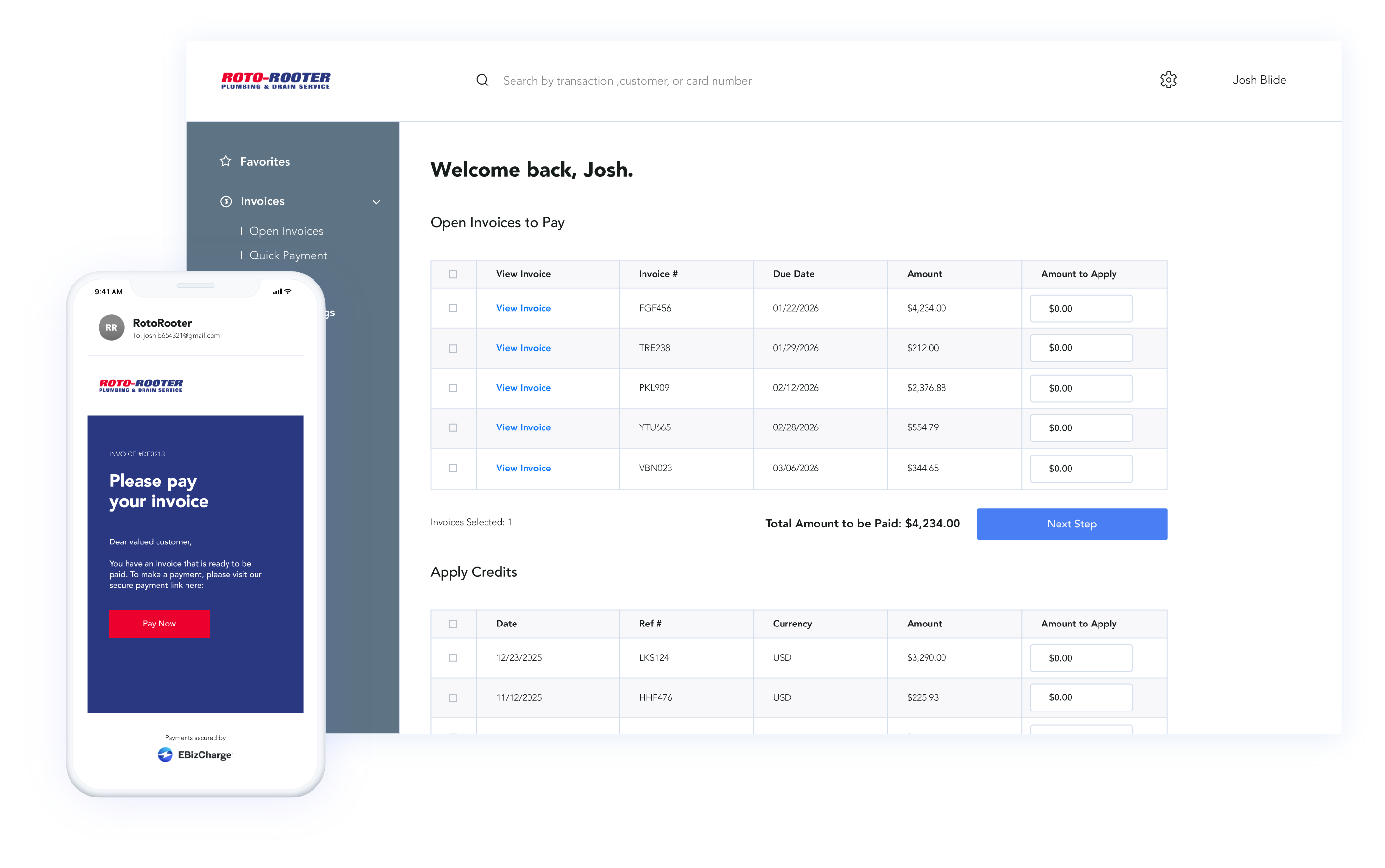

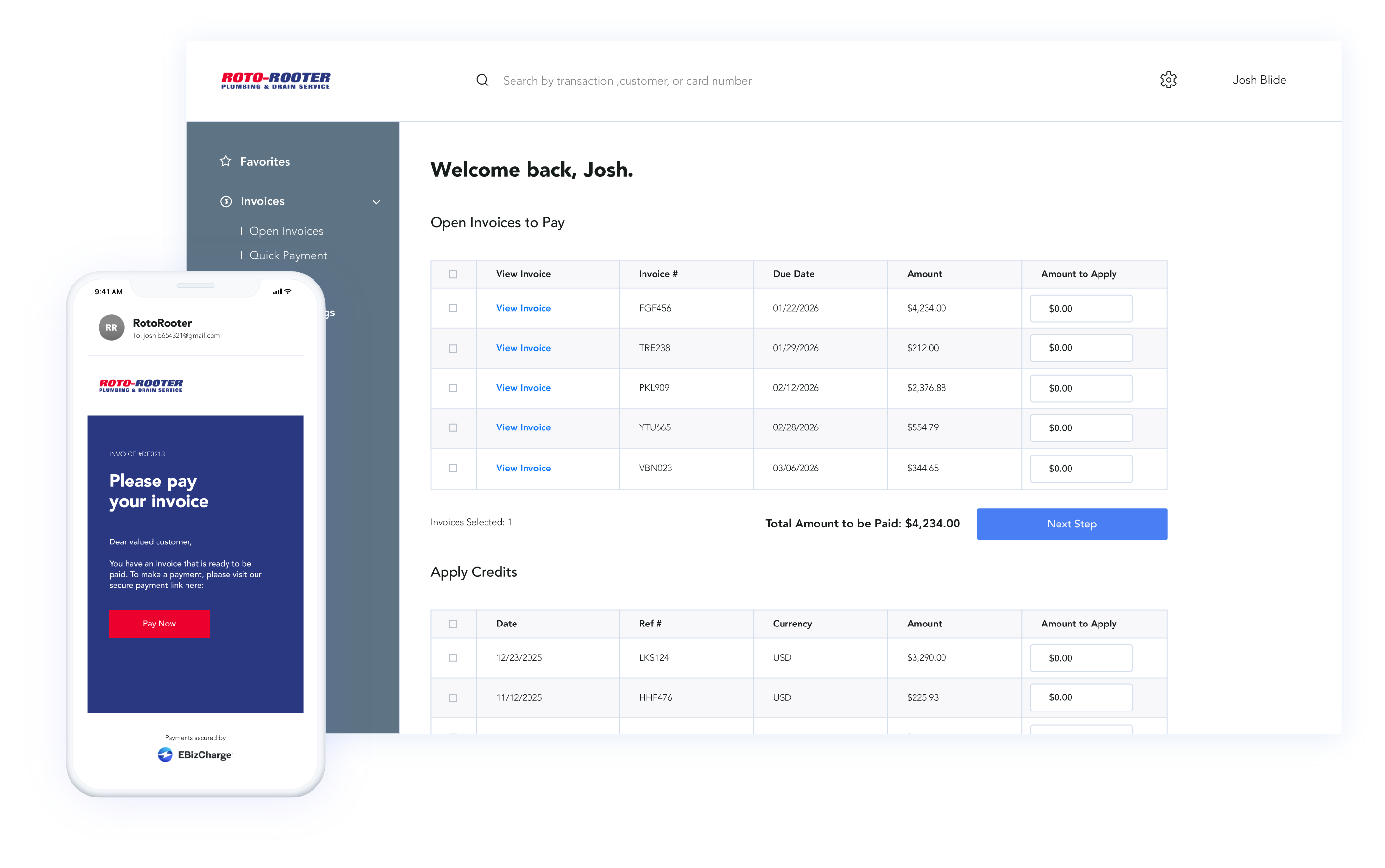

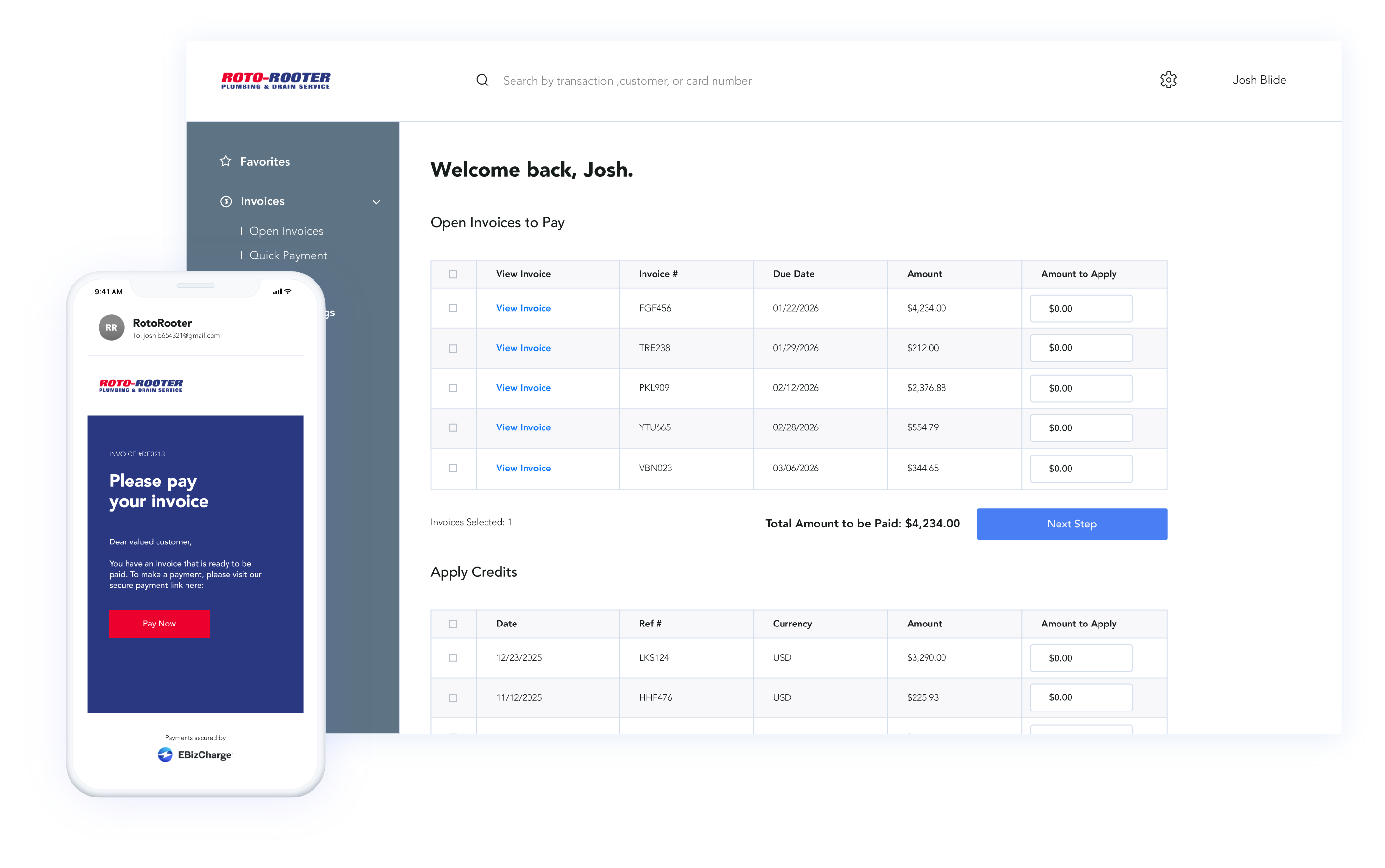

PAYMENT PROCESSING

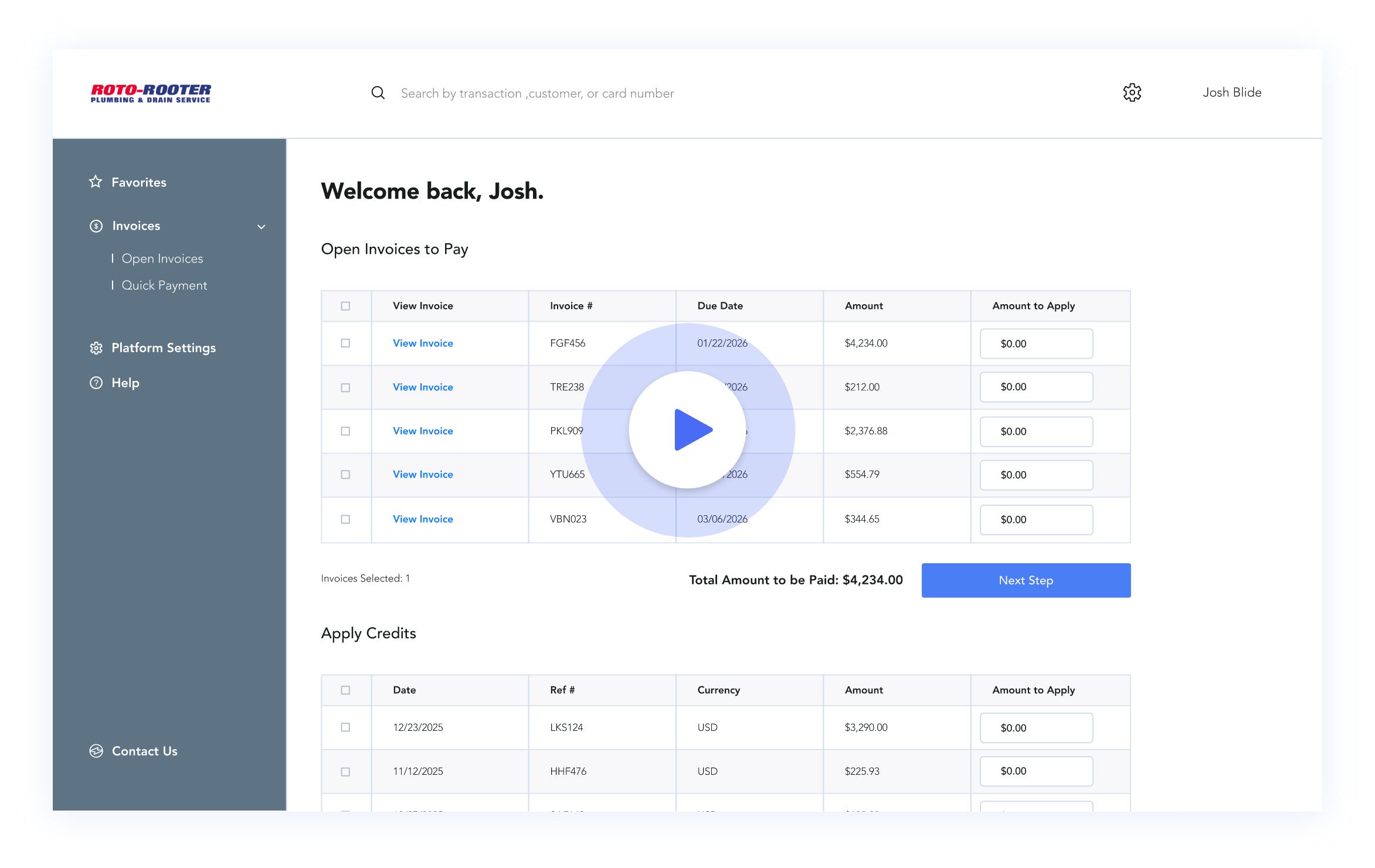

Speed up payment collection by 200%

Speed up payment collection by 200%

Speed up payment collection by 200%

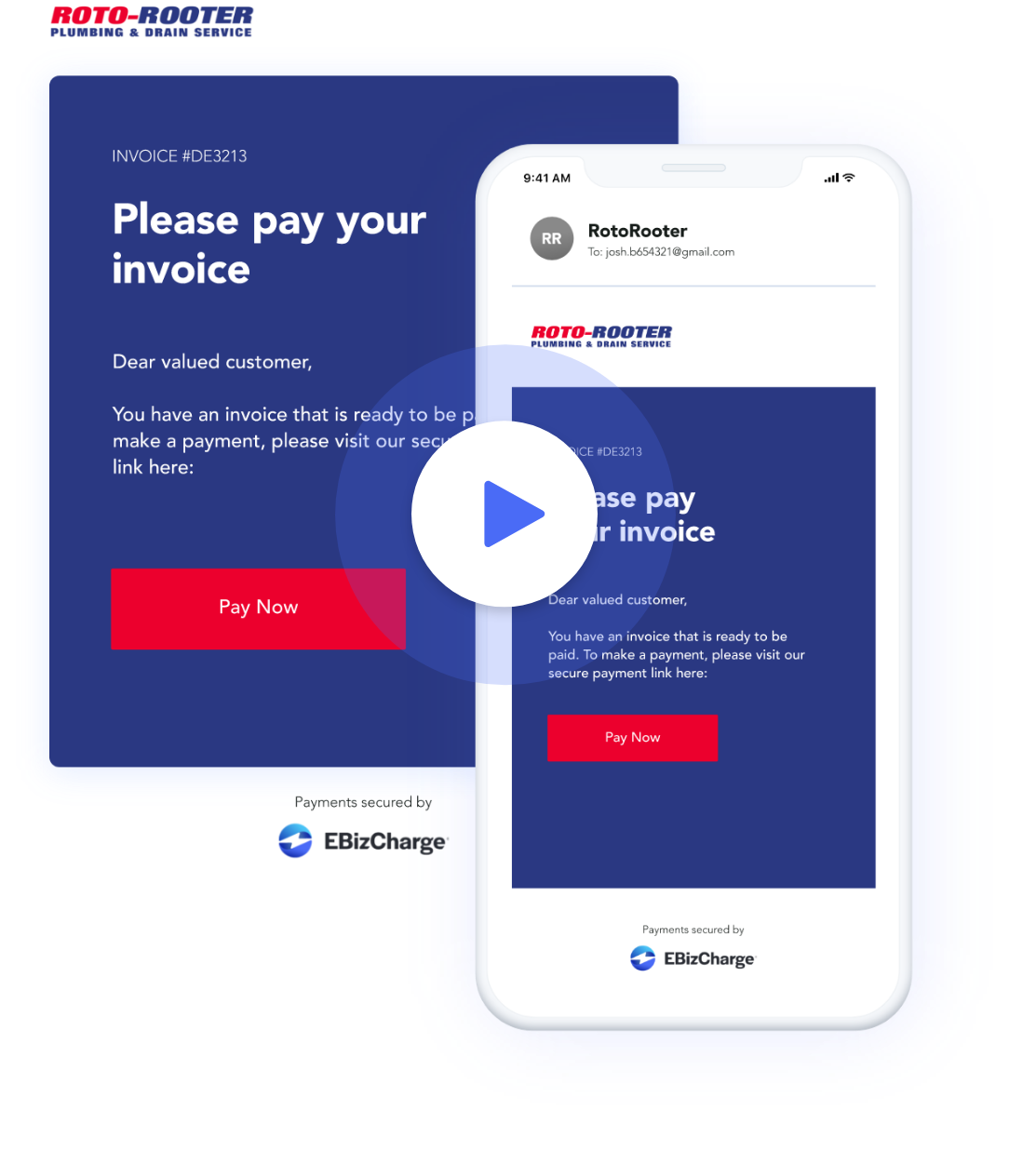

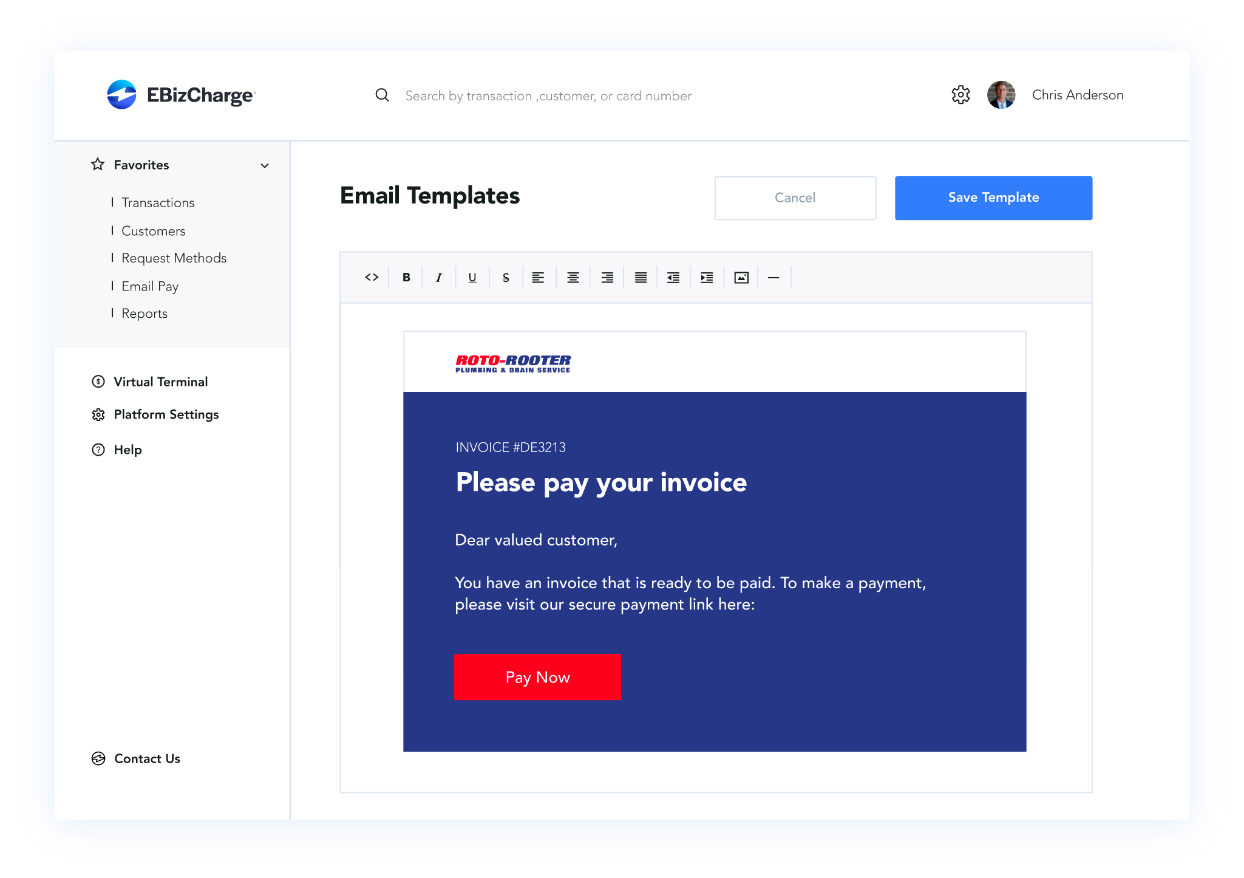

57% of invoice payments were collected late by small- to medium-sized businesses (SMBs) in the U.S. last year. We fixed that.

No long term contracts. No hidden fees. Just better payments.

No long term contracts. No hidden fees. Just better payments.

We save these big name brands an average of 16 accounting hours each week

Franklin Shiraki,

CFO

Franklin Shiraki

CFO

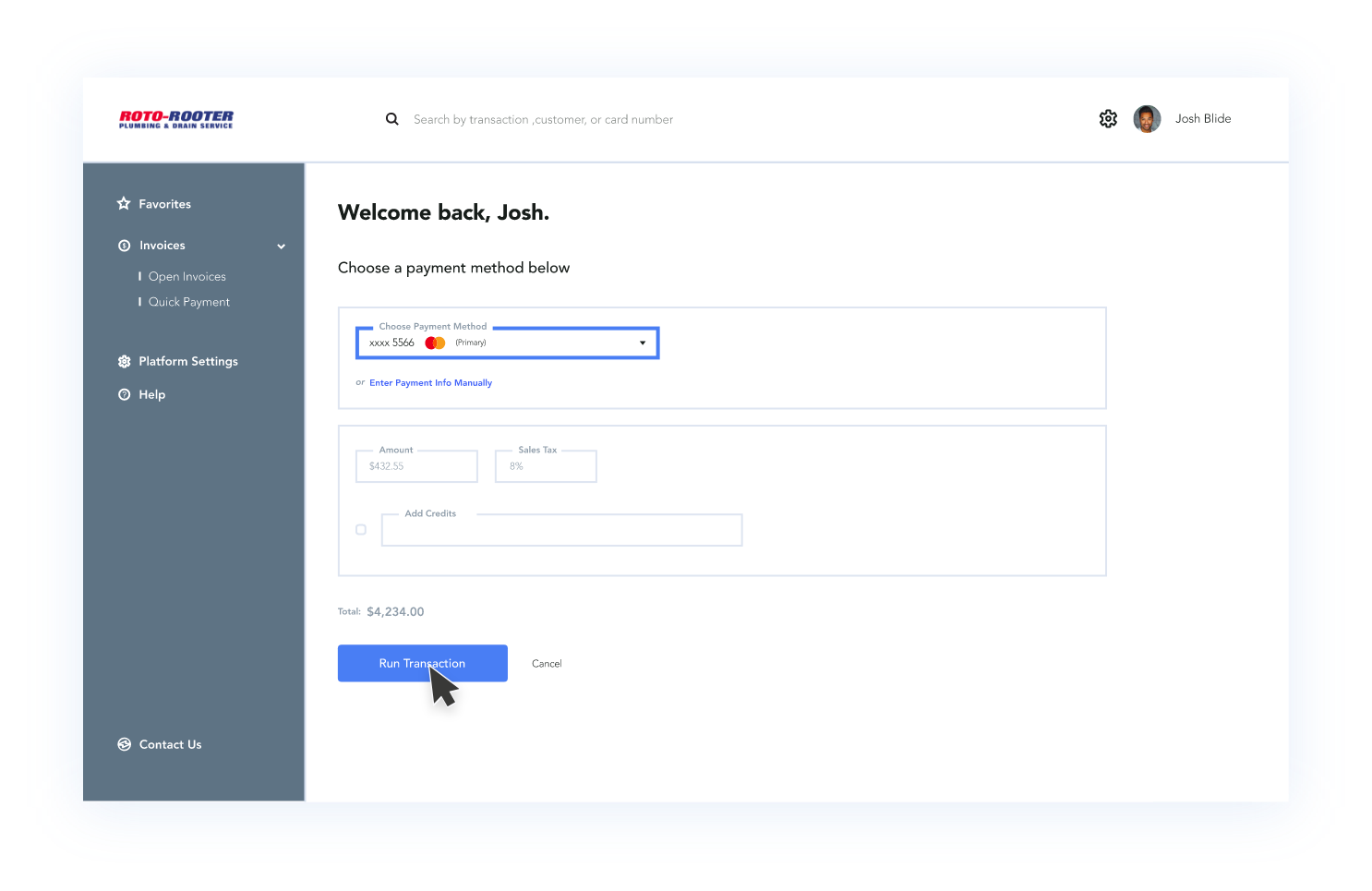

“I like that it’s in the system and you’re able to hold customers’ payment information that way. It’s super quick, easy, and efficient.”

Marian Lepore

CEO

“Your high level of customer service, regular updates to your product and consistent pricing have made me a very satisfied customer”

Joy Campbell,

Accounting and IT Manager

“We no longer have to store the credit cards. Now when an order is taken and they are a credit card customer, the software will automatically bring up the customer’s information and only display the last four numbers of the credit card”

Last year alone, EBizCharge helped over 40,000 users decrease time spent collecting payments.

Last year alone, EBizCharge helped over 40,000 users decrease time spent collecting payments.

No long term contracts. No hidden fees. Just better payments.

Sync payment data between the tools your business already uses

Sync payment data between the tools your business already uses

Sync all your transaction data across 100+ accounting, ERP, CRM and eCommerce systems.

Featured in

Read about us

Out of the box security features

Out of the box security features

Tokenization & Encryption

Tokenization is the process of substituting sensitive data (such as credit card numbers) with non-sensitive equivalents. A random token is used to represent the data so no sensitive information is ever directly stored in the database. This process ensures all customer data is safe, even in the case of a security breach.

Off-Site Data Storage

Storing data on your own system leaves you and your customers vulnerable to attacks. EBizCharge allows you to store data on our secure third-party server, reducing your liability and protecting your data from attacks.

PCI-Compliance

Being PCI-compliant refers to a business complying with the operational and technical standards to ensure credit card data is safe. Failure to comply to these standards will result in costly penalty fees.

Customizable Fraud Modules

Use module controls to set numerous levels of security to personalize your gateway. Some examples of modules include: duplicate transaction control, block by country, block by IP address, and many more.

TLS 1.2 Protocols

The internet isn’t always secure. That’s why EBizCharge uses the latest TLS protocol to protect your customers’ data when sending it online. To ensure the highest level of security, EBizCharge uses a 2048-bit RSA key and does not support cyphers known to be weak or vulnerable.

EMV Terminals

EMV is the new technical standard for all credit cards. (You might recognize it as the chip you see on a credit card.) It simply stores a cardholders data on the chip, that when used, generates a unique transaction code that cannot be used again.

Get a free cost-analysis to see how much you can save

Get a free cost-analysis to see how much you can save

Pay per transaction | $0 upfront costs