Blog > Wireless Credit Card Processing: How It Works and Its Benefits for Businesses

Wireless Credit Card Processing: How It Works and Its Benefits for Businesses

As more customers prefer to pay with credit or debit cards, businesses need a reliable and secure payment processing system. One system that’s gained popularity in recent years is wireless credit card processing, which provides business owners a convenient solution to accept payments on the go.

This article will discuss wireless credit card processing, how it works, its benefits for businesses, and the differences between wireless and mobile credit card processing.

What is wireless credit card processing?

For businesses trying to grow and enhance their operations, a reliable credit card processing system can make a big difference by separating your company from competitors and creating an effortless customer checkout experience.

Wireless credit card processing is a method of accepting payments where the credit card machine communicates wirelessly with the payment gateway, allowing for greater mobility and flexibility. Payments are processed through a wireless connection using a portable credit card machine connected to Wi-Fi or Bluetooth.

Wireless credit card processing is beneficial for businesses that operate in multiple locations, such as food trucks or pop-up shops, or those that require payments on the go, such as delivery services or mobile vendors.

With a smoother checkout experience, customers can feel good about purchasing from your company. With that said, how does wireless credit card processing work? The following section will go through the steps of wireless processing to accept payments.

How wireless processing works

Wireless credit card processing machines use Wi-Fi or cellular networks to communicate with the payment gateway, allowing merchants to accept customer credit card payments without requiring a wired connection. The devices typically include a wireless credit card terminal and a wireless card reader, which work together to process transactions.

There is an abundance of methods customers can use with wireless credit card processing. These include credit and debit cards, smartphones (Apple Pay, Google Pay, Samsung Pay, etc.), and key fobs.

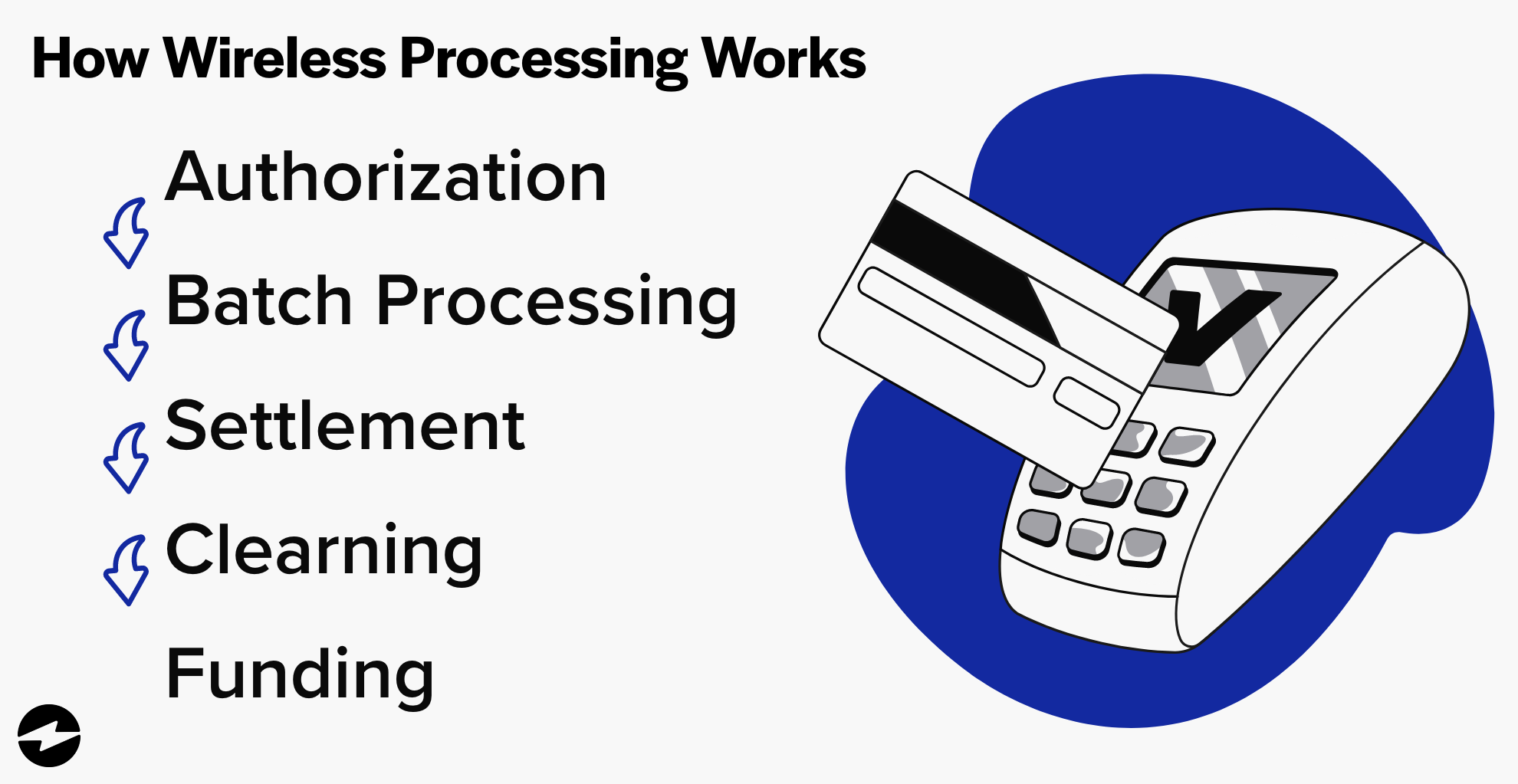

As simple as the idea sounds, wireless credit card processing has a five-step process that’s important to understand when dealing with many payments.

The five steps of wireless payment processing include:

- Authorization

- Batch processing

- Settlement

- Clearing

- Funding

Step 1: Authorization

The first step in wireless credit card processing is an authorization. When customers want to make a purchase, they provide their credit card information, which is verified for authenticity and validity.

The verification is typically done through a credit card reader or mobile app that securely communicates with the payment processor.

Step 2: Batch Processing

Once the authorization is successful, the transaction is batched and sent for processing. This means the payment processor collects a group of transactions ranging in size from a few payments to several hundred, depending on the merchant’s transaction volume. The payment processor then sends them to the card networks (e.g., Visa, Mastercard) for approval.

The purpose of batch processing is to streamline the transaction process by consolidating multiple transactions into a single batch. By doing so, the payment processor can reduce the time and cost of transmitting individual transactions for approval by sending the batch to the card networks for approval as a single unit.

Step 3: Settlement

After the batch processing, the merchant’s bank account is credited with the transaction amount, and the customer’s card is charged. This is known as settlement, and it typically happens within 24-48 hours after the transaction is made.

During this time, the payment processor calculates the total amount of all approved transactions in the batch, deducts any applicable processing fees, and credits the remaining funds to the merchant’s bank account.

Step 4: Clearing

The transaction information is then sent to the customer’s bank for clearance. The customer’s bank clears a series of checks to ensure the credit card is not stolen or used fraudulently. The bank also verifies that the customer has enough credit to complete the transaction.

Once the transaction has been cleared, the payment processor can proceed with the final step of the process.

Step 5: Funding

Funding is the final step in wireless credit card processing when the merchant receives the funds from the transaction in its bank account, which typically occurs within 1-2 business days after settlement.

Quick access to funds is vital for businesses, especially small ones that need to manage their cash flow. Wireless credit card processing allows companies to receive funds more quickly and efficiently than traditional payment methods. Rapidly receiving funds can improve your financial position and provide more flexibility to manage other business operations.

It’s important not to confuse wireless credit card processing with mobile credit card processing. While the two are similar, major differences should be addressed.

The differences between wireless credit card processing and mobile credit card processing

Wireless and mobile credit card processing are two popular methods of accepting payments on the go, such as at events, in-store pop-ups, and other mobile businesses.

While these wireless and mobile credit card processing may seem similar at first glance, there are some critical differences between them that companies should be aware of when choosing which method is suitable for their needs.

Some key differences between wireless credit card processing and mobile credit card processing include costs and physical terminal requirements.

Costs

Transaction fees differ between wireless and mobile credit card processing. Wireless credit card processing typically charges a percentage fee per transaction, whereas mobile credit card processing often charges a flat rate per transaction or a monthly subscription fee.

Terminal vs. mobile application

Wireless credit card processing typically involves a wireless reader connecting to a smartphone or tablet via Bluetooth or Wi-Fi. The reader allows merchants to accept credit and debit card payments without needing a traditional point-of-sale (POS) system. Wireless credit card processing is ideal for businesses that need to get paid while traveling, such as food trucks, pop-up shops, and mobile service providers.

On the other hand, mobile credit card processing typically involves a mobile app that merchants can download onto their smartphone or tablet. With mobile credit card processing, there’s no need for mobile credit card terminals since the terminal is the phone. The app allows merchants to accept credit and debit cards by manually entering the customer’s credit card information or by using the device’s camera to scan the card. Mobile credit card processing is ideal for businesses that don’t have access to a wireless credit card reader or don’t want to invest in one.

While wireless and mobile credit card processing are similar in that they both allow for payment processing, businesses should consider the differences between these methods when choosing which is best for their needs.

Wireless credit card processing is ideal for businesses that prefer a physical card reader to accept payments on the go. Whereas mobile credit card processing is perfect for businesses that prefer using a mobile app to process payments and want to avoid investing in a credit card reader.

If you decide to move forward with wireless credit card processing, there are some requirements you’ll need to be aware of before you can start accepting payments with a wireless credit card processor.

What are the requirements for wireless credit card processing?

Accepting payments via wireless credit card processors only requires a few elements, such as a wireless credit card machine and a payment gateway.

Many credit card processing machines are available on the market, including those that use Wi-Fi or cellular networks. Additionally, you’ll need to set up an account with a payment processor that offers wireless credit card processing services.

Since the need for a wireless credit card reader is one of the most essential aspects of accepting payments wirelessly, knowing your different terminal options is important.

The different wireless credit card processing machines on the market

With many different types of wireless credit card terminals to choose from, you can assess the unique features and capabilities of each to find the best fit.

Some devices are designed specifically for small businesses, while others are better suited for larger enterprises. Some machines have touchscreens, while others have traditional keypads. Some engines support multiple payment types, including debit and credit cards and mobile payments, while others only support credit cards.

When selecting a wireless credit card machine for your business, you must consider your specific needs and requirements. A primary device with a keypad and small display may be sufficient if you only accept credit cards and don’t require additional features. However, if you want to accept multiple payment types, have a larger display for customers, or need other security features, you may want to invest in a more advanced machine.

Wireless credit card processing terminals for your company

Picking a wireless EMV terminal can take a lot of work, considering how many terminals are available.

To help with this, you can start by looking into two popular wireless Wi-Fi credit card readers: Castles VEGA 3000 and Castles MP 200L.

Castles VEGA 3000

The Castles VEGA 3000 is an excellent compact option if you want to accept payments wirelessly. Some of its main features include:

- Accepts all major card types

- Integration capabilities

- High-security processor

- Operable under extreme conditions

- Linux open architecture OS

- PCI PTS 4.x

- EMV contact/contactless Lv1

- EMV contact Lv2

- Contactless scheme certifications (Paypass, Paywave, ExpressPay, D-PAS, J-Speedy, QPBOC)

Castles MP 200L

The Castles MP 200L is another option for your company’s wireless payment processing capabilities. Some of its main features include:

Accepts all major card types

- Works with both iOS and Android

- Remote download

- Long-lasting rechargeable battery

- High-security processor

- Operable under extreme conditions

- PCI PTS 4.x

- EMV contact/contactless Lv1

- EMV contact Lv2

- Contactless scheme certifications (Paypass, Paywave, ExpressPay, D-PAS, J-Speedy, QPBOC)

Regardless of the wireless EMV terminal you choose, the benefits of accepting payments wirelessly can separate you from the rest of the competition.

The benefits of wireless credit card processing for your business

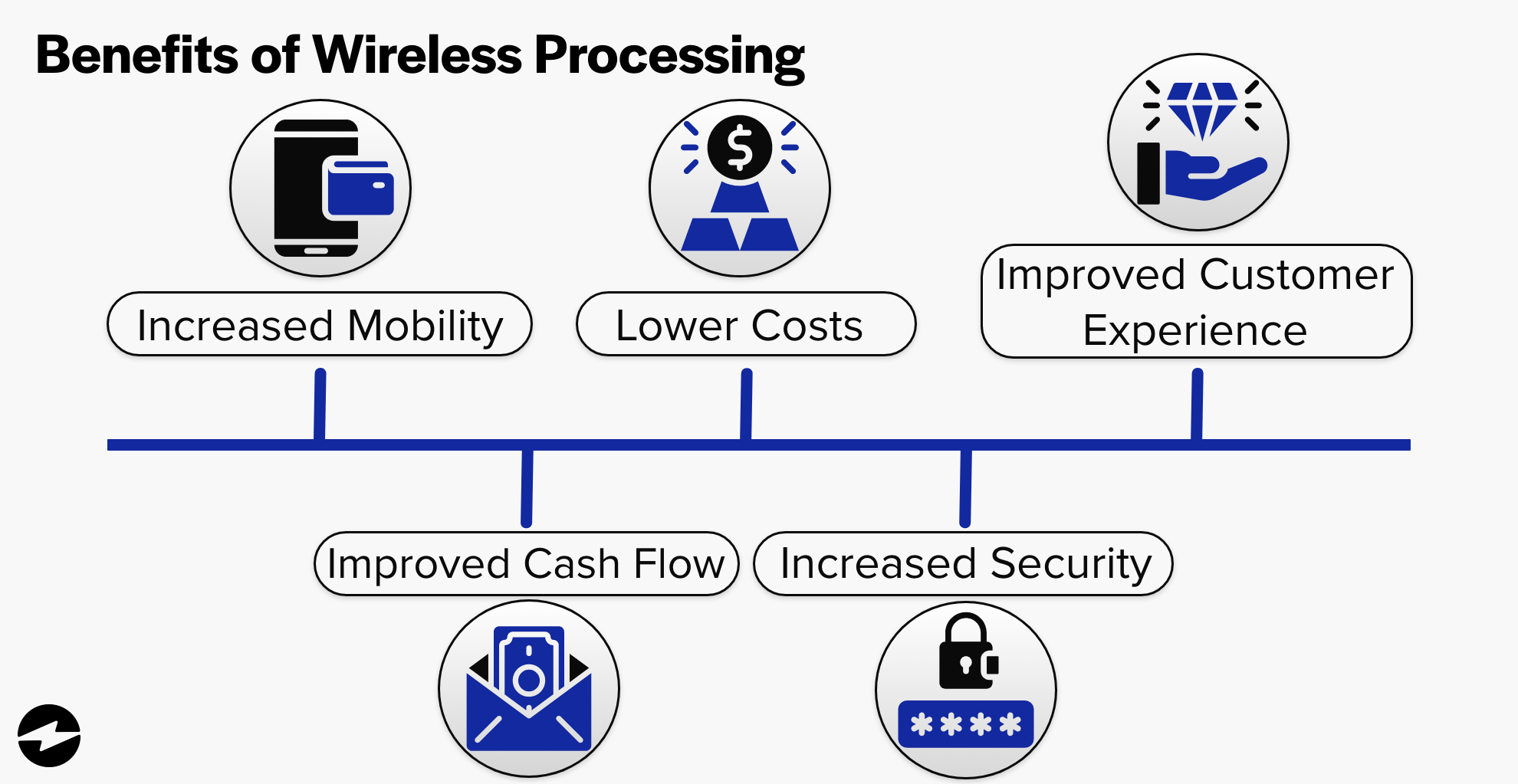

Thanks to its portable capability and contactless payments, wireless credit card processing offers several benefits for businesses of all sizes.

Four of the most notable benefits of wireless credit card processing include:

- Increased flexibility

- Improved cash flow

- Enhanced payment security

- Lower costs

Increased flexibility

Wireless credit card processing allows businesses to accept customer payments anywhere, whether in a physical storefront or on the go. This flexibility can help companies attract new customers and increase sales.

The increased flexibility of wireless credit card processing can also help businesses adapt to changing market conditions and customer preferences. For example, during the COVID-19 pandemic, many companies had to quickly pivot to contactless payments to meet customer demand for a safer and more hygienic payment experience.

Wireless credit card processing can help businesses stay agile and respond to changing circumstances by giving them the tools to accept payments in various situations.

Improved cash flow

Thanks to the more accelerated and efficient payment process wireless credit card processing provides, businesses can improve their cash flow.

Wireless credit card processing typically allows for funds to be deposited into your account within 1-2 business days, allowing your business to access its revenue faster and put it to use for your business which can also reduce the risk of chargebacks.

Enhanced payment security

Wireless credit card processing machines are designed to be secure and protect customer data. Additionally, many machines offer fraud prevention and dispute resolution features, which can help protect businesses from payment-related issues.

You’ll also have access to enhanced security features to help protect your business and customers’ sensitive information. From encryption technology to fraud detection measures, wireless credit card processing can provide peace of mind that your transactions are secure.

Lower costs

Wireless credit card processing has been a game-changer for many businesses, especially those with mobile or remote payment needs. This payment solution offers a more cost-effective alternative to traditional POS systems.

Setting up a traditional POS system can be costly, with expenses such as hardware, software, and installation fees. In contrast, wireless credit card processing typically requires minimal setup costs, making it an attractive option for small and medium-sized businesses with limited budgets.

In addition to lower setup costs, wireless credit card processing often comes with lower transaction fees than traditional methods. This is because mobile payment solutions operate on a cloud-based platform, which is generally more cost-effective than on-premise software.

Lower transaction fees and setup costs can yield significant savings for businesses, allowing them to allocate more funds to other areas such as marketing or inventory management.

Seamlessly integrate wireless credit card processing into your business

Installing wireless credit card processing can be effortless when using a reliable payment processor like EBizCharge.

With EBizCharge, you’ll simply download a mobile application on your smartphone or tablet and sync a compatible wireless EMV terminal to access a user-friendly interface to easily accept payments and manage your account.

Summary

- What is wireless credit card processing?

- How wireless processing works

- The differences between wireless credit card processing and mobile credit card processing

- What are the requirements for wireless credit card processing?

- The different wireless credit card processing machines on the market

- The benefits of wireless credit card processing for your business

- Seamlessly integrate wireless credit card processing into your business