Templates | Credit Card Authorization Form

Credit Card Authorization Form Template

Credit Card Authorization Form Template

Looking for a credit card authorization form pdf?

Looking for a credit card authorization form pdf?

Download our free form today.

Securely Authorize credit card payments with our easy-to-use Credit Card Authorization Form!

Download our sample credit card authorization form to securely collect and process payment details for one-time or recurring transactions. Our fillable PDF authorization form helps businesses prevent chargebacks and streamline payments. Print your free PDF copy now!

What is a credit card authorization form?

A credit card authorization form is pretty much what it sounds like: a document that gives you permission to charge a customer’s credit card.

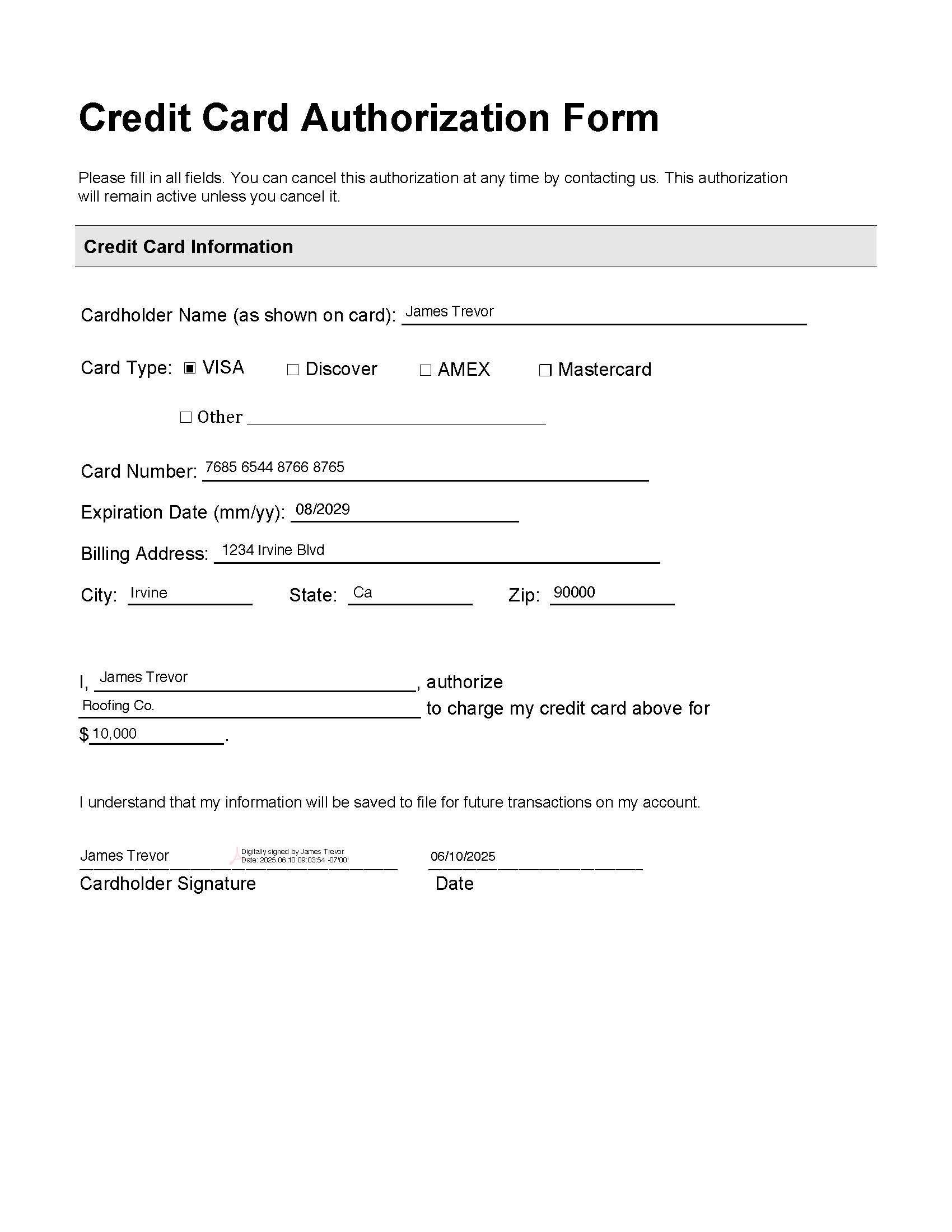

The form typically includes the cardholder’s name, billing information, card number (often masked for security), the amount to be charged, and their signature. Depending on the situation, it might authorize a one-time charge or allow for recurring payments—like for a subscription, ongoing services, or installment plans.

It’s a simple tool, but a really important one. At its core, it’s about consent. You’re asking the cardholder to say, “Yes, I’m allowing this charge,” in writing.

Why you need a credit card authorization form

If you accept credit card payments—and especially if you don’t swipe the card in person—you need some kind of proof that the customer approved the charge. That’s exactly what this credit card form provides.

It acts like a safety net for both you and your customer. For you, it creates a paper trail that shows the cardholder knew what they were paying for and agreed to it. For the customer, it helps ensure their card isn’t used without their knowledge.

In practical terms, it protects your business. Without written authorization, you’re wide open to disputes. And as any business owner knows, credit card chargebacks can be frustrating, time-consuming, and expensive.

So even though it might feel like extra paperwork, think of it as a really simple insurance policy. A few minutes upfront can save you a lot of trouble later.

When would I use this payment authorization form?

You’d typically use a cc authorization form in situations where you’re not collecting payment in person. This includes things like:

- Phone or email orders

- Recurring billing agreements

- Custom orders or large invoices

- Service contracts with scheduled payments

Basically, any time there’s no physical swipe or chip dip happening at the point of sale, it’s smart to use an authorization form.

Even if you meet with your customers in person, there are still instances when an authorization form makes sense, such as when charging their card at a later date or for an amount that hasn’t been finalized yet (e.g., catering deposits, project milestones, or hotel incidentals).

It’s also helpful when you’re billing on behalf of someone else, like a business charging an employee’s card. It just keeps everything above board.

How a credit card authorization form helps prevent chargebacks

If you’ve dealt with a chargeback before, you know how messy it can get. The customer disputes the charge, the bank freezes the funds, and suddenly, you’re spending time gathering evidence and writing up responses instead of focusing on your actual work.

A signed credit card authorization form gives you one of the strongest defenses in that situation.

It shows the cardholder agreed to the payment, understood the amount, and acknowledged the terms. When banks review chargebacks, they want to see clear, written evidence that the transaction was legitimate. This form delivers exactly that.

It won’t stop every chargeback—no single thing can. But it goes a long way toward showing you did everything right, especially for card-not-present transactions.

So if you’re serious about protecting your revenue (and your time), having a signed authorization form in your back pocket is a no-brainer.