Blog > What is the Importance of Applied Cash?

What is the Importance of Applied Cash?

Cash application is an integral part of a business’s accounts receivable (AR) management and is essential for maintaining financial stability.

The process of applied cash involves applying customer payments to the respective invoices, helping to ensure a business’s books are accurate and up-to-date.

This article will explore the nature of cash application, including its importance and the process behind it.

What is cash application in accounts receivable?

Cash application is the process of accurately matching customer payments to their invoices and processing the payment so the money can be spent.

Cash application is essential to B2B transactions to ensure each transaction is fulfilled accurately. Businesses typically track three forms of cash application: invoices, payments, and remittances.

Traditionally, controllers and accountants manually completed cash application tasks, but this has quickly changed with commercial transactions growing in volume and complexity. Businesses have now turned to automated or hybrid cash application solutions to replace time-consuming and error-prone manual operations to improve accuracy, efficiency, and speed.

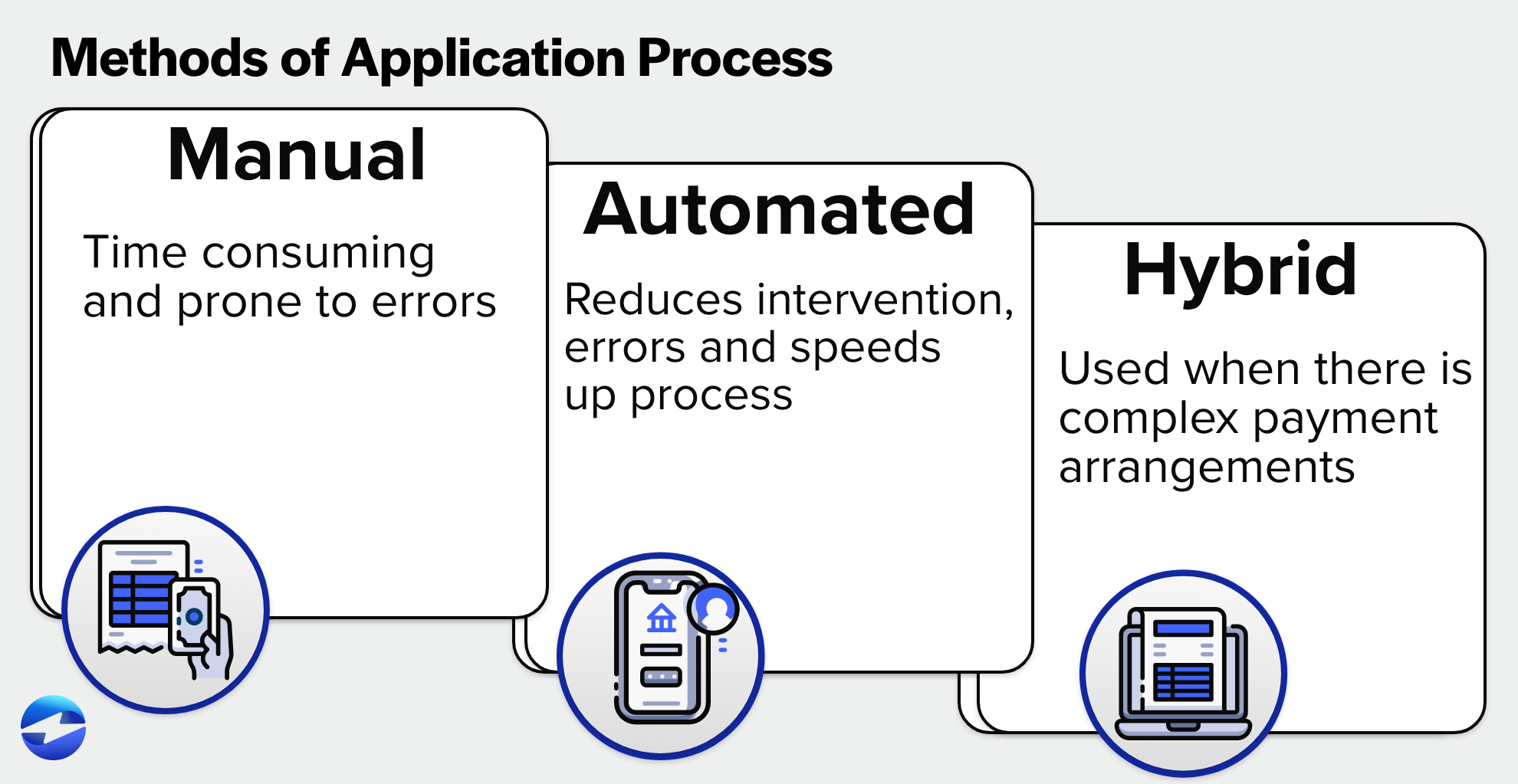

Before examining the overall benefits, it’s essential to understand each method of cash application — manual, automated, and hybrid — and its benefits.

What is manual cash application?

Manual cash application is the traditional method of processing customer payments, where payments are manually recorded and applied to the customer’s account.

Businesses applying cash via manual cash application may find it outdated, time-consuming, and prone to errors since it involves manual entry and reconciliation of payment information.

That said, manual cash application requires direct customer communication, promoting opportunities to refine customer relationships. Despite the human element manual cash application offers, automation is seen as the new and improved method of cash application.

What is automated cash application?

Automation in cash applications is a more efficient and accurate method of processing customer payments because the payments are automatically applied to the customer’s account using cash application software.

Automated cash application software uses unique algorithms to match payments with customers’ accounts based on information such as customer’s names, payment dates, and payment amounts. Some automated cash application software features can also be customized to meet specific business needs, making it an invaluable tool for improving productivity.

While cash application automation is generally viewed as the most efficient method, hybrid methods can also be helpful in certain situations.

What is hybrid cash application?

Hybrid cash application combines manual and automated cash application methods. With this method, some payments are processed automatically while others are processed manually.

Hybrid cash applications can be helpful when there’s limited information available to match payments to the customer’s account or when complex payment arrangements require manual intervention. Although it’s best to keep discrepancy rates as low as possible, accounting for a potential margin of error is always good.

Now that you’re aware of the different cash application methods, you may still be wondering how does cash application work?

What is the cash application process?

Understanding the cash application process will help you effectively manage your AR and strengthen your financial stability, whether you’re a small business owner or a financial tycoon.

The cash application process typically involves three key steps:

- Payments are received

- Payments are matched with the appropriate invoice

- Payments are posted to your ERP

1. Payments are received

Cash application processing starts with the receipt of payment from the customer. In most cases, customers will also send a form of remittance advice that indicates which invoice(s) the charge is for. If the payment is made via check, the remittance advice may be added to the line memo or in various formats.

It’s worth noting that buyers aren’t technically required to send remittance advice, although it’s considered a common courtesy. As a result, payments may be received without any accompanying remittance information.

2. Payments are matched with the appropriate invoice

Once you’ve received payment and accompanying remittance advice, the charge is matched with the correct invoice and credited to the customer’s account.

As previously mentioned, payments can be matched to the appropriate invoice manually, automatically, or using a hybrid approach.

3. Payments are posted to your ERP

The final step in the cash application process is to post the payment to your enterprise resource planning (ERP) system or accounting software which signals that the accounts receivable entry is no longer open.

If you don’t use an ERP that automatically updates journal entries in its system as payments come in, your team may have to post these invoices manually. This can involve flipping between multiple excel spreadsheets and keying everything into your ERP, leading to more inefficiency and significant human error.

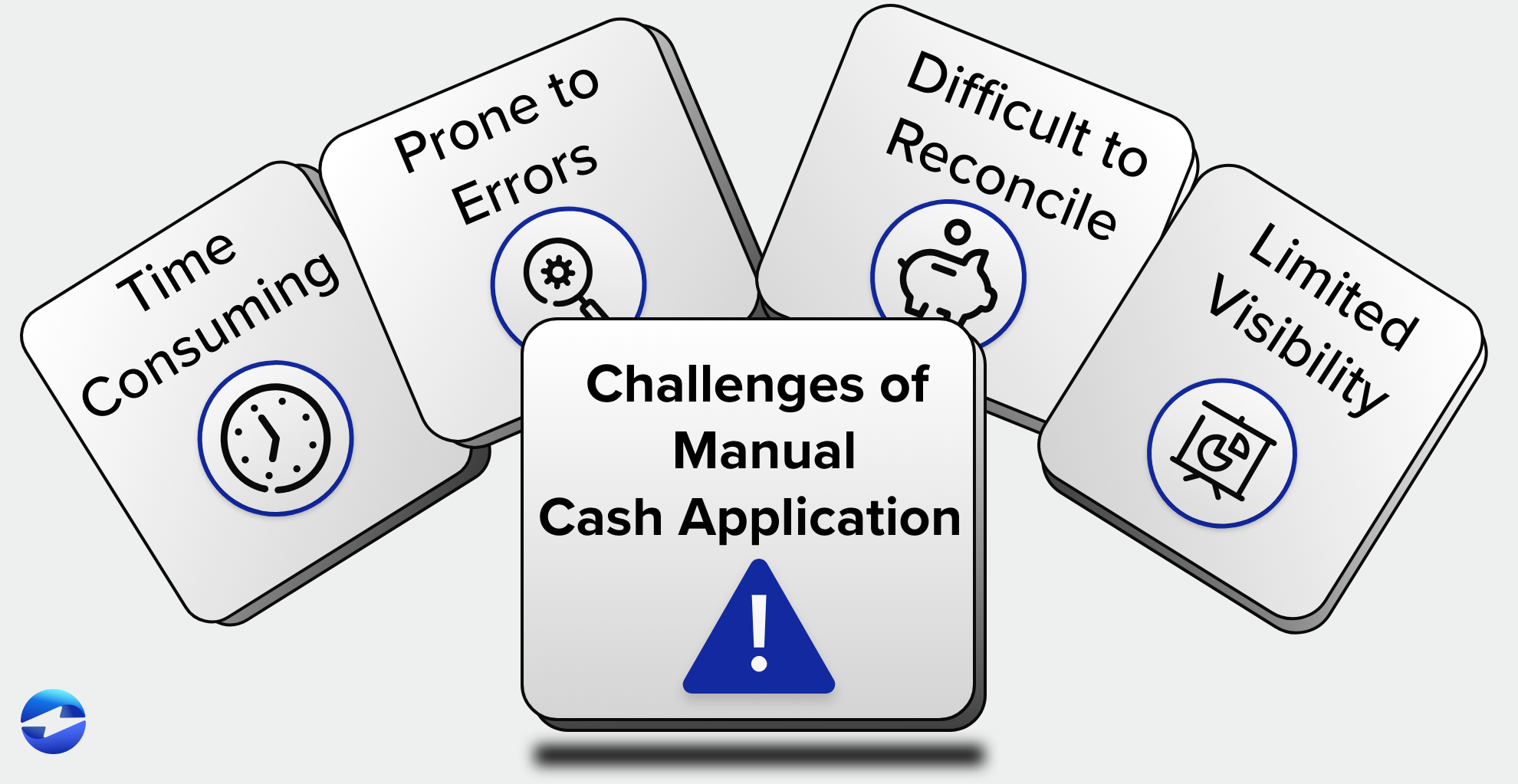

The challenges of manual cash application

The complex nature of manual cash application can be challenging for many businesses. With the rise of electronic payments, orders can come in via many methods, creating tedious work for accountants.

Previously, the cash application process used to be relatively simple. Once an order was recorded, a check would follow for the invoiced amount. The accountant must match the order’s name and amount to the check to authenticate it. The check is then cashed, and the process is complete.

Nowadays, many forms of payment can be used to complete the cash application process, such as electronic invoicing, digital payment portals, eChecks, bank transfers, and more. All these payment methods must be matched to the order, which can be monotonous and time-consuming.

A single payment may cover multiple invoices, creating another complication when trying to allocate the funds correctly. Payments may also be made at different times, making the process more inconvenient for AR professionals. Additionally, the payment amount may not precisely match any invoice amount, possibly due to discounts or customer order issues.

Despite its complexities, there are still several reasons why cash application is essential for businesses.

Why is cash application important?

Applying cash is critical to a company’s financial health, with each method offering unique benefits.

Manual cash application provides a human element, whereas automated cash application improves efficiency and accuracy, and hybrid cash application combines these two methods for more flexibility.

Overall, the top advantages of cash application in accounting include:

- Enhanced cash flow management

- Improved financial reporting and payment discrepancy identification

- Increased efficiency and productivity

Enhanced cash flow management

Cash application helps businesses maintain and manage a more steady and predictable cash flow process.

If payments aren’t applied promptly, it can lead to cash flow bottlenecks and future financial problems for your business. Therefore, a more streamlined cash application process will help you process payments faster to avoid these issues and reduce days sales outstanding (DSO).

DSO measures a company takes to collect customer payment after a sale. By reducing DSO, businesses can improve cash flow and reduce the risk of bad debts.

Improved financial reporting and payment discrepancy identification

A proper cash application process ensures that your finance department has an accurate, up-to-date picture of your company’s financial health.

Cash application allows businesses to generate real-time reports, including cash forecasts and aging reports, which are crucial for making informed financial decisions.

The accurate reporting that cash application provides will help your company identify payment discrepancies or errors, such as overpayments and underpayments. Addressing these issues in a timely manner can reduce the risk of customer disputes and improve the overall customer experience.

Increased efficiency and productivity

Efficiency and productivity are two main objectives of companies’ payment processing initiatives.

As previously mentioned, automation is one of the most efficient cash application methods since it reduces manual labor and the number of errors within the process. This allows employees to shift their focus to other tasks that yield more cost savings.

Cash application helps increase operational efficiency and productivity while assisting businesses to grow and compete more in the marketplace.

Optimize your AR process with cash application

Cash application is a critical component of the AR process, as it improves cash flow, customer relations, data accuracy, financial standing, and overall efficiency.

Businesses can refer to this article to successfully implement cash application by assessing their current operations, taking advantage of automated software, and performing routine evaluations to meet evolving demands.

Frequently asked questions about applied cash

Frequently asked questions about applied cash

- What is cash application in accounts receivable?

- What is manual cash application?

- What is automated cash application?

- What is hybrid cash application?

- What is the cash application process?

- The challenges of manual cash application

- Why is cash application important?

- Optimize your AR process with cash application

- Frequently asked questions about applied cash