Blog > 5 Ways to Professionally Ask for Payment via Email (With Templates)

5 Ways to Professionally Ask for Payment via Email (With Templates)

Asking for payment can be uncomfortable. No one wants to spend the time to individually contact customers and engage them in a potentially awkward conversation. Unfortunately, these awkward conversations are often necessary because late payments are rampant. According to a study by LinkedIn, 54% of small and medium-sized enterprises experience late payments, with 6 days being the average delay.

If you establish a system, create dunning letter templates, and offer convenient payment options to customers, you can reduce late payments and eliminate the need to spend extra time or effort following up on late payments.

Read on for 5 examples of how to write an email asking for a payment request professionally and politely.

Set up a system

First, set up a payment system and clearly communicate it to your customers. If you don’t provide them with an easy-to-understand payment schedule, then how can you expect them to pay on time?

Every company has different needs. Depending on your business, you may ask for a down payment upfront, or maybe you only charge the full amount after services are rendered. In any case, make your expectations abundantly clear to customers, including any late fees or penalties they may incur if they miss the payment deadline.

Once you’ve established a payment schedule and communicated it to customers, stick with it. Many businesses set up a series of emails they use when asking for payment. For example, a common schedule is to send out an email:

- A week before the due date

- On the due date

- One week after the due date

- Two weeks after the due date

- One month after the due date

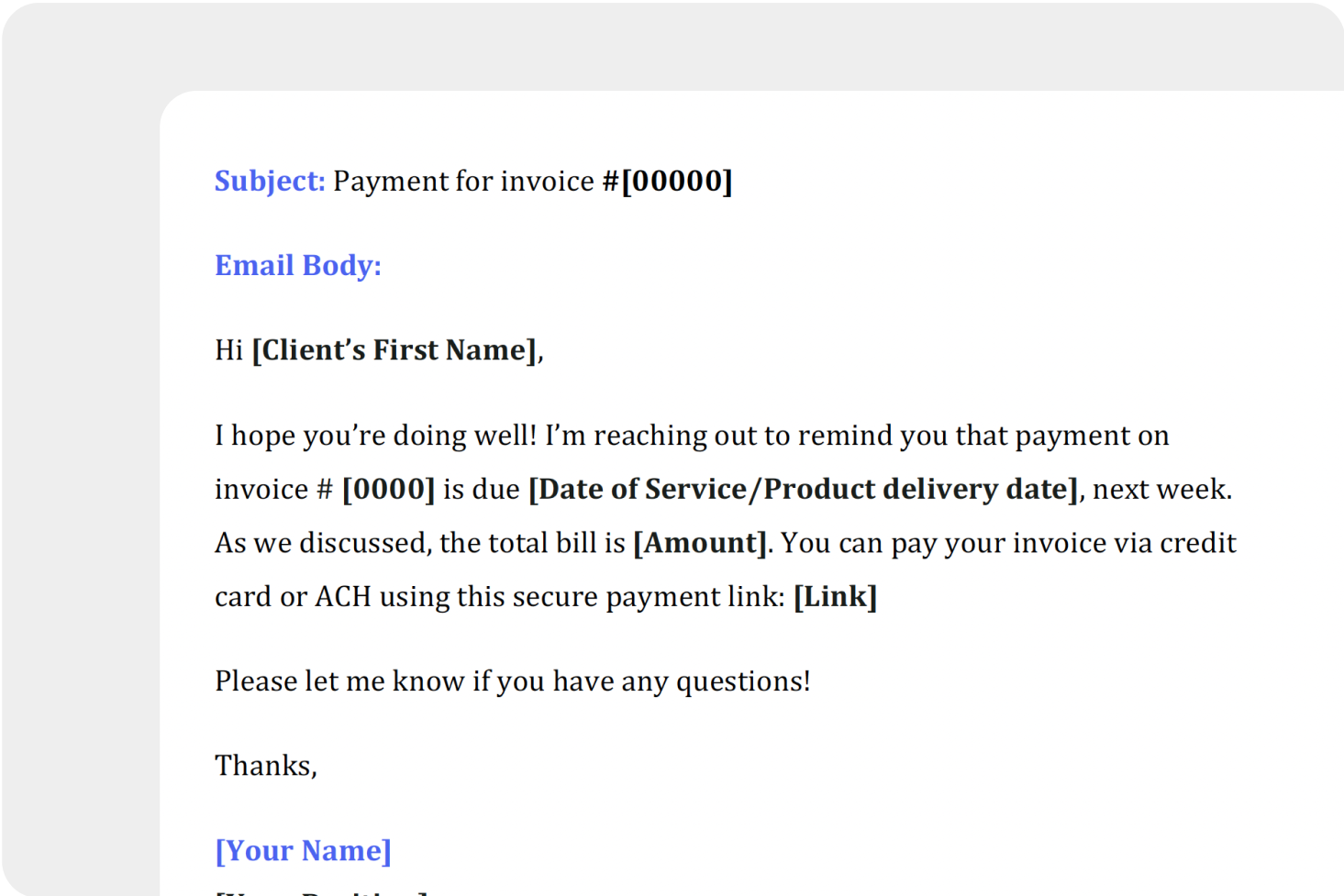

Create payment request templates

Don’t reinvent the wheel every time you communicate with customers. Create templates to easily ask for money politely.

Templates remove the stress of having to type up a new email or text message every time you reach out. Instead of worrying about getting the wording exactly right, you can simply send your pre-written template in a matter of seconds.

For even more convenience, automate your payment emails with a tool like EBizCharge. With EBizCharge, you can create a series of email templates and then set up a schedule for when you’d like them to be automatically delivered.

How to professionally ask a customer for a payment using an email payment link

When writing an email payment request, run through the following checklist to make sure it’s sufficient:

- Polite and Professional Tone: Maintain a polite and professional tone throughout the email. Show gratitude for the partnership and for being chosen as a vendor.

- Set Proper Expectations: When writing an invoice email, set clear and proper expectations for payment terms and expected next steps. Provide all necessary payment information and confirm payment terms and invoice details.

- Offer Assistance: Offer assistance and provide contact information for any questions or additional information. Request confirmation of receipt and ask the customer to share any anticipated payment delays.

Here are five samples.

These are some common ways you can ask for a payment politely. These payment request templates can be adapted for text messages as well.

Give customers convenient payment options

Finally, to ensure your customers pay on time, give them easy payment options. No one wants to sit down, write out a check, address an envelope, and drop it in the mail. That outdated payment method is just a series of small inconveniences that customers will most likely put off until the last moment. But if you give customers convenient payment options, they’re more likely to pay on time. The more friction you can remove between your customers and the payment, the better.

One of the tools you can use to make payments easier for customers is email pay. With email pay, you can send individual invoices to customers via email. Customers receive an email with a link to make payment. When they click on the link, they’re taken to a secure web form where they can pay off the invoice with a credit card, debit card, or ACH payment. Once they make a payment, they get a receipt emailed to them, and the paid invoice syncs back to your accounting or ERP software. Customers like email pay because:

- They can quickly and easily make payments

- They can pay on the go using a mobile device or tablet

- They can pay outside of regular business hours

- They don’t have to set up a phone call with you to make a payment over the phone

When payments are this easy, your customers are happy, and collections are a breeze.

Start colleting payments faster

Is collecting payments a hassle?

Our email pay feature is a hands-free way to send payment links to your customers. Check it out!

Collections are the lifeblood of any business. Without prompt payment, your cash flow will suffer and impact the overall health of the company. Fortunately, you can use convenient collection tools to take the pain out of asking customers for payment via email. With the right system in place, you’ll experience quicker collections, increased cash flow, and more time back in your day.