Blog > How to Integrate a Payment Gateway into NetSuite

How to Integrate a Payment Gateway into NetSuite

Since seamless transactions have become a standard expectation for most in the modern payment landscape, effectively integrating a payment gateway into your existing business system can be the difference between efficient operations and a logistical nightmare.

Thankfully, merchants can sync reliable payment gateways into popular accounting or enterprise resource planning (ERP) systems like NetSuite to accelerate and improve online purchases while enhancing customer trust and security.

This article will guide companies through the necessary steps to integrate NetSuite payment gateways into their business systems.

What is NetSuite?

NetSuite is a cloud-based ERP platform that provides businesses with a comprehensive suite of tools for managing financials, customer relationships, eCommerce, inventory, and more. It offers real-time data visibility, automation, and scalability, making it suitable for businesses of all sizes, from small startups to large enterprises.

As an all-in-one business management solution, NetSuite helps companies transform operations by consolidating them into a centralized system, reducing the need for multiple standalone applications.

NetSuite’s cloud-based nature allows users to access the platform from anywhere for greater flexibility and security.

With the right payment gateway, NetSuite can provide a seamless payment experience for merchants and their customers.

What is a payment gateway?

A payment gateway facilitates secure electronic transactions by linking customers, businesses, and their financial institutions.

When a customer initiates a purchase, the payment gateway sends a payment request to the payment processor, which then communicates with the customer’s issuing bank to authorize the transaction.

Payment gateways can manage various payments, including credit, debit, and ACH/eChecks, while ensuring payment data is encrypted during transmission. This encryption protects sensitive payment information, such as credit card details, from unauthorized access.

While there are numerous payment gateways to choose from, it’s essential to know what tools and features to look for to make the best choice.

How to choose the right payment gateway for NetSuite

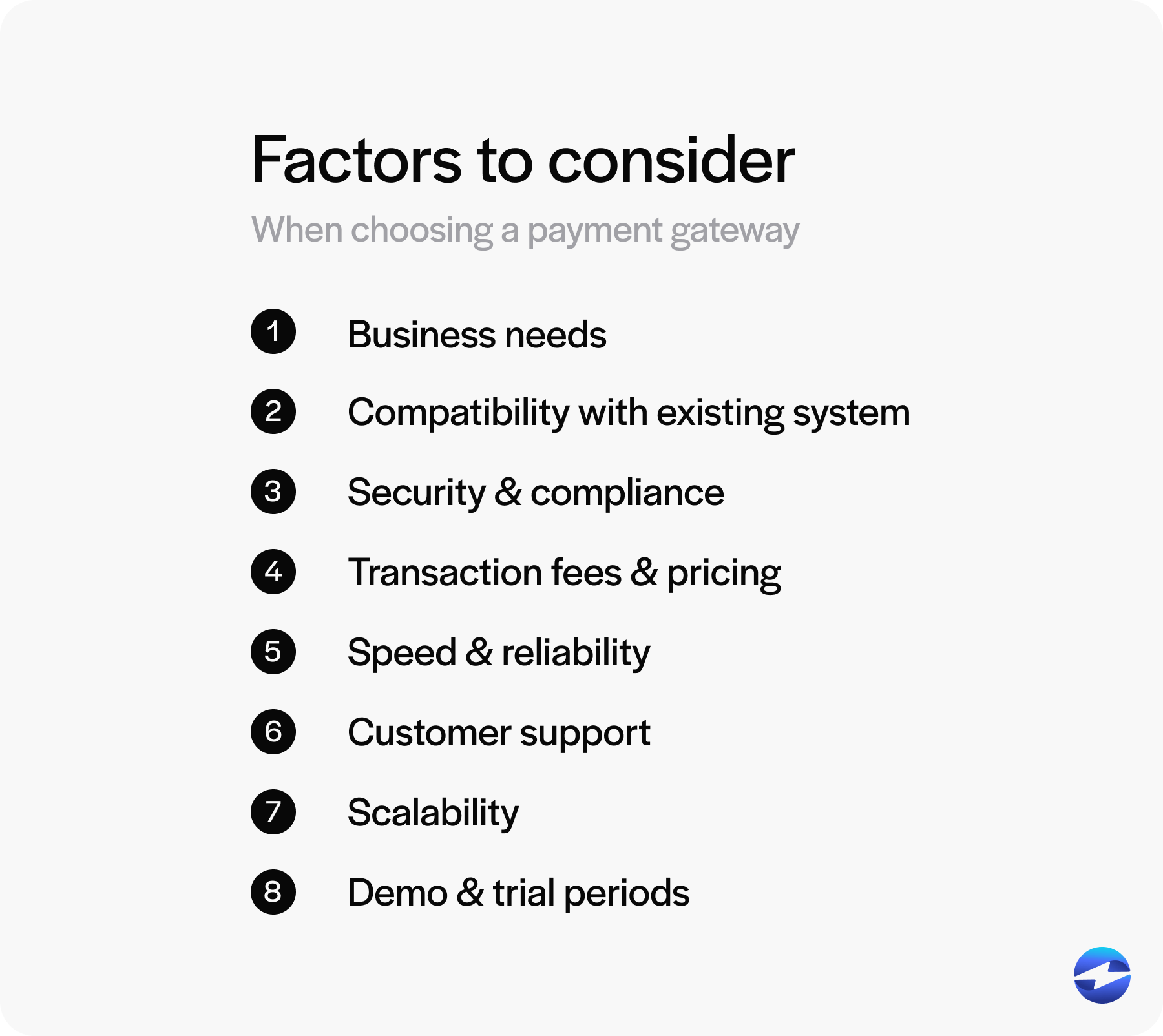

Choosing the right payment gateway can affect how efficiently you process payments. An ideal gateway will effortlessly support your financial operations, boost cash flow, and integrate with your existing systems.

Here are nine tips to help you choose the best payment gateway for your business:

- Assess your business’s needs: Start by identifying your payment requirements. Do you need support for high transaction volumes, digital wallets, or international payments? Understanding these necessities helps you choose a gateway that aligns with your financial operations.

- Verify compatibility with your existing systems: Ensure the payment gateway is compatible with NetSuite or other existing business software. This compatibility can reduce the risk of integration issues and ensure payment workflow efficiency.

- Evaluate security and compliance features: It’s vital for payment gateways to offer Payment Card Indsutry (PCI) compliance and robust encryption to protect customer payments and financial data from threats and strengthen customer trust.

- Consider transaction fees and pricing structure: Review each gateway’s pricing structure and transaction fees. Since these fees can affect your profit, selecting a gateway with fair pricing that suits your payment volume and cash flow needs is essential. Transparent, upfront pricing is key to avoiding any additional hidden fees.

- Prioritize speed and reliability: A fast and reliable gateway can minimize payment delays and enhance payment processing operations. Look for providers that offer quick payment collection tools and are known to be dependable to ensure more customer satisfaction.

- Review customer support and service availability: High-quality customer support is essential for resolving any issues that may arise. Therefore, reviewing your gateway support is crucial to ensure their team is readily available and responsive to resolve any payment-related concerns quickly.

- Check for customization and scalability: A flexible payment gateway with customizable features that fit unique needs and adaptable software that can scale to handle increasing transaction volumes can benefit merchants looking to grow their business.

- Read customer reviews and industry reputation: Customer reviews and industry reputation provide insights into a payment gateway’s performance.

- Demo and trial periods: Take advantage of demo or trial periods offered by payment gateway providers to test their features, user interfaces, installation process, and integration compatibility before commitment.

These techniques will allow you to choose the best payment gateway for your business.

Now that you know how to evaluate a payment gateway, it’s time to learn how to integrate this system into NetSuite.

How to integrate a payment gateway into NetSuite

Merchants must follow several essential steps in the NetSuite payment integration process to ensure effortless and secure payment processing for their customers.

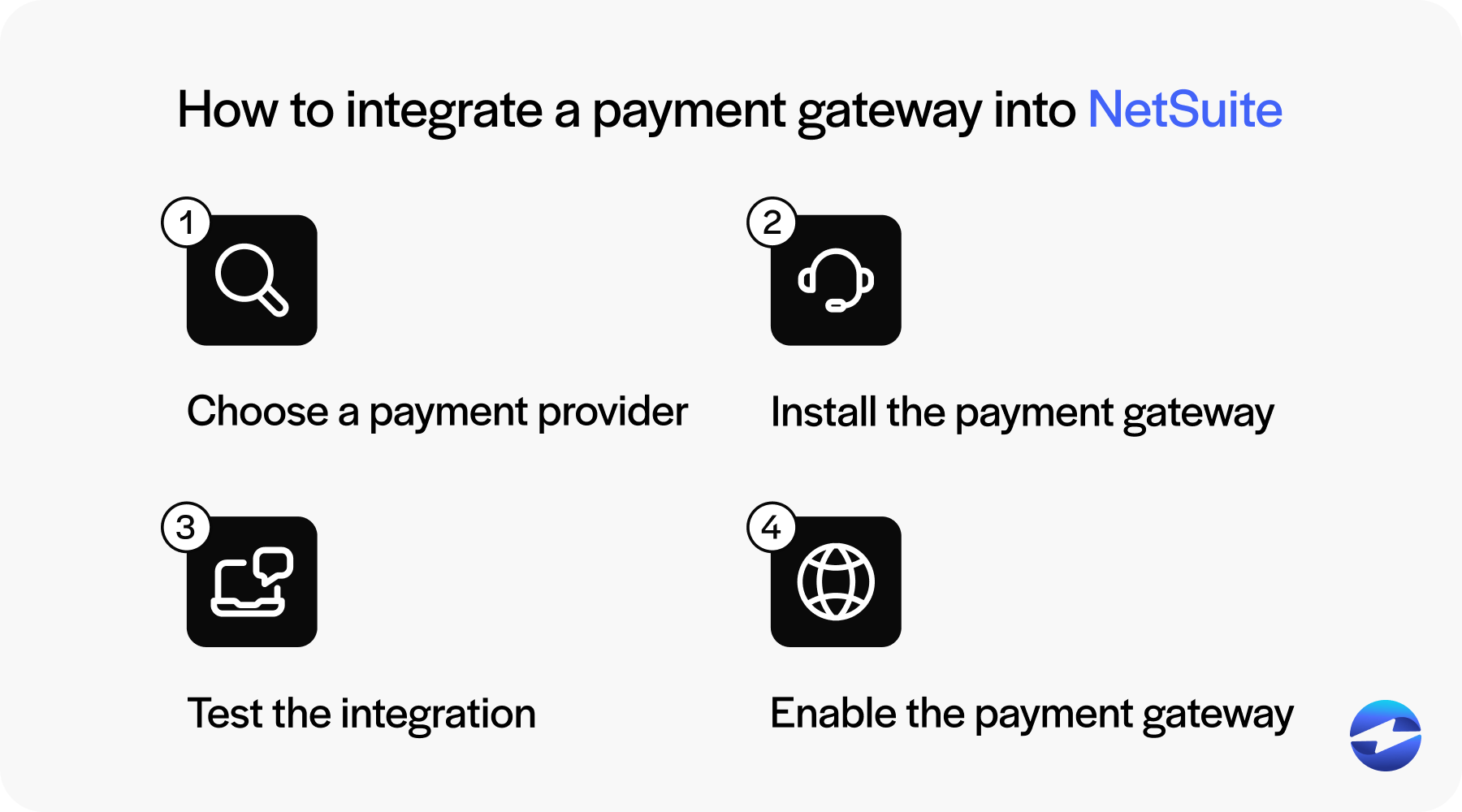

Here are the four steps you need to take to successfully integrate a payment gateway into your NetSuite system:

- Choose a payment gateway provider

- Install the payment gateway

- Test the integration

- Enable the payment gateway

1. Choose a payment gateway provider

Before integrating a payment gateway, you’ll want to find a payment processor compatible with NetSuite and can set up your merchant account.

You can apply for a merchant account by submitting business and financial details to the provider for approval. Ensure your chosen provider offers:

- A prebuilt NetSuite integration or an Application Programming Interface (API) that allows seamless connection.

- Full PCI compliance to protect sensitive customer payment data and implement advanced security measures.

- Support for various payment methods, such as credit cards, ACH transfers, digital wallets, or other payment methods, to meet diverse customer preferences.

- Transparent transaction fees and costs to find a cost-effective provider with the lowest fees with no hidden charges.

After selecting a provider, you can start the installation process.

2. Install the payment gateway

Once you have your payment gateway account and credentials, the next step is to implement the NetSuite payment integration.

The gateway installation process typically involves entering the necessary API credentials, configuring the payment settings, and ensuring all required transaction types (such as authorizations, sales, refunds, and voids) are enabled.

This setup allows NetSuite to communicate with the payment gateway to process transactions.

3. Test the integration

Before using the payment gateway for legitimate transactions, it’s crucial to test payments to ensure they’re efficiently processed in NetSuite and accurately recorded in reports.

Merchants should regularly test transactions to see if their payment gateways process payments with minimal delays and no errors to identify any disruptions.

4. Enable the payment gateway

Once you’ve confirmed the payment gateway is properly configured and transactions are processing correctly, the last step is to switch from test mode to live mode.

Once you’ve disabled test mode, you can enable the NetSuite payment gateway integration to start processing transactions within this ERP system.

It’s important to actively monitor and manage these operations to ensure the best user experience for customers. You should also keep an eye on transaction reports to address any issues promptly.

By following these steps, merchants can integrate their desired payment gateway into NetSuite for seamless payment processing and take advantage of numerous benefits.

10 benefits of payment processing in NetSuite

With a robust payment processing infrastructure in NetSuite, your business will have access to many benefits that can transform how it collects customer payments.

Here are 10 advantages of syncing payment processing in NetSuite:

- Seamless integration with NetSuite ERP: NetSuite payment gateway integrations like EBizCharge ensure that payments, invoices, and financial records are automatically updated in one centralized platform. This eliminates the need for third-party tools or manual data input, reducing errors and improving efficiency.

- More recording accuracy and less manual work: Automated reconciliation in NetSuite streamlines the process of matching payments with invoices, reducing manual work and errors. It ensures accurate financial records by automatically aligning transactions with bank statements, minimizing discrepancies. This improves cash flow visibility, enhances reporting accuracy, and saves time for finance teams by eliminating the need for manual data entry and adjustments.

- Greater flexibility and customer satisfaction: Multiple payment methods provide greater flexibility, allowing customers to choose their preferred payment option, whether it’s credit cards, ACH/eChecks, or digital wallets, enhancing their overall experience. Businesses can also select payment methods with lower transaction fees to generate more cost savings.

- Enhanced cash flow: Faster payment processing means businesses receive funds quicker, improving cash flow and liquidity. Features like automated billing and recurring payments help maintain steady revenue streams.

- Improved security and compliance: A NetSuite-integrated AR service ensures compliance with industry security standards such as PCI Compliance. Advanced security features like encryption, tokenization, off-site data storage, and 3D Secure can further protect sensitive payment data and reduce fraud and chargeback risks.

- Real-time transaction visibility: Businesses can track payments in real-time, allowing for better financial forecasting and decision-making. Customizable reports and dashboards provide insights into sales, refunds, and payment trends.

- Reduced processing fees: Top NetSuite-integrated payment processors offer competitive processing rates to secure the lowest rates. Customized pricing can tailor fees based on transaction volume, industry type, or specific customer needs. Some providers also offer surcharge options for businesses to pass processing costs to customers, further cutting costs.

- Scalability: Whether a company is small or enterprise-level, a flexible NetSuite payment processor that can adapt to changes in transaction volumes can encourage more growth for your business. International businesses can also benefit from working with a provider that supports multi-currency and cross-border payments to make these transactions easier.

- Customizable workflows: Customizable workflows in NetSuite can tailor payment collections to meet unique operational requirements and customer preferences. These workflows can be automated to manage various payment scenarios, from one-time transactions to complex recurring billing cycles. They can also incorporate approval hierarchies, notifications, and other business rules, enabling companies to maintain control and compliance while optimizing payment operations.

- Improved customer experience: With faster and more secure transactions, you can improve the overall customer experience and satisfaction. Features like self-service payment portals achieve this by simplifying how customers manage and pay invoices.

To achieve these benefits and more, merchants can work with a well-integrated NetSuite payment gateway like EBizCharge, which enables secure and effortless customer payments and provides scalable services to optimize cash flow.

How the EBizCharge payment gateway optimizes payments in NetSuite

EBizCharge offers a reliable NetSuite payment gateway that allows merchants to easily accept and process customer payments inside this ERP system.

By offering features like email payment links, a bill pay portal, auto pay, mobile pay, and EMV devices, the top-rated EBizCharge payment gateway provides a comprehensive solution for modern payment needs. It allows businesses to accept a wide range of digital payment methods and the flexibility to enhance the user experience while boosting cash flow and reducing payment delays.

EBizCharge is a PCI-compliant payment software with advanced security measures like tokenization, encryption, off-site data storage, 3D Secure, fraud prevention modules, and more to guarantee secure payment processing. It optimizes payment workflows and accelerates payments with tools like automated payment reminders, recurring billing, a branded customer payment portal, and secure email payment links.

In addition to its numerous features, EBizCharge offers transparent and customizable pricing plans to help businesses secure the lowest processing rates. Instead of a one-size-fits-all pricing model, it provides interchange-plus pricing and other tailored options based on transaction volume and business needs.

With EBizCharge’s powerful NetSuite payment gateway integration, merchants can solidify a seamless customer payment experience while yielding more long-lasting success.

FAQs regarding integrating a payment gateway into NetSuite

FAQs regarding integrating a payment gateway into NetSuite

Summary

- What is NetSuite?

- What is a payment gateway?

- How to choose the right payment gateway for NetSuite

- How to integrate a payment gateway into NetSuite

- 10 benefits of payment processing in NetSuite

- How the EBizCharge payment gateway optimizes payments in NetSuite

- FAQs regarding integrating a payment gateway into NetSuite