Blog > Implementing ACH Payments in NetSuite for B2B Transactions

Implementing ACH Payments in NetSuite for B2B Transactions

When it comes to B2B transactions, speed, security, and cost all matter. That’s why more and more businesses are turning to ACH—Automated Clearing House—as their preferred payment method. Unlike traditional paper checks or even credit cards, ACH transfers offer a balance of efficiency and affordability that’s hard to beat.

If you’re using NetSuite, you’re already in a strong position to streamline your payment workflows. With the right configuration and tools, NetSuite ACH payments can become a powerful part of your billing and receivables strategy. This article walks you through what you need to know about implementing ACH in NetSuite—from native features to automation and integrations—so you can improve your B2B cash flow without adding complexity. It’s also an opportunity to explore how NetSuite payment automation and the right payment solution can reduce friction across your collections process.

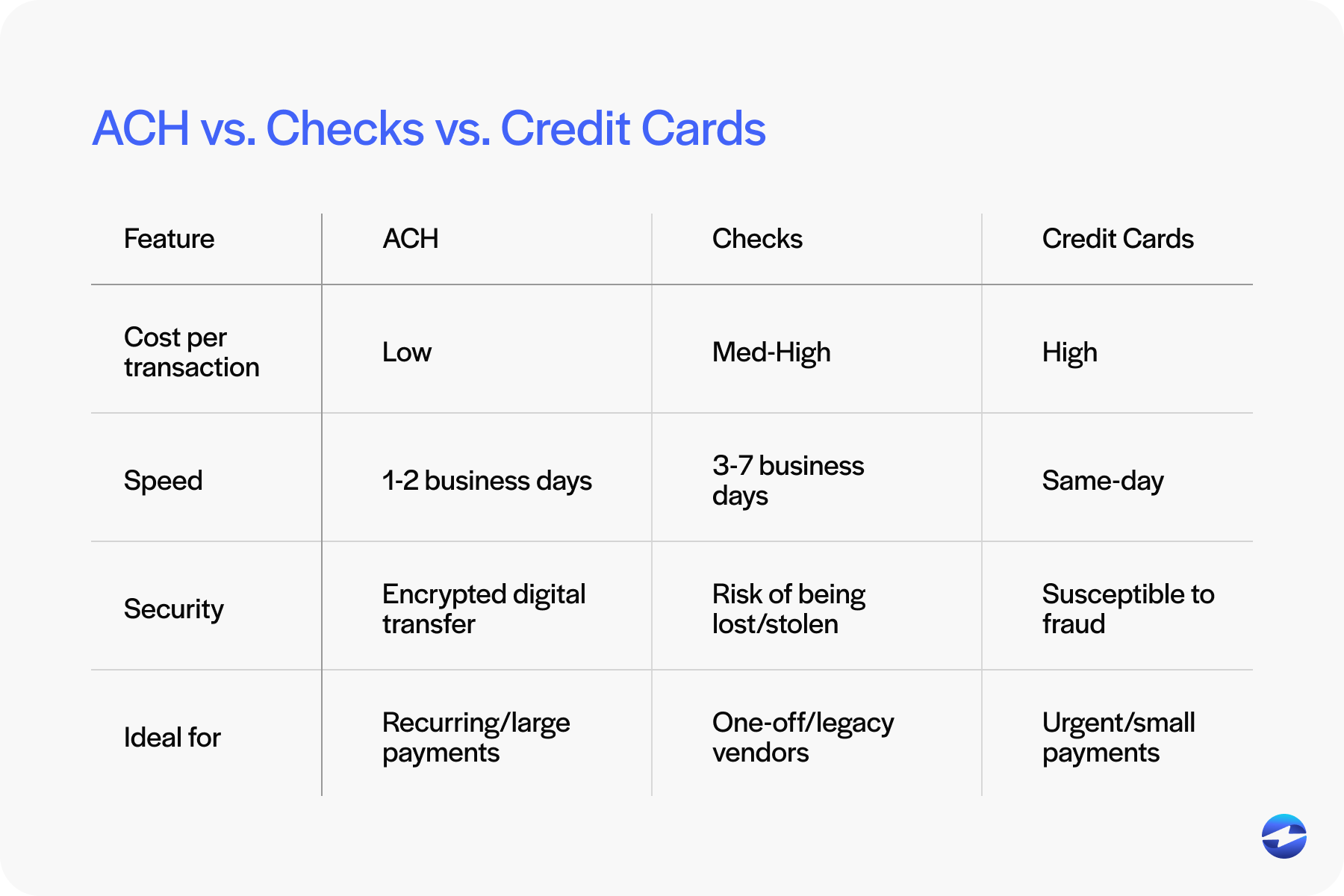

ACH vs. Other B2B Payment Methods

For B2B transactions, checks have been the norm. But they’re slow, error-prone, and costly to process. Delays in mailing, lost checks, and manual entry are headaches for customers and AR staff alike. Credit cards, which are faster and more convenient, tend to add higher interchange fees and expose merchants to greater risk of chargebacks and fraud, particularly for bigger B2B transactions.

That’s where ACH comes in. ACH transactions offer an affordable alternative that provides both convenience and security. ACH payments tend to be cheaper per transaction than credit cards and can be automated to handle recurring or subscription-type billing models. They’re also more secure than checks since they remove the physical touch from the process and rely on secure electronic transfers.

ACH works best in long-term vendor relationships or repeat business where payment terms are stable. For businesses with high volumes of invoices or recurring billing cycles, NetSuite ACH processing offers a scalable, reliable solution. It streamlines manual efforts while maintaining processing costs under control, enabling finance teams to concentrate more on strategy and less on running down payments.

NetSuite’s Native Capabilities for ACH

NetSuite includes built-in support for ACH payments, though the capabilities vary depending on your setup. At its core, NetSuite allows you to set up bank account records and enable ACH as a payment method for customers or vendors. This is often the first step in implementing NetSuite payment automation.

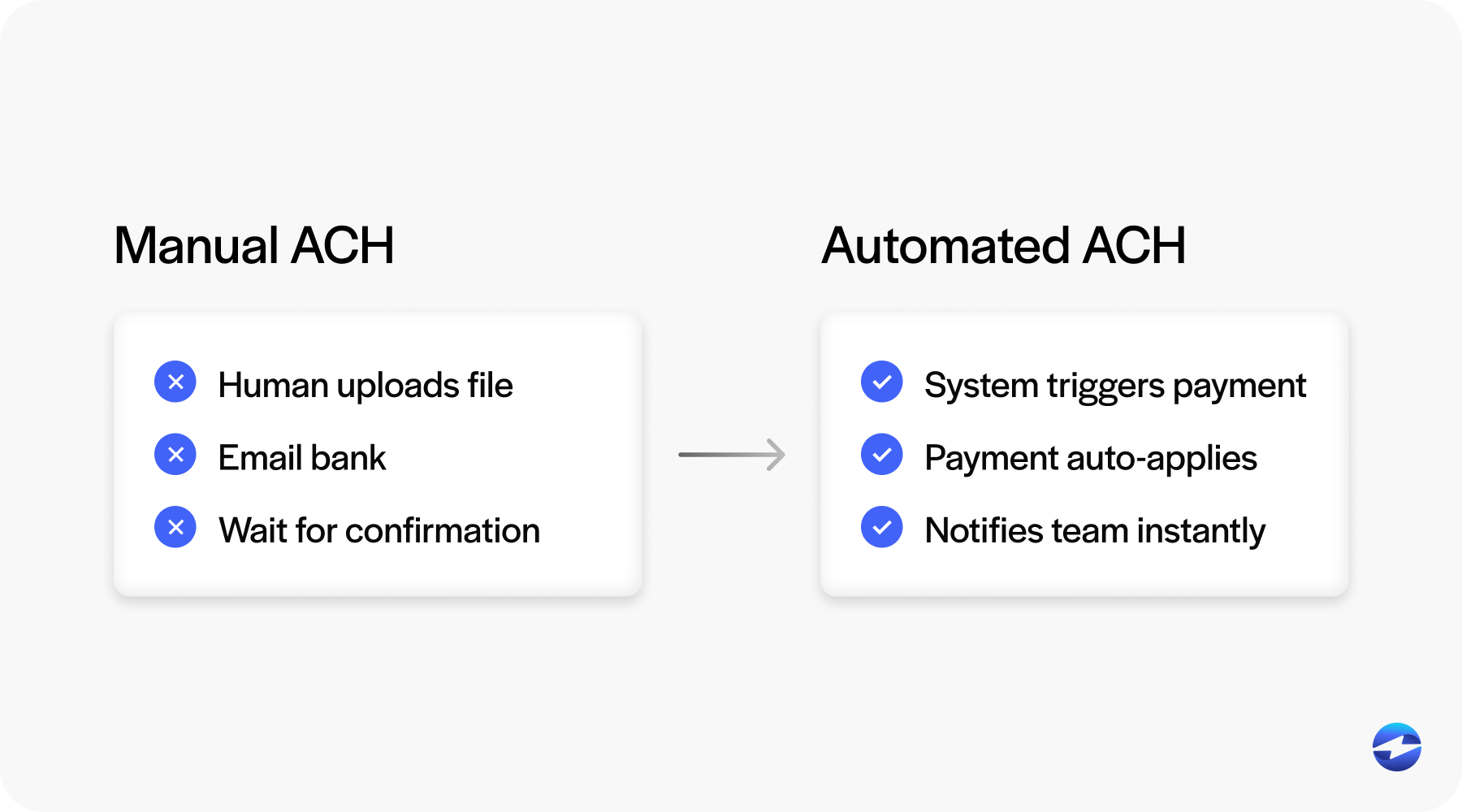

Using the Electronic Bank Payments SuiteApp, you can create payment batches, generate NACHA files, and send those files to your bank. While functional, this method still relies on a manual export-and-upload process.

For teams seeking more hands-off workflows, native NetSuite ACH processing has its limits. Without real-time syncing or validation, it’s easy to run into delays or errors. That’s why many companies opt for a NetSuite ACH integration or pair it with a broader payment processing solution to go beyond basic functionality.

Enhancing ACH Payment Workflows with Automation

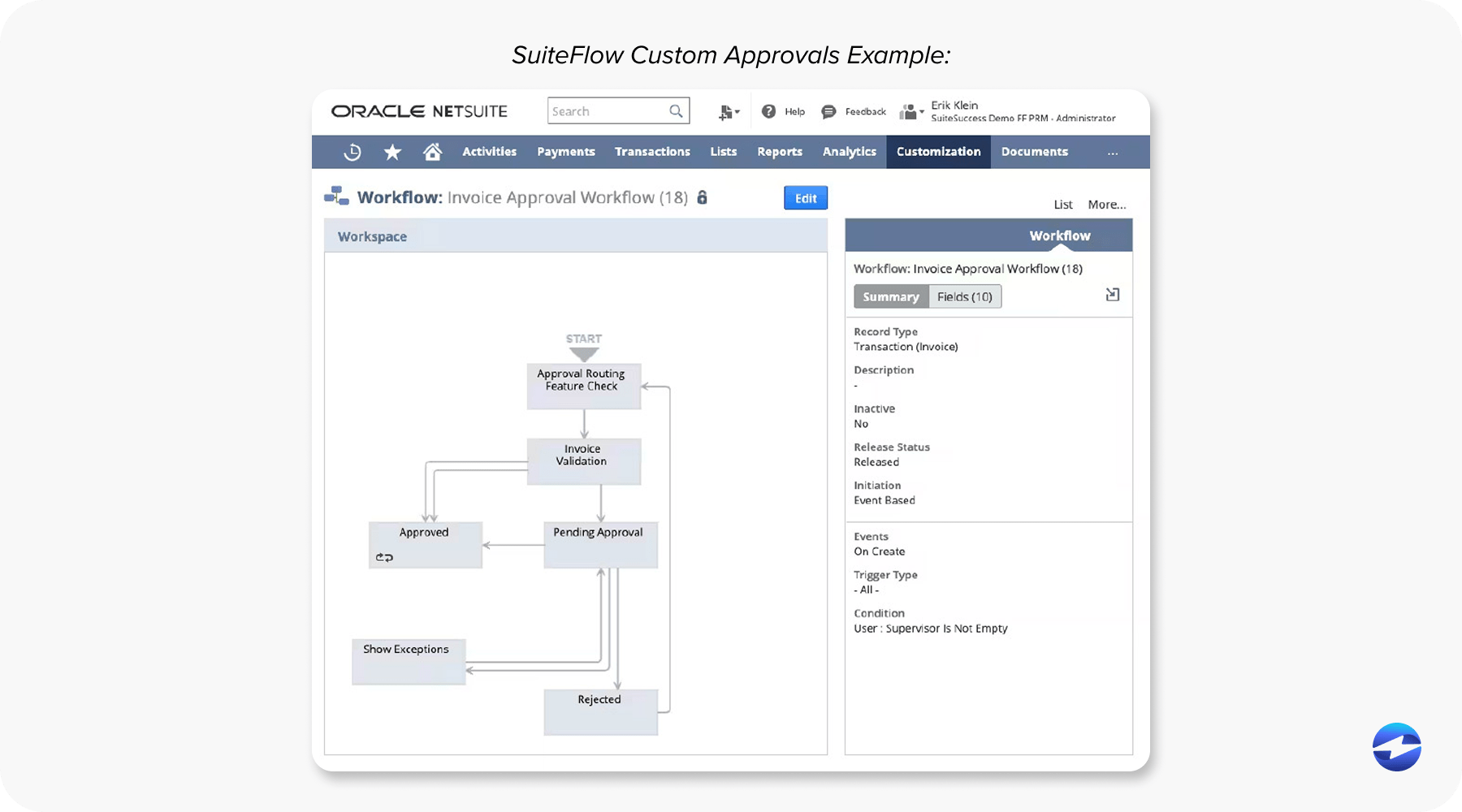

If you’re already using NetSuite for billing and invoicing, it makes sense to automate as much of the ACH process as possible. This is a core part of NetSuite payment optimization.

SuiteFlow is a great place to start. You can use it to create workflows that trigger ACH submissions based on invoice status, customer type, or due date. For example, when an invoice is marked as due, a payment request could automatically be submitted through your ACH provider. This kind of workflow represents automated payment collection for NetSuite at its most useful.

You can also set up reminders and confirmation messages that notify customers when payments are initiated or completed. These small touches go a long way in improving customer experience and keeping your AR process on track.

Saved searches and dashboards help you monitor the success of your NetSuite ACH payments. By tracking errors, payment status, and exception handling, you can tighten your process over time and avoid surprises. It all contributes to a more strategic use of payment automation NetSuite users can build into their day-to-day.

Integrating a Payment Processor for ACH

For most finance teams, the real efficiency boost comes from integrating a payment processor directly into NetSuite. ACH processing may seem straightforward on the surface, but when you’re managing dozens—or even hundreds—of invoices a week, manual handling can quickly become a burden. A NetSuite ACH integration eliminates repetitive steps like file uploads, data re-entry, and bank reconciliation, helping finance teams operate with far greater speed and accuracy.

When evaluating a payment processor, it’s important to look beyond basic functionality. The right payment processing solution should support tokenization, so customer banking info is stored securely and reused safely without exposing sensitive data. It should also offer real-time updates so your AR team doesn’t have to chase down confirmations or manually update payment statuses across multiple systems.

Some processors even allow you to create rules for how and when payments are applied, giving you more control over cash application and reducing the risk of mismatches. This is especially helpful in B2B settings where partial payments or payment against multiple invoices is common.

With a proper integration in place, NetSuite ACH payments become part of a closed-loop workflow. You send the invoice, the customer pays via ACH, and the system does the rest—from applying the payment to sending receipts and updating dashboards. It’s a cleaner, faster, and more scalable way to handle ACH in NetSuite and fully realize the benefits of NetSuite payment automation.

Best Practices for ACH in B2B Environments

As more B2B businesses adopt ACH as their go-to payment method, the importance of handling those transactions correctly from the start can’t be overstated. Even the most powerful payment workflows can fall apart without attention to detail and proper setup. That’s why getting the fundamentals right is critical—especially if you’re scaling your AR operations or transitioning from checks and manual processing.

To get the most out of NetSuite ACH processing, it’s important to follow a few best practices:

- Validate account info upfront: Use tools that confirm routing and account numbers at the time of entry.

- Automate recurring billing: ACH is perfect for scheduled payments—use NetSuite billing cycles to your advantage.

- Maintain compliance: Make sure your ACH processes follow NACHA and PCI standards, especially when handling sensitive data.

You’ll also want to keep customer records clean and organized. Properly linked bank accounts, clear payment terms, and communication logs make ACH payment workflows more reliable and easier to troubleshoot. These practices are fundamental to improving NetSuite payment optimization.

EBizCharge for ACH in NetSuite

One way to take B2B payment processing to the next level in NetSuite is by using EBizCharge. This payment processing solution integrates directly into the ERP, offering an embedded experience that simplifies ACH workflows while also reducing the risks and inefficiencies tied to manual processing.

With EBizCharge, customers can save banking info securely and pay directly from emailed invoices or customer portals. This kind of flexibility encourages faster payments and enhances the customer experience by offering a self-service option. Behind the scenes, payments are automatically applied to the right invoices, and the NetSuite dashboard stays updated in real time—helping teams maintain accurate records without additional steps.

For companies looking for a full-featured NetSuite ACH integration, EBizCharge offers a seamless way to handle ACH alongside NetSuite credit card processing. It’s a unified payment solution that cuts down on manual effort, reduces errors, and helps maintain a cleaner receivables process. This level of automation and visibility is particularly valuable for businesses managing high transaction volumes or recurring billing schedules. It’s a perfect fit for teams investing in automated payment collection for NetSuite and wanting a scalable payment processing solution.

Unlocking Faster, Smarter B2B Payments with ACH in NetSuite

In B2B settings, ACH has become a reliable and cost-effective alternative to checks and cards. And when implemented inside a powerful ERP like NetSuite, it can help streamline even the most complex AR workflows.

By combining NetSuite ACH functionality with automation tools and a trusted payment processing solution, businesses can reduce delays, improve accuracy, and offer a smoother payment experience to their customers.

If your finance team is still handling ACH through a patchwork of spreadsheets and file uploads, now’s the time to consider upgrading. With a smart NetSuite ACH integration in place—and the added strength of NetSuite payment automation and a modern payment solution—your AR process won’t just keep up—it’ll move ahead.