Blog > How Do You Set Up Automated Billing?

How Do You Set Up Automated Billing?

Automated billing transforms how businesses handle their finances, offering a seamless and error-free approach to invoicing and payments. With its foundations in digital efficiency, automated billing could be the financial game-changer your company needs.

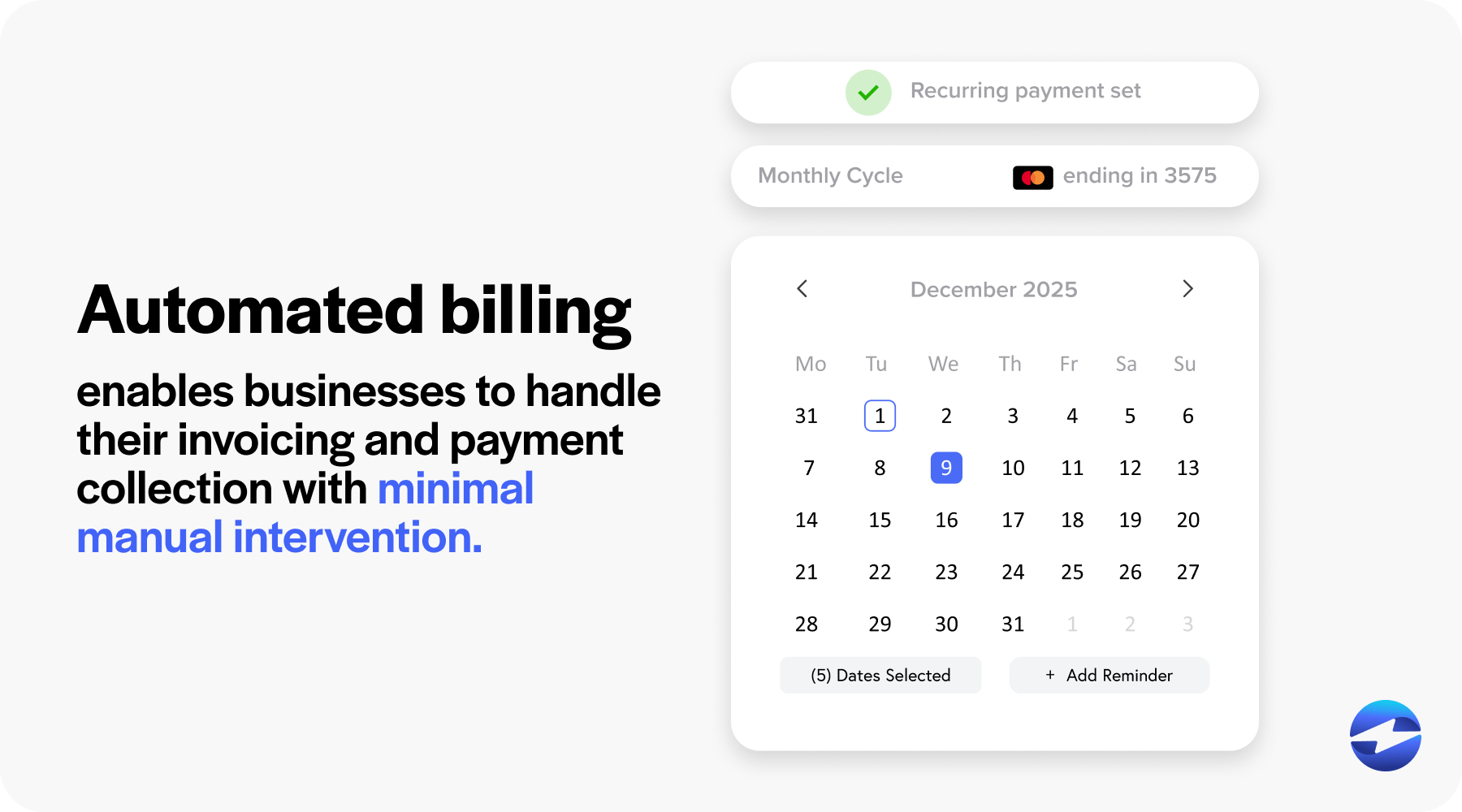

What is automated billing?

Automated billing is a process that enables businesses to handle their invoicing and payment collection with minimal manual intervention. Essentially, automated billing software takes over the tasks traditionally managed by finance teams, such as generating invoices based on customer use or subscription level, keeping track of payments due, issuing reminders for outstanding invoices, and processing received payments.

How does automated billing work?

Automated billing systems work by integrating with a company’s existing financial and customer databases and their accounting software. This integration allows the software to efficiently monitor service usage or product purchases and automatically trigger invoicing based on the predefined billing model and payment terms.

Here’s a quick breakdown of the steps involved:

- Customer information management: The system stores and manages customer data, such as contact information, billing history, and payment preferences.

- Service/product tracking: It tracks the usage or purchase of products and services tied to each customer.

- Invoice generation: The software automatically generates accurate invoices based on the tracked information and the set billing cycles.

- Invoice distribution: Invoices can then be issued to customers through online portals, email, or other preferred delivery methods without any manual process.

- Payment processing: Once a customer makes a payment – through credit cards, online portals, or bank transfers – the system processes and records the payments. These late payments can trigger automatic reminders to the customers.

- Reporting and reconciliation: The software also provides a suite of reporting tools that help businesses track and analyze billing and payment patterns for better financial insights.

By automating the invoicing process, businesses can eliminate time-consuming manual processes, decrease the likelihood of billing errors, ensure consistency in their billing process, and allow more focus on core business activities. This will ultimately lead to a more efficient billing solution and improved cash flow management.

The benefits of automated billing solutions

Automated billing services revolutionize how businesses handle financial transactions, offering myriad benefits that bolster efficiency and customer satisfaction. These benefits include time efficiency, improved accuracy, enhanced customer service, scalability, cost savings, regulatory compliance, insights and analytics, and integration with other systems.

Time efficiency

Billing automation saves time that would otherwise be spent on repetitive tasks, allowing employees to focus on more strategic activities. This automation can also operate 24/7, processing transactions outside of regular business hours, further enhancing efficiency by accelerating the overall billing cycle. With automated billing solutions, invoices can also be generated and sent out promptly, often immediately after a transaction or service is completed, eliminating the lag time associated with manual invoice creation.

Improved accuracy

Automated billing software is programmed to follow predefined rules and procedures consistently, minimizing the risk of human error inherent in manual billing processes. It ensures that invoices are accurate and free from mistakes by automating tasks such as invoice generation, calculating totals, and applying discounts or taxes. This accuracy extends to other aspects of billing, such as recording payments and updated account balances, leading to a more reliable and transparent financial record.

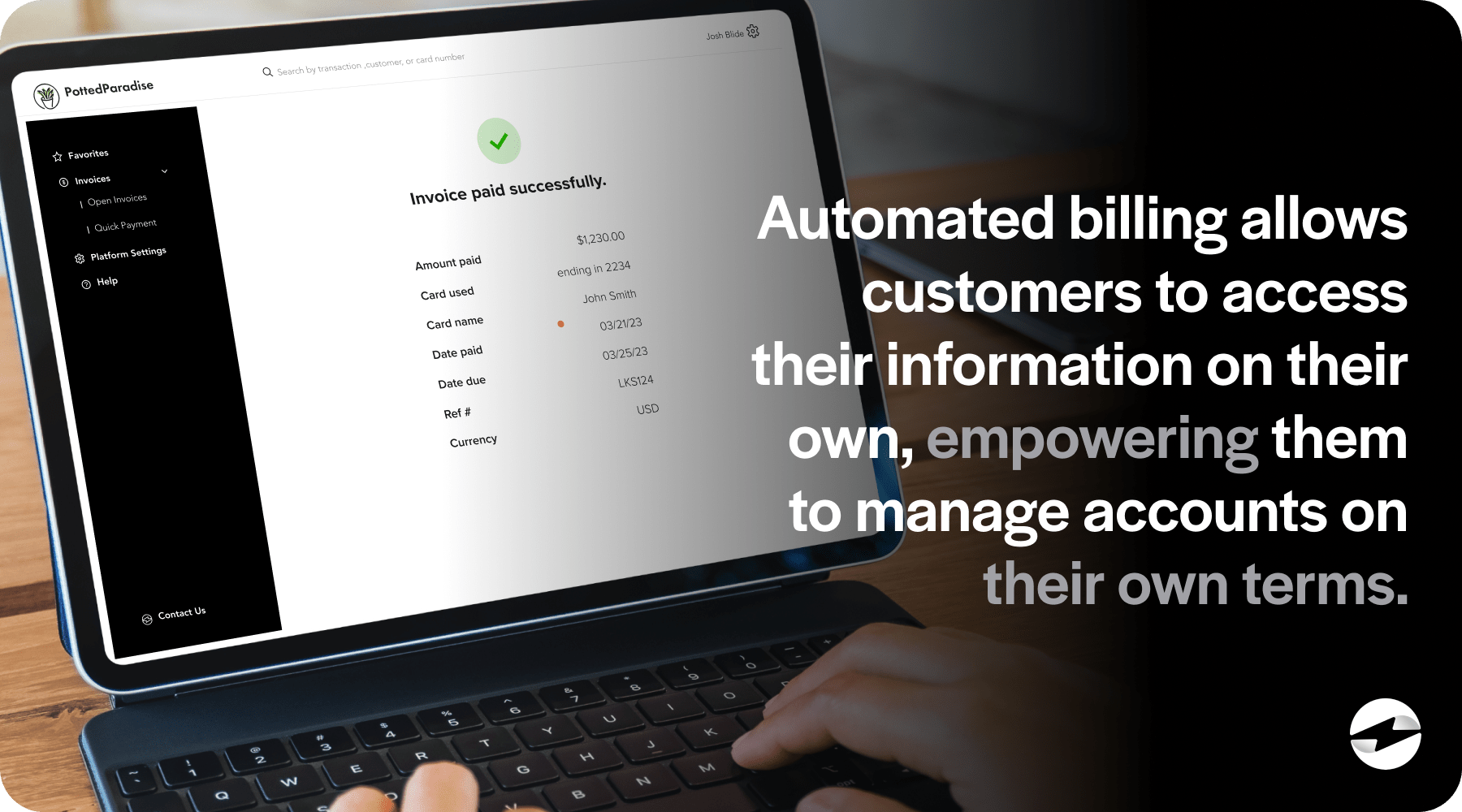

Enhanced customer service

Automated billing allows customers to access their billing information, view invoices, and make payments easily and quickly through self-service portals or online platforms. This accessibility empowers customers to manage their accounts on their own terms, reducing the need to contact customer support for billing-related inquiries or assistance. Moreover, automated billing systems can send out timely reminders and notifications about upcoming payments or changes in billing terms, keeping customers informed and reducing the likelihood of missed payments. By offering a more efficient and user-friendly billing process, businesses can enhance customer satisfaction and loyalty, fostering positive relationships with their clientele.

Scalability

Automated billing services are designed to efficiently handle large volumes of transactions, making it easier for businesses to scale up their operations as they acquire more customers or expand into new markets. With automation, businesses can easily adjust billing structures without requiring manual intervention or adjustments to their billing systems. This flexibility enables businesses to scale their billing operations seamlessly and cost-effectively, ensuring they can continue to meet the needs of their growing customer base without experiencing bottlenecks or disruptions in their billing processes.

Cost savings

As mentioned, automated billing systems allow businesses to streamline repetitive tasks such as invoice generation, payment processing, and reconciliation, eliminating the need for dedicated personnel to handle these processes manually. This reduction in labor costs translates into direct savings for businesses, as fewer resources are required to manage billing operations.

Regulatory compliance

Automated billing systems are designed with built-in features and functionalities that ensure compliance with relevant laws, regulations, and industry standards governing billing practices, such as data privacy regulations, tax laws, and consumer protection statutes. This includes regulations like the Payment Card Industry Data Security Standard (PCI DSS), which sets security standards for organizations regarding securely storing, processing, and transmitting cardholder data to prevent data breaches and fraud.

Insights and analytics

Automated billing systems are equipped with built-in reporting and analytics that enable businesses to generate comprehensive reports, dashboards, and visualizations that offer valuable insights into various aspects of their billing operations. By analyzing billing data, businesses can gain a deeper understanding of customer payment patterns, trends, and preferences, allowing them to tailor their billing strategies and offerings to better meet customer needs and expectations.

Integration with other systems

By integrating billing with other systems, businesses can eliminate manual data entry and duplication of efforts, reducing the risk of errors and improving data accuracy. For example, integrating billing with CRM systems allows businesses to synchronize customer information and billing data, ensuring that customer records are up-to-date and consistent across all systems. Moreover, integration with accounting software enables businesses to automate the transfer of billing data to their general ledger, eliminating the need for manual journal entries and reconciliation processes. This integration ensures that financial data is accurate and reflects current billing information, facilitating financial reporting and analysis.

Now that you’re familiar with the benefits of automated billing, it’s time to set it up.

How to set up automated billing

Setting up automated billing requires careful planning and execution to ensure the system aligns with your business model, enhances your billing process, and ultimately delivers value. Here is a quick rundown of how to set it up.

Make the necessary preparations

Before setting up automated billing, it’s crucial to prepare the groundwork. Follow these steps to position your business for a seamless transition:

Assess your business’s needs

To start, identify the specific billing needs of your business. Consider the following:

- The complexity of your billing cycles.

- The variety of payment terms you offer.

- The types of payment methods you accept.

- The volume of invoices and payment processes.

Research and select a suitable system

With your needs in mind, explore the market for automated billing software. Here are features to compare:

- Integration capabilities with existing systems.

- Compliance with security and regulatory standards.

- The ability to handle various payment methods (credit cards, bank transfers, online payments).

- Customization options for billing cycles and invoice templates.

- Customer payment portal functionality.

Prepare your data and infrastructure

Lastly, prepare your customer data, billing information, and other relevant data points to ensure they are clean, accurate, and ready for import into the new system. Verify that your hardware and networking infrastructure can support the chosen software. In some cases, upgrading your infrastructure may be necessary to handle the new billing system efficiently.

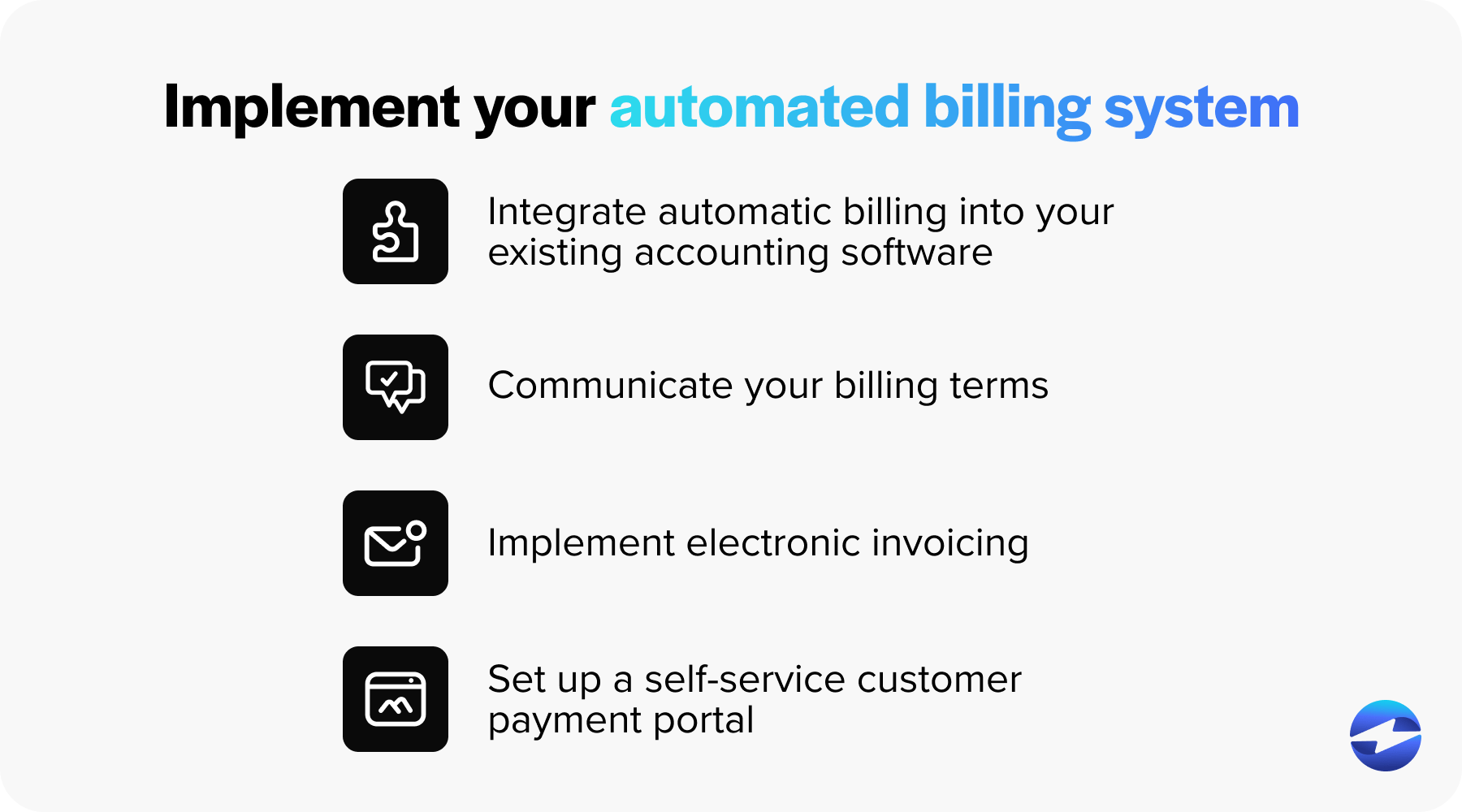

Implement your automated billing system

Now that you’ve made your preparations, it’s time to implement your automated billing system.

- Integrate automatic billing into your existing accounting software. Seamless integration of automated billing with your existing software is crucial for maintaining financial data consistency and accuracy. To achieve a seamless integration, start by utilizing APIs provided by both the billing system and accounting software to establish a direct line of communication between the two platforms. Ensure that data fields in your billing system align with those in your accounting software to avoid loss of data compatibility. Next, real-time synchronization should be set up to ensure that invoicing and payment data flow instantaneously into the accounting ledger, and procedures for detecting and correcting any data syn discrepancies should be implemented. Double-check that the integration complies with security protocols to protect sensitive financial information. Consulting both platform providers can be beneficial, as they may offer technical support or integration services to facilitate a hassle-free setup.

- Communicate your billing terms. To convey this information clearly, include concise billing terms on each invoice, covering payment due dates, applicable late fees, and accepted payment methods. To reiterate billing terms and conditions, utilize various communication channels such as email, postal mail, or a customer payment portal. Additionally, send reminders of upcoming payment due dates and changes to billing terms well in advance to ensure customers are informed.

- Implement electronic invoicing. To establish electronic invoicing, generate invoices in digital formats such as PDFs, which can be easily emailed to customers or made available in customer portals. You can also use automation rules to trigger invoice creation upon fulfilling certain criteria, like the conclusion of a billing cycle. Additionally, e-signature capability should be incorporated for added authenticity and legal compliance, and all electronic invoices should be stored securely and backed up for record-keeping and auditing purposes.

- Set up a self-service customer payment portal. Begin by designing an intuitive interface that allows customers to seamlessly view invoices, access billing history, and make payments without encountering any complexities. Prioritize integrating secure, PCI-compliant payment processing features to safeguard financial transactions and instill trust in your customers. It’s also beneficial to enhance the portal’s usability by including comprehensive self-help resources such as FAQs and troubleshooting guides, facilitating smooth navigation for customers who may require assistance. Moreover, it ensures the portal’s accessibility across various devices and demographics. By providing a self-service portal, you not only streamline payment processes but also foster timely payments and elevate overall customer satisfaction with their billing experience.

Now that you know how to set up automated billing, you should familiarize yourself with some best practices for implementing it into your business.

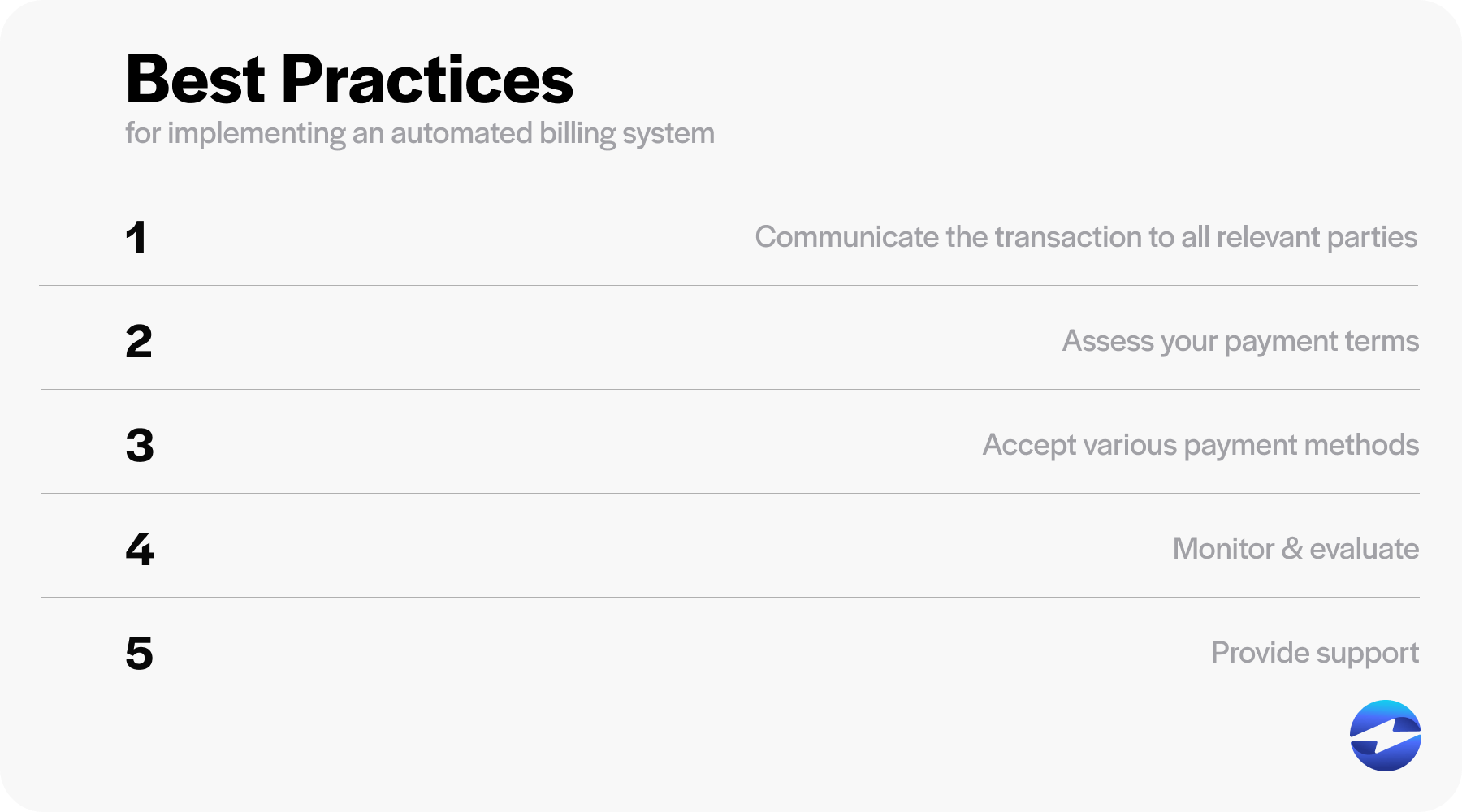

Best practices for implementing an automated billing system

Transitioning to an automated billing system represents a significant shift for any business, impacting internal operations and customer interactions. Effective implementation requires careful planning and execution of best practices to ensure a smooth transition and maximize the new system’s benefits.

Communicate the transition to all relevant parties

Effective communication about the transition from manual to automated billing is key. Customers must be informed to understand the benefits and changes to the billing experience, ensuring they encounter no surprises. Thorough communication helps to build trust and acceptance. Details about new features, like electronic invoicing and online portals, should be shared so customers can take full advantage of the new system.

Assess your payment terms

When transitioning to an automated billing system, re-evaluating your payment terms is crucial to align them with your business objectives and the expectations of your customers. An automated system allows for greater flexibility in setting payment terms that can lead to faster payments and improved cash flow. However, clear terms must be established to prevent misunderstandings and disputes. This assessment can be an opportunity to introduce incentives for early payments or to set up payment plans for higher-value invoices, enhancing the overall customer experience and satisfaction.

Accept various payment methods

The acceptance of diverse payment methods is significant in an automated billing system, as it offers customers convenience and choice, facilitating timely payments. Multiple payment options, including credit cards, online payments, direct bank transfers, and mobile payment solutions, cater to the preferences of different customers. Offering a range of payment methods can reduce barriers, decrease late payments, and help businesses cater to a broader market, ultimately enhancing customer satisfaction and loyalty.

Monitor and evaluate

To maximize the efficiency and effectiveness of an automated billing system, ongoing monitoring and evaluation are essential. This helps quickly identify any issues, understand customer payment behaviors, and adapt to changing needs. Regular performance reviews against set metrics and customer feedback facilitate continuous improvement of the billing process. It also ensures the system remains up-to-date and meets the evolving requirements of both the business and its customers.

Provide support

Ensuring the availability of customer support is vital when implementing an automated billing system. Support channels such as hotlines, live chat, email assistance, and comprehensive online resources can help promptly address customer questions or issues with the new system. Exceptional customer service contributes to a positive experience, fosters trust, and can prevent issues from escalating into bigger problems or customer churn. It’s also an opportunity to gather valuable feedback to refine and enhance the billing system.

By following these best practices, businesses can navigate automation implementation with confidence. For a more seamless experience, consider using a top-rated payment solution with automated billing capabilities like EBizCharge.

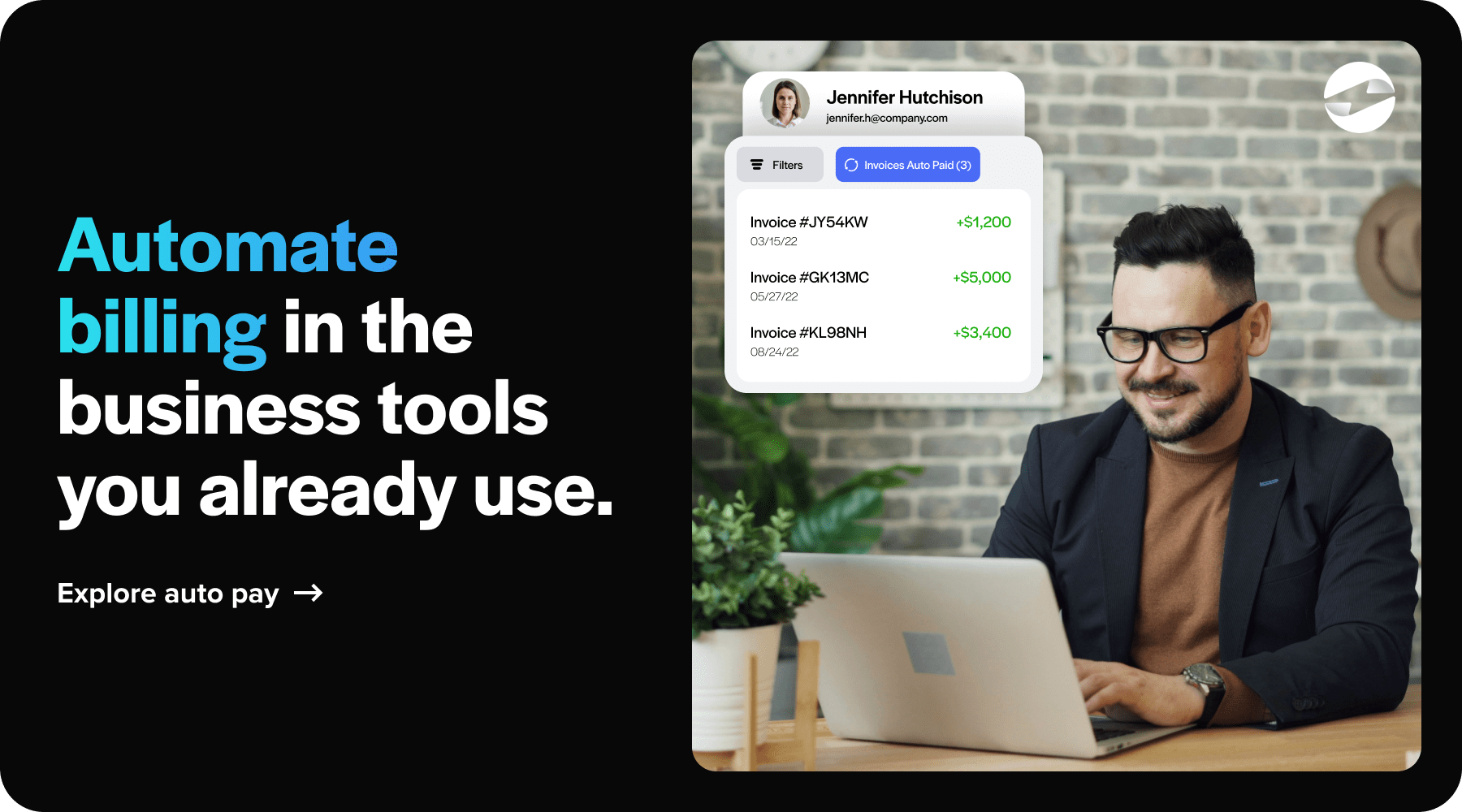

Simplify the billing process with EBizCharge

Thanks to its robust automated billing features, EBizCharge stands out as a comprehensive solution designed to streamline businesses’ billing process. By leveraging this billing automation platform, businesses can efficiently handle various payment methods, including credit cards and bank transfers, significantly minimizing the risk of human error and late payments.

One of the primary advantages of this top-rated payment platform lies in its ability to reduce manual processes inherent in traditional invoicing systems, facilitating faster and more accurate invoice generation. EBizCharge also incorporates a customer payment portal, providing customers with a convenient platform to view, manage, and process payments, enhancing overall customer satisfaction. Additionally, the platform seamlessly integrates with leading accounting software, ensuring that all billing data remains up-to-date and minimizing the need for manual data entry. With customizable billing cycles tailored to fit specific business models, EBizCharge also ensures timely billing according to agreed payment terms. Furthermore, its advanced reporting capabilities offer detailed insights into payment tracking and streamlines billing solutions.

With EBizCharge, businesses can anticipate a reduction in the billing cycle, improved cash flow, and an overall more efficient billing process adaptable to various billing models.