How to Integrate a Payment Gateway into Acumatica

How to Integrate a Payment Gateway into Acumatica

EBizCharge is the #1 customer-rated payment gateway for Acumatica

Acumatica’s electronic payment processing is a game-changer for businesses looking to enhance their sales and receivables processes. Integrating a payment gateway into Acumatica’s system further streamlines online transactions, allowing businesses to accept payments securely and efficiently.

This article will guide you through the steps necessary to set up Acumatica integrated payments effectively. From selecting the right provider to testing the integration, you’ll learn how to optimize your Acumatica payment processing capabilities for optimal efficiency.

What is Acumatica?

Acumatica is a cloud-based ERP system designed to meet the diverse needs of mid-sized companies. It provides integrated functionalities across various business operations, from finance and accounting to customer relationship and inventory management.

One of Acumatica’s standout features is its user-friendly interface, which enhances collaboration and efficiency across different business workflows. Real-time insights from a unified source help businesses simplify automation and coordinate operations more efficiently.

Recognized for its high customer satisfaction ratings, Acumatica is considered one of the fastest-growing cloud ERP solutions, making it a reliable choice for businesses looking to streamline their operations and improve overall efficiency.

To get the most out of Acumatica’s services, businesses should integrate a payment gateway that further enhances payment operations with a comprehensive suite of tools and features.

Why businesses should integrate a payment gateway into Acumatica

Integrating a payment gateway into Acumatica isn’t just a technical upgrade; it’s a strategic move that enhances operational efficiency and minimizes errors associated with payment processing.

- Automation: An integrated payment gateway automates accounts receivable tasks, decreasing manual entry and the likelihood of errors as well as freeing up valuable time for other crucial tasks. These integrations also offer competitive transaction fees, making it a cost-effective choice for businesses handling high-volume transactions.

- Faster customer payments: An Acumatica integration facilitates faster customer payments, providing options like click-to-pay links and a self-service portal for managing invoices. This not only speeds up the payment process but also improves customer satisfaction and loyalty. Allowing customers to pay their invoices with just a few clicks also increases convenience, potentially boosting sales and repeat business.

- Compliance with industry standards: Compliance with Payment Card Industry Data Security Standards (PCI-DSS) is another significant benefit of integrating a payment gateway into Acumatica. Handling sensitive credit card information securely reduces the risk associated with data breaches and ensures that your business remains compliant with industry standards.

- Mobile capabilities: Acumatica’s mobile capabilities allow businesses to accept payments anywhere, increasing flexibility and convenience in payment collection. This seamless integration of multiple payment methods ensures a smooth and efficient payment process, enhancing operational efficiency and customer satisfaction.

Now that you know their benefits, it’s time to set up a payment gateway into Acumatica.

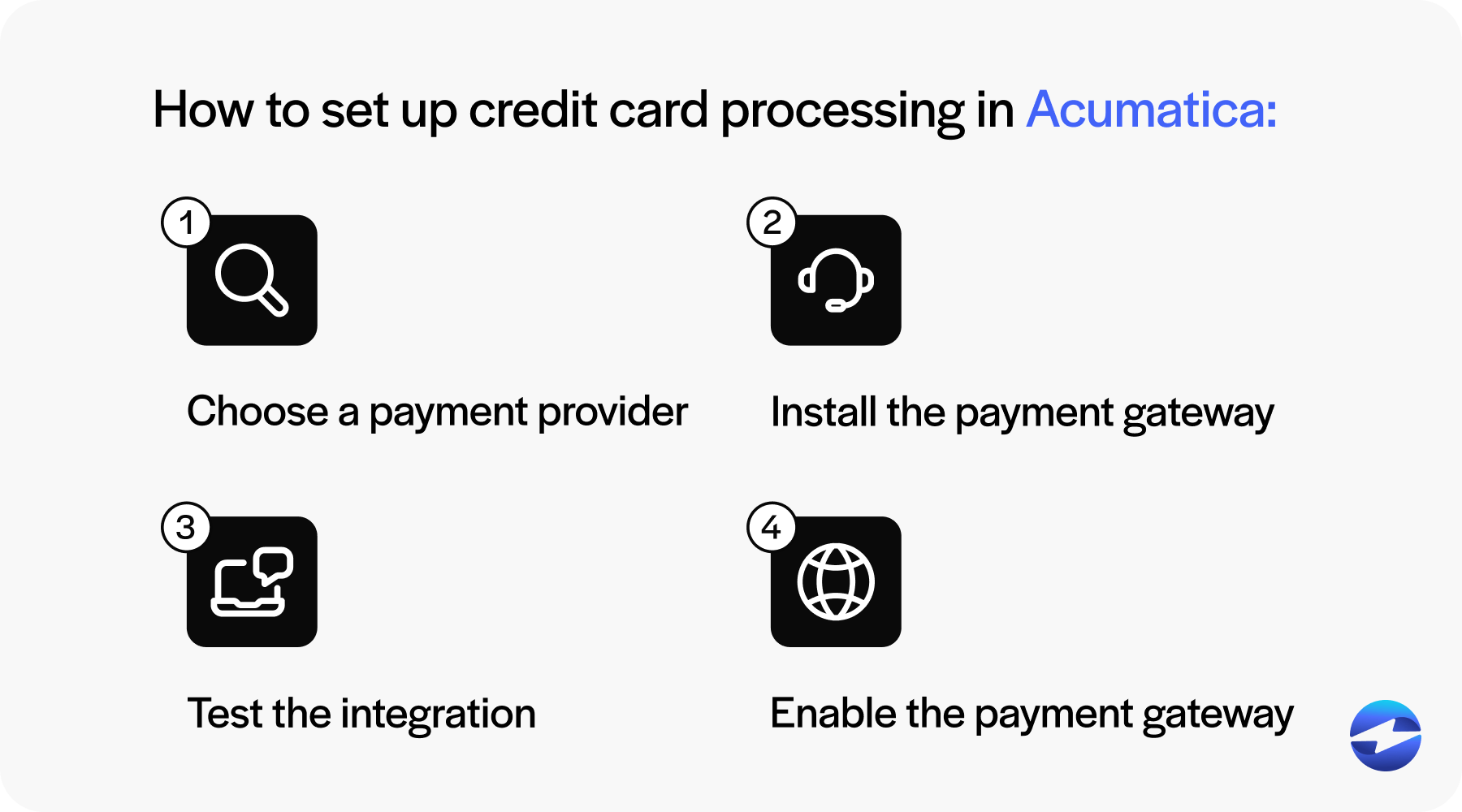

Setting up credit card processing in Acumatica

Your chosen payment gateway provider should help you set up the payment gateway that will allow you to process credit cards in Acumatica, but it’s important to understand the basic breakdown of how the integration process works. Efficient setup ensures that Acumatica payments are processed quickly and securely. This benefits both businesses and their customers.

Here is a quick breakdown of how to set up credit card processing in Acumatica:

- Choose a payment gateway provider

- Install the payment gateway

- Test the integration

- Enbale the payment gateway

1. Choose a payment gateway provider

Choosing a payment gateway is the first step in setting up credit card processing in Acumatica. It involves ensuring compatibility with Acumatica and confirming the payment gateway meets your business needs. Trusted payment gateways like EBizCharge are commonly used for their reliability and robust features.

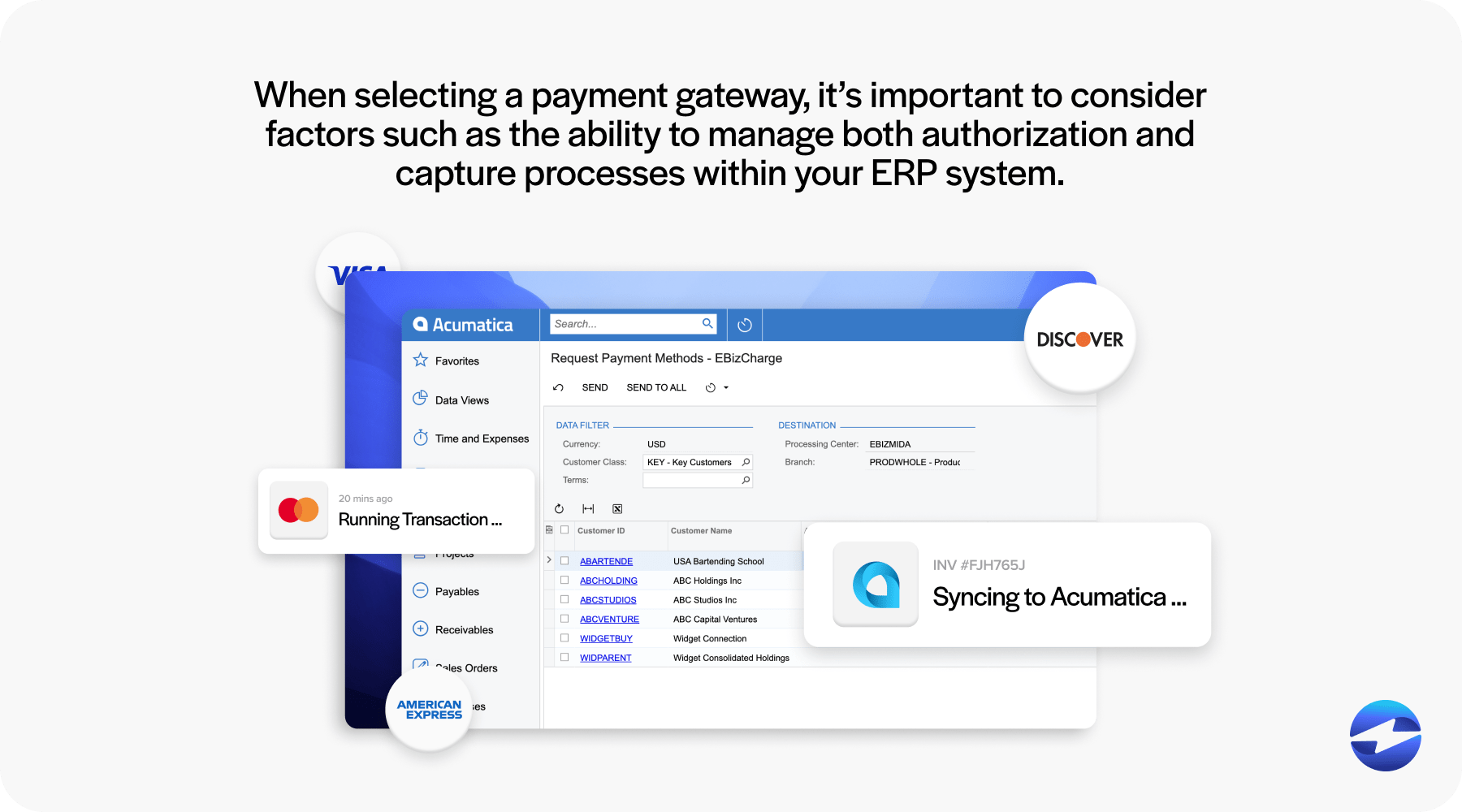

When selecting a payment gateway, it’s important to consider factors such as the ability to manage both authorization and capture processes within your ERP system. Acumatica’s marketplace offers a regularly updated list of certified payment solutions to assist users in making an informed choice.

2. Install the payment gateway

The next step is to install the payment gateway. This step requires you to configure the connection by inputting essential credentials, such as API keys and identifiers provided by the payment gateway. By establishing these connection settings, Acumatica can securely communicate with the external payment service, facilitating the transmission and processing of transactions. This configuration is critical because it forms the foundation for subsequent testing in a sandbox environment and, ultimately, for live operations. Ensuring that the processing center is correctly set up guarantees that all payment operations, including authorization and capture, are handled properly and in accordance with both Acumatica’s and the payment gateway’s specifications.

3. Test the integration

Once the payment gateway is integrated, make sure to test it before going live. This involves using a sandbox environment to verify that Acumatica payment processing works as expected. Processing various test transactions, such as authorization, capture, void, and refunds, helps ensure that all aspects of the payment gateway are functioning properly.

Documentation and resources from both Acumatica and the payment gateway are invaluable for ensuring a smooth integration testing process.

4. Enable the payment gateway

The final step in integrating a payment gateway into Acumatica is enabling it for live transactions after successful testing. This involves completing a configuration process that includes entering the API keys obtained from your chosen payment gateway provider.

Once the payment gateway is enabled, businesses can set specific payment types they want to accept, like credit and debit cards, within the Acumatica system.

When setting up credit card processing, it’s important to choose a payment gateway that fits your business’s needs. Evaluating each gateway option will help you get the most out of your payment operations.

Choosing the right payment gateway

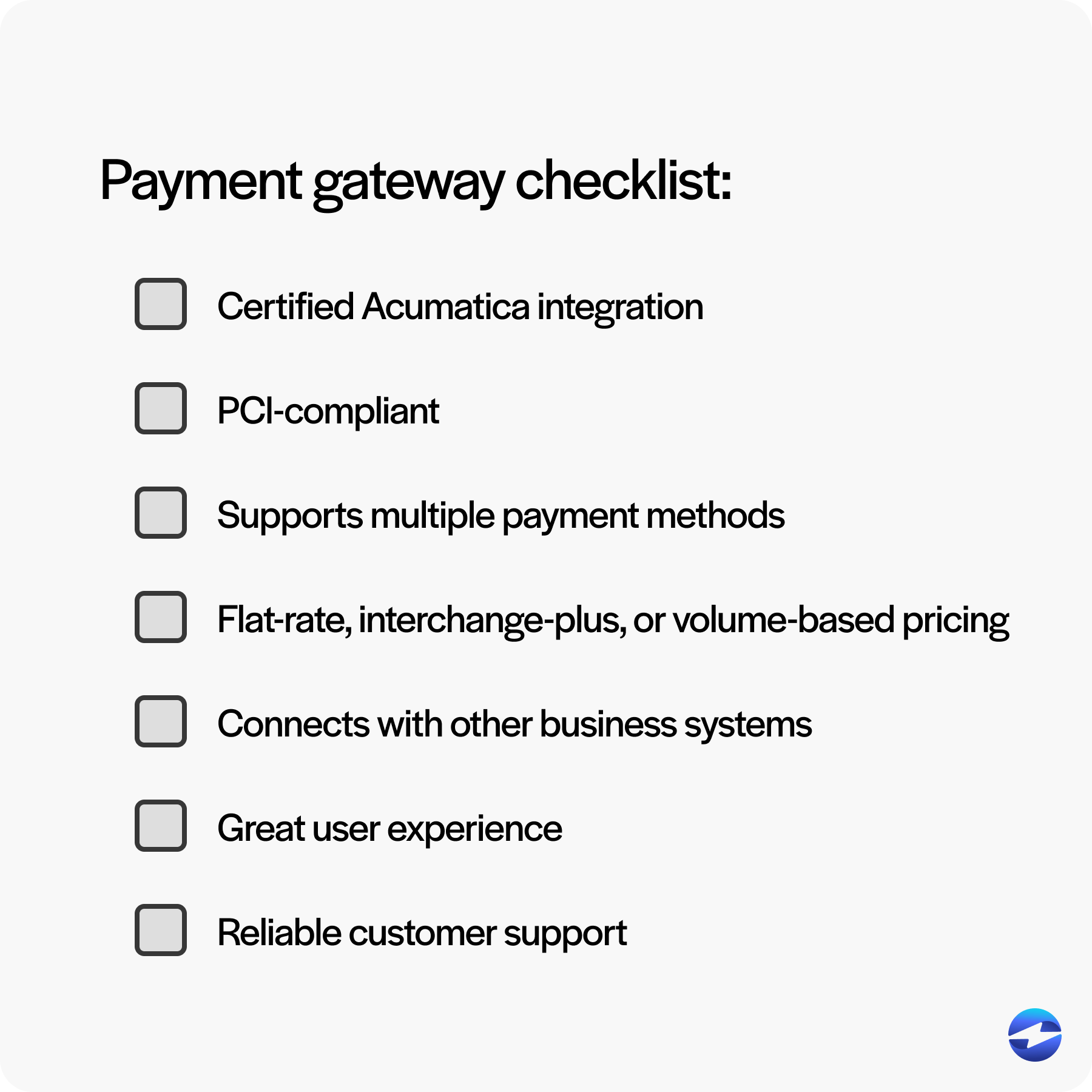

The right payment gateway should integrate smoothly with Acumatica, minimizing setup time and ensuring real-time transaction synchronization. Look for a provider with a certified Acumatica integration to avoid compatibility issues.

Security and compliance are also crucial factors to consider. Opt for a PCI-compliant gateway with encryption, tokenization, and fraud detection tools to protect customer data and prevent chargebacks. Additionally, your gateway should support multiple payment methods, including credit/debit cards, ACH, digital wallets, and BNPL options, ensuring a frictionless payment experience for customers.

Cost is another major factor. Compare transaction fees, monthly costs, setup fees, and chargeback charges to find a provider with competitive and transparent pricing. Flat-rate, interchange-plus, or volume-based pricing can help minimize costs based on your business needs.

A well-integrated payment gateway should also connect with other essential business systems such as CRM, accounting software, eCommerce platforms, and POS systems. This reduces manual work, improves reporting accuracy, and streamlines financial operations.

User experience matters – both for your team and your customers. Look for a payment gateway with an intuitive dashboard, automated invoicing, self-service payment portals, and mobile compatibility for easy access. A seamless checkout process and recurring billing features can further improve efficiency.

Reliable customer support is essential, especially for payment processing. Choose a provider with 24/7 support, quick response times, and minimal downtime to ensure smooth operations and quick issue resolution.

Finally, consider customization and scalability. Your Acumatica payment gateway should grow with your business, offering API access, custom payment flows, multi-location support, and high-volume processing capabilities. By evaluating these factors, you can select a payment gateway that enhances efficiency, reduces costs, and integrates seamlessly with Acumatica.

EBizCharge: A comprehensive Acumatica payment gateway solution

Integrating a payment gateway like EBizCharge with Acumatica can streamline financial operations by enhancing payment processing efficiency. EBizCharge’s Acumatica integrated payments simplify transactions and reduce manual entry, minimizing errors and improving overall accuracy. This integration also provides a secure environment for handling Acumatica payments, ensuring that sensitive customer data is protected through encryption and compliance with industry standards.

EBizCharge offers a range of tools designed to optimize payment workflows, including automated invoicing, real-time payment reconciliation, and a built-in customer payment portal that allows clients to securely make payments online. Its tokenization technology ensures that cardholder data is securely stored, reducing the risk of fraud while maintaining PCI compliance. The system also supports recurring billing, making managing subscription-based payments and long-term customer accounts easier.

Additionally, EBizCharge automates payment processing details, saving time by reducing manual tasks, and offers comprehensive reporting tools that provide detailed insights into financial activities. Businesses can access real-time transaction data, generate custom financial reports, and monitor cash flow more accurately. With a user-friendly interface, seamless integration, and advanced payment management features, EBizCharge ensures that businesses using Acumatica can process payments efficiently, securely, and with minimal operational friction.