Blog > NetSuite Payments: Your Guide to Processing Credit Cards

NetSuite Payments: Your Guide to Processing Credit Cards

With an ever-growing reliance on online transactions, understanding the nuances of payment systems is essential. NetSuite offers a comprehensive suite of financial services designed to streamline payment processes. Knowing how to effectively utilize its features can enhance your business’s cash flow and customer satisfaction.

Whether you’re a seasoned user or a newcomer, this guide will equip you with the knowledge you need to harness the full potential of NetSuite payments.

Understanding credit card processing in NetSuite

NetSuite credit card payment processing allows businesses to securely process customer payments by integrating with payment gateways and merchant accounts, enabling seamless transactions for online, in-store, and invoice-based sales.

NetSuite automates key aspects of the payment process, including authorization, capture, and settlement, reducing manual effort and minimizing errors. Additionally, it includes security features such as tokenization, encryption, and fraud prevention tools to ensure compliance with Payment Card Industry Data Security Standards (PCI DSS).

By using a NetSuite-integrated payment solution, businesses can streamline payment operations, enhance financial reporting, and improve cash flow management.

To take full advantage of NetSuite’s payment processing capabilities, users should integrate a trusted payment gateway that offers seamless integration as well as extensive tools and features that streamline the payment process.

Choosing a payment gateway for NetSuite

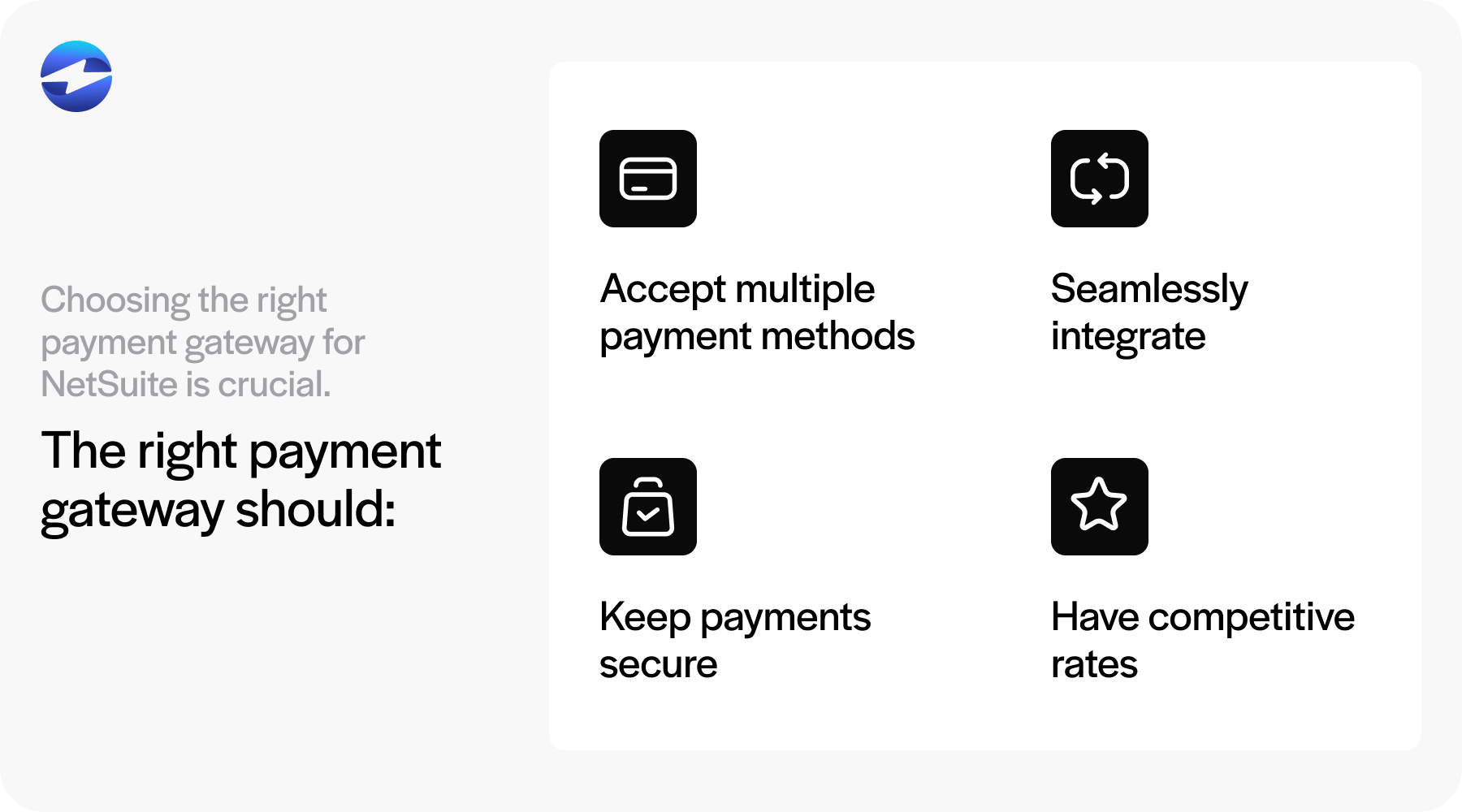

Choosing the right payment gateway for NetSuite is crucial. Businesses can start by identifying their specific needs. Consider factors like the types of payments you accept. Ensure the gateway supports a wide range of payment methods.

Next, look for seamless integration with NetSuite ERP systems. This helps streamline financial records and eliminates manual data entry. Compatibility is key for smooth payment workflows. Consider the gateway’s payment processing capabilities. A good gateway should offer secure transactions and protect sensitive financial data. Check if it handles electronic payment methods efficiently.

Transaction fees are another factor to consider. Compare different gateways to find one with competitive rates.

Choose a gateway that enhances your financial reporting and supports seamless payment processes. Ultimately, the right gateway can improve your overall payment processing options and efficiency.

Setting up credit card payment processing in NetSuite

Understanding how to set up credit card payment processing in NetSuite helps manage credit card payments efficiently while maintaining accurate financial records. Proper setup minimizes errors and manual data entry, enhancing financial health and cash flow management.

Choose a NetSuite payment gateway provider

Setting up credit card processing in NetSuite begins with choosing the right NetSuite payment gateway provider. This is the foundation for processing credit cards through NetSuite. Compare gateways based on integration with NetSuite, security features, and transaction fees.

When selecting a payment gateway provider for NetSuite, consider factors such as:

- Compatibility: Ensure the gateway integrates smoothly with NetSuite.

- Supported payment methods: Choose a gateway that supports the credit cards and payment types you intend to accept.

- Security and compliance: Look for PCI-compliant gateways with fraud prevention tools.

- Fees and costs: Compare transaction fees, setup costs, and monthly fees.

- Customer support: Ensure the provider offers reliable customer support.

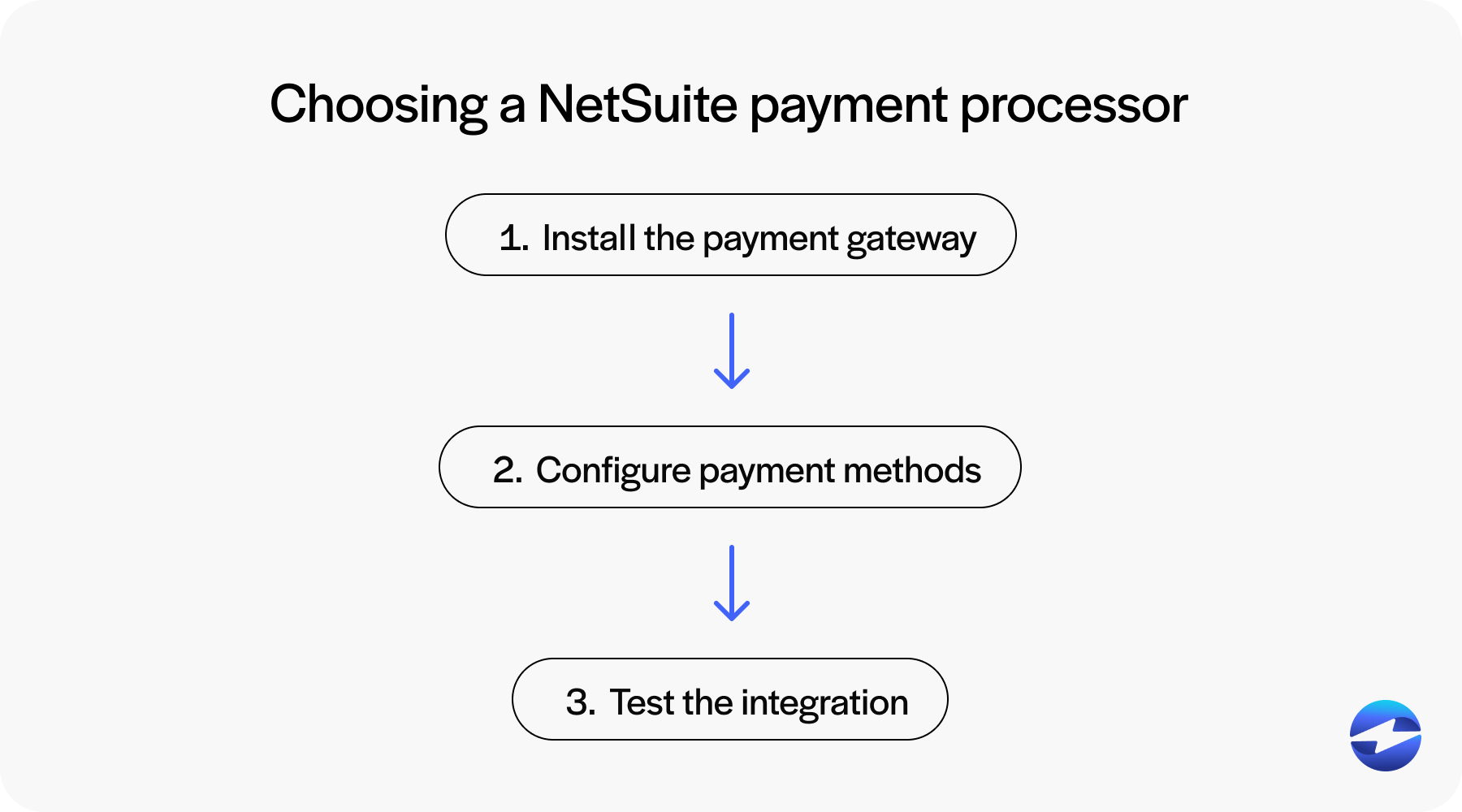

Install the payment gateway

After selecting a gateway, the next step is installation. This integration is vital for efficient payment workflows and keeping financial transactions secure. Follow the installation guidelines provided by the gateway provider.

This process typically involves:

- Configuring API credentials: You’ll need API keys or credentials from the gateway provider to connect it to NetSuite.

- Merchant account: The provider will typically have you link a merchant account.

Configure payment methods

Once installed, configure the payment methods you wish to accept. Set up the system to handle various types of payments, including electronic payment methods. Proper configuration ensures you can process all desired payment types smoothly. This enhances your payment processing capabilities and financial reporting.

Test the integration

Testing the integration is the last step. This step checks that everything functions correctly before you go live. Ensure the gateway processes payment transactions without issues and that financial records are updated accurately. Testing helps detect and resolve any errors early, ensuring secure transactions and efficient payment processing.

- Run test transactions: Most gateways offer a “sandbox” or test mode where you can simulate payments.

- Check transaction flow: Verify that payments are correctly authorized, captured, and recorded in NetSuite.

- Review error handling: Test different scenarios, such as declined transactions and refunds, and record in NetSuite.

- Validate reporting: Ensure payment data appears accurately in NetSuite’s financial reports.

Now that you know how to set up credit card processing in NetSuite, you should also know how to automate and optimize these payments.

Automating and optimizing credit card payments in NetSuite

Integrating credit card payments into NetSuite ERP streamlines financial operations and enhances efficiency. By automating and optimizing payment processes, businesses can reduce manual effort, minimize errors, and improve cash flow.

Automate credit card processing

Businesses can enable automatic payments for approved transactions, eliminating the need for manual invoicing. For subscription-based models, configuring recurring billing ensures customers are charged automatically, improving cash flow consistency.

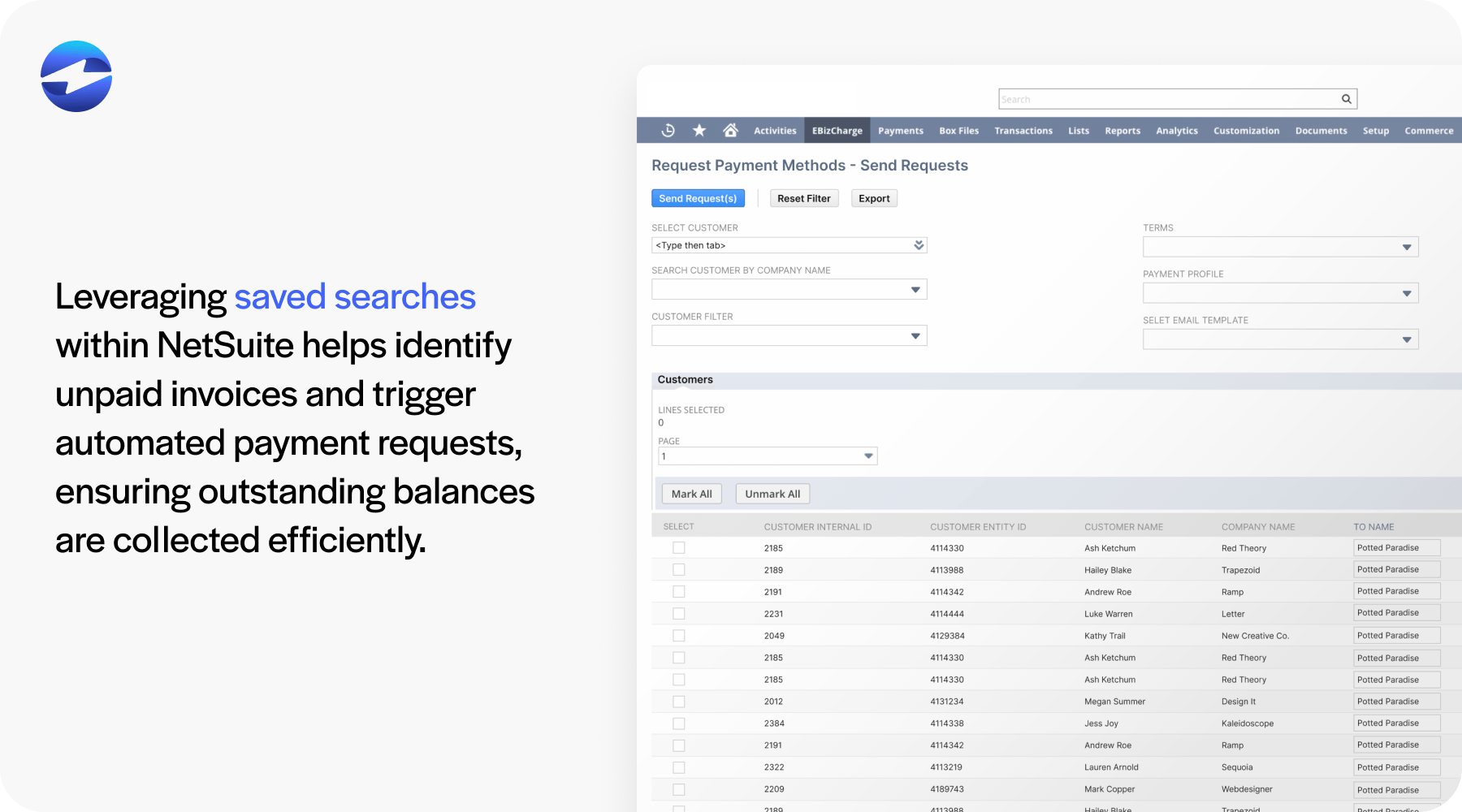

To optimize payment scheduling, businesses can implement scheduled payment processing by configuring batch processing for bulk transactions, minimizing approvals and delays. Leveraging saved searches within NetSuite helps identify unpaid invoices and trigger automated payment requests, ensuring outstanding balances are collected efficiently.

Security is also a critical component of automation, and tokenization plays a vital role in safeguarding sensitive payment data. Tokenization replaces raw credit card information with a secure token, reducing fraud risk while allowing customers to store payment details securely for future transactions. With PCI-compliant tokenization supported through integrated payment gateways, NetSuite ensures businesses maintain high-security standards while streamlining payment workflows.

Optimize payment reconciliation and reporting

Automating reconciliation in NetSuite enhances financial accuracy and efficiency by reducing manual intervention. NetSuite’s automated reconciliation feature matches payments with bank transactions, ensuring seamless financial tracking and minimizing discrepancies. Integrating with payment gateways that provide real-time updates further streamlines this process, allowing businesses to maintain up-to-date financial records without manual effort.

In addition to reconciliation, generating real-time payment reports is essential for monitoring transaction activity and identifying potential issues.

Reduce payment failures

Dunning management can be used to automatically retry failed payments, reducing the need for manual follow-ups. To keep customers informed, email notifications can be set up to alert them about expired cards or payment failures, prompting them to update their payment information proactively.

Offering multiple payment methods enhances cash flow by providing customers with flexible options to complete their transactions. Accepting a variety of payment methods, including credit cards, ACH transfers, and digital wallets, accommodates different customer preferences and reduces payment friction. A self-service payment portal allows customers to update their payment details independently, ensuring uninterrupted transactions without requiring direct intervention from the business. By combining automated payment recovery with diverse payment options, businesses can improve cash flow consistency and enhance the overall customer experience.

Strengthen security and compliance

Strengthening security and maintaining compliance in NetSuite is essential for protecting payment data and preventing fraud. Ensuring PCI compliance is critical, as businesses must integrate PCI-compliant payment solutions to secure transactions and safeguard sensitive information.

Rather than storing raw credit card data, companies should rely on tokenization, which replaces sensitive details with secure tokens, reducing the risk of fraudulent transactions and ensuring compliance with industry standards.

In addition to compliance measures, implementing fraud prevention tools enhances security and minimizes financial risk. Address Verification Service (AVS) and CVV verification should be enabled to prevent unauthorized transactions and reduce chargeback rates. Fraud monitoring systems can be set up to detect suspicious activity, providing real-time alerts that allow businesses to take immediate action against potential threats. For an added layer of security, 3D Secure authentication helps the cardholder’s identity before processing transactions.

By combining compliance measures with proactive fraud prevention strategies, businesses can create a secure and trustworthy payment environment within NetSuite.

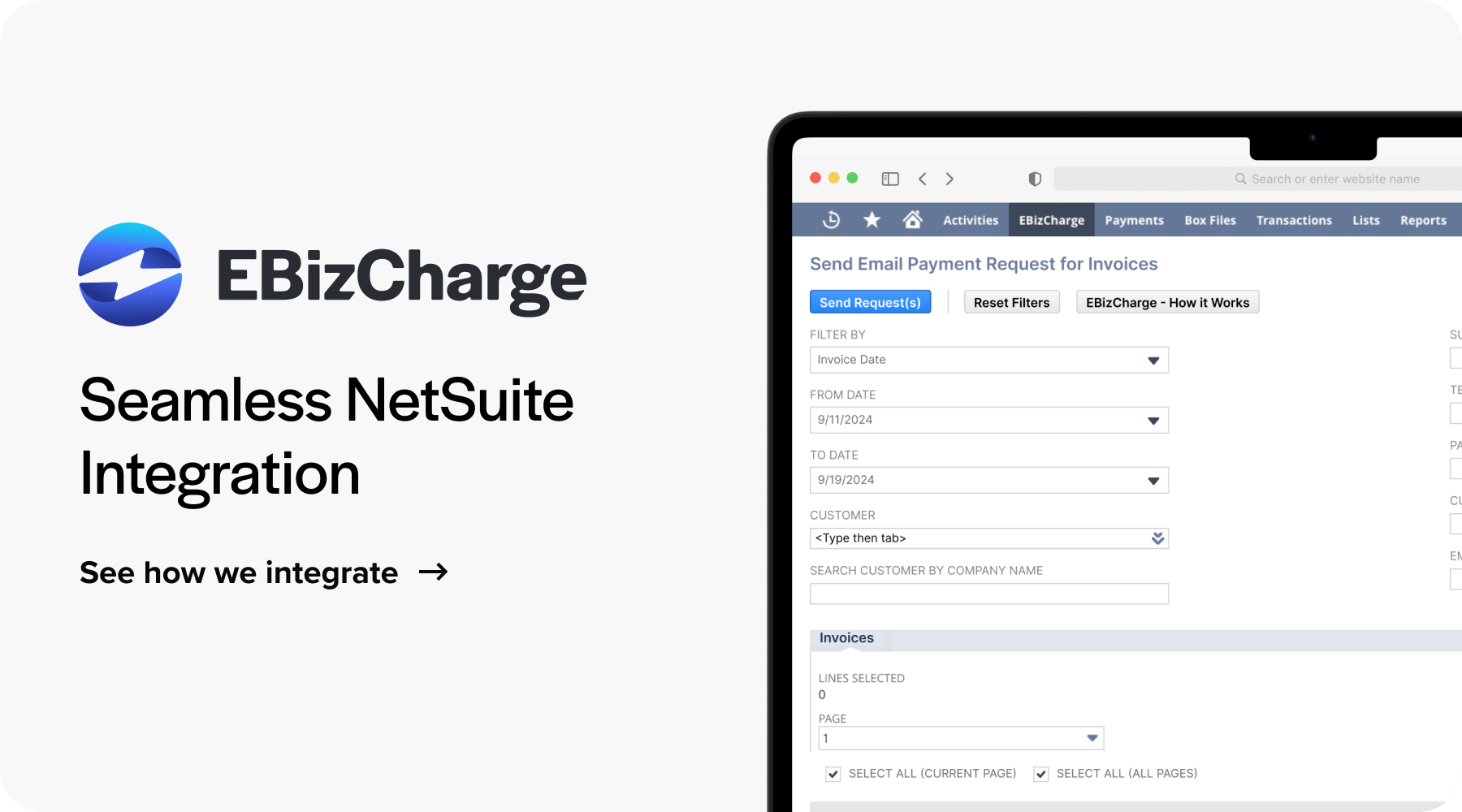

Efficient payment processing with EBizCharge’s NetSuite integration

EBizCharge can significantly streamline credit card processing within NetSuite by offering seamless integration with your NetSuite ERP, eliminating the need for manual data entry. This integration reduces the chances of errors and saves valuable time. EBizCharge provides a wide range of payment processing capabilities, supporting various payment types, including credit cards, debit cards, and digital wallets. This flexibility ensures businesses can cater to different customer preferences, enhancing the accounts receivable process.

Additionally, EBizCharge ensures secure transactions, safeguarding financial transactions and records while also helping manage transaction fees effectively, which is crucial for maintaining financial health. With its seamless integration, businesses can reduce manual data entry, while its broad range of payment methods allows them to meet diverse customer needs. The platform’s robust security measures protect financial data, ensuring compliance and fraud prevention.

By leveraging EBizCharge, businesses can enhance the efficiency of their payment processes, streamline credit card transactions, and improve financial reporting. This ultimately results in better cash flow management and more efficient payment workflows.

FAQs regarding credit card processing in NetSuite

FAQs regarding credit card processing in NetSuite

Summary

- Understanding credit card processing in NetSuite

- Choosing a payment gateway for NetSuite

- Setting up credit card payment processing in NetSuite

- Automating and optimizing credit card payments in NetSuite

- Efficient payment processing with EBizCharge’s NetSuite integration

- FAQs regarding credit card processing in NetSuite