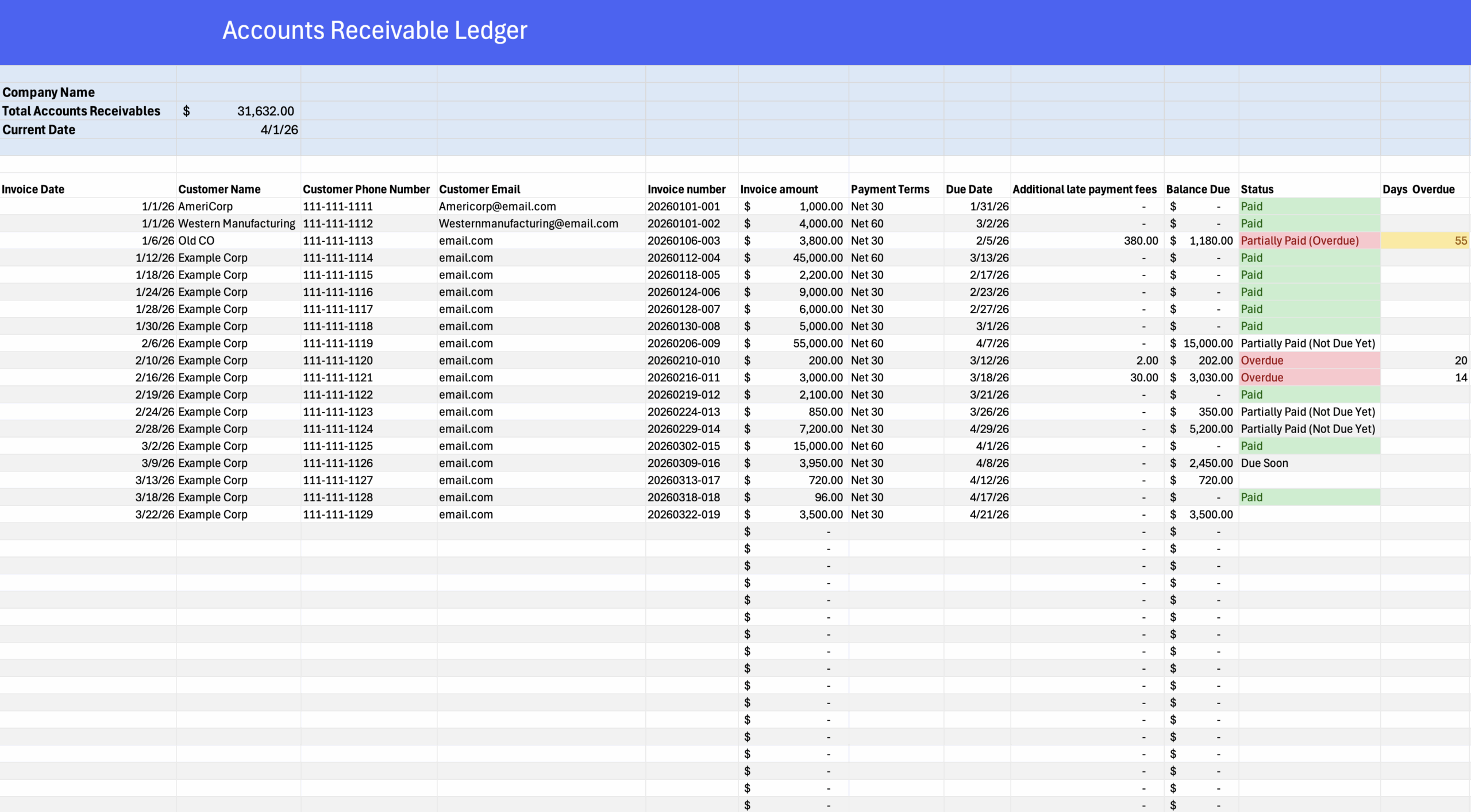

Templates | Accounts Receivable Ledger

Accounts Receivable Template

Accounts Receivable Template

Get a free Accounts Receivable Excel Template to easily track customer invoices, monitor due dates, and stay on top of your cash flow.

Get a free Accounts Receivable Excel Template to easily track customer invoices, monitor due dates, and stay on top of your cash flow.

Download our excel template today.

Download our free Accounts Receivable Template to track invoices, spot overdue payments, and manage cash flow with ease.

Stay organized and on top of your invoices with an Accounts Receivable Excel Template made to improve your financial management.

If you’re running a business, big or small, keeping track of who owes you money can get overwhelming fast. That’s where a simple Excel accounts receivable template can really come in handy. It gives you a clear snapshot of what customers haven’t paid yet, how much they owe, and how long it’s been since the invoice went out. No fancy software required. Just a structured spreadsheet that helps you stay organized.

What’s Included in This Accounts Receivable Template

This free Excel template is set up to help you track and manage your outstanding invoices without any complicated formulas or setup. Here’s what you’ll find inside:

- Customer name and contact info so you can quickly reference who owes what

- Invoice number and date for easy cross-referencing with your records

- Amount due and amount paid columns to track partial and full payments

- Due date and days outstanding to flag overdue invoices at a glance

- Payment status tracking so you can see which invoices are open, paid, or past due

- Running balance totals that update automatically as you enter payments

It’s designed to work as a simple accounts receivable ledger that you can customize to fit your business. Whether you’re tracking a handful of invoices or managing receivables across dozens of clients, the format is flexible enough to scale with you.

Why it helps to have an accounts receivable template

An accounts receivable spreadsheet lays everything out in one place, so you don’t have to dig through old emails or chase down paperwork. You can see outstanding balances at a glance, prioritize follow-ups, and keep things moving.

When you don’t know what’s coming in or when, it’s hard to make smart decisions. Whether you’re trying to restock inventory, cover payroll, or just keep the lights on. This kind of template is especially useful for small business owners, bookkeepers, freelancers, and really anyone who bills clients or customers directly. If you’re sending invoices, this gives you a low-effort way to track whether those invoices are actually getting paid. It also helps you spot patterns, like which clients are consistently late or which ones tend to pay quickly.

How to Track Accounts Receivable in Excel

Tracking accounts receivable in Excel doesn’t have to be complicated. The key is having a consistent format that you update regularly so nothing slips through the cracks. Here’s a straightforward approach:

Start by entering every invoice as its own row. Include the customer name, invoice number, issue date, due date, and total amount. As payments come in, log the date and amount paid in the corresponding columns. Your spreadsheet should automatically calculate the remaining balance and flag anything that’s past due.

The most important habit is updating it consistently. Even the best accounts receivable spreadsheet won’t help if it’s two weeks out of date. Set a regular cadence, whether that’s daily or weekly, and stick with it. Over time, you’ll start to see patterns in which customers pay on time and which ones need reminders, and that information is valuable when you’re making decisions about extending credit or adjusting payment terms.

What Is an Accounts Receivable Action Plan?

An accounts receivable action plan is a structured approach to reducing overdue balances and improving how quickly your business collects payments. It typically outlines who is responsible for follow-ups, when reminders go out, and what steps to take when invoices hit certain aging thresholds.

A basic action plan might look something like this: send a friendly reminder three days before an invoice is due, follow up on day one past due, escalate with a phone call at 15 days, and involve management or collections at 30 or 60 days. The specifics will vary depending on your business and your customer relationships, but having a documented process makes a big difference. It takes the guesswork out of collections and makes sure nothing falls through the cracks just because someone forgot to follow up.

This accounts receivable template gives you the data foundation you need to build an action plan around. When you can see at a glance which invoices are overdue and by how much, it becomes much easier to prioritize your follow-ups and take action before small balances turn into big problems.

Accounts Receivable Collection Tips

Collecting on overdue invoices is one of those tasks that nobody enjoys, but staying on top of it is what keeps your cash flow healthy. Here are a few practical tips that work well alongside this template:

- Send invoices promptly. The longer you wait to send an invoice after delivering goods or services, the longer you’ll wait to get paid. Make it a habit to invoice on the same day the work is completed or the product ships.

- Set clear payment terms upfront. Make sure your customers know when payment is expected before the work begins. Net 30 is standard in many industries, but if you’re dealing with customers who consistently pay late, shorter terms like Net 15 or even payment on delivery might be worth considering.

- Automate reminders when possible. If you’re tracking everything in Excel, set calendar reminders for yourself to follow up on invoices that are approaching their due date. If you’ve outgrown the manual approach, payment automation tools like EBizCharge can send reminders automatically and let customers pay directly from the invoice.

- Don’t let overdue balances sit. The longer an invoice goes unpaid, the harder it gets to collect. If something hits 60 or 90 days past due, escalate it. A polite but direct phone call is usually more effective than another email at that stage.

What are accounts receivable on a balance sheet?

Accounts receivable represent the money that customers owe your business for goods or services they’ve already received but haven’t paid for yet. You’ll find it listed as a current asset on your balance sheet because it’s expected to be paid within a short period, usually 30 to 90 days. It’s the unpaid invoices your business is waiting to collect, and it plays a big role in understanding your company’s short-term financial health.

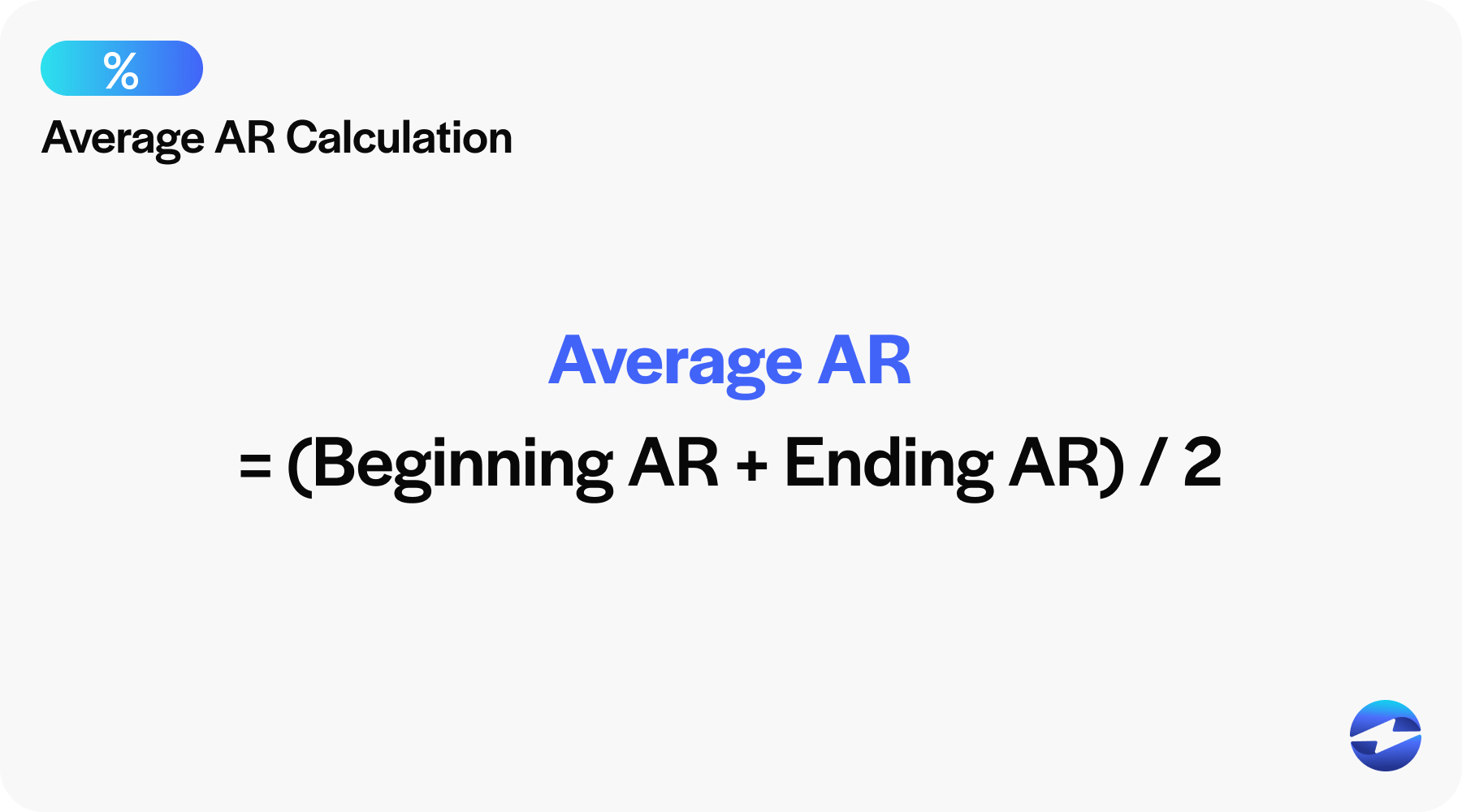

What is the formula for average accounts receivable?

Average accounts receivable is the typical amount of money your customers owe you over a certain period of time. It’s calculated by adding the beginning and ending accounts receivable balances for a period (like a month or year) and then dividing by two.

Average Accounts Receivable = (Beginning AR + Ending AR) ÷ 2

Businesses use this number to get a better sense of how much they’re usually waiting to collect, and it’s especially helpful when figuring out how efficiently you’re getting paid.

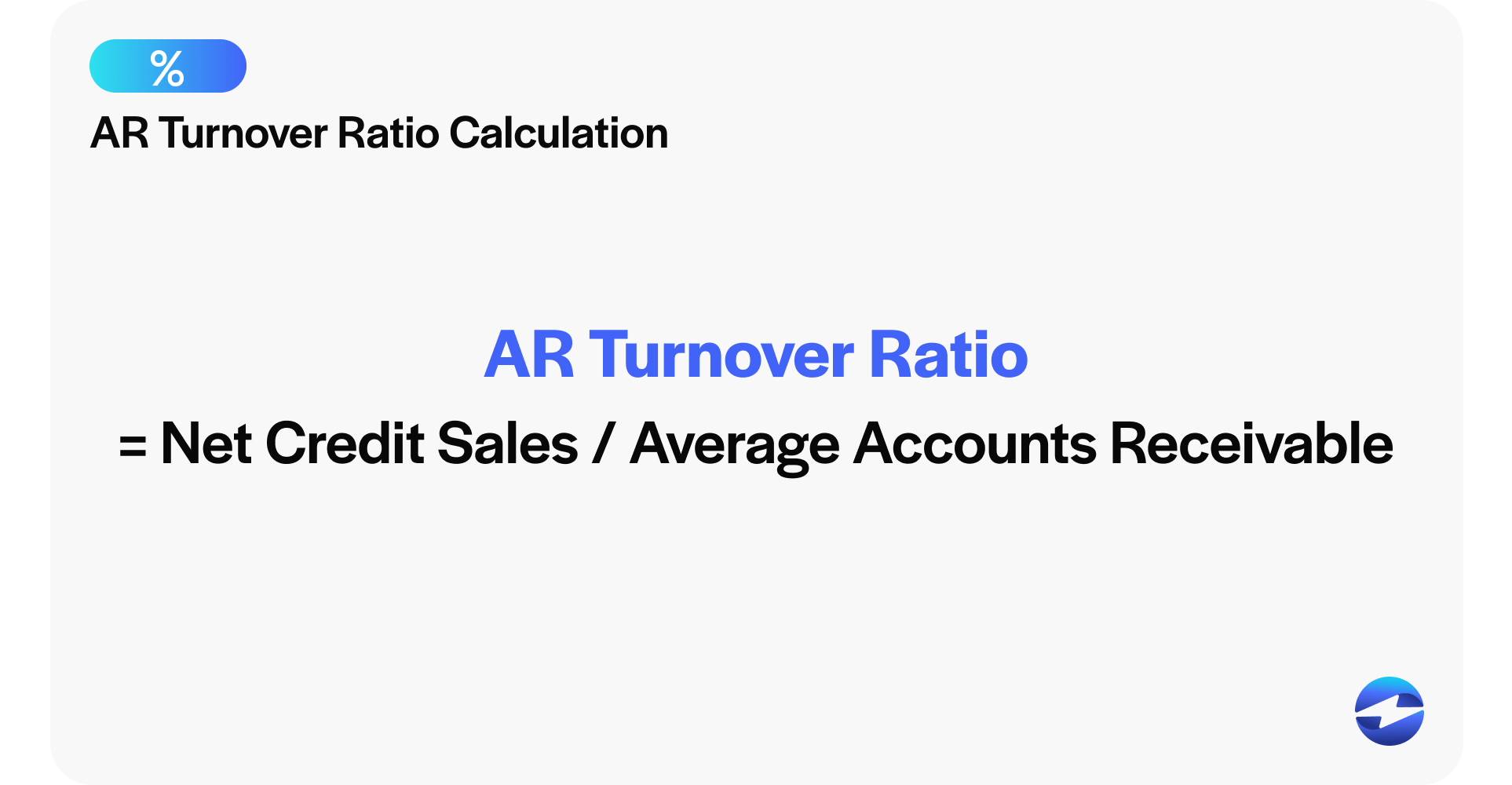

What is the accounts receivable turnover formula?

The accounts receivable turnover formula measures how efficiently your business collects payments from customers. The formula is:

Accounts Receivable Turnover = Net Credit Sales ÷ Average Accounts Receivable

This tells you how many times, on average, your receivables are collected during a given period. A higher number usually means you’re collecting quickly, while a lower number could suggest delays or issues with unpaid invoices.

Would this template also be considered an accounts receivable aging report?

Not exactly, but it’s very close and could be easily adapted into one. An accounts receivable aging report specifically groups outstanding invoices by how long they’ve been overdue. While this accounts receivable report does not currently group invoices into aging buckets, it has the data needed to do so. With a few columns added (like aging buckets), it could double as an aging report.

When to Move Beyond an Excel AR Template

An Excel accounts receivable template is a great starting point, especially if you’re a small business or freelancer managing a manageable number of invoices. But there’s a point where spreadsheets start to create more work than they save.

If you’re spending more time updating your spreadsheet than actually following up on overdue payments, that’s a sign. Same goes if you have multiple people who need access to the same data, or if you’re finding that invoices are slipping through the cracks because the spreadsheet didn’t get updated in time.

At that point, it usually makes sense to look at accounts receivable automation. Tools like EBizCharge integrate directly with your ERP or accounting system and handle invoice tracking, payment reminders, and collections workflows automatically. Your AR data stays current without the manual upkeep, and customers can pay invoices online with a click. It’s the next step when your business has outgrown the spreadsheet.

Frequently Asked Questions

What is an accounts receivable ledger?

An accounts receivable ledger is a record of all outstanding invoices your business is owed. It tracks each customer’s balance, invoice dates, payment history, and amounts still due. This template functions as a simple AR ledger you can manage in Excel.

What’s the difference between accounts receivable and accounts payable?

Accounts receivable is money owed to your business by customers. Accounts payable is money your business owes to vendors or suppliers. They sit on opposite sides of your balance sheet: AR is an asset, AP is a liability.

How often should I update my accounts receivable spreadsheet?

At minimum, update it weekly. If you’re processing a high volume of invoices, daily updates will give you a more accurate picture of your cash position and help you catch overdue payments sooner.

Can I use this template for multiple clients?

Yes. Each row represents a separate invoice, so you can track as many clients as you need. You can also sort or filter by customer name to see all outstanding invoices for a specific client.

What are aging buckets in accounts receivable?

Aging buckets group your outstanding invoices by how long they’ve been unpaid, typically in ranges like current, 1 to 30 days, 31 to 60 days, 61 to 90 days, and 90 days or more. This template can be adapted into an aging report by adding columns for these time ranges.