Blog > How to Write An Invoice Email: A Step-by-Step Guide

How to Write An Invoice Email: A Step-by-Step Guide

The moment of truth in any business transaction comes when it’s time to send the invoice. Therefore, understanding the anatomy of an invoice email is crucial for prompt payment and professional relationships.

An invoice email not only requests payment but also reflects your business’s attention to detail and communication skills. From itemizing services rendered to setting clear payment expectations, every component of an invoice email is a building block toward fiscal efficiency.

What is an invoice email?

An invoice email is a digital method of requesting payment for services rendered or goods provided. As the world leans more towards paperless transactions, email invoicing is steadily replacing the traditional mailing of paper invoices.

When a business owner or service provider sends an invoice via email, they’re dispatching an electronic version of the billing document that lists the goods or services supplied and their associated costs. A billing email serves the same purpose, whether you’re issuing a single invoice or managing recurring billing cycles across multiple clients. This email typically contains, or is attached to, the actual invoice document (often in PDF format), ensuring that invoice details such as the amount due, payment terms, and the deadline for payment are clearly communicated to the client.

While the purpose of invoice emails may seem straightforward, it’s still crucial to understand their benefits and why these emails are becoming increasingly essential for businesses.

Why is writing an effective invoice email important?

Crafting an effective invoice email is crucial for several reasons, including improved revenue and financial management and stronger business relationships.

Invoice emails directly influence how quickly and reliably a business gets paid, affecting cash flow and overall financial health. A clear and concise invoice email ensures that the recipient understands the payment request and that there’s no ambiguity about the amount, due date, or means of payment. This clarity minimizes the risk of late payments or overdue invoices, which can negatively impact business operations.

Effective invoice emails can also encourage more professional relationships between business owners and customers. These emails serve as friendly reminders that a payment is due, encouraging timely settlements while demonstrating the value placed on customer service and professionalism.

In addition, a well-structured email minimizes any potential confusion that might delay payment, offering the recipient all necessary payment details and available payment options, such as credit card or direct bank transfers, at their fingertips. Businesses typically include support contacts for any related invoice questions on these emails, reassuring customers that support is on hand if needed.

For these reasons, mastering the art of sending effective invoice emails is a valuable skill for ensuring the smooth operation of a business’s payment process.

How to write an email with an invoice attached: 7-step process with examples

Sending an effective invoice email is crucial for securing prompt payments and enhancing your business’s financial health.

Here are seven steps to crafting your invoice email:

- Email subject: Start with a clear and concise subject line that includes ‘Invoice’ and the invoice number, narrowing down what your email is about. For example, “Invoice #12345 from [Your Company Name].”

- Email address: When sending invoice emails, use a professional email address that reflects your business’s domain.

- Email message:

- Greetings: Use a friendly opening, like “Dear [Recipient’s Name],”

- Body: Briefly explain the purpose of the email, for example, “Please find attached Invoice #12345 for [Product/Service provided].”

- Payment Terms: Clearly state the payment term, such as “due within 30 days.”

- Payment Details: Outline available payment options (credit card, bank transfer, etc.).

- Contact details: Always include your contact information for any inquiries or clarification regarding the invoice or the payment process.

- Attachment: Attach the invoice, preferably as a PDF file, ensuring it’s appropriately named and formatted.

- Closing remark: To ensure a positive end to the communication, end the email on a friendly note with an offer to answer any questions.

- Signature: Use a professional email signature with your full name, position, and company details.

Remember, the tone should be polite yet assertive, ensuring a friendly reminder while emphasizing the importance of timely payments.

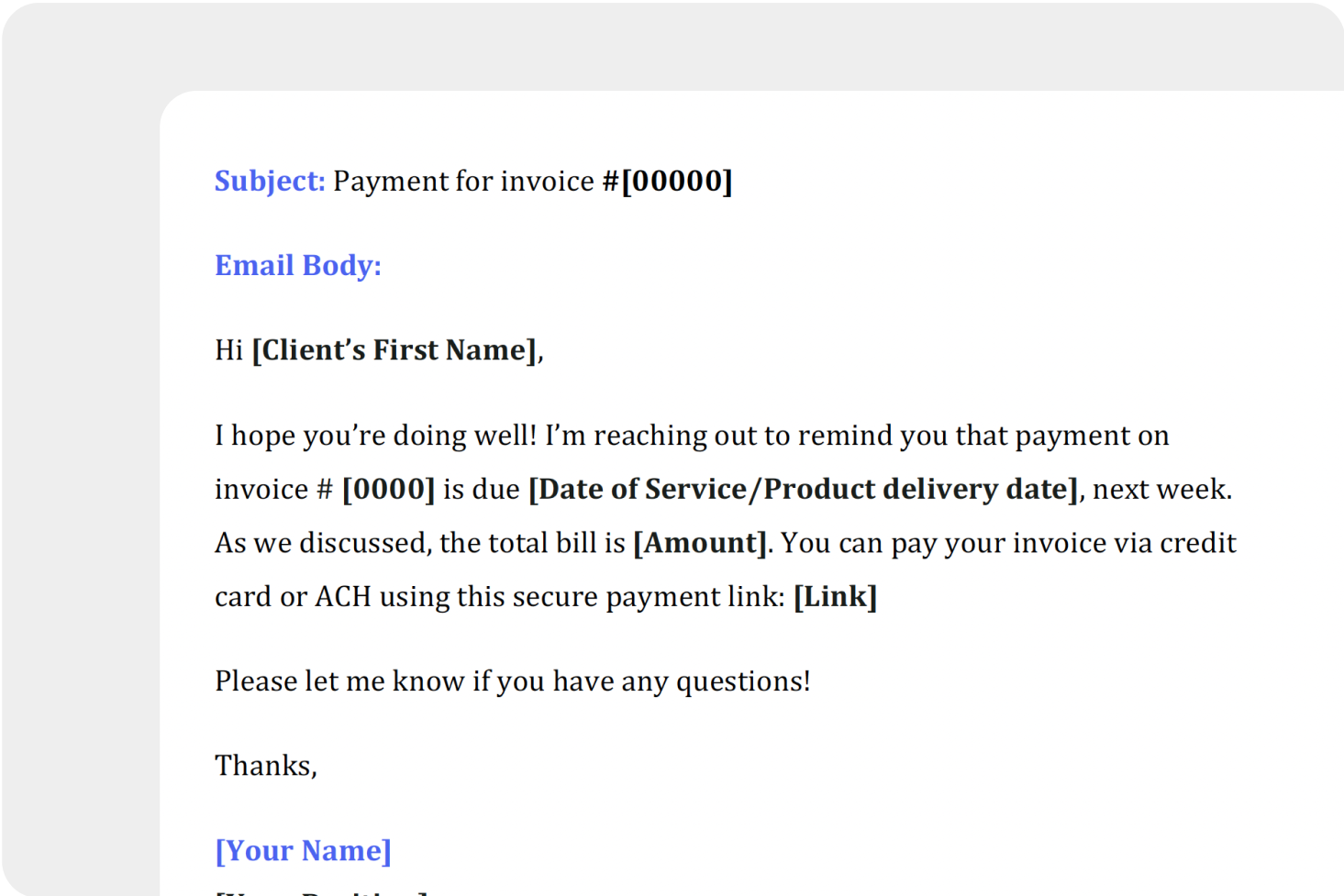

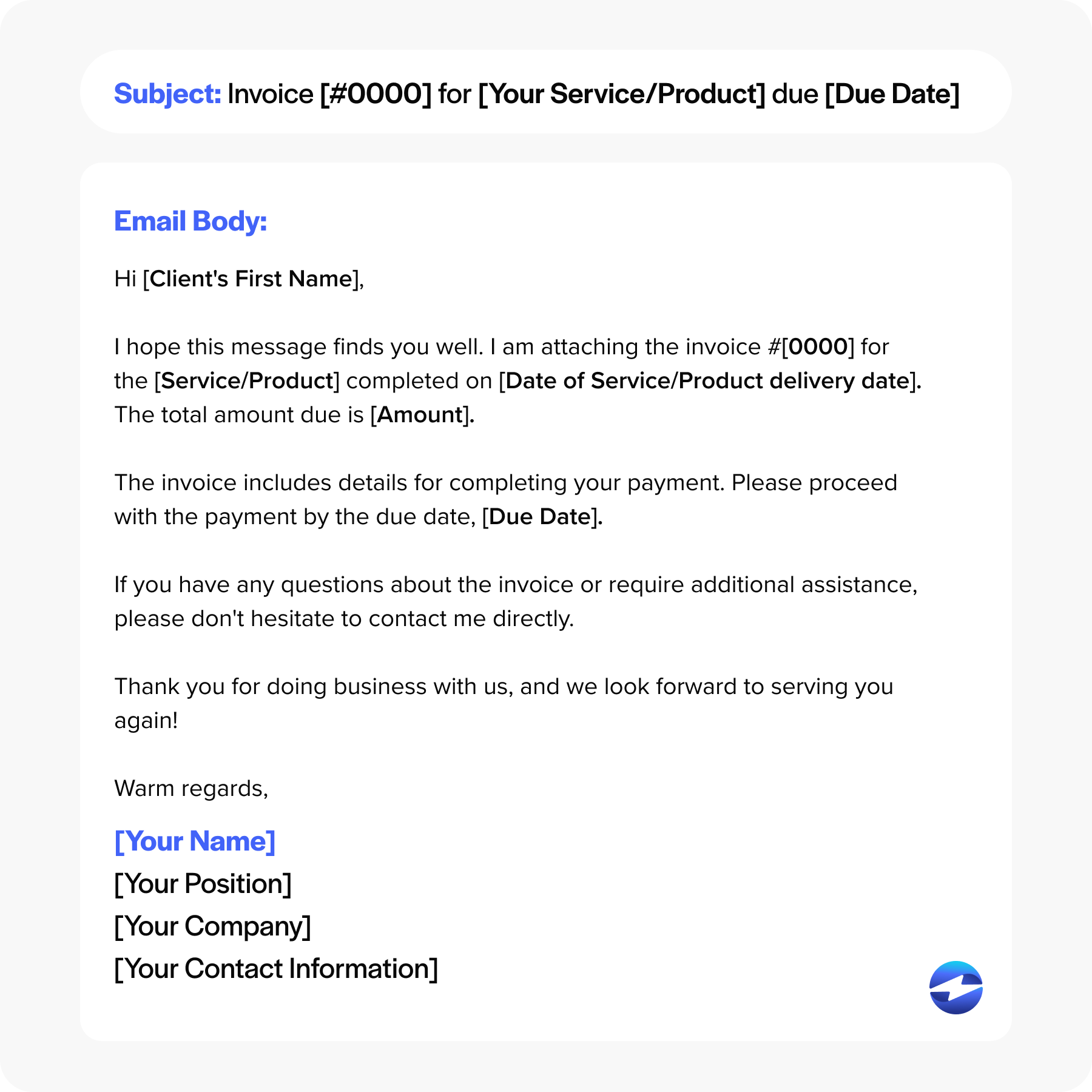

Example of an invoice email (format and template)

When preparing to send an invoice through email, a proper template can save you time and ensure consistency. Below is a sample email invoice template that you can adapt to fit your needs:

Remember to customize the placeholder terms in brackets with the appropriate details related to your invoicing situation and attach the invoice PDF file to your email before sending it. This template is designed to be clear and professional, which is essential when emailing invoices.

Other Invoice email wording examples

The right wording depends on where you are in the payment cycle. Here are a few short examples you can adapt.

For a standard invoice send: “Please find attached invoice #[0000] for [service/product]. Payment is due by [date]. Let us know if you have any questions.”

For a friendly reminder before the due date: “Just a quick note that invoice #[0000] is due on [date]. Please let us know if you need anything from our end.”

For a formal invoice request to a supplier: “Could you please send over the invoice for [purchase/service] at your earliest convenience? We’d like to process payment promptly.”

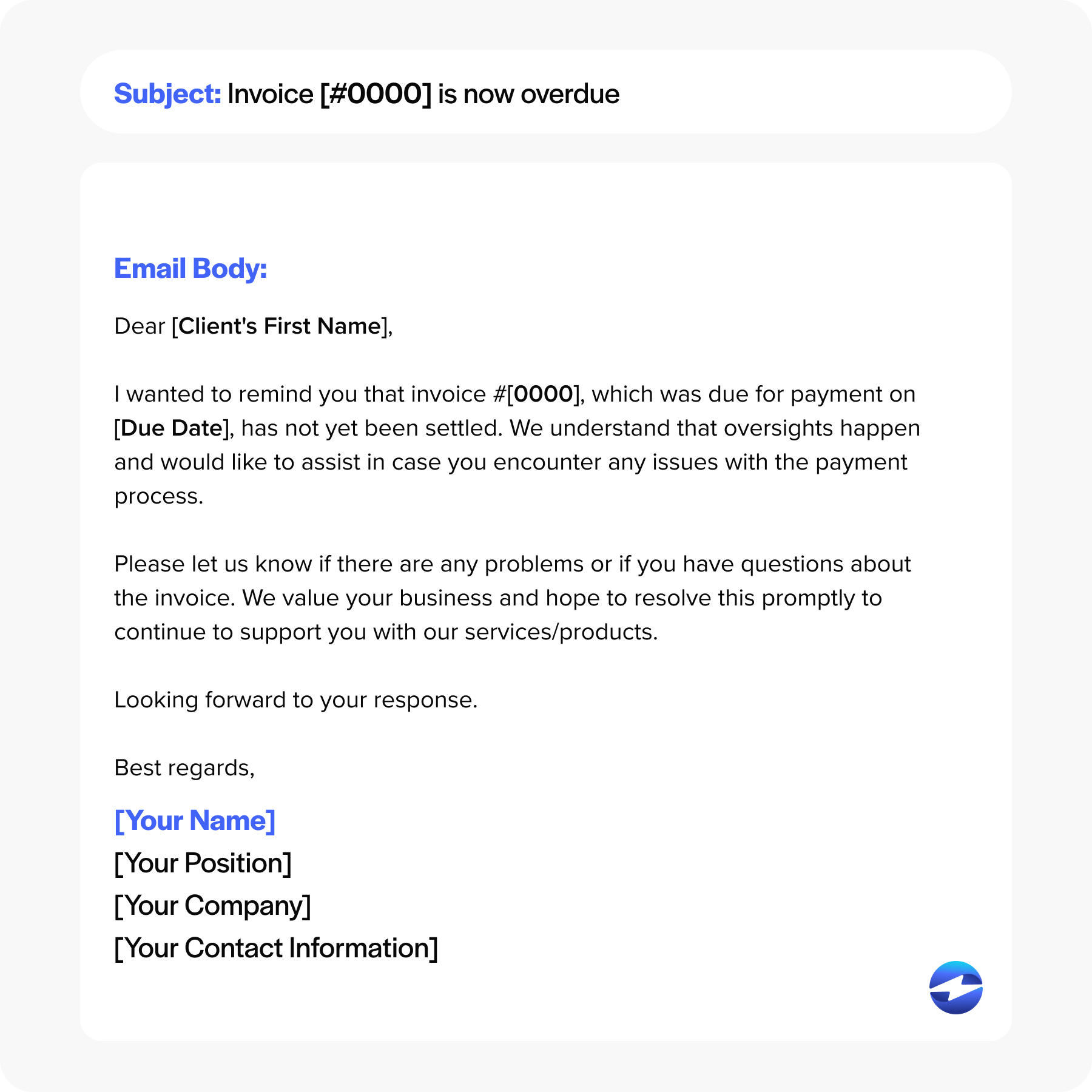

How to follow up on your invoice email

An important aspect of managing your cash flow as a business owner is following up on unpaid invoices. Following up is necessary when you have yet to receive timely payments as per the agreement with your client.

Send a polite payment reminder shortly before the due date to encourage timely settlement. If the due date passes without payment, here’s an effective template you can use to follow up on your invoice email:

When asking for payment, make an effort to be professional and polite. Keep these follow-up emails concise and courteous. If the invoice remains unpaid, consider a more direct approach and possibly involve collection measures, depending on the amount overdue and your company’s policies.

Remember that preserving a good client relationship is vital, so exercise understanding and offer solutions, such as payment plans, if necessary.

How to Request an Invoice from a Supplier

There are a few situations where you might need to follow up with a supplier for an invoice. Maybe the work is complete but the bill never arrived, or you need documentation for your records before closing out the month. Whatever the reason, a short and professional email is all it takes.

Keep it direct. State what the order was, when it took place, and that you’re looking to get payment processed quickly. Suppliers respond faster when they know payment is ready to go on your end.

Here is a sample email you can adapt depending on the situation.

Creating powerful invoice emails to enhance your payment collections

Mastering the art of crafting effective invoice emails is crucial for businesses to ensure timely payments and minimize late payments. You can streamline the invoicing process and encourage prompt payments by providing transparent invoice information, clear payment terms, and convenient payment options.

In addition to drafting effective invoice emails, businesses can use reliable payment processing platforms like EBizCharge, which offers a robust suite of payment collection tools like email payment links, a customer payment portal, and recurring billing to collect payments on time. It also integrates directly with QuickBooks payment processing and dozens of other accounting platforms, so every collected payment posts to your books automatically.

Frequently Asked Questions

What is a billing email?

A billing email is any email sent to request or confirm payment. The term is often used interchangeably with invoice email, though billing emails can also include payment confirmations, account statements, and reminders. For most businesses, a billing email and an invoice email serve the same function: communicating what is owed and how to pay it.

How do I send an invoice through email?

Write a professional email with a clear subject line that includes the invoice number and due date. Attach the invoice as a PDF, include a brief message summarizing the amount due and payment options, and send it from a business email address. If your payment platform supports it, include a direct payment link so the client can pay without leaving their inbox.

What should I write when sending an invoice via email?

Keep it short. State what the invoice is for, the amount due, the due date, and how to pay. Include your contact details in case the client has questions. A one or two-sentence body with a clean attachment is more effective than a lengthy explanation.

How to pay an invoice through email?

Follow these steps to pay an invoice through email:

- Review the invoice details carefully.

- Follow the payment instructions provided in the email.

- Pay securely online via the provided payment link or initiate a bank transfer using the provided details.

- Confirm the payment by checking your bank account or receiving a payment confirmation.

- Consider notifying the vendor once the payment is made to ensure they update their records accordingly.

How to request an invoice from a supplier by email (sample)?

You can politely and professionally request an invoice from a vendor by simply asking. Here is an example:

Subject: Request for Invoice – [Your Company Name]

Dear [Supplier’s Name],

I hope this email finds you well.

We are requesting the invoice for the recent transaction(s) made with [company] to ensure our records remain accurate and up-to-date. Could you please provide us with the invoice for the following items:

- [List of items purchased]

- [Transaction date(s)]

Thank you so much for your help and quick reply!

What is a remit payment?

A remittance payment, commonly referred to as a “remittance,” is the process of sending money as a payment to settle an invoice or fulfill a financial obligation. When you remit payment, you are essentially sending funds to another party, such as a vendor, supplier, or service provider, to pay for goods or services provided. The term “remit” can be used as both a verb (to remit payment) and a noun (the remittance itself).

Best regards,

[Your Name]

[Your Position]

[Your Company Name]

[Your Contact Information]

- What is an invoice email?

- How to write an email with an invoice attached: 7-step process with examples

- Example of an invoice email (format and template)

- How to follow up on your invoice email

- How to Request an Invoice from a Supplier

- Creating powerful invoice emails to enhance your payment collections

- Frequently Asked Questions