Templates | ACH Form

ACH Payment Form

ACH Payment Form

Looking for an ACH authorization form template?

Looking for an ACH authorization form template?

Download our free PDF today.

Over 1,000+ users have trusted our ACH form to help simplify their transactions—download it today.

Our PDF ACH form was made to help streamline your payment processing. Whether you need a vendor ACH authorization form template for business transactions or a printable blank ACH form, we’ve got you covered. Our ACH payment authorization form for customers is available for free.

Learn about ACH payments

What is an ACH Form?

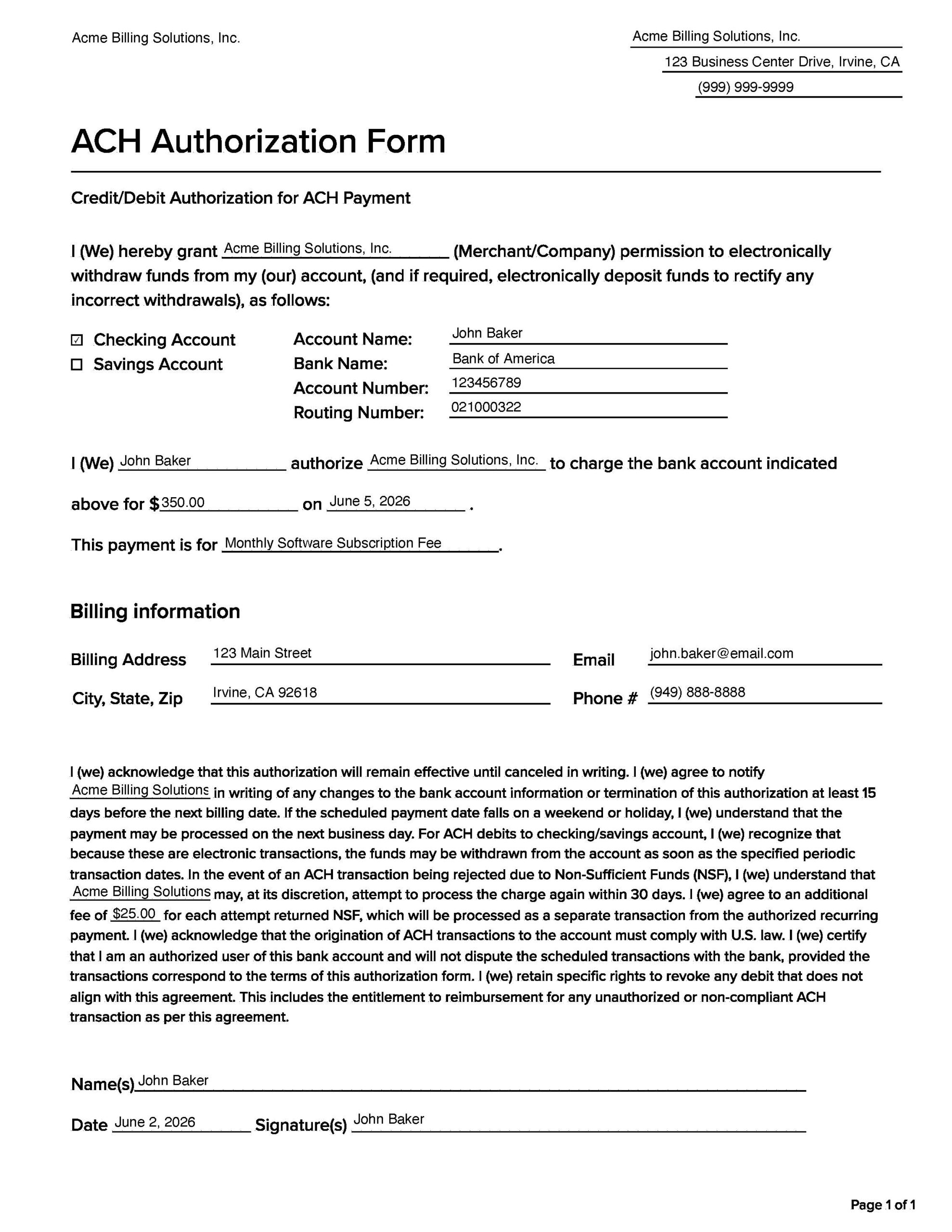

ACH authorization forms are used to grant permission to a financial institution to debit or credit an individual’s or business’s account, allowing for the transfer of funds between bank accounts through the ACH network.

Before a business can debit and charge money from its clients’ checking accounts using the Automatic Clearing House (ACH) Network, it needs to gain authorization to do so. To receive this permission, your client has to fill out an ACH authorization form. This ACH payment form facilitates secure and efficient transactions.

Using the ACH network rather than other traditional methods offers benefits like lower costs, improved accuracy, and quicker processing. The process usually takes a few business days, which is quicker than the several days or weeks that traditional payment methods may require. ACH forms also ensure secure transactions by requiring the account holder’s signature to authorize the transfer of funds.

When would I use an ACH form?

Before a business can debit and charge money from its clients’ checking accounts using the ACH Network, it needs to gain authorization to do so. To receive this authorization, your client has to fill out an ACH authorization form. For vendor transactions specifically, a vendor ACH form is required to ensure that payments can be made directly into the vendor’s account.

Should you print the ACH authorization form or send it online?

This is a common question, and honestly, the answer depends on what works best for your business and your customers.

Some companies still prefer handing clients a paper form. Maybe you’re face-to-face, or your client isn’t too tech-savvy. In those cases, printing the form just feels easier. On the other hand, sending the form online—via email or a secure link—is faster and saves you a lot of back-and-forth.

Let’s walk through the pros and cons of both options so you can figure out which one makes the most sense for you.

| Method | Pros | Cons |

|---|---|---|

| Printed Form | – Feels more personal in face-to-face settings – Useful if your customer isn’t tech-savvy – Easier to explain in person |

– Slower process – Paper can get lost or damaged – Requires manual filing or scanning |

| Online Form | – Faster to send and receive – Easier to store and track – Customers can fill it out from anywhere |

– May not work well for clients who aren’t comfortable with tech – Requires a secure way to send and collect the form |

If you’re working with clients remotely or want to speed things up, online forms are the way to go. Just make sure you’re using a secure method (especially if bank info is involved). But if your customers prefer that pen-and-paper route or you’re in a more traditional industry, don’t stress—there’s nothing wrong with sticking to printed forms.

Whichever route you choose, make it easy for your customer to complete and return the form. That’s what matters most.

FAQs

What is ACH information?

ACH information includes the details required for electronic transfers between bank accounts, such as account numbers and routing numbers. This information is essential for completing authorization forms and setting up transactions.

What is the difference between a standard ACH authorization form and a vendor ACH form?

A standard ACH authorization form lets you set up payments or transfers between a business and its clients, like for direct deposits or bills. A vendor ACH form is used specifically for making payments directly to vendors (suppliers).

While both forms do the same job of authorizing ACH transactions, the vendor form is just customized for payments to vendors. You can usually use one form for both purposes, but you might need to tweak it depending on what you’re paying for.

How to request ACH payment from customer?

To request an ACH payment from a customer, you should:

- Provide an Authorization Form: Send the customer an authorization form to complete.

- Gather Required Information: Ensure the form includes their bank account and routing numbers.

- Submit the Form: Send the completed form to your ACH payment processor.

- Set Up the Payment: Arrange the payment details with your processor, including the amount and frequency.

- Confirm with Customer: Verify the setup and payment details with the customer.

How to get an ACH form from your bank?

To get an ACH form from your bank, you can:

- Contact Your Bank: Give your bank a call or visit a branch and ask for the ACH form or guidance on how to get it.

- Use Online Banking: Log in to your online banking account. Many banks offer ACH forms for download directly from their website.

- Check the Bank’s Website: Visit your bank’s website and look for a section on forms or ACH services where you might find the form you need.

- Download from Other Sources: You can also find ACH forms on other platforms like EBizCharge. Just go to their website and download the form that fits your needs.