Blog > NetSuite Suite Billing: Advanced Revenue Management

NetSuite Suite Billing: Advanced Revenue Management

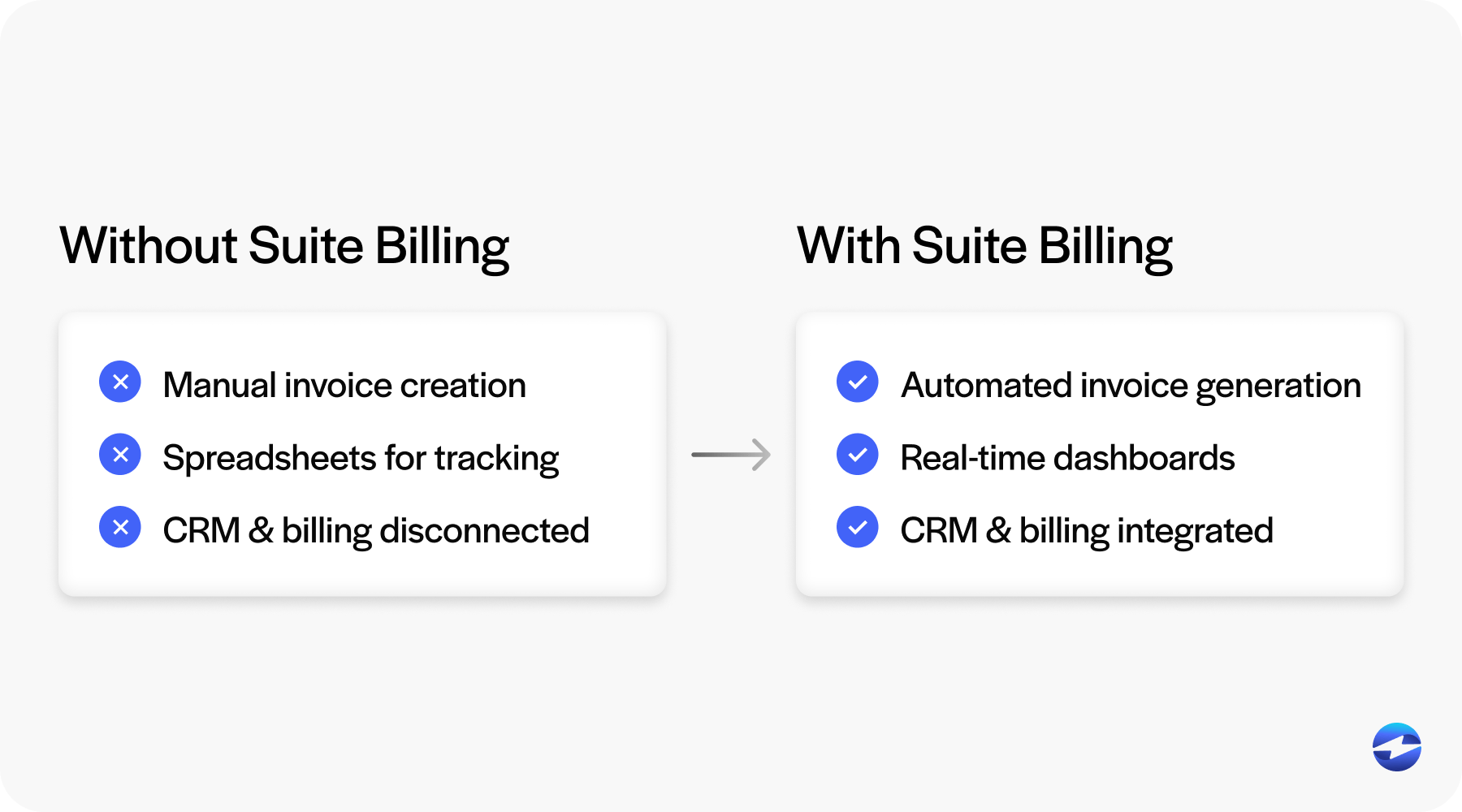

Billing isn’t what it used to be. Businesses today rely on more complex revenue models—subscription-based billing, usage-based pricing, product-service bundles, and contract modifications. Trying to manage all that with spreadsheets or disconnected systems only creates confusion and slows down the closing process.

That’s where NetSuite Suite Billing comes in. Designed to support modern finance operations, Suite Billing NetSuite is a flexible, integrated billing and revenue management engine built right into the NetSuite ERP ecosystem. It helps teams streamline invoicing, automate revenue recognition, and support compliance—all within one unified system.

This article is for software as a service (SaaS) companies, service-based organizations, and businesses using or evaluating NetSuite to manage complex billing workflows. We’ll cover what Suite Billing NetSuite offers, how it connects to other parts of the system, and what to consider when building a more efficient finance operation.

What Is NetSuite Suite Billing?

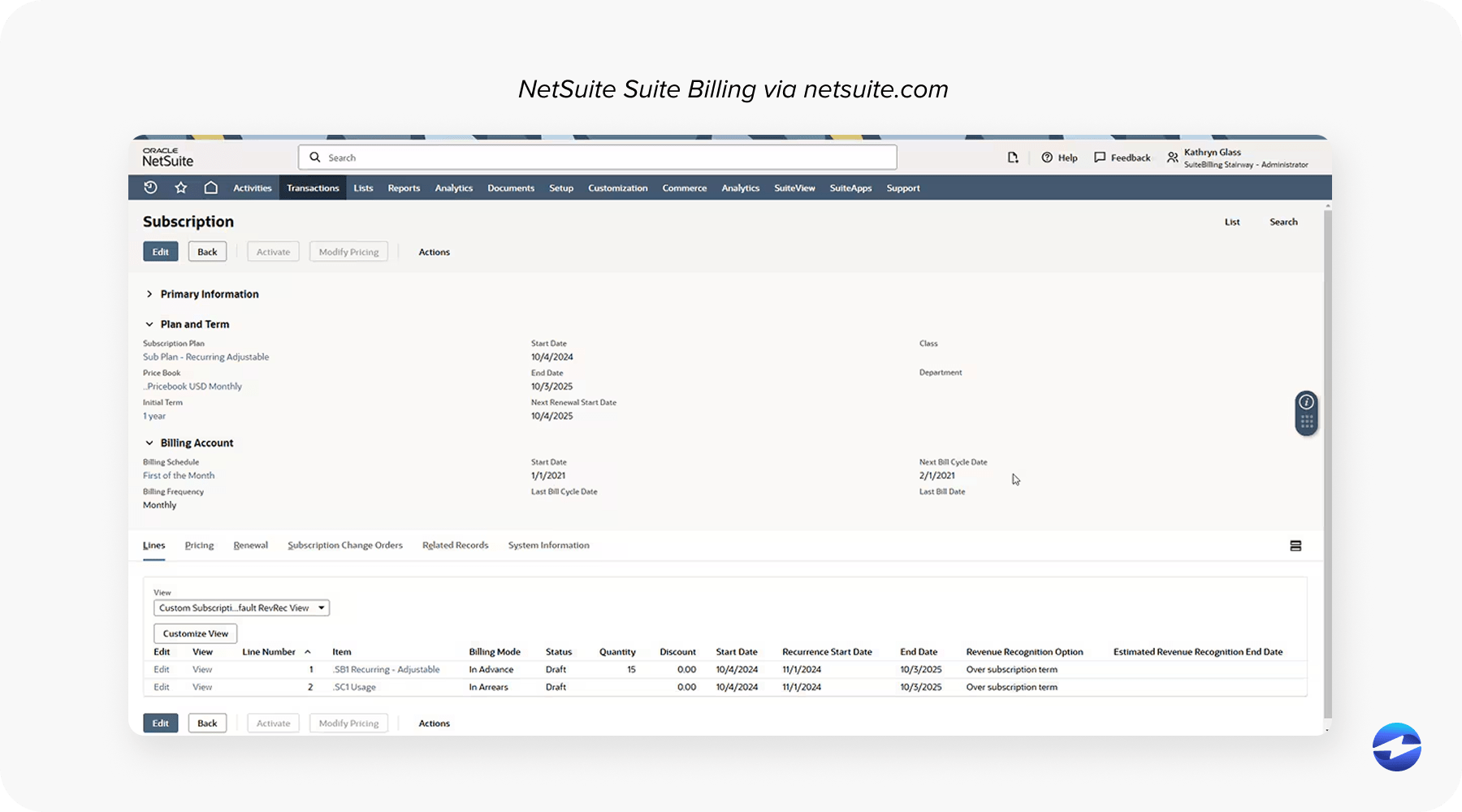

NetSuite Suite Billing is more than just a billing program. It’s a robust engine adaptable to any pricing and invoicing model. Whether your business bills monthly, based on milestones, or through hybrid models, Suite Billing can accommodate it.

Some of the most important features include:

- Usage-based and subscription billing

- Flexible invoicing schedules (monthly, quarterly, mid-cycle)

- Revenue recognition automation and ASC 606 compliance

- Complete integration with your NetSuite billing and accounting modules

As part of the NetSuite platform, Suite Billing doesn’t stand alone. It’s sewn into order management, CRM, and project management, so all your teams, from sales to accounting, can see current billing information in real time.

Key Benefits of Suite Billing for Revenue Management

With evolving pricing models and increasing regulatory enforcement, antiquated billing systems usually fall short. That’s why NetSuite billing, when done right, can significantly change how your company handles cash flow, compliance, and customer relationships.

Here’s how Suite Billing helps:

- Unifies billing and revenue recognition in a single platform—no more switching between tools.

- Automates complex schedules so you reduce errors and save time.

- Supports GAAP and ASC 606 compliance, which is crucial for audits.

- Handles contract changes (upgrades, downgrades, cancellations) without disrupting your ledger.

With the added benefit of real-time visibility, finance teams can forecast revenue patterns in advance, reduce touchpoints manually, and grow billing operations with confidence. These capabilities drive internal productivity and build customer confidence by making billing timely, accurate, and transparent.

Implementation Considerations

Rolling out Suite Billing NetSuite isn’t plug-and-play—it requires thoughtful setup to get the most out of it.

Start by:

- Cleaning up your data, especially customer and contract information

- Mapping your revenue recognition rules in advance

- Involving both accounting and operations teams early

Don’t skip the sandbox testing phase. It’s where you’ll find edge cases, like custom billing cycles or unusual contract terms, that could throw off your schedules. A phased rollout also gives your team room to adjust and build confidence in the system.

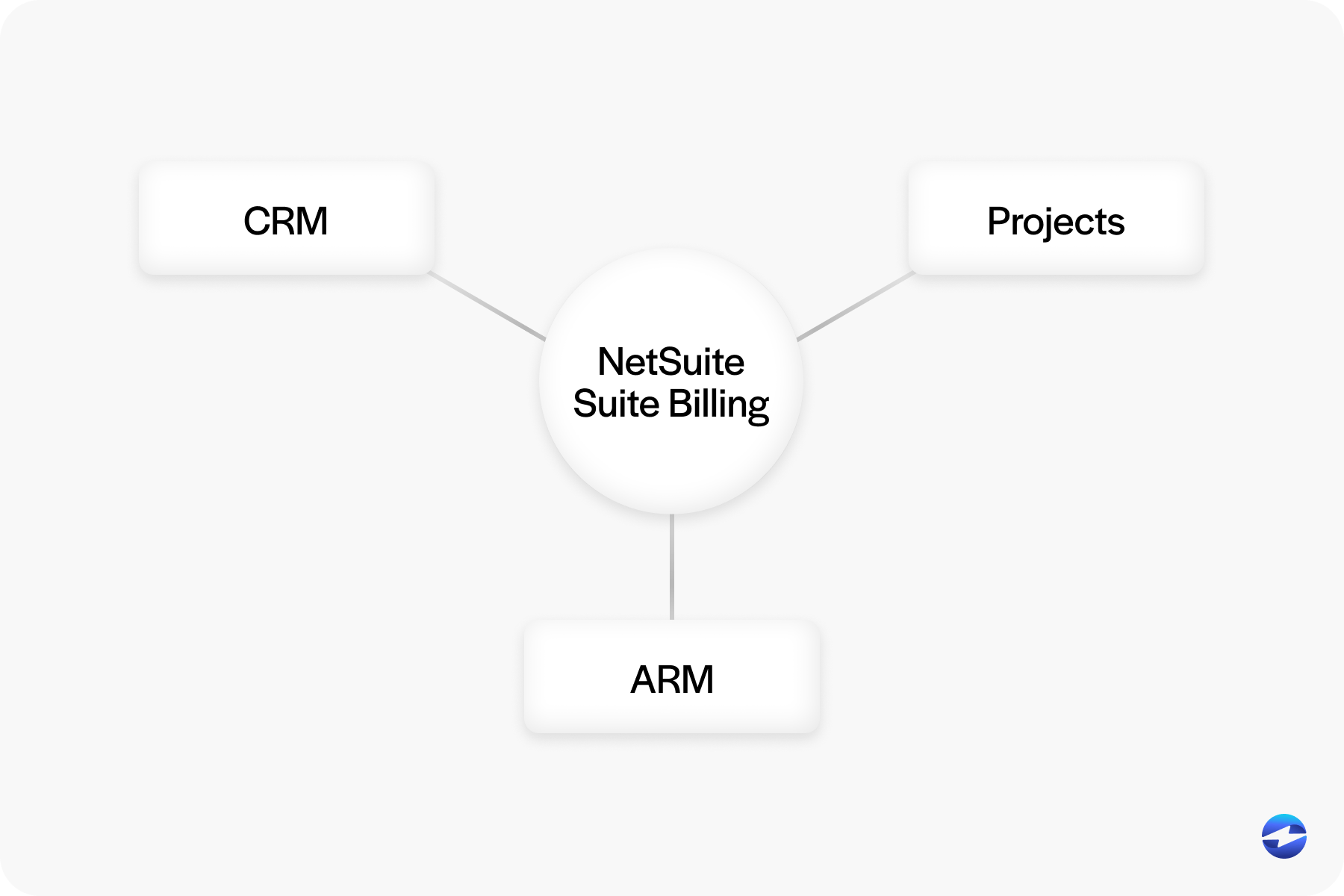

Integration with Other NetSuite Modules

One of the biggest strengths of NetSuite Suite Billing is how it works hand-in-hand with other NetSuite modules to form a truly unified financial management system. This kind of deep integration is especially valuable for growing businesses that want to scale without layering on additional tools or complexity. Instead of jumping between disconnected apps or relying on manual data transfers, everything flows together in a way that saves time and improves accuracy.

- It pairs with Advanced Revenue Management (ARM) to support flexible revenue rules

- Syncs with CRM to align sales quotes with billing terms

- Works with Projects to manage time and materials billing

The result? Real-time updates to your financial reports, deferred revenue schedules, and cash flow forecasts. No more reconciling separate systems or waiting on spreadsheets.

Enhancing NetSuite Billing with EBizCharge Integration

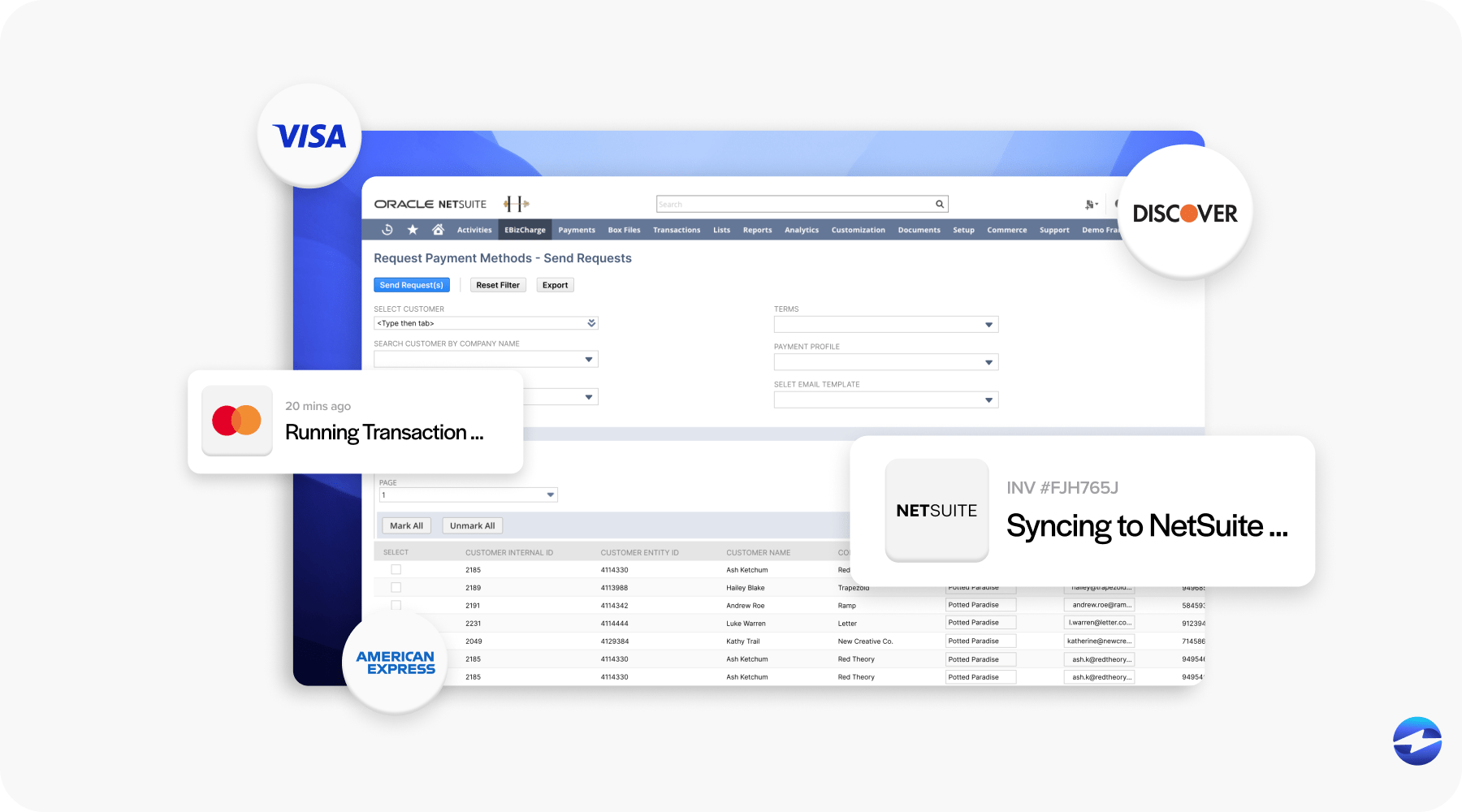

While Suite Billing handles billing, NetSuite payment processors play a key role in cash collection.EBizCharge, as a native payment solution for NetSuite, helps finance teams close the gap between invoicing and payment collection.

By embedding payment processing directly within NetSuite, EBizCharge enables the processing of ACH, eCheck, and credit card payments without ever needing to leave the system. This circumvents third-party gateways and reduces manual reconciliation procedures.

This top-rated solution features real-time payment posting, secure tokenization, click-to-pay, and batch processing. These features make it easy to process large volumes of invoices and recurring payments. Whether you send 10 or 10,000 invoices a month, EBizCharge gets it right and keeps it moving.

The result is a streamlined payment process and more visibility into accounts receivable (AR). It transforms the system from a standard billing engine into a comprehensive payment processing solution.

Best Practices for Long-Term Success

Implementing Suite Billing NetSuite is just the beginning. As your business grows and your billing models evolve, staying on top of how your system operates becomes increasingly important. The right configuration can help you avoid errors, accelerate cash flow, and give stakeholders a real-time understanding of financial performance. However, even the best tools need thoughtful management to reach their full potential.

To get the most out of your Suite Billing NetSuite setup, consider these tips:

- Revisit your revenue rules regularly, especially after pricing or product changes

- Automate exception handling wherever possible to avoid bottlenecks

- Use dashboards to monitor cash flow, invoice status, and revenue recognition health

And don’t forget about your NetSuite payment processor—partnering with the right provider can make a big difference in payment reliability, speed, and customer satisfaction.

Ultimately, the key to long-term success is continual improvement. Check in with your finance and operations teams regularly to identify where friction still exists. The more proactive you are about refining your processes, the more value you’ll get out of Suite Billing and the surrounding payment processing solution.

Improving Business Operations with NetSuite Suite Billing

NetSuite billing is powerful, but even more so when combined with the right tools and processes. Whether managing subscription revenue, milestone billing, or usage-based contracts, NetSuite Suite Billing gives you the framework to be compliant, consistent, and scalable.

When combined with a strong payment gateway like EBizCharge, your billing and payment operations become more than just functional; they become a competitive advantage. The right payment processor can turn receivables into real-time visibility, reduce errors, and give your finance team better visibility.

In the end, building a payment processing solution around Suite Billing isn’t just about speed; it’s about getting paid accurately, securely, and on time.