Blog > How Do You Use QuickBooks Payment Links?

How Do You Use QuickBooks Payment Links?

QuickBooks is a comprehensive accounting software designed to meet businesses’ financial management needs. Developed by Intuit, it allows users to handle various accounting tasks such as tracking expenses, creating invoices, and managing inventory.

What are payment links?

Payment links are secure, shareable URLs businesses can send to customers to facilitate immediate payment for services or products.

When customers click on a payment link, they’re redirected to a payment gateway where they can pay via credit card, bank transfer, or other preferred payment methods. These links can be sent via email, text, or even embedded in online invoices, giving your customers a flexible and straightforward way to process payment promptly and securely.

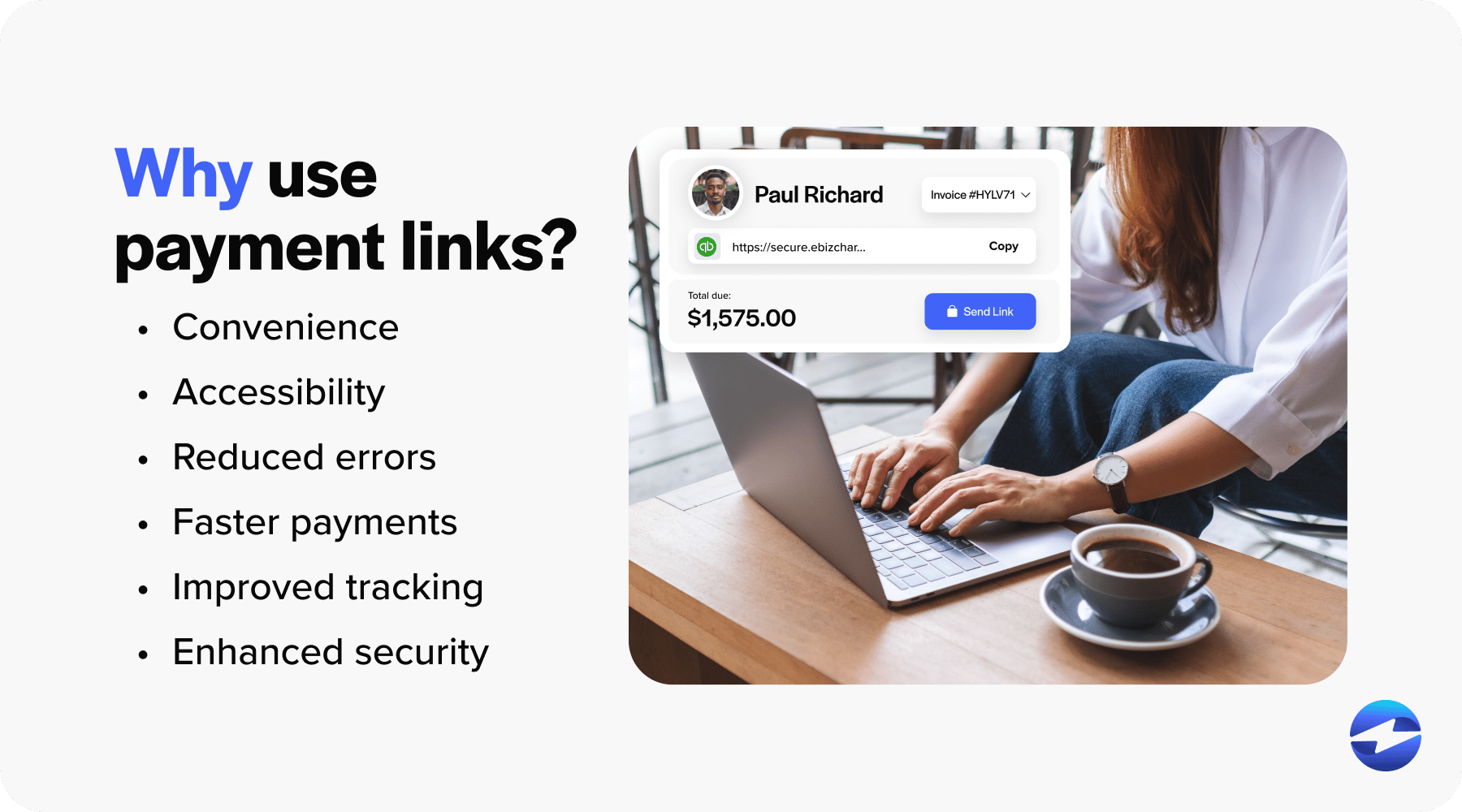

6 benefits of payment links

Payment links provide numerous advantages to businesses, enhancing their financial operations and customer interaction.

Here are some of the key benefits of employing payment links:

- Convenience: Payment links allow customers to make payments easily and conveniently from anywhere with an Internet connection, using their preferred device. This eliminates the need for physical checks or cash payments, streamlining the payment process for businesses and customers.

- Accessibility: Payment links can be shared via various communication channels such as email, text message, or social media, making it easy to reach customers regardless of their location or time zone. This accessibility allows for more effortless customer payments, increasing the likelihood of prompt invoices and better cash flow.

- Reduced errors: By providing a direct link to a secure payment portal, payment links minimize the risk of manual data entry errors when customers manually input payment information. This can mitigate and eliminate payment discrepancies and reconciliation issues, saving businesses time and resources.

- Faster payments: Payment links streamline the payment process, allowing customers to complete transactions quickly with just a few clicks. This results in faster payment processing times than traditional payment methods, accelerating cash flow and improving financial efficiency.

- Improved tracking: Payment links often come with built-in tracking and reporting capabilities, allowing businesses to monitor payment activity in real time. This visibility enables you to track payment status, identify late payments, and reconcile accounts more efficiently, for better financial management and decision-making.

- Enhanced security: Many payment link solutions incorporate advanced security features such as encryption and tokenization to protect sensitive payment data. This helps lower the risk of unauthorized access, providing peace of mind to businesses and customers.

Now that you know what payment links are and their benefits, it’s time to learn how to set them up.

Setting up payment links in QuickBooks Online and Desktop

To set up payment links in QuickBooks, businesses must first establish a merchant account.

A merchant account is essential to securely process credit and debit card payments, serving as an intermediary between businesses, customers’ issuing banks, and payment processors. Without a merchant account, businesses can’t accept online payments or generate links within QuickBooks.

QuickBooks offers two primary options for setting up a merchant account and enabling payment links. First, businesses can opt for a QuickBooks Payment Account, which allows them to set up payment processing directly within the QuickBooks platform.

Alternatively, businesses can integrate a third-party payment processor like EBizCharge to facilitate payment processing. EBizCharge often provides more competitive rates and features than QuickBooks Payment Accounts, making it a cost-effective solution for businesses looking to save on payment processing fees.

Once you’ve acquired your merchant account, it’s time to set up your payment links.

Setting up payment links in QuickBooks Online

- First, sign into your QuickBooks account.

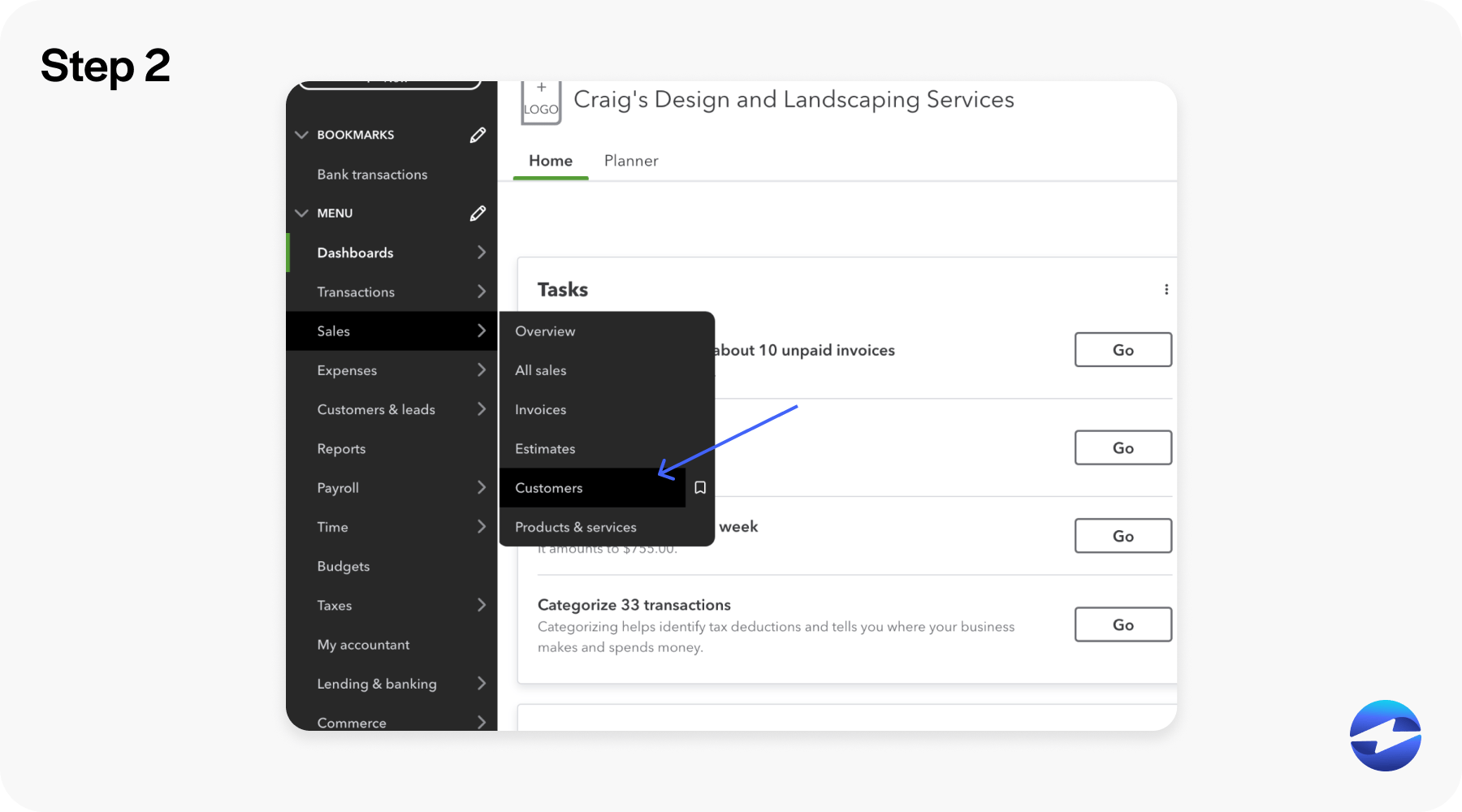

- In the dashboard, locate and select the “Sales” tab on the menu bar. In this tab, find and click “Customers”.

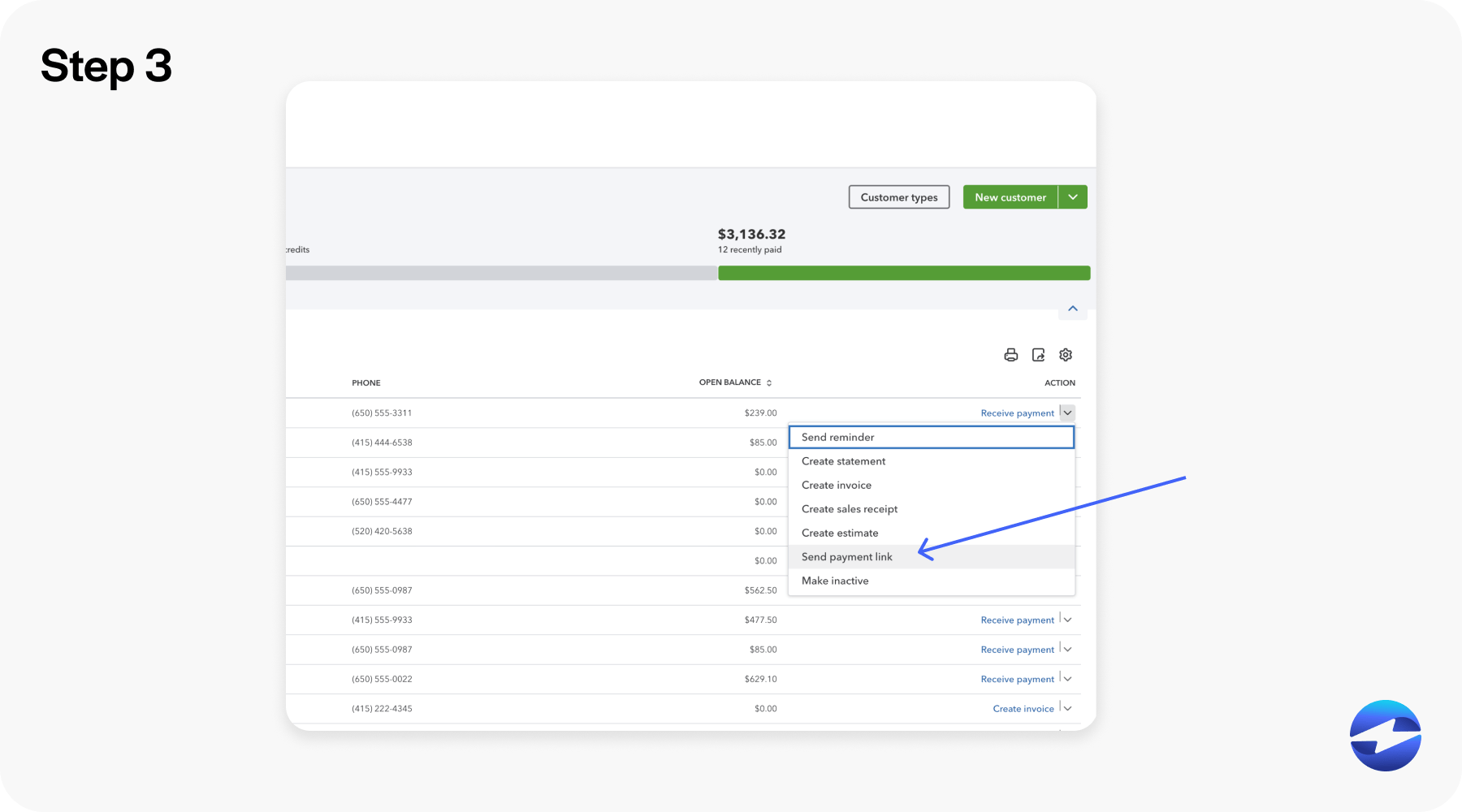

- Next, click on the “action” button on the right-hand side of the customer’s account and select “Send Payment Link”.

- Proceed to generate a new payment link. There are also options to customize your payment link to add your business’s name.

- Fill out the necessary payment information, including transaction details and customer data. Then, you can select the payment methods you wish to offer.

- Once you’re ready, send your payment link directly to your customer. You can also copy the payment link to send it through a different channel, like an alternate email, text message, or a QuickBooks QR code that customers can scan with their smartphones.

- Once sent, customers can click on the payment link, which will take them to a secure payment page to select a payment method and pay their invoices.

- You can then check the status of payment in the payment links tab. You can also view the link details, send payment reminders, and edit your payment links.

Setting up payment links in QuickBooks Desktop

- Open QuickBooks Desktop and sign into your company file.

- Click on the “Sales” tab on the menu bar located at the top of the page. Then find and click on “Customers”.

- Find the customer you wish to send the payment link to and locate the “actions” tab next to the account. Select “Send Payment Link”.

- In the new window that appears, click the “Create Payment Link” button.

- Fill in the required details such as the payment amount, description, customer name, email address, and preferred payment method.

- Once completed, find and click on the “Send Payment Link” to email the link directly to your customer. You can also copy the payment link to send it through a different channel, like an alternate email, text message, or a QuickBooks QR code.

While implementing payment links simplifies payment collections, leveraging payment solutions like EBizCharge can further streamline businesses’ payment collections.

Enhancing the QuickBooks experience with EBizCharge

QuickBooks payment links offer a seamless solution for businesses seeking efficient and secure payment processing. By integrating with platforms like EBizCharge, businesses can optimize their payment systems for enhanced functionality and cost-effectiveness, taking advantage of features like data synchronization, streamlined workflows, and enhanced reporting capabilities. As businesses continue to adapt to evolving market demands, leveraging QuickBooks payment links alongside EBizCharge becomes increasingly indispensable for staying competitive in the digital landscape.