EBizCharge Supports High-Volume Credit Card Processing Services

EBizCharge Supports High-Volume Credit Card Processing Services

Fast, secure, and reliable credit card processing built for businesses with large transaction volumes.

As businesses grow and transaction volumes increase, the need for a dependable and scalable payment processing solution becomes critical.

High-volume merchants – whether they’re in eCommerce, wholesale, retail, or service industries – require specialized tools to efficiently manage thousands of transactions while maintaining security, speed, and cost-effectiveness. That’s where EBizCharge stands out.

As a leading provider of integrated payment solutions, EBizCharge offers tailored services that support the complex needs of high-volume businesses, helping them streamline payment processing operations, improve cash flow, and reduce processing costs.

This article will explore what high-volume merchants are, the key features and benefits they provide, and how EBizCharge helps high-volume merchants thrive in fast-paced, competitive markets.

What is a high-volume merchant account?

A high-volume merchant account is a payment processing account specifically designed for businesses that regularly process a large volume of credit and debit card transactions.

These accounts are ideal for companies across numerous industries with high transaction volumes, including eCommerce, retail chains, and travel and hospitality.

To qualify for a high-volume merchant account, businesses typically must process a minimum of $100,000 per month in total sales, although some processors may have different thresholds.

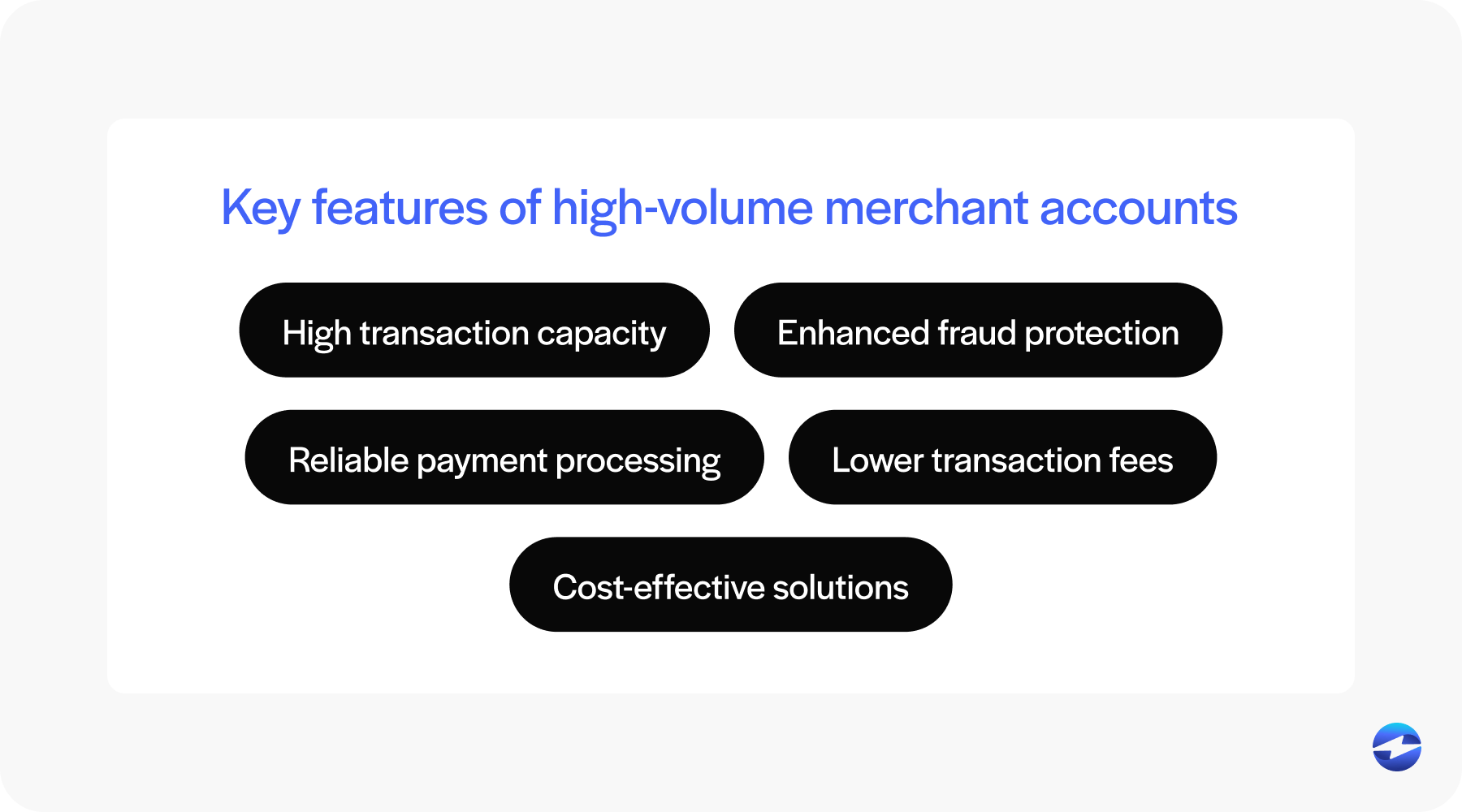

Key features of high-volume merchant accounts include:

- High transaction capacity: These accounts handle large daily transaction volumes without delays or system overloads, ensuring uninterrupted payment flows during peak sales periods, which is critical for businesses with heavy customer traffic.

- Enhanced fraud protection: With higher transaction volumes comes greater exposure to fraud risks. High-volume merchant accounts come equipped with advanced fraud detection tools and chargeback prevention features to safeguard merchants and their customers.

- Reliable payment processing: Stability and uptime are essential when processing thousands of transactions. These accounts offer powerful infrastructure with fast, consistent, and dependable payment processing across all channels.

- Lower transaction fees: Many high-volume accounts benefit from tiered or negotiated pricing models. As your volume increases, you may qualify for lower per-transaction rates, which can significantly reduce your overall processing costs.

- Cost-effective solution: High-volume merchant accounts streamline operations and reduce the need for multiple processing solutions. By consolidating your payment infrastructure, you can cut overhead while maximizing efficiency and profitability.

In addition to these features, high-volume merchant accounts offer several advantages, including enhanced cash flow, scalability, support, and faster payment collections.

High-volume merchant accounts improve cash flow by accelerating payment processing and easily scaling to accommodate business growth. They offer dedicated customer support to manage large-scale transactions more effectively, reducing errors and enhancing the overall user experience. This reliability and efficiency also build customer trust, which is crucial for businesses operating in competitive markets.

Merchants with increasing transaction volumes often partner with credit card processing solutions specializing in high-volume accounts to manage payments effectively while maintaining operational stability and customer satisfaction.

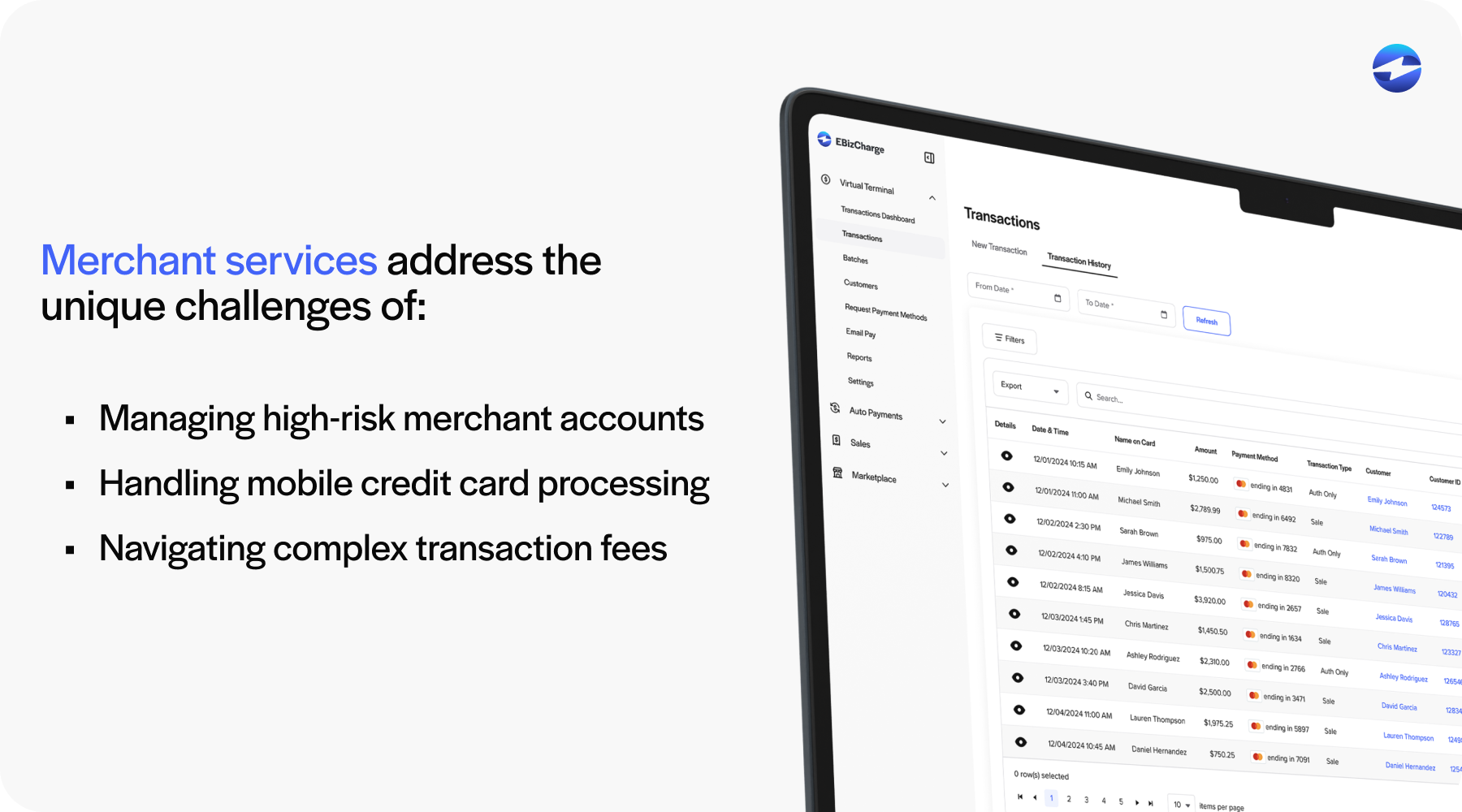

What are high-volume merchant services?

High-volume merchant services are specialized payment processing solutions designed for high-volume merchant accounts.

These merchant services are especially beneficial if a company has significant transaction volume, as they address the unique challenges of managing high-risk merchant accounts, handling mobile credit card processing, and navigating complex transaction fees.

High-volume merchants are often considered high-risk due to their larger financial exposure and greater potential for fraud or chargebacks. Processing a high volume of transactions increases the chances of encountering fraudulent activity, customer disputes, or regulatory issues.

If high-volume merchants suddenly go out of business, the financial losses for banks and payment processors can be substantial. As a result, payment providers often assess both volume and risk factors together when categorizing merchants.

In addition to technical performance, high-volume merchant services enhance the customer experience by ensuring quick, seamless, and dependable payment processing.

Integration capabilities are another advantage of high-volume merchant services, as most reliable providers enable businesses to sync their payment processing systems with their existing accounting, enterprise resource planning (ERP), eCommerce, and customer relationship management (CRM) software for powerful financial management.

Partnering with the right payment processors and payment gateways allows merchants to maintain a steady payment flow, mitigate risks, and foster lasting customer trust and loyalty.

How EBizCharge supports high-volume merchants

Whether managing large transaction loads, minimizing processing costs, or maintaining tight cash flow controls, high-volume merchants face unique challenges. Luckily, EBizCharge can help.

EBizCharge is designed to meet various needs with its scalable, efficient, and secure payment processing solutions. Its powerful infrastructure ensures fast and reliable transactions, even during peak business hours, helping businesses avoid bottlenecks and downtime.

Additionally, EBizCharge provides transparent and competitive flat-rate pricing structures that help high-volume merchants control costs and predict expenses without the risk of hidden fees. For businesses with more complex processing needs, EBizCharge also offers tiered and interchange-plus pricing models. These options provide merchants with the flexibility to select a structure that aligns with their transaction profiles, yielding greater potential for savings based on volume and card type.

It also offers advanced reporting and reconciliation tools that integrate directly with major accounting, ERP, CRM, and eCommerce systems, allowing merchants to streamline their financial workflows, reduce manual data entry, and gain real-time insights into transaction activity.

With dedicated support and custom configuration options, EBizCharge empowers high-volume businesses to optimize payment operations and drive sustainable growth.

Why merchants love EBizCharge

Beyond its capabilities for high-volume merchants, EBizCharge stands out as a top-rated payment solution thanks to its flexibility, ease of use, and customer-first approach.

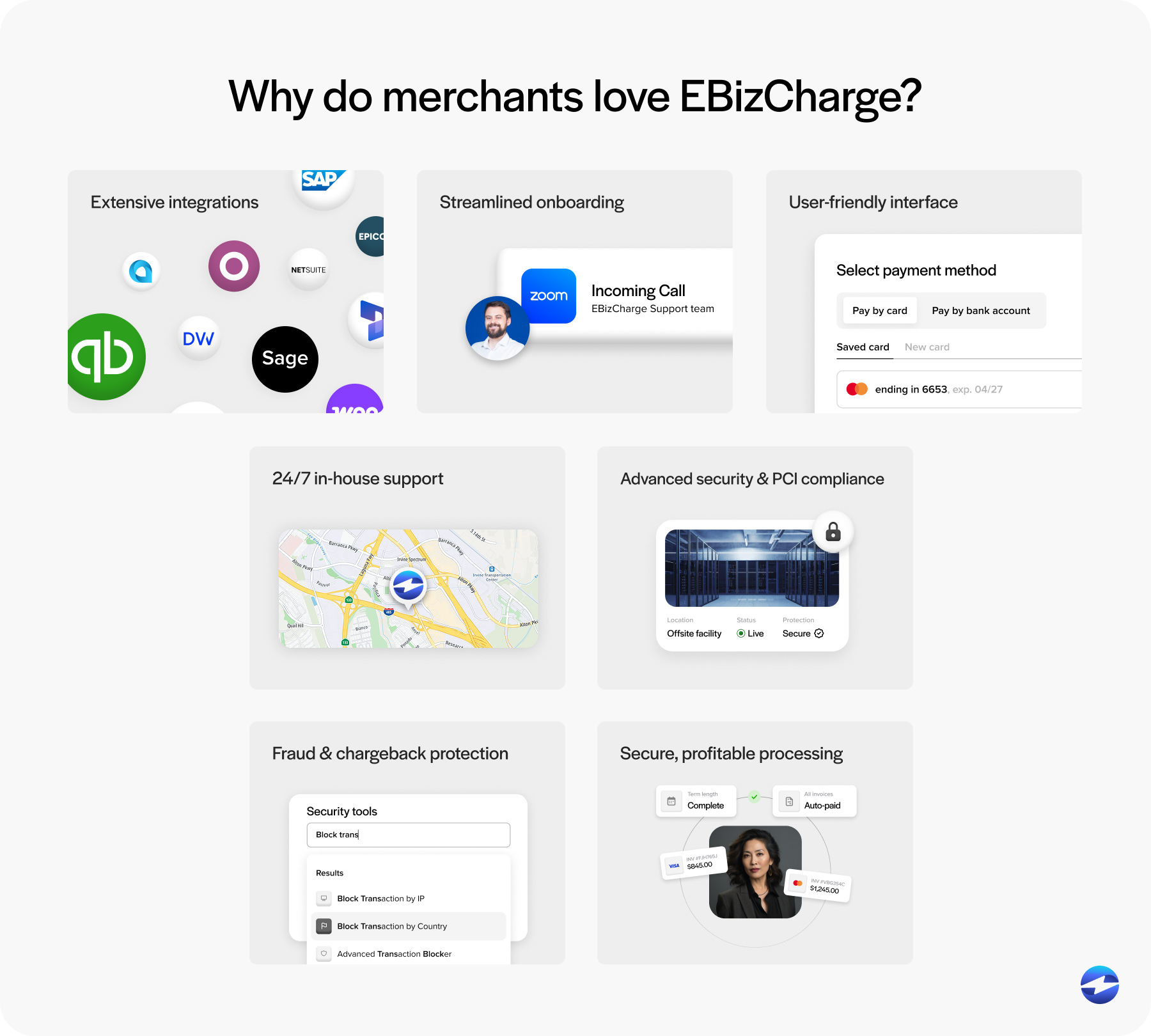

Seven key benefits of EBizCharge include:

- Extensive integrations: Easily connect with over 100 popular ERP, accounting, CRM, and eCommerce platforms to automate payments, eliminate duplicate data, and accelerate billing and reconciliation.

- Streamlined onboarding: Offers hands-on implementation support and comprehensive training to help merchants go live quickly and efficiently.

- User-friendly interface: Designed for ease of use, even for non-technical users, making daily operations straightforward and efficient.

- 24/7 in-house support: Access to dedicated customer support at any time, ensuring reliable assistance whenever it’s needed.

- Advanced security and Payment Card Industry (PCI) compliance: Includes built-in tools such as tokenization, encryption, and customizable fraud modules to reduce fraud and enhance security at no additional cost.

- Fraud and chargeback protection: Helps reduce payment fraud, mitigate chargebacks, and protect merchants with proactive risk management tools.

- Secure, profitable processing: Enables merchants to process secure transactions with confidence while improving business profitability via greater operational efficiency and lower profit loss.

Overall, EBizCharge delivers a streamlined, secure, and highly adaptable payment solution that’s easy to implement, use, and scale across all industries.

Does EBizCharge offer lower processing rates for high-volume merchants?

Yes. EBizCharge offers custom pricing structures tailored to high-volume businesses, including flat-rate and interchange-plus options. These pricing models help reduce costs by leveraging your transaction volume to secure more competitive rates while eliminating hidden fees and unpredictable monthly charges.

Can EBizCharge integrate with my existing ERP or accounting system?

Absolutely! EBizCharge offers native integrations with over 100 ERP, accounting, and CRM systems, including QuickBooks, NetSuite, Microsoft Dynamics, Sage, Salesforce, SAP, Acumatica, and more.

These integrations enable high-volume merchants to automate payment acceptance, sync transaction data, and streamline reconciliation, all from within their existing platforms.

How does EBizCharge handle high-risk transactions for high-volume merchants?

EBizCharge offers advanced risk management features such as customizable transaction limits, fraud filters, and card validation rules. These tools help merchants mitigate the risk of chargebacks and fraudulent activity, particularly in industries with a high volume of online or card-not-present (CNP) transactions.