Blog > Accept Credit Card Payments in QuickBooks

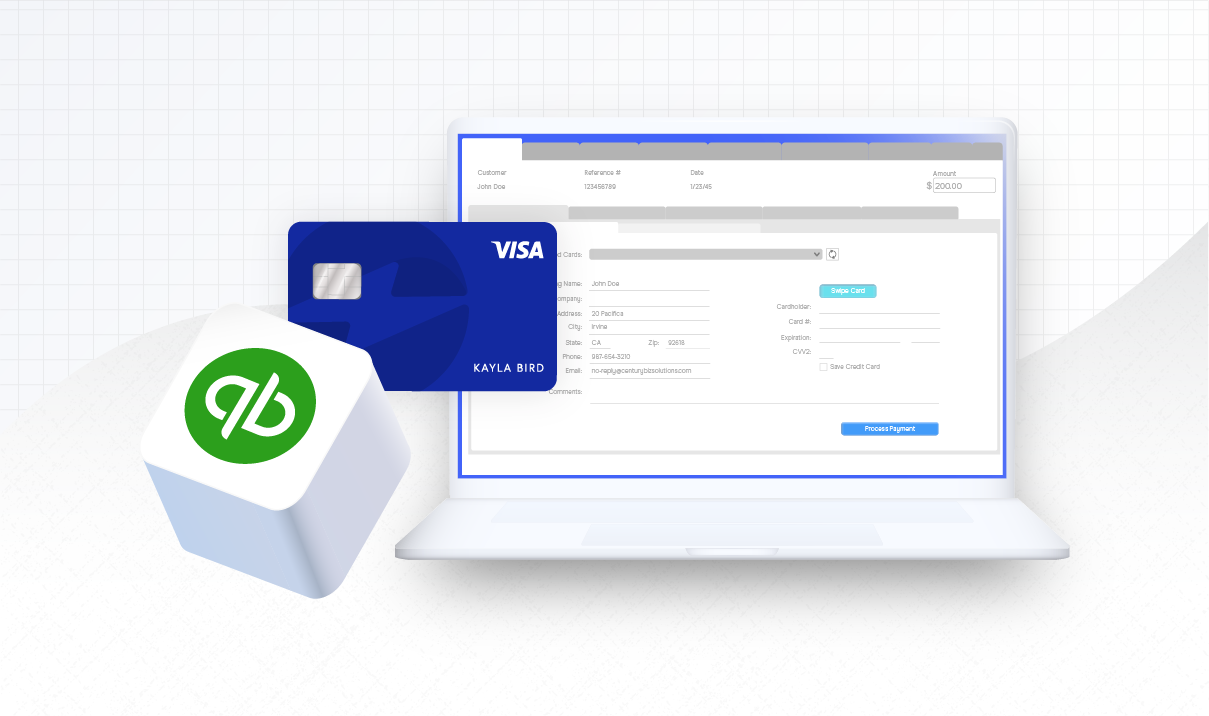

Accept Credit Card Payments in QuickBooks

Why should I accept credit cards in QuickBooks?

Accepting credit cards in QuickBooks is a great option for businesses that are looking to streamline their accounting and offer their customers easy payment options. Not every customer carries cash and processing a credit card can be a long process with all the extra accounting work. That’s where processing credit cards within QuickBooks can help. When you process a credit card inside QuickBooks, each transaction will automatically apply payments back into the invoice, eliminating the need to do it manually. This cuts out the extra accounting work and saves you time at the end of each day.

How to accept payments:

How your business processes credit cards inside of QuickBooks may vary depending on your current payment processor and business needs. Payment providers such as EBizCharge simplify the transaction process by allowing you to accept credit card payments in QuickBooks in several different native modules. EBizCharge allows you to accept payments in:

- Sales Orders

- Refunds and Credits

- Receive Payments

- Create Invoices

You can accept payments in EBizCharge by either choosing a customer’s saved credit card or using the EBizCharge module inside of QuickBooks to add a new form of payment. Once a card is chosen, you can process the payment from inside the module.

What happens after you make the payment?

Like every other credit card transaction, the payments you accept directly in QuickBooks need to be authorized and confirmed. Once a payment has been received, EBizCharge automatically updates the balance due on your invoice. This eliminates double data entry and saves you time while balancing your books.

Is processing credit cards in QuickBooks safe?

Processing credit cards inside of QuickBooks resembles a transaction run through a virtual terminal. With EBizCharge, payment information is passed through a PCI-compliant payment gateway, ensuring your business is following standards set by the Payment Card Industry. More importantly, EBizCharge keeps your customers’ credit card data safe. Along with being PCI compliant, EBizCharge tokenizes and encrypts credit card information. We also reduce your liability by storing credit card data on our secure third-party server.

What about online payments?

Processing credit cards in QuickBooks is a great way for you to save time. With automatic reconciliation and no time spent fixing double data entry errors, why wouldn’t you choose to accept credit cards in QuickBooks?

The answer: Online payments. But don’t let that discourage you. A lot of businesses don’t know that you can sync your online payments back into QuickBooks.

With the growth of eCommerce platforms, more and more customers are using their credit cards to make online purchases. Just in 2019 alone, eCommerce sales reached a tremendous $3.46 trillion, begging the question:

How do online payments sync back into QuickBooks?

The answer is simple.

EBizCharge offers three options that allow your customers to pay off invoices at their convenience:

- eCommerce bridge

- Online payment portal

- Email pay

An eCommerce bridge allows merchants using a shopping cart platform (such as Magento and WooCommerce) to sync credit card payments back into QuickBooks. Meaning there’s no need to reconcile your books for online payments.

A second option is a powerful tool native to the EBizCharge payment gateway. The customer payment portal is a self-service platform that allows customers to log in and pay off outstanding invoices. Simply upload invoices straight from your QuickBooks software and allow customers to make credit card payments online. QuickBooks automatically updates the balance due on invoices once a credit card payment is received.

A third option allows you to email secure payment links from directly inside QuickBooks. Typically used for one-time credit card transactions, email pay allows customers to pay off invoices within seconds. Payments automatically sync back into QuickBooks, and EBizCharge updates the balance due.

Get started accepting credit cards in QuickBooks

Processing credit cards inside of QuickBooks saves you time by automating daily reconciliation and avoiding double data entry errors. After learning about credit card processing inside QuickBooks, you can use the EBizCharge credit card integration to start processing credit cards today.