Blog > How Do You Offset Credit Card Processing Fees?

How Do You Offset Credit Card Processing Fees?

Every swipe or tap of a credit card comes with processing fees that can hinder a business’s profitability if not properly managed.

To navigate these expenses, it’s essential to understand the different types of fees involved and the strategies available to counteract them.

This article will provide helpful strategies for merchants to offset these fees to minimize the costs of accepting credit card payments.

Understanding credit card processing fees

It’s essential for businesses to know how to navigate credit card processing fees to maintain healthy cash flows and revenue streams. These fees aren’t just a single expense but comprise various types, each affecting the bottom line.

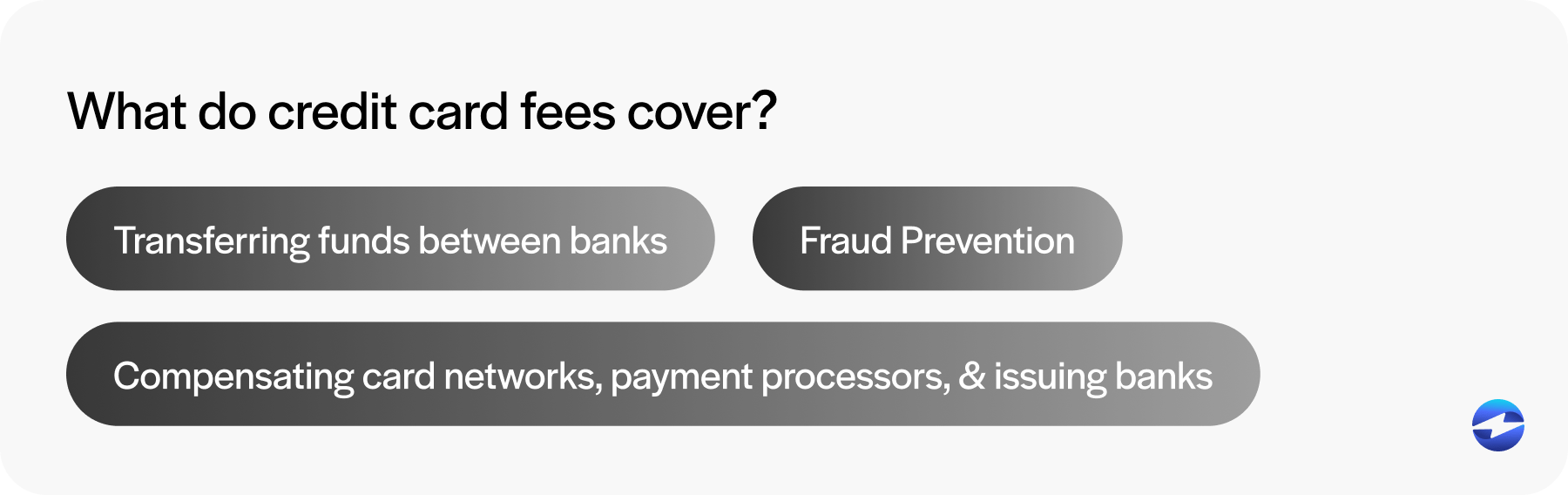

Credit card processing fees are the costs associated with card transactions that businesses must pay to accept and process credit or debit cards from customers. These fees typically range from 1.5% to 3.5% and can cover the costs associated with transferring funds between banks, fraud prevention, and compensating card networks, payment processors, and issuing banks.

Understanding the various credit card processing fees your company may encounter will help you find effective ways to offset them and enhance operational cost efficiency.

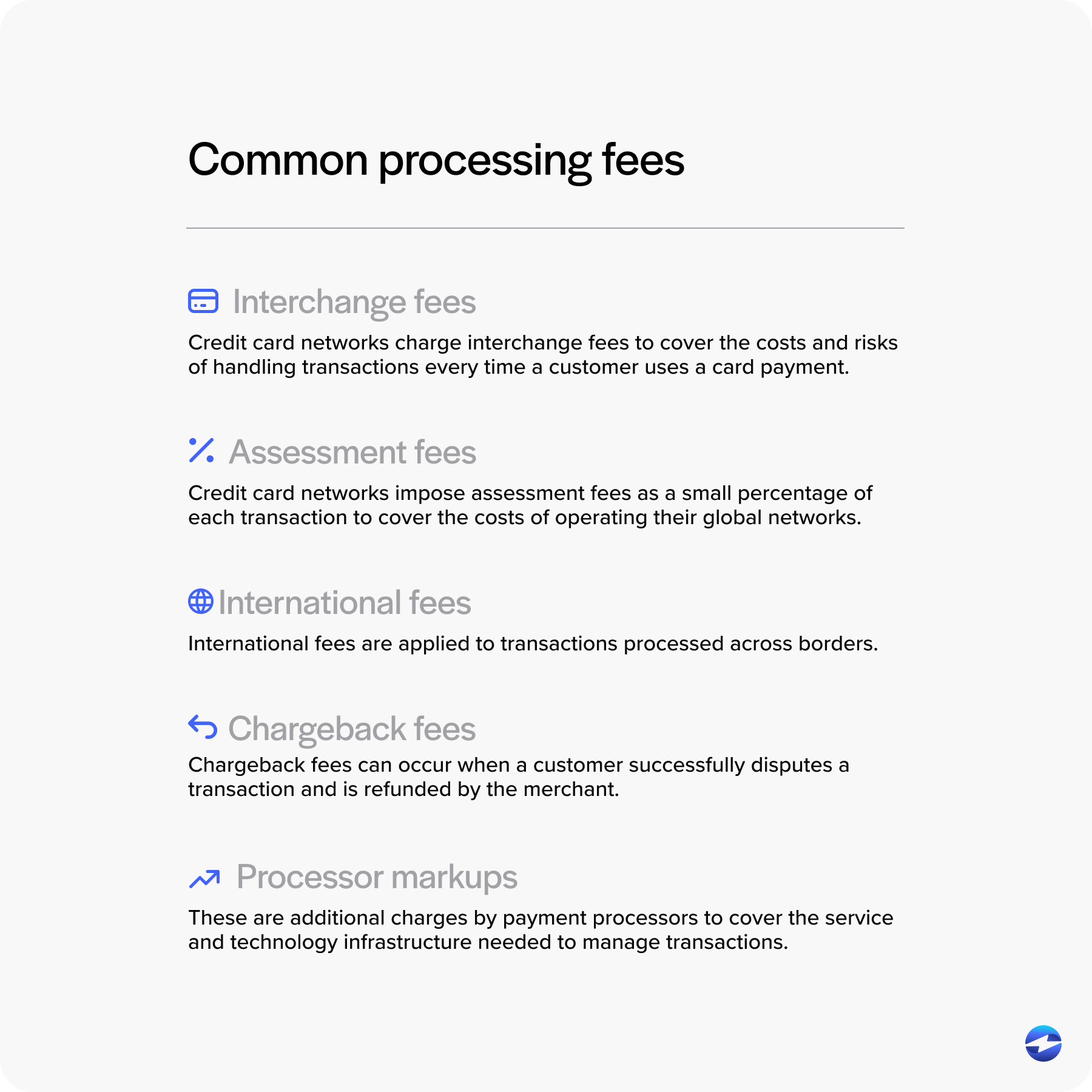

Here are some of the most common processing fees:

- Interchange fees are set by credit card networks like Visa and Mastercard. They charge these fees to merchants every time a customer uses a card payment to cover the cost of handling transactions and the risks involved. These fees can vary depending on factors like card type and transaction volume.

- Assessment fees are imposed by credit card networks to cover the cost of operating their global networks. Unlike interchange fees, assessment fees aren’t negotiable and are charged as a small percentage of each transaction. These fees may change depending on the card network but typically remain consistent for all transactions within that network.

- International fees (or foreign transaction fees) are applied when a transaction is processed across borders. When a customer from another country makes a payment, these fees are charged to cover the additional handling and currency conversion processes. International fees may be higher than domestic fees, but they’re necessary for businesses that operate online or serve global clients.

- Chargeback fees can occur when a customer disputes a transaction. If the dispute is resolved in favor of the customer, the merchant is charged a fee to cover the processing cost of reversing the transaction. A chargeback can happen due to fraud or dissatisfaction with a product and can hinder the reputation of your business.

- Processor markups are additional charges by payment processors to cover the service and technology infrastructure needed to manage transactions. Since markups vary by provider, exploring different payment processors can help you limit these costs to improve profitability and cash flow.

Beyond the standard fees, businesses should understand the pricing structures used by processors, as these influence overall costs.

3 standard pricing structures of credit card processing

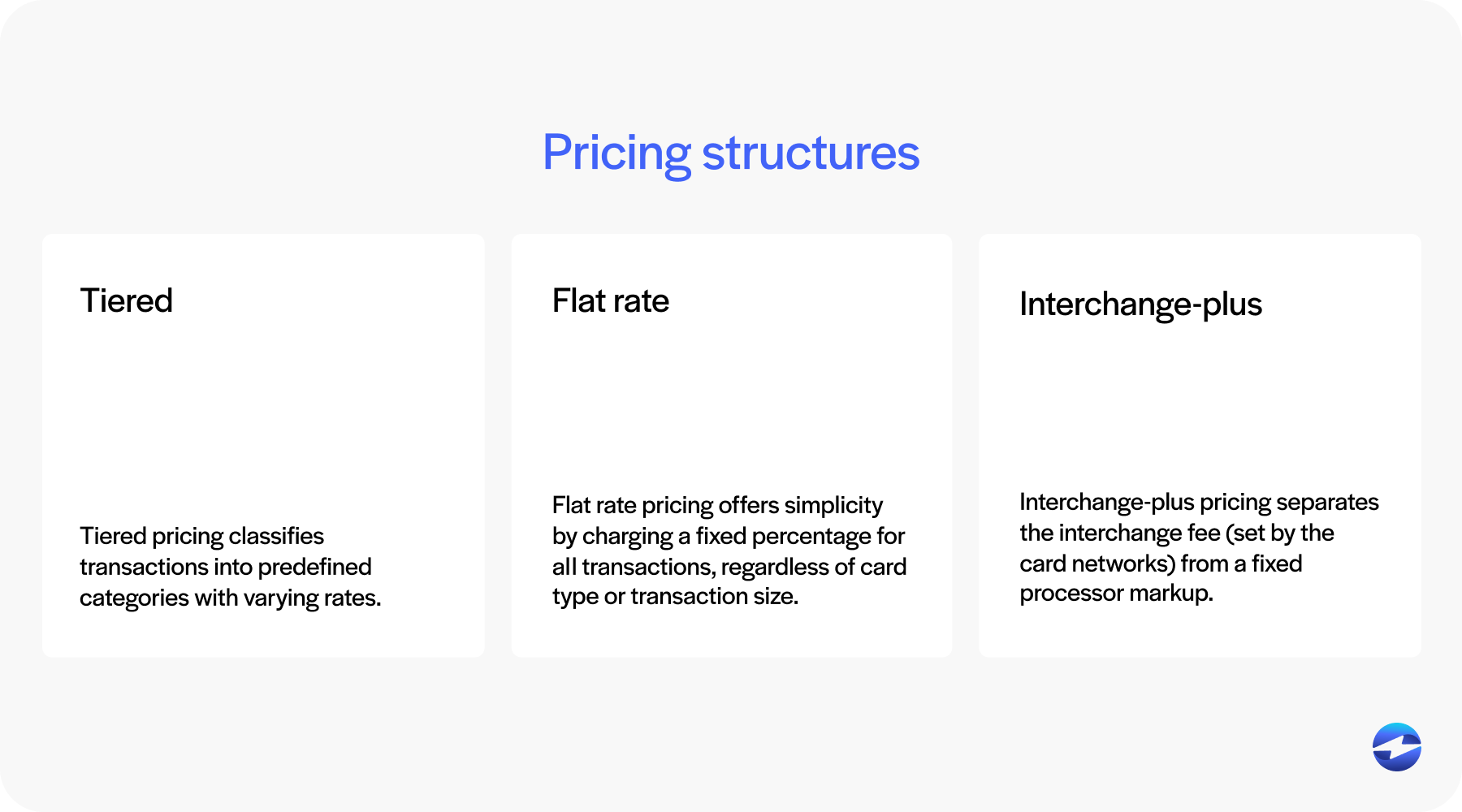

Payment processors typically offer three main pricing models – tiered, flat rate, and interchange-plus – each with advantages and drawbacks.

Knowing how these pricing structures work can help your business make informed decisions and optimize payment processing expenses.

Here’s how each pricing structure works:

- Tiered pricing classifies transactions into predefined categories (qualified, mid-qualified, and non-qualified) with varying rates. This model can be unpredictable, as many transactions fall into higher-cost tiers.

- Flat rate pricing offers simplicity by charging a fixed percentage for all transactions, regardless of card type or transaction size. While transparent, it may not always be the most cost-effective pricing structure for high-volume merchants.

- Interchange-plus pricing, often preferred for its clarity and fairness, This can give merchants better insights into where their money is going and result in lower costs for companies with substantial or varied transaction volumes.

Differentiating the various pricing structures and fees associated with credit card processing can enable your business to implement strategies to manage or pass these costs to customers legally.

How to offset credit card processing fees

Credit card processing fees can eat into a business’s profit margins, especially when a significant portion of sales are made through credit card payments. Fortunately, there are several ways to offset costs without compromising customer experience or compliance.

The following sections will provide five strategies merchants can use to mitigate the financial burden and impact of payment processing fees.

1. Implement a cash discount program

A cash discount program is a simple way to offset credit card processing fees by offering customers a discount for using cash payments instead of credit or debit cards.

Cash discount programs incentivize customers to choose a lower-cost payment method that’s financially advantageous for your business. These programs can reduce the volume of card transactions, thereby lowering the interchange fees associated with them.

Nonetheless, it’s crucial to communicate this program to your customers to ensure transparency.

2. Surcharge credit card transactions

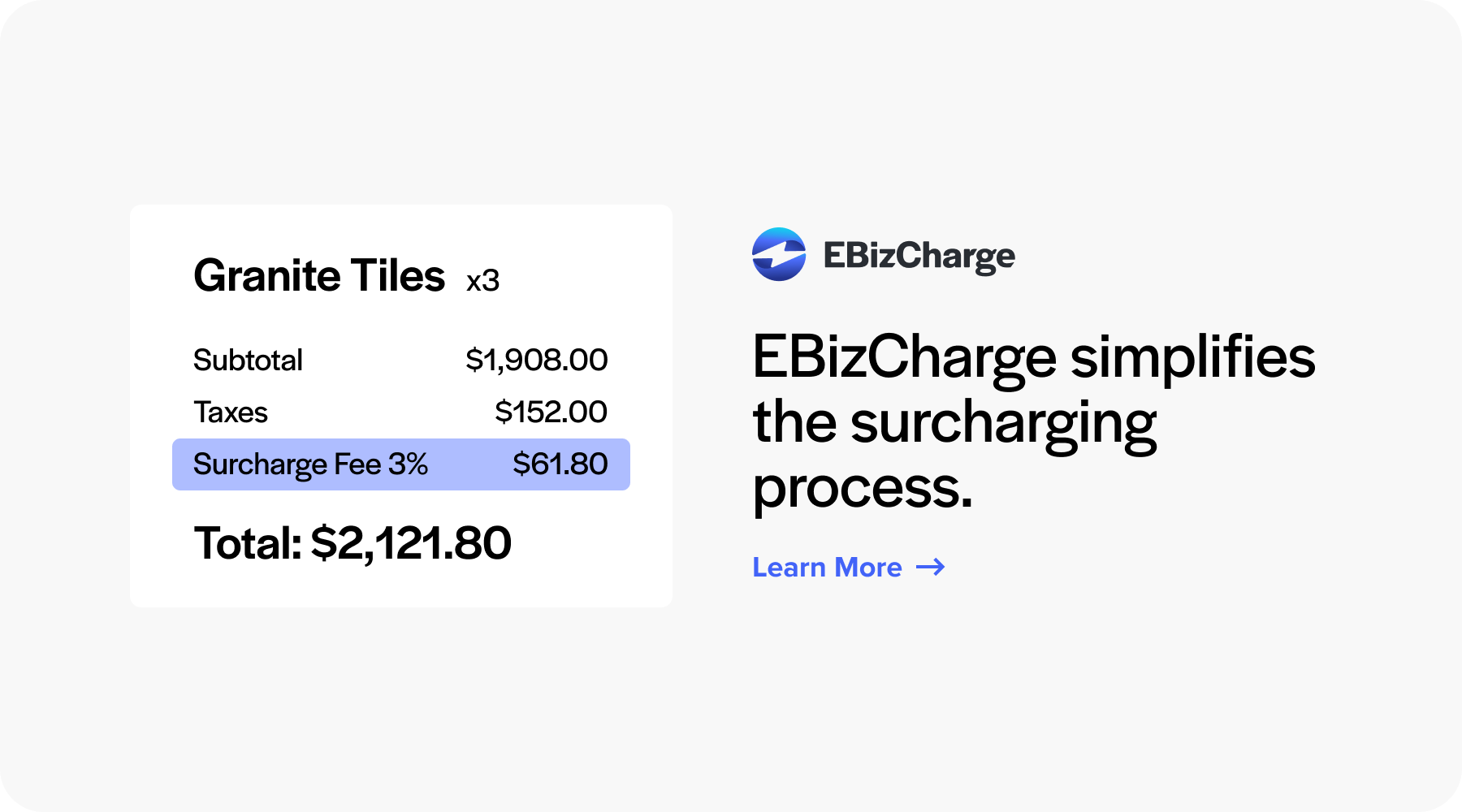

Credit card surcharging involves merchants charging an additional fee (a percentage of the transaction) to customers who choose to pay by credit card.

Surcharging transfers the responsibility of the credit card processing fee to the customer so that businesses may recover the costs of handling these transactions and lower the impact on their profit margin.

When implementing surcharging, it’s imperative to comply with regulations and guidelines set by credit card networks and local state legislatures. This includes clearly communicating the surcharge to customers before purchase and limiting surcharging amounts to the legal amount, which is capped at 4% in the U.S. That said, specific card networks like Visa cap their surcharging amounts at 3%, so verifying surcharging practices with your network is essential.

It’s also important to note that surcharging is not legal in all 50 states, so merchants must ensure it’s lawful in their area before passing these costs to customers.

In addition to staying within legal surcharging limitations, your company should ensure charges are fair and clearly stated on its website or storefront to maintain customer trust and satisfaction.

3. Encourage alternative payment methods

Encouraging alternative payment methods can significantly offset credit card processing fees since debit cards, Automated Clearing House (ACH)/eChecks, and other options are typically more cost-effective.

To effectively encourage alternative payments, businesses should highlight the benefits of these methods to customers, such as faster processing times and enhanced security features. Providing incentives or discounts for using these methods can also be a compelling strategy.

By diversifying payment options, businesses can reduce credit card processing fees and offer more convenience to customers to improve satisfaction and brand loyalty.

4. Negotiate with your payment processor

Negotiating pricing and rates with payment processors can also offset credit card processing fees, as these providers typically determine many costs involved in accepting credit card transactions.

Transparent payment processors often leave room for negotiation, especially for companies with high transaction volumes. Merchants should arm themselves with knowledge about market rates as well as their own transaction volumes. Detailed insights into these areas can strengthen your bargaining position. Leveraging competitive offers from other processors can also lead to better rates.

Businesses can solidify more profitability when processing these payments by effectively negotiating lower credit card processing fees with processors.

5. Leverage level 2 and level 3 processing

Level 2 and 3 processing refers to enhanced data processing options that allow businesses to submit additional transactions details, such as customer codes, tax amounts, or line-item product descriptions, along with the standard payment information. These higher data levels are primarily available to B2B and B2G (business-to-government) merchants that process corporate, purchasing, or government cards.

By providing this extra information, businesses help reduce the perceived risk of the transaction for card-issuing banks, which can qualify them for lower interchange rates. As a result, businesses that qualify for level 2 and 3 processing can significantly lower their credit card processing costs, improving their margins on high-ticket or frequent transactions. P roper setup with a compatible payment gateway and merchant account provider is usually required to take full advantage of these savings.

Implementing level 2 or 3 processing requires an understanding of which transactions qualify and ensuring your system can capture the necessary data. Businesses that manage to make this transition benefit from reduced credit card processing fees on qualifying transactions. This strategy is particularly beneficial for merchants frequently handling large transactions, as the savings can be substantial. By leveraging this advanced processing, companies can improve their cost structure significantly.

One of the first factors businesses should consider when offsetting credit card processing fees is their choice of payment processor. Evaluating each processor’s costs and fees before implantation is crucial for keeping costs down.

Offsetting credit card processing fees with EBizCharge

EBizCharge offers valuable, practical solutions to help businesses offset credit card processing fees while maintaining efficiency and compliance.

EBizCharge’s seamless integration with numerous accounting, enterprise resource planning (ERP), customer relationship management (CRM), and other platforms reduces costs and enhances operational workflows.

EBizCharge supports credit card surcharging, enabling merchants to legally pass processing fees to customers who choose to pay with credit cards — helping these companies recoup costs without compromising transparency.

Additionally, the platform facilitates interchange optimization by ensuring that transactions are processed in ways that qualify for the lowest possible rates, resulting in lower overall fees. To further support financial oversight, EBizCharge offers robust reporting tools that provide clear, detailed insights into payment activity and associated costs.

Altogether, these features make EBizCharge a powerful ally in reducing the financial impact of credit card processing, helping businesses protect their bottom line while simplifying payment management.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge