Templates | Invoice Template

Free Invoice Template

Free Invoice Template

Get a blank invoice template you can customize—just fill in your preferred terms like Net 30, Net 15, Due on Receipt, or 2/10 Net 30 to fit your business needs!

Get a blank invoice template you can customize—just fill in your preferred terms like Net 30, Net 15, Due on Receipt, or 2/10 Net 30 to fit your business needs!

Download our blank invoice template today.

Download our free Invoice Template to effortlessly create, send, and track professional invoices for your business!

Stay on top of your billing with our free, easy-to-use Net 30 invoice template. Customize, send, and track invoices effortlessly while ensuring smooth payment processing and cash flow management.

Get paid faster with our professional invoice templates. Easily customize, send, and manage invoices to streamline your payment process and keep your business running smoothly.

What is an invoice?

At its core, an invoice is just a bill. It’s a document that tells your customer how much they owe you, what they’re paying for, and when the payment is due.

It’s one of the most basic tools in business—and also one of the most important. Whether you’re a freelancer, contractor, consultant, or a small business owner, you’ll probably send out invoices regularly. Think of it as the formal handshake that happens after the work is done or the product is delivered. You’ve held up your end—now it’s time to get paid.

Invoices help keep everyone on the same page. They spell out the details, prevent misunderstandings, and serve as a paper trail in case questions ever come up later.

What’s included on an invoice?

Even though invoices can look different depending on the business or industry, they all usually include a few key pieces of information. If you’re new to this, some of the terms might sound a little formal, but once you get the hang of it, it’s all pretty straightforward.

Common invoice terms to understand:

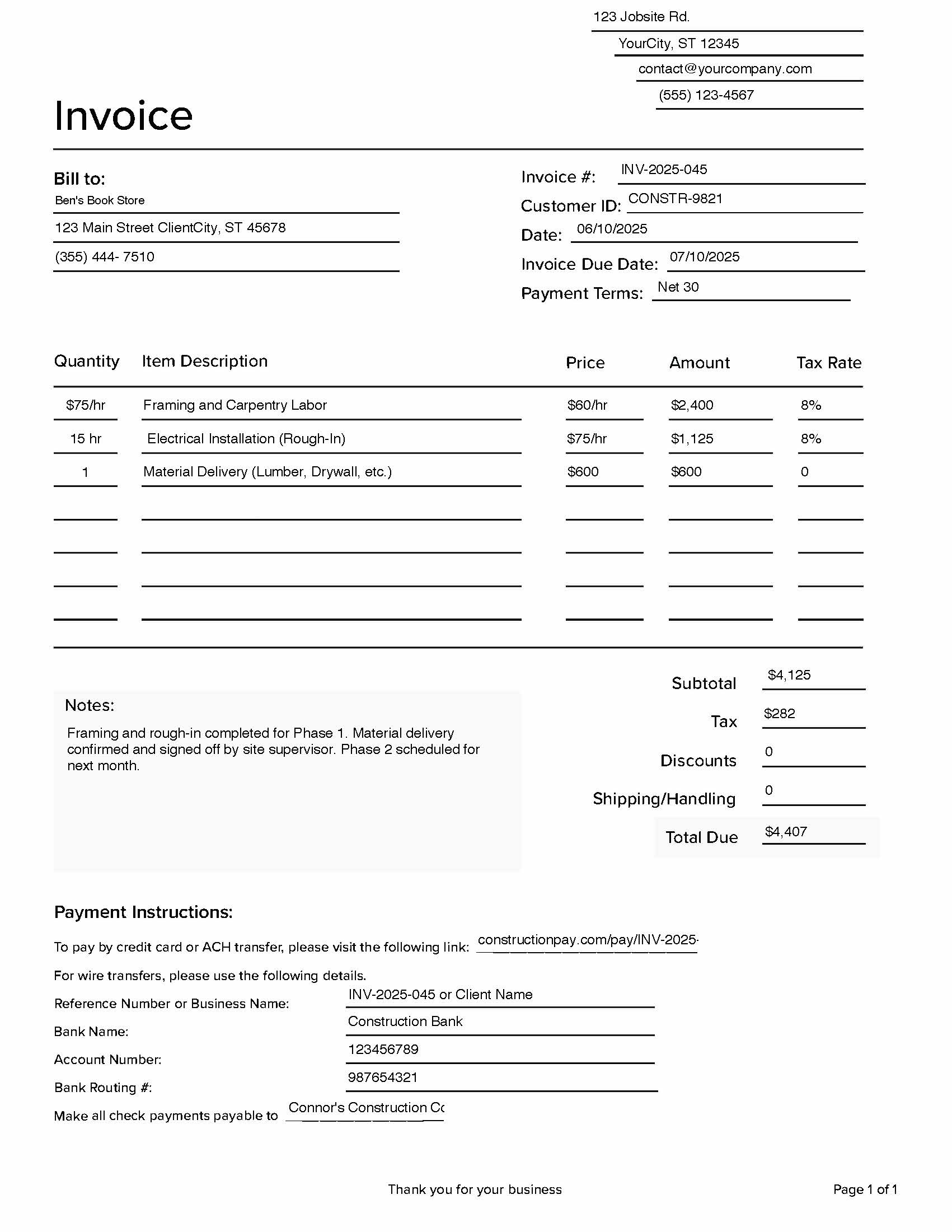

- Invoice number: This is a unique number that helps you keep track of each invoice. It can be as simple as 001, 002, 003, or include the date or client initials—whatever helps you stay organized.

- Invoice date: The date the invoice was created. This is important for tracking when payment is due.

- Due date (a.k.a. Net 30, Net 15, etc.): “Net 30” means payment is due 30 days after the invoice date. “Net 15” means 15 days. This sets the clock for when you expect to be paid.

- Bill to: The name and contact info of the customer or client you’re sending the invoice to.

- Description of goods or services: A breakdown of what you provided. This could be hours worked, products sold, or services delivered. Be as clear as possible so the customer knows exactly what they’re paying for.

- Rate and quantity: If you’re billing hourly, include your hourly rate and total hours. If you’re selling items, list the price and number of items.

- Subtotal, tax, and total due: Add up everything, include sales tax (if applicable), and show the final amount the client owes.

- Payment instructions: Let them know how to pay you—whether it’s a link to pay online, ACH details, or where to mail a check.

How to create an invoice

You don’t need fancy software to create an invoice. You can use a template in Word, Google Docs, or Excel.

What matters is that it’s clear, complete, and easy to read. A standard invoice should include:

- Your business information: Start with your name or company name, address, phone, and email at the top.

- Your client’s details: Right below or off to the side, include who the invoice is going to.

- An invoice number and date: This helps you keep everything organized and avoid duplicates.

- The work or items: Break it down line-by-line. Add rates, hours, quantities, whatever fits what you do.

- Clear payment terms: This is where “Net 30” comes in. If you expect payment within 30 days, include that. You can write: Payment terms: Net 30, this tells the client that the payment is due 30 days from the invoice date.

- How to pay you: Always include payment instructions—whether it’s a payment link, a bank account number, or who to make the check out to.

How are invoices used in accounting?

Invoices are more than just requests for money—they’re part of your financial records. Every invoice you send or receive becomes part of your business’s story. They help track income, manage cash flow, and prepare for taxes.

Where you’ll see invoices most often:

- Construction: Contractors often invoice after a project milestone or for hours worked on a job site.

- Freelancers and consultants: Designers, writers, marketing pros—most bill hourly or per project and send invoices to get paid.

- Retail and wholesale: Product-based businesses use invoices to show what was sold, in what quantity, and at what price.

- Medical and dental offices: Invoices can be used for out-of-pocket billing or insurance records.

- Professional services: Think lawyers, accountants, engineers—any service where billing happens after the work is performed.

From an accounting perspective, invoices help with more than just getting paid. They can be used to match payments, record revenue, and even help with forecasting your future income. When you’re keeping good records, your accountant (or future self) will thank you.