Blog > What Is the Role of Merchant Acquirers in Credit Card Processing?

What Is the Role of Merchant Acquirers in Credit Card Processing?

As digital transactions dominate the market, understanding the mechanics of credit card processing becomes essential for businesses and consumers. Intermediaries like merchant acquirers that facilitate these digital transactions play a crucial role.

This article will outline a merchant acquirer’s specific functions and obligations and what businesses should consider when selecting one.

What is a merchant acquirer?

Merchant acquirers, also known as acquiring banks, are responsible for setting up and maintaining merchant accounts, allowing businesses to accept payment cards from customers.

When consumers make a credit card purchase, the merchant acquirer acts as the intermediary between the merchant and the card networks, ensuring the transfer of funds from the issuing bank to the merchant.

What’s the difference between acquirers, issuers, and payment processors?

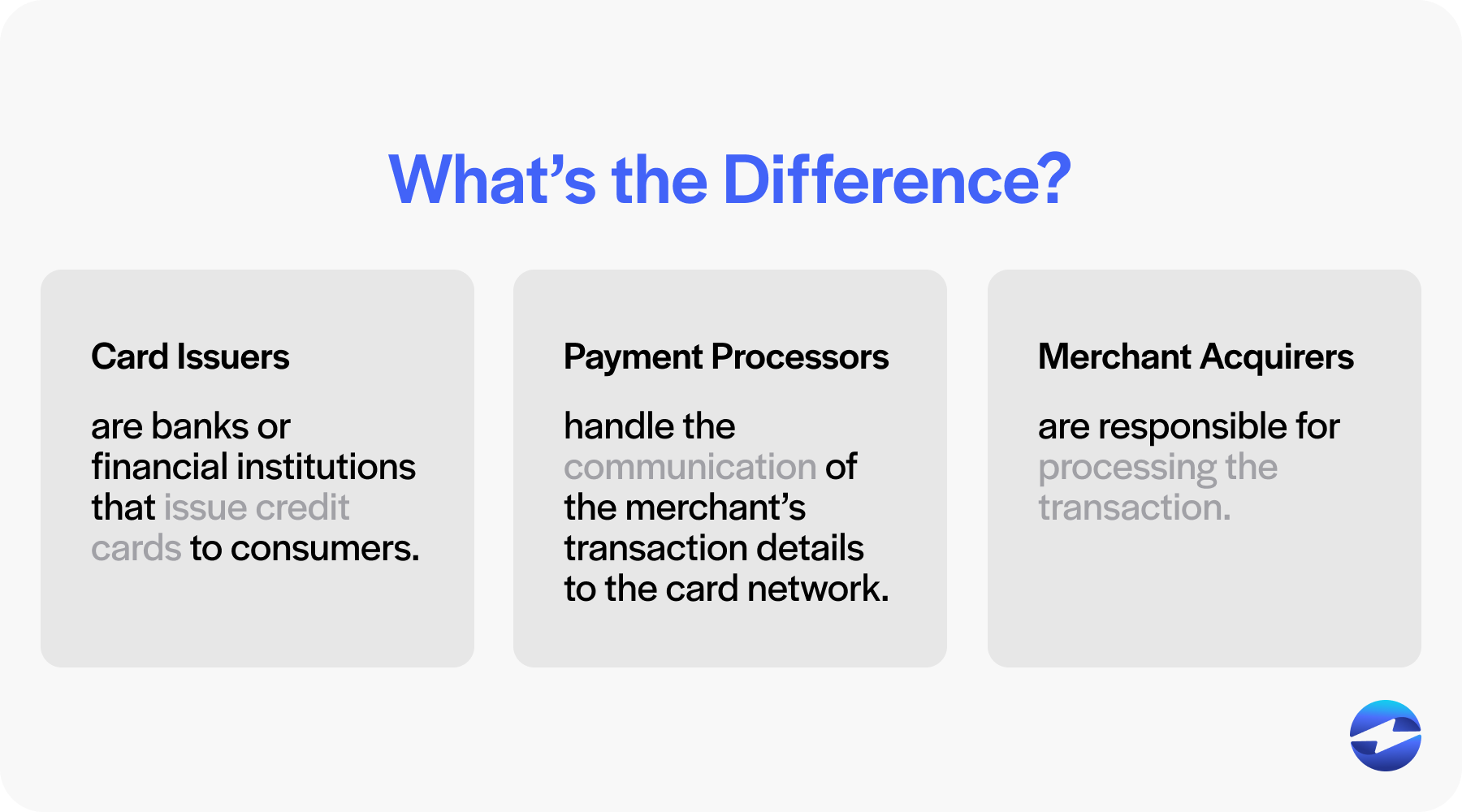

When navigating the realm of credit card processing, it’s crucial to distinguish between merchant acquirers (acquiring banks), card issuers, and payment processors, as each plays a distinct role in the card transaction ecosystem.

Card issuers are banks or financial institutions that issue credit cards to consumers. They extend credit to cardholders, manage their accounts, and authorize or decline transactions based on the cardholder’s creditworthiness and account status.

Payment processors act as intermediaries between merchants, merchant acquirers, and card networks. They handle the communication of the merchant’s transaction details to the card network, ensuring the secure and efficient transfer of transaction data.

Finally, merchant acquirers are responsible for processing the transaction, ensuring the funds are deposited into the merchant’s account. Put simply, merchant acquirers focus on merchant relationships and transaction settlement, while card issuers focus on cardholder accounts, and payment processors ensure smooth data transmission between all parties involved.

Merchants should understand these distinctions to select the best partners to develop the most efficient payment systems for their businesses. While these entities work closely together to ensure smooth transactions, each contribution to the transaction is integral to the financial flow of the card payment process.

The role of merchant acquirers in credit card transactions

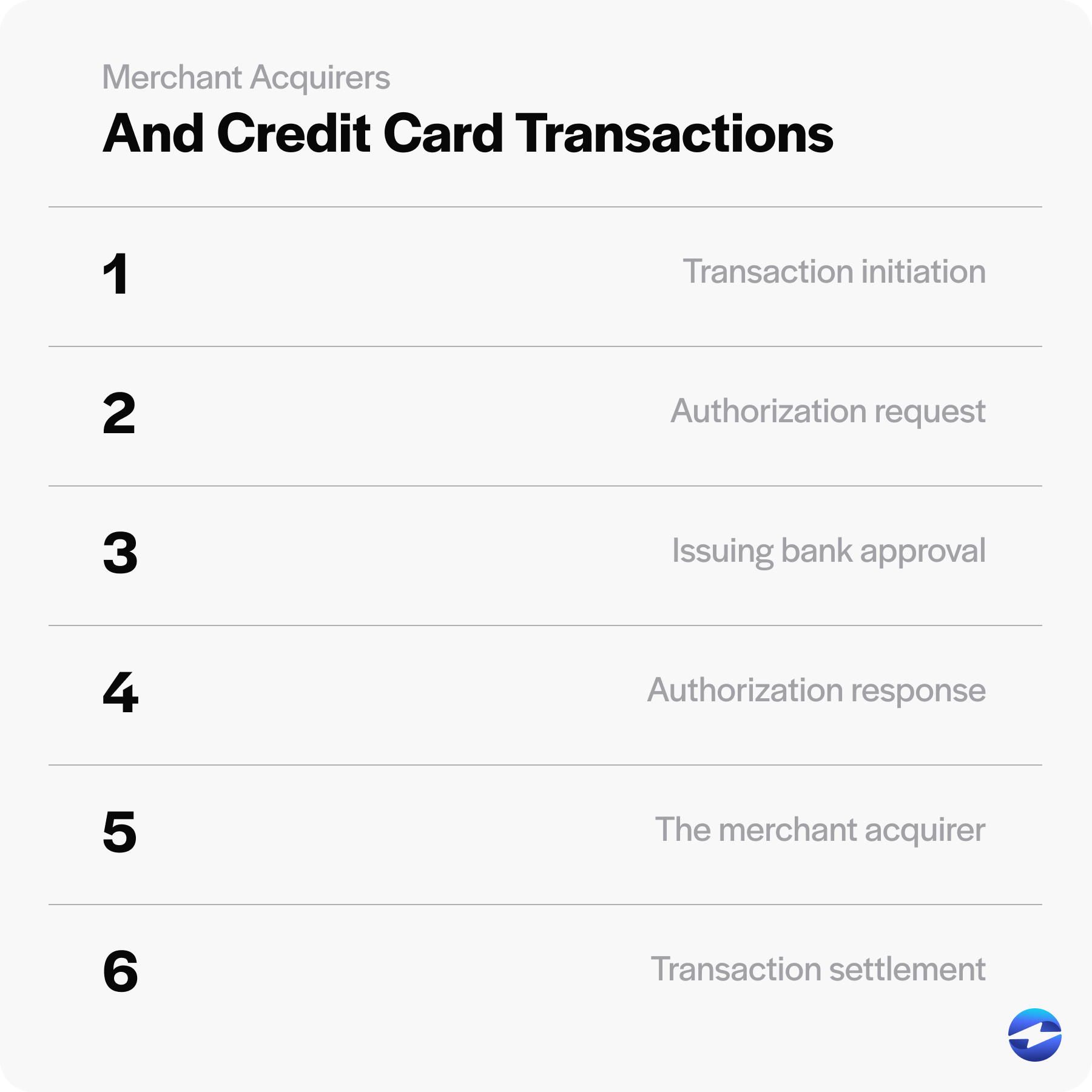

Merchant acquiring services are critical to the payment process. Here’s a quick breakdown of the payment process, outlining the role of merchant acquirers in this process:

- Transaction initiation: The customer makes a purchase using a credit card, either online or in-store.

- Authorization request: The merchant sends the transaction details to the payment processor, who forwards it to the credit card network.

- Issuing bank approval: The credit card network routes the request to the customer’s issuing bank, which checks for sufficient funds, fraud indicators, and account status. The issuing bank then approves or declines the transaction and sends the response back through the network.

- Authorization response: The payment processor receives the response and forwards it to the merchant. If approved, the merchant completes the sale.

- The merchant acquirer: The acquirer processes the transaction, ensuring funds are transferred from the issuing bank to the merchant’s account.

- Transaction settlement: The issuing bank transfers the transaction amount to the credit card network, which forwards it to the merchant acquirer. The acquirer then deposits the funds into the merchant’s account after deducting fees.

Thus, merchant acquirers are essential since they ensure a secure and efficient backend infrastructure for credit and debit card transactions.

Additional obligations of merchant acquirers

Merchant acquirers often offer a range of other merchant payment acquiring services, such as payment gateways, electronic payment technology, and customer support for handling card transactions.

Acquirers are tasked with the authorization request when a card payment is made, checking if sufficient funds are available in the cardholder’s account and if the card details are valid. They also oversee the final settlement of card transactions, transferring the funds to the merchant’s account minus any transaction fees for the services provided.

Now that you know the functions of a merchant acquirer, you should familiarize yourself with what to look for when choosing one for your business.

Finding the best merchant acquirer for your business

Choosing the right merchant acquirer is crucial for businesses of any size that want to accept credit card and debit card payments.

Here’s a quick checklist of what your acquirer should provide to ensure you’re choosing the right one for your business:

- PCI compliance: A suitable merchant acquirer should prioritize data security by complying with the Payment Card Industry Data Security Standard (PCI DSS) to ensure that credit and debit card information is handled securely, mitigating the risk of breaches.

- Seamless integrations: Merchant acquirers should offer seamless integrations with your existing systems. Integration into accounting and enterprise resource planning (ERP) software, point-of-sale (POS) systems, websites, and mobile apps is vital to accommodate digital payments and optimize the payment experience for consumers. These integrations should be compatible across various platforms and devices to ensure more flexible and user-friendly solutions for merchants and their customers.

- Simple onboarding process: The onboarding process should be quick and hassle-free. A smooth onboarding experience reflects the provider’s commitment to customer service and operational efficiency.

- Multiple payment options: Support for multiple payment options is a hallmark of a dependable merchant acquirer. Diverse payment methods include credit and debit cards, digital wallets, ACH, mobile payments, and more. By enabling various payment methods, an acquirer caters to a broader customer base, thus enhancing the merchant’s potential market reach and sales volume.

- Subscription-based transactions: In today’s market, many businesses rely on recurring revenue models. A merchant acquirer should support subscription-based transactions, allowing companies to manage repeat payments seamlessly. This is imperative for businesses that operate on membership or service subscription models, ensuring consistent cash flow and customer retention.

- Reporting and analytics: Detailed reporting and analytics are essential components to sufficient merchant acquiring services. These tools help businesses track and analyze payment trends, identify transaction patterns, and make informed decisions based on real-time data. With comprehensive insights into payment activities, companies can optimize their financial strategies.

- Cost transparency: Businesses must consider cost transparency when selecting a merchant acquirer. Understanding all potential charges, from transaction fees to monthly service charges, can help you manage expenses and avoid unexpected costs. A transparent merchant acquirer builds trust by providing a clear breakdown of fees and any conditional charges that may apply.

- Customer support: Exemplary customer support is a must when choosing a merchant acquirer. Reliable support ensures timely assistance with any issues that may arise, from transaction queries to technical difficulties. A dedicated support team that provides responsive service can significantly reduce the impact of payment-related disruptions on a business’s operations.

Selecting a merchant acquirer well-suited to your business’s needs can lead to a streamlined checkout experience, reliable support, and potentially lower costs.

How to facilitate seamless transactions with EBizCharge

EBizCharge is an all-in-one payment processing platform that provides a reliable payment gateway, merchant services, and payment integrations that work harmoniously with merchant acquirers to facilitate seamless credit card processing.

The EBizCharge payment software easily integrates with various ERP and accounting systems, customer relationship management (CRM) platforms, and shopping carts, enabling businesses to securely and efficiently process payments inside these platforms.

By offering seamless integration capabilities, complete payment security and PCI compliance measures, and superior customer support, EBizCharge optimizes customer payments for businesses. Its ability to streamline payment processing while maintaining high data security standards makes EBizCharge an ideal choice for companies looking to optimize their invoice operations and provide an effortless customer payment experience.