Blog > Streamlining NetSuite Bill Payment and Vendor Management

Streamlining NetSuite Bill Payment and Vendor Management

If you’re part of a finance or accounts payable (AP) team using NetSuite, chances are you’re juggling a long list of vendor bills, deadlines, and manual approvals. Getting vendor payments out on time and without error isn’t just a nice-to-have—it’s essential for preserving vendor relationships, controlling cash flow, and maintaining clean books.

But let’s face it: without the right structure, NetSuite bill payment workflows can be clunky. Duplicate bills, approval delays, and a lack of real-time visibility into your liabilities can slow things down. That’s why streamlining NetSuite bill payment and vendor management isn’t just about efficiency—it’s about staying proactive and error-free.

This article will explore how to improve the way your team handles NetSuite bill payment and vendor management, covering common challenges, best practices, and tools that can make your workflow smoother and more reliable.

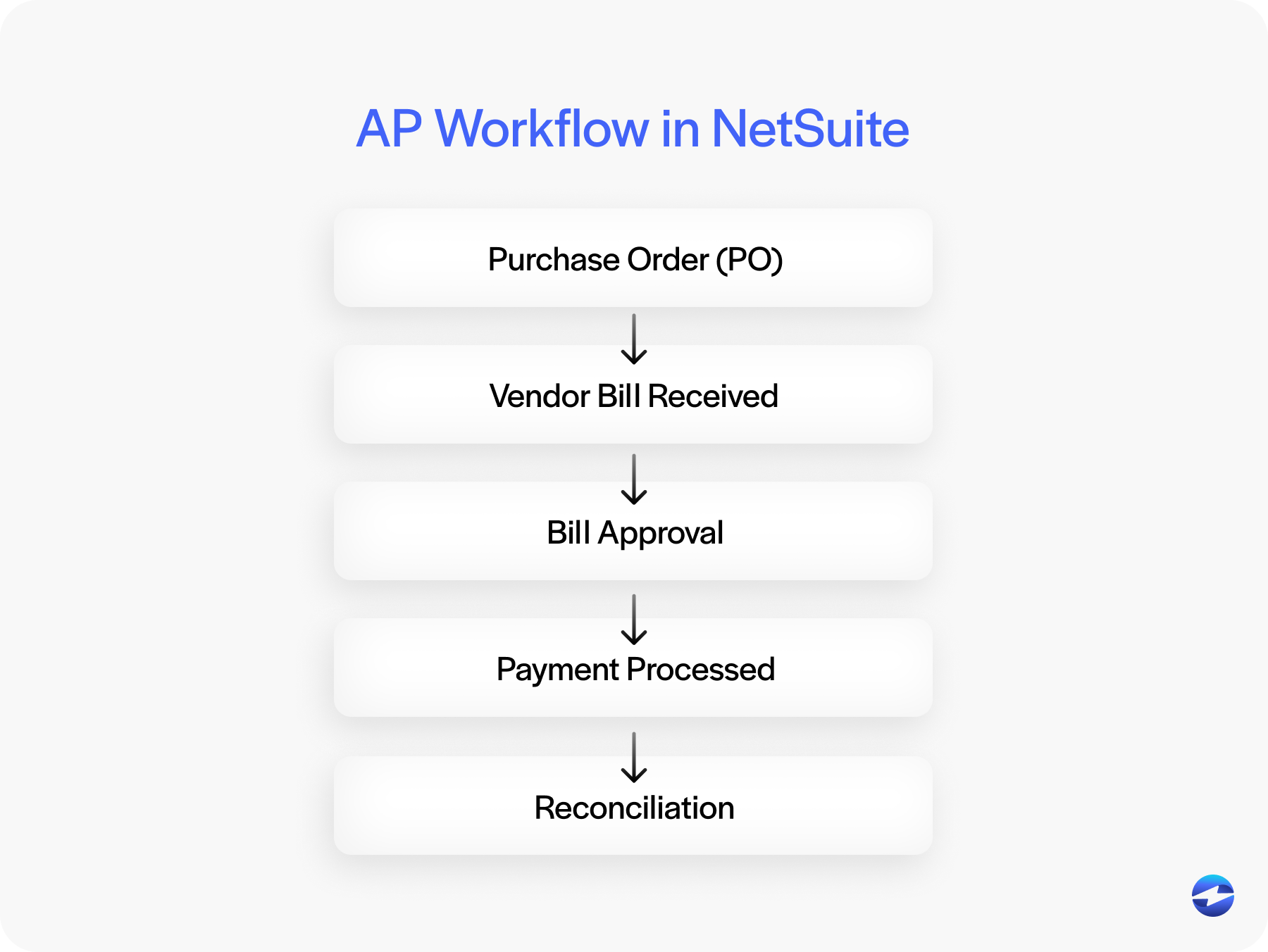

Understanding NetSuite’s AP Workflow

NetSuite’s accounts payable (AP) process revolves around a standard procure-to-pay cycle. You start with purchase orders (POs), receive bills from vendors, and then pay those bills on or before the due date.

Every stage is tied to your vendor records. A well-maintained vendor profile can influence how bills are coded, routed for approval, and paid. Inaccurate or incomplete vendor records often lead to delays or errors during NetSuite bill payment processing.

When it’s all working, it’s smooth. But when even one piece is off—a missing tax ID or incorrect bank details, for example—it creates friction across the entire AP chain.

Common Pain Points

Some of the biggest issues in NetSuite billing and vendor management show up in the small things: missed approvals, late payments, or duplicate bills that mess with your reporting.

Manual data entry is still a major hurdle. Without automated NetSuite bill capture, AP teams spend too much time keying in invoice details that should already be tied to a purchase order. And let’s not forget vendor communication: unclear payment statuses and inconsistent contact information slow everything down.

Then there’s the issue of timing. If your payment schedule is out of sync with your cash flow forecasting, you risk either missing discounts or overdrawing accounts. Add in the occasional duplicate entry or mismatched PO, and it’s easy to see why optimizing NetSuite bill payment is so important.

Best Practices for Vendor Management

A clean vendor record makes everything easier.

Start by ensuring your vendor data is complete: contact info, payment preferences, tax IDs, bank accounts, and contract terms should all be recorded. NetSuite gives you the flexibility to create custom fields, so take advantage of that to capture data that’s meaningful to your business.

Assigning vendor categories also helps segment reporting. If you’ve got different terms for contractors, product suppliers, and service providers, this can be especially useful.

And perhaps most importantly—keep that data clean. Regular audits of vendor records can prevent payment delays, errors, and compliance headaches down the line.

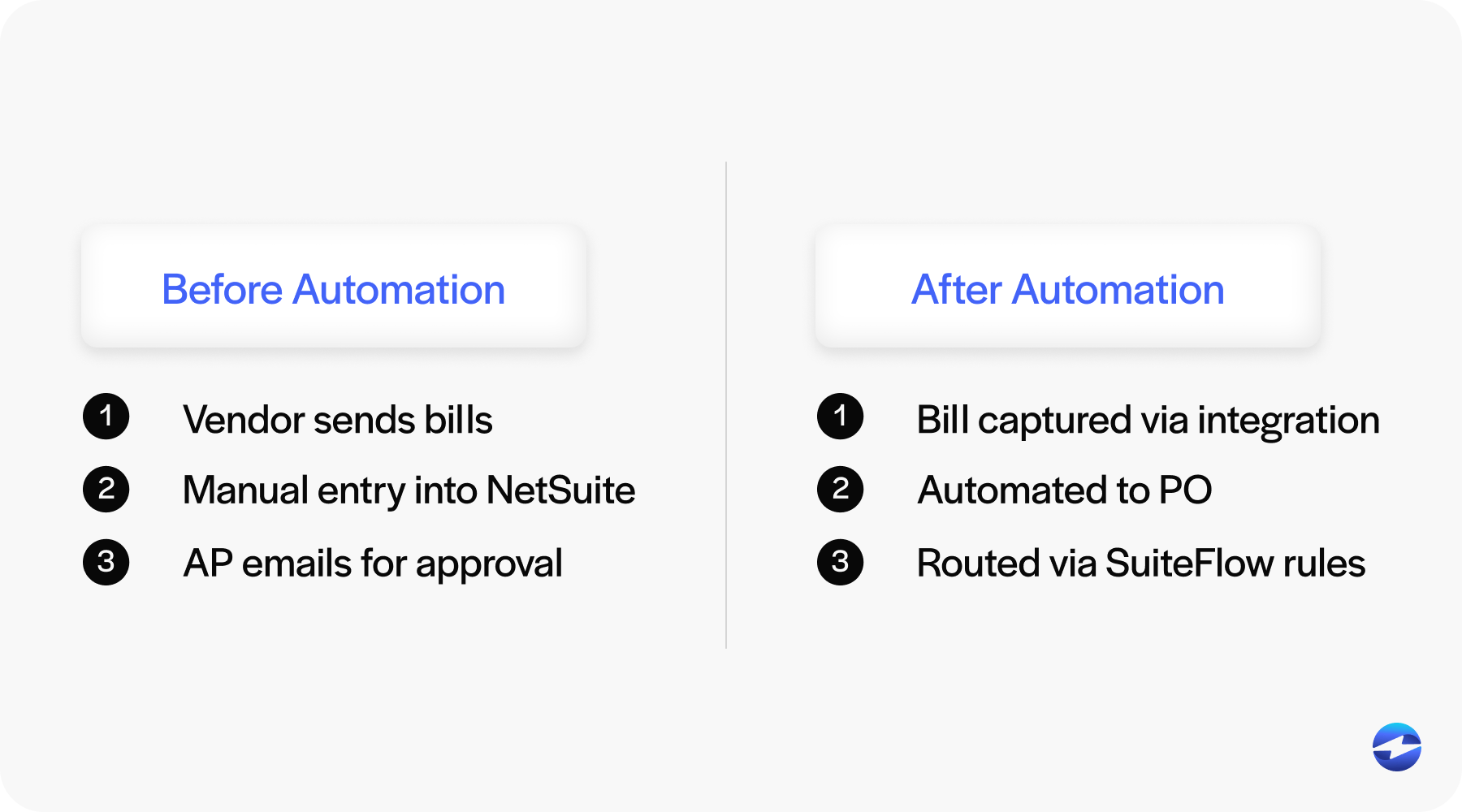

Automating Bill Payment Workflows

The more repeatable your process, the easier it is to automate.

Start with SuiteFlow to create approval workflows that match your business rules. For example, route all bills over $5,000 to a senior manager or auto-approve recurring monthly vendor charges. You can even set up alerts for overdue bills or unapproved invoices.

From there, build out scheduled payment batches. Assign default bank accounts and preferred payment methods for each vendor to cut down on manual decisions. This is where NetSuite payment processing really shines—especially when it’s connected to a reliable payment processor that seamlessly handles ACH, credit card, and virtual card payments.

Automating approvals and payments isn’t just about speed—it’s also about reducing errors and keeping your AP team focused on exceptions rather than routine tasks.

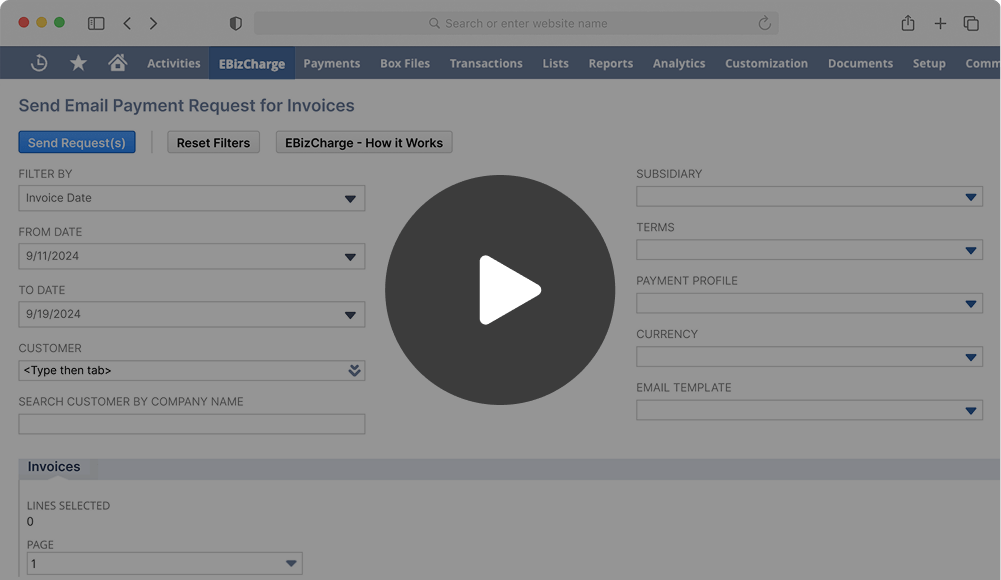

Leveraging EBizCharge for Payment Efficiency

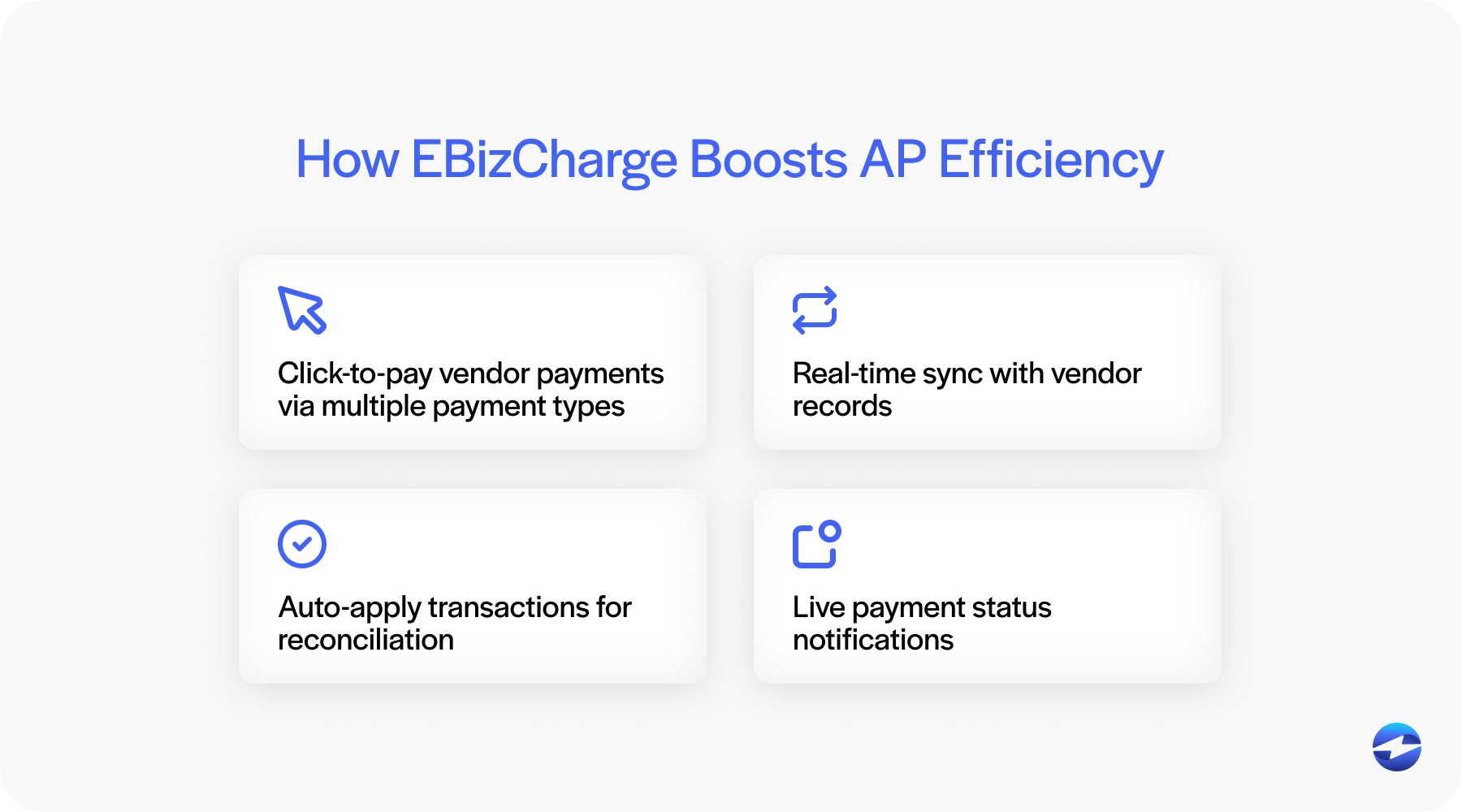

EBizCharge integrates directly with NetSuite to bring greater speed and accuracy to your AP processes. It’s a powerful payment processing solution that helps eliminate friction in NetSuite bill payment processing.

You can use EBizCharge to pay vendors through virtual cards, ACH, or credit card—right from inside NetSuite. Payments are logged instantly, reconciled in real time, and linked to the right vendor records. That reduces manual work and increases transparency.

EBizCharge also supports automated workflows and offers live payment status updates, so you’re not left wondering if a payment went through or which batch it was part of. With its seamless NetSuite integration, EBizCharge helps you maintain tighter control over vendor payments and reporting.

And if you’re using NetSuite credit card processing for other parts of your business, having a unified payment solution simplifies reconciliation and helps you avoid working with multiple disconnected tools.

Reporting and Cash Flow Management

Keeping track of what’s due, what’s paid, and what’s pending is essential. Luckily, NetSuite provides strong tools for this—if you know how to use them.

Start with aging reports. Customize them to reflect your vendor categories and terms. Build saved searches that flag overdue bills, highlight duplicate entries, or track pending approvals.

NetSuite bill capture data feeds into your ability to forecast cash requirements accurately. By analyzing past payment trends and current obligations, your team can make more informed decisions about when and how to disburse funds—especially when multiple vendors are on different payment cycles.

Simplifying NetSuite Bill Payment

Streamlining your NetSuite bill payment process doesn’t require a complete overhaul. Small improvements—like cleaner vendor records, basic automation, or better NetSuite integration with a payment processor—can save hours each week and significantly reduce risk.

Tools like EBizCharge bring these improvements within reach by handling the heavy lifting of payment processing and reconciliation. When paired with your internal AP processes, a solution like this can transform your workflow from reactive to strategic.

If you’re on an AP or finance team looking to reduce friction and improve accuracy, now’s the time to evaluate where your NetSuite billing and vendor management could be more efficient. With the right payment solution in place, you’ll get faster payments, cleaner books, and more bandwidth to focus on what matters most.