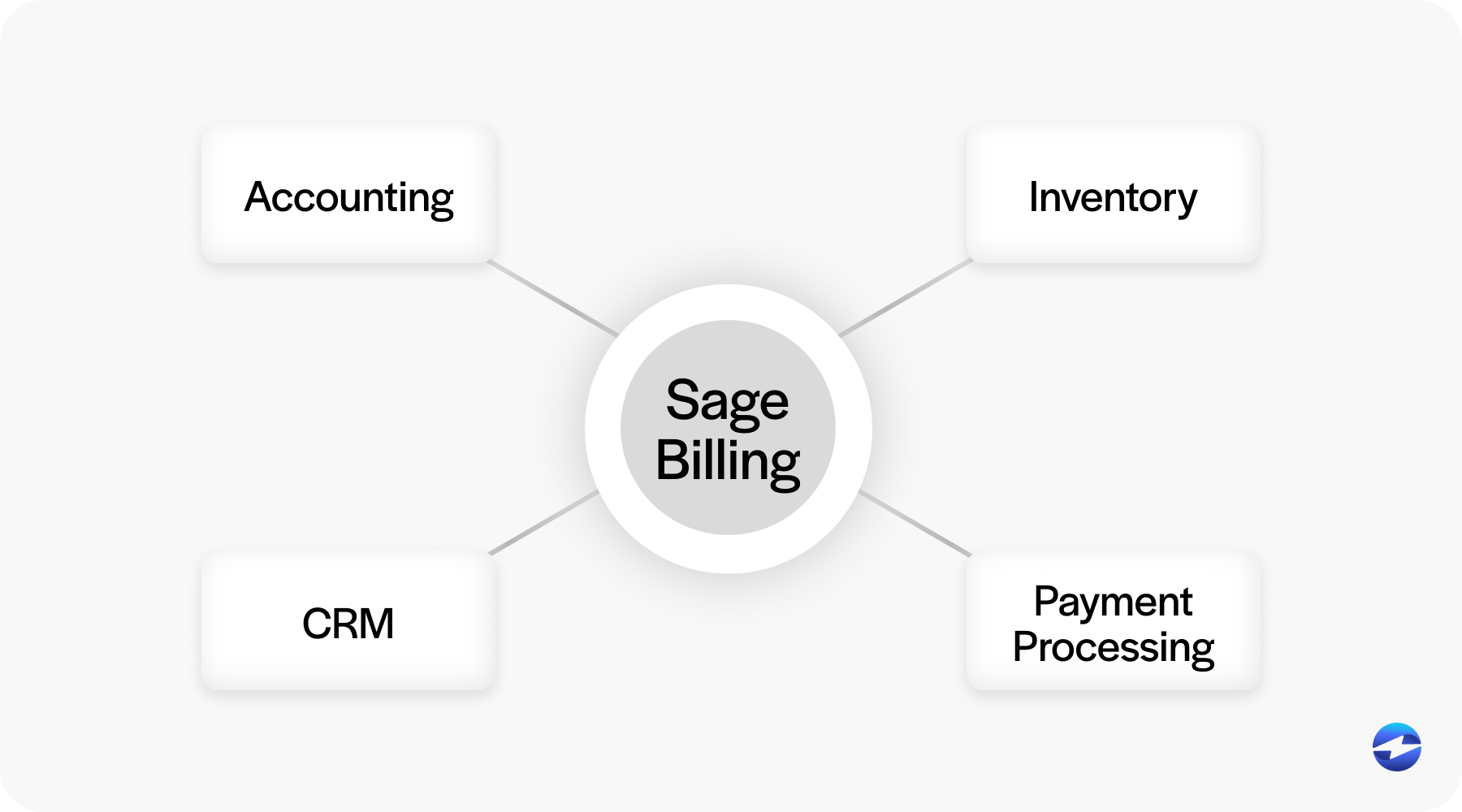

Integrating with Other Sage Modules

Tie your billing into accounting, inventory, and customer relationship management (CRM). This creates a single source of truth so invoices reflect real-time data from across your business. That way, you avoid common mistakes like billing for out-of-stock products or missing service dates.

Configured well, Sage billing becomes a tailored tool that not only matches your workflow but actively supports it – helping you maintain accuracy, efficiency, and clear communication with your customers.

Best Practices for Optimization

Even with a good setup, there’s always room to fine-tune. Optimization is about making your Sage billing software work faster, smarter, and more efficiently while ensuring it fits seamlessly into your daily operations. It’s not just about tweaking settings – it’s about creating a system that anticipates problems, encourages on-time payments, and gives you better insights into your finances.

Automate where you can

Recurring invoices, scheduled reminders, and automatic reporting reduce manual work and cut down on missed steps. Automation frees up your team’s time so they can focus on resolving exceptions rather than pushing routine tasks through.

Use reports to guide decisions

Look for patterns – customers who pay late, seasonal spikes in billing, or recurring issues with specific payment types. By analyzing these trends, you can adjust terms, improve collections strategies, or shift resources to busier times of the year.

Keep your data clean

Regularly check your customer records and invoice templates to prevent errors and disputes. Clean data not only reduces billing mistakes but also improves the accuracy of your forecasting.

Improve the customer experience

Provide self-service portals and clear payment tracking. Make it easy for customers to find invoices, see their payment history, and pay online. A smoother customer experience often translates to quicker payments.

When you build these practices into your routine, you turn Sage billing into a proactive tool rather than a reactive one. Over time, this approach helps you maintain steady cash flow and a billing process that’s both dependable and adaptable.

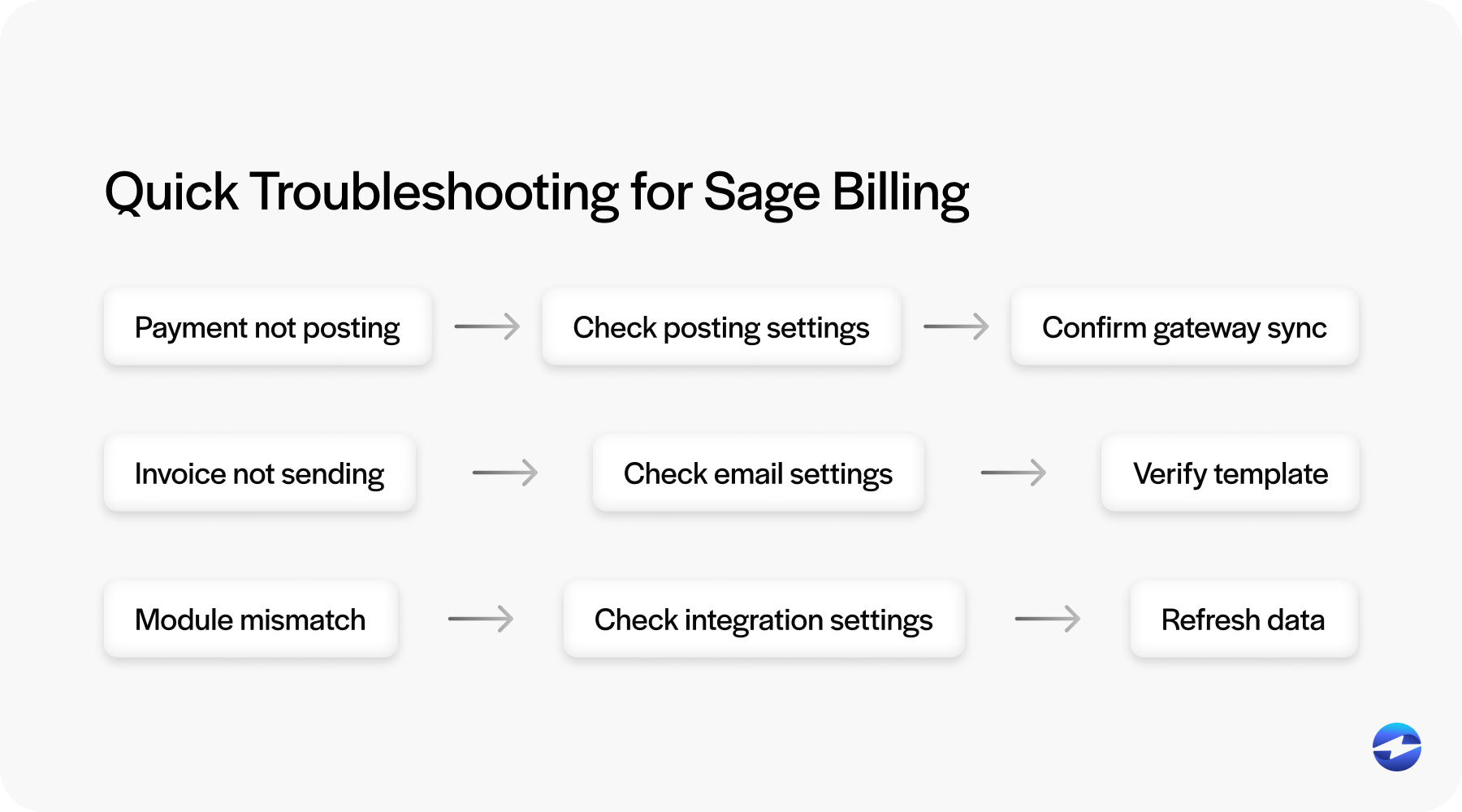

Troubleshooting Common Issues

Even the best setups have their off days. A payment gateway might throw an error, an invoice might not send, or two modules might not sync like they should. These hiccups happen, and they don’t always mean something is seriously wrong.

When they do po up, start with the basics – check your Sage payment processing settings, make sure your email system is sending messages, and confirm that your network isn’t slowing things down. More often than not, the fix is something small, like updating credentials or restarting a connection.

The key is to jump on these issues quickly so they don’t pile up and mess with your cash flow. A little troubleshooting now can save you from bigger headaches later.

Future Trends in Sage Billing

Sage ERP systems are moving toward more automation, predictive analytics, and seamless integrations with eCommerce platforms. We’re talking about smarter tools that can predict payment delays, automatically match payments to invoices, and even recommend the best times to bill customers based on historical behavior. These innovations mean a future where billing is even less manual and more deeply connected to the rest of your operations, from inventory to customer relationship management.

For businesses, staying aware of these developments isn’t just interesting – it’s strategic. Keeping an eye on where Sage billing software is headed ensures you’re ready to adopt new features, avoid being caught off guard by changes, and gain an edge in efficiency and customer satisfaction.

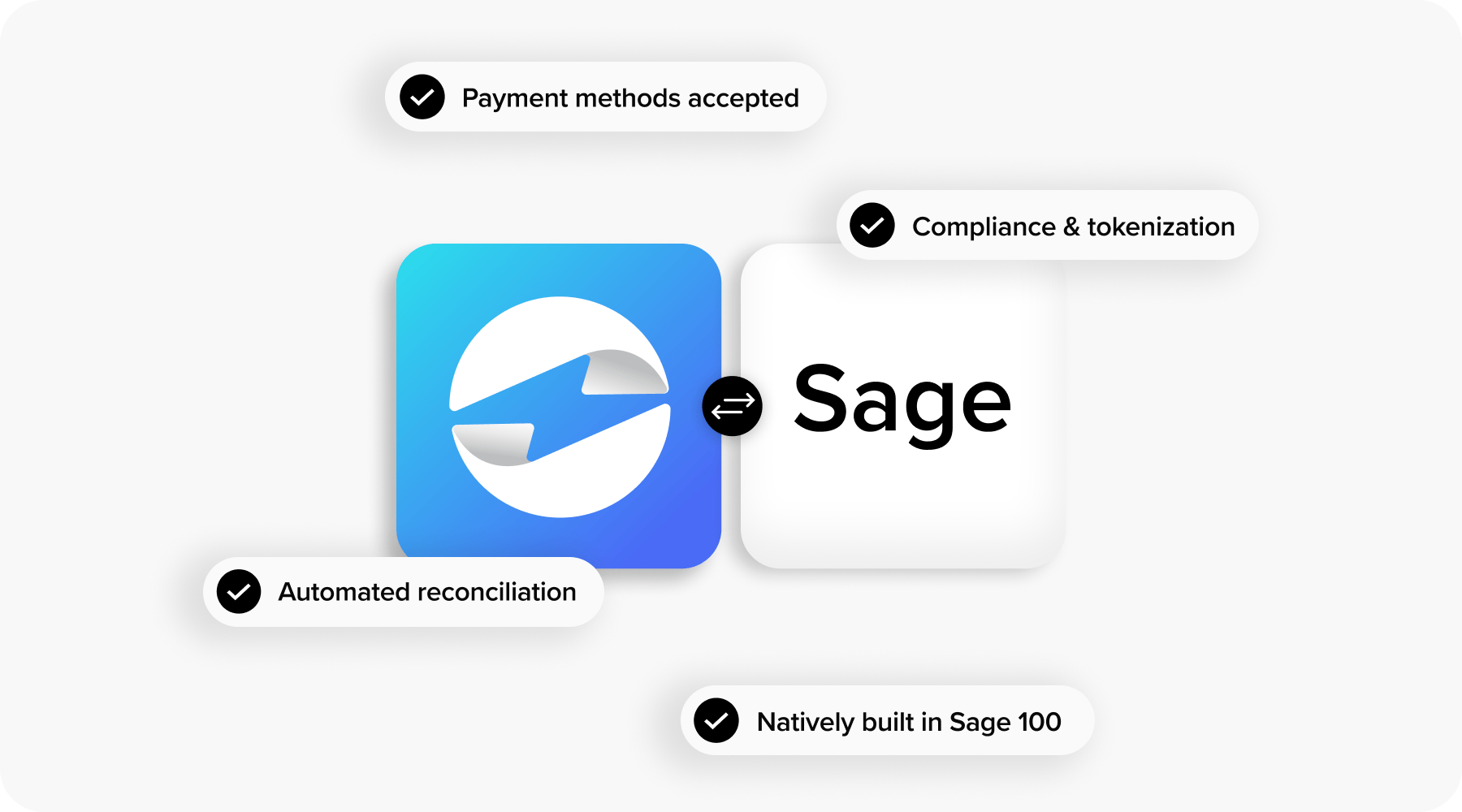

How EBizCharge Supercharges Sage Billing

Sage billing software is more than just an extra feature – it’s a practical, day-to-day tool that helps keep your business running smoothly. With EBizCharge’s seamless Sage integration, you can take that functionality even further by connecting payment processing directly into your Sage ERP system. Whether you’re on Sage 100, Sage 50, Sage 500, or Sage Intacct, EBizCharge streamlines the entire payment workflow – letting you accept credit cards, ACH, and other payment types right inside Sage without switching between systems.

This integration not only speeds up payment collection but also reduces manual entry, minimizes errors, and gives you real-time visibility into your transactions.

Over time, it becomes one of those behind-the-scenes helpers that doesn’t just quietly keep things running – it actively makes your billing process faster, more accurate, and far less stressful for your team.