Blog > Accepting Online Payments with Internet Merchant Accounts

Accepting Online Payments with Internet Merchant Accounts

The shift toward eCommerce has made it essential for businesses to implement the right tools and protocols to navigate online payments effectively. Enter the Internet merchant account, a key player in this financial ecosystem.

By understanding the components and processes involved in Internet merchant accounts, businesses can streamline their payment operations and provide a seamless shopping experience.

This article will explore the intricacies of Internet merchant accounts, detailing their importance for online transactions and guiding you through the setup process.

What is an Internet merchant account?

An Internet merchant account (IMA) is a type of banking account that allows online businesses to accept credit and debit card payments. It serves as an intermediary between a merchant and a payment processor, facilitating the transfer of funds during online transactions.

Internet merchant accounts are essential for online merchants looking to establish a seamless online payment system. They provide a secure platform for processing transactions, ensuring the consumer’s payment information and the merchant’s funds are protected. This account is typically integrated with a payment gateway, which is responsible for the safe transmission of transaction data.

By enabling credit card payments, eCommerce businesses can cater to a broader customer base and enhance their sales opportunities.

8 components of an Internet merchant account

Understanding the various components of an Internet merchant account is vital for any business planning to conduct online transactions. These components can provide a seamless and secure payment experience and build customer trust.

In addition to Internet merchant account elements providing a seamless and secure payment experience that builds customer trust, they can enable merchants to make more informed choices and enhance their online payment infrastructure.

Here are eight components of Internet merchant accounts to familiarize yourself with:

- Merchant Identification Number (MID): Every merchant account is assigned a unique Merchant Identification Number, which serves as a reference for all transactions processed through the account. This number helps payment processors and banks identify the merchant and track payments accurately.

- Payment processor: The payment processor ensures that the payment data is transmitted securely between the merchant, customer, and issuing bank, enabling real-time approvals or rejections.

- Payment gateway integration: Most Internet merchant accounts integrate with a payment gateway. The gateway acts as the intermediary that collects, encrypts, and transmits transaction data to the payment processor. This integration ensures a seamless and secure transaction flow.

- Transaction settlement: After a payment is authorized, the merchant account facilitates the settlement process. This involves transferring the approved funds from a customer’s bank to the merchant’s account, usually within one to two business days.

- Fraud detection and security tools: Merchant accounts often include tools and standards to prevent fraud and enhance security, including Payment Card Industry Data Security Standards (PCI-DSS). Features like Address Verification Systems (AVs), Card Verification Value (CVV) checks, and encryption protocols protect sensitive customer data and minimize chargebacks.

- Fees and pricing structures: Internet merchant accounts typically come with various fees, including transaction fees, monthly maintenance charges, and sometimes setup costs. Some providers offer tailored pricing models based on a business’s transaction volume and needs.

- Reporting and analytics tools: Detailed transaction reports and analytics tools are often included to help merchants track sales, manage cash flow, and reconcile accounts. These insights are essential for financial planning and operational efficiency.

- Support for multiple payment methods: To cater to diverse customer preferences, many Internet merchant accounts support multiple payment methods, including major credit and debit cards, digital wallets, and even alternative payment systems like Automated Clearing House (ACH) transfers.

Now that you know what an Internet merchant account is, you should understand how payment gateways work since they’re vital to accepting payments.

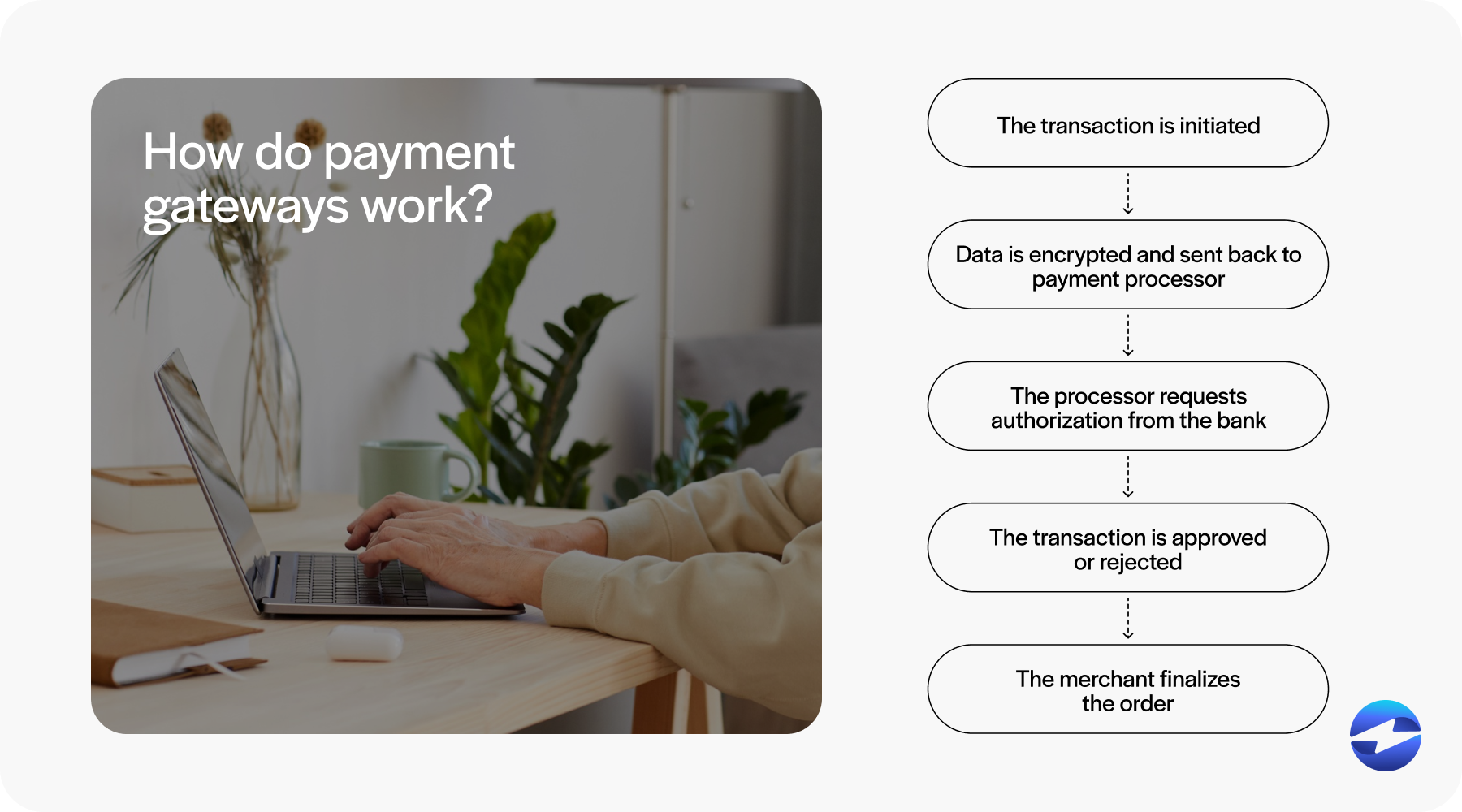

How do payment gateways work?

Payment gateways serve as the interface between your online business and your customer’s payment source, such as credit or debit cards.

When a customer places an order on a merchant’s website, the payment gateway collects and encrypts the transaction details to secure it before transmitting the information to the payment processor.

Once the payment processor receives the encrypted data, it communicates with the customer’s bank to authorize the transaction. This either approves or declines the transaction based on factors like available funds and credit limits. The approval or decline is then sent back through the payment gateway to the online merchant, alerting them to complete the order or notify the customer of payment issues.

Here’s a quick breakdown of how the process works:

- Transaction initiation: Customers enter their payment details at checkout.

- Data encryption: Data is encrypted and sent to the payment processor.

- Authorization request: The processor communicates with the bank for approval.

- Response delivery: A notification of approval or rejection is sent to the merchant.

- Completion: The merchant finalizes the order or informs the customer of issues.

Understanding how payment gateways work highlights their critical role in facilitating secure and efficient online transactions.

While payment gateways are vital for processing online payments, they rely on Internet merchant accounts to function seamlessly.

Why are Internet merchant accounts important for online transactions?

Without reliable Internet merchant accounts, eCommerce businesses won’t be able to process online credit and debit card transactions efficiently and securely.

Internet merchant accounts facilitate real-time payment processing that accelerates transactions and, as a result, facilitates more customer satisfaction and smoother operations. By working with Internet merchant account providers, businesses can ensure their payment systems are robust and reliable.

Many providers will typically provide merchant accounts and payment gateways to facilitate more efficient customer payment collections, minimize the risk associated with online fraud and chargebacks, and provide businesses and customers peace of mind.

Additionally, Internet merchant accounts offer various payment options, including major credit cards like Visa and American Express, enhancing a business’s ability to cater to a broader customer base.

Internet merchant accounts also simplify reconciliation by providing detailed transaction records, which help manage cash flow more effectively.

Now that you understand the importance of Internet merchant accounts, it’s time to set one up.

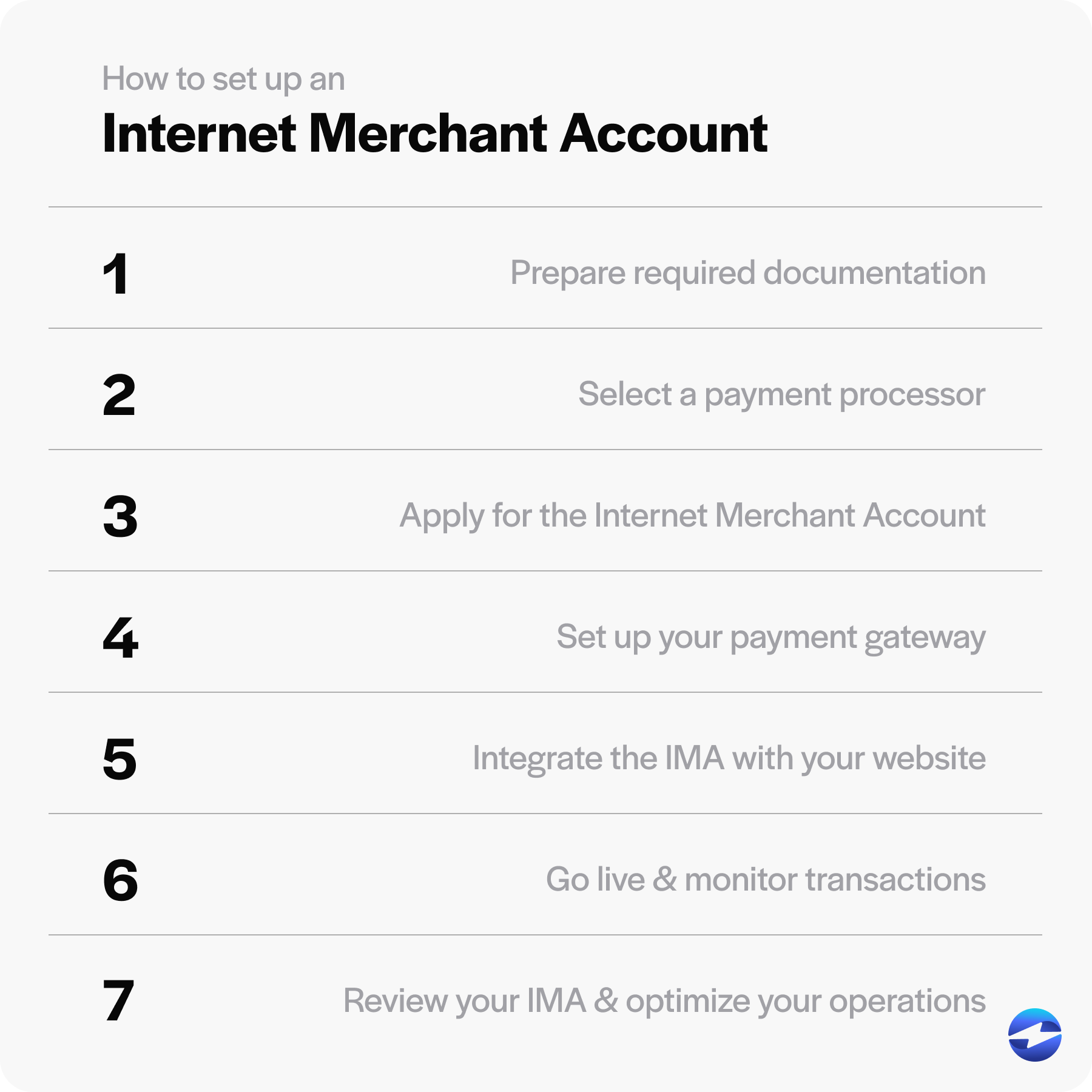

How to set up an Internet merchant account

Setting up an Internet merchant account involves selecting the right provider, completing the application, and ensuring seamless integration with your eCommerce platform.

Each step of setting up your Internet merchant account is vital to guaranteeing more secure transactions and enhanced customer experiences.

Here are eight steps to set up your Internet merchant account:

- Prepare required documentation

- Select a payment processor

- Apply for the Internet Merchant Account (IMA)

- Set up your payment gateway

- Integrate the IMA with your website

- Implement security measures

- Go live and monitor transactions

- Review your IMA and optimize your operations

1. Prepare required documentation

Most providers require documentation to set up your merchant account, including a business license, bank account, identification numbers, and website information.

A valid business license proves that your business is legally registered, while a bank account establishes your business checkout account where funds can be deposited.

For tax purposes, merchants typically must provide identification numbers, such as tax identification numbers (TINs) or employer identification numbers (EINs).

2. Select a payment processor

When selecting a payment processor, choosing one that aligns with your business needs is crucial. Start by comparing factors such as fees, integration options, and security features.

Finding cost-effective payment processors that offer robust payment features for your business to quickly and securely collect payments is vital. The best providers will maintain full Payment Card Industry (PCI) Compliance and offer advanced security measures, robust payment collection tools like recurring billing and online customer payment portals, and customized pricing to secure the lowest rates.

When it comes to fees, some providers charge flat fees while others apply a percentage per transaction. Therefore, it’s essential to consider your transaction volume and frequency to determine which pricing model is most cost-effective and practical for your business operations.

3. Apply for the Internet Merchant Account (IMA)

Once you’ve chosen a merchant account provider, contact this provider to initiate the application process. Many offer online applications, making this process simple and convenient.

During the process, the provider may conduct a credit check and evaluate your business’s risk level to ensure you’re a viable client with a low likelihood of chargebacks or fraud.

4. Set up payment gateway

Setting up a payment gateway is essential for securely processing transactions between your website and your Internet merchant account.

Most payment processors offer gateway services by including it as part of their package, while others may charge for this separately. Be sure to choose a solution that integrates seamlessly with your payment processor to ensure smooth and secure transaction handling.

5. Integrate the IMA with your website

To integrate your IMA with your website, use plugins or APIs to establish the connection.

Some top-rated merchant account providers may offer built-in integrations with major Enterprise Resource Planning (ERP) software and other business systems to sync eCommerce payments across platforms and simplify the process.

Once integrated, thoroughly test the payment system to ensure a seamless and secure checkout experience for your customers.

6. Implement security measures

Implementing robust payment security measures is essential to safeguard your business and customer data.

Utilize tools like encryption, tokenization, and SSL certificates to encrypt sensitive data and ensure compliance with PCI requirements to meet industry standards for secure payment processing.

These practices help prevent fraud and protect against data breaches, fostering trust with your customers.

7. Go live and monitor transactions

Once your setup is complete, you can go live and begin processing transactions. Monitoring these transactions and regularly reviewing your account closely for any signs of suspicious activity will allow you to verify that payments are correctly and securely processed.

Stay prepared to address chargebacks and disputes promptly to maintain smooth operations and protect your business.

8. Review your IMA and optimize your operations

It’s essential to periodically review your Internet merchant account provider’s terms, as fees or policies may change over time.

As your business grows, you can also explore opportunities to reduce transaction costs and optimize your operations.

Merchants should follow these steps to set up an IMA and accept online payments successfully. Working with a top-rated, reliable payment processor like EBizCharge is also essential to ensure efficient online payment collections, low costs, and top-tier security.

Accept online payments with ease using EBizCharge

EBizCharge stands out as a robust solution for Internet merchant accounts, effectively streamlining the process of accepting online payments.

EBizCharge is an all-in-one payment software designed for simplicity and efficiency by providing a merchant account, payment gateway, and numerous payment integrations that seamlessly sync with online platforms so businesses can handle credit and debit card transactions with ease.

With its reliable payment gateway, EBizCharge enhances the overall user experience and reduces checkout friction, boosting merchants’ conversion rates.

EBizCharge supports various payment options so online businesses can cater to diverse customer bases and maximize their revenue potential. It also simplifies the reconciliation process and provides comprehensive reporting features, allowing merchants to easily track online transactions and make informed financial decisions.

With its top-tier security measures and full PCI compliance, EBizCharge protects sensitive customer data with tools like encryption, tokenization, 3D Secure, and more.

Overall, EBizCharge is a cost-effective and top-rated payment processing platform for Internet merchants seeking a dependable online merchant banking partner. Get started by applying for a merchant account today.