Blog > What is Manufacturing Accounting? Everything You Need to Know

What is Manufacturing Accounting? Everything You Need to Know

Manufacturing accounting is an essential practice that mirrors the precision required in the production process, ensuring every dollar spent and earned is meticulously tracked.

To fully grasp its importance, you can dive into what accounting in manufacturing entails and how it operates within the industry.

What is manufacturing accounting?

Manufacturing accounting is a specialized branch of accounting that focuses on tracking and managing the financial operations of manufacturing businesses. It enables these companies to accurately record and report their transactions, particularly those related to production.

This accounting approach includes various manufacturing costing methods tailored to production processes, such as activity-based, standard, and process costing.

Manufacturing accounting is crucial to maintaining inventory valuation, aiding the production cost analysis, and facilitating informed decision-making. By overseeing these aspects, companies can evaluate their financial position using financial statements within the given accounting period, such as the income statement and the balance sheet.

As with most accounting systems, there are some challenges to consider.

Challenges in manufacturing accounting

Accounting in manufacturing faces several unique challenges due to the complex nature of the production process and the intricate tracking required.

Determining the actual cost of manufactured goods can be complicated as costs must be allocated between direct materials, direct labor, and manufacturing overhead. Incorrect allocation can skew product costs and overall profitability. Manufacturing businesses must also decide on an inventory valuation method, which can significantly impact the cost of goods sold and financial reporting.

In standard manufacturing costing, actual production costs can differ from standard costs. High variances can indicate issues in the production process or the standard setting.

Manufacturers must also adhere to various accounting standards and regulations, as non-compliance can lead to legal repercussions and financial penalties.

Furthermore, fluctuations in raw material costs, labor rates, and overhead expenses can significantly affect manufacturing costs, making it challenging to stay agile and responsive to these changes while maintaining accurate costs.

Since manufacturing accounting costs are a common challenge for many businesses within the industry, it’s essential to become acquainted with them to keep track of your production.

What costs are associated with manufacturing accounting?

Manufacturing cost accounting encompasses various costs to create a comprehensive financial picture of business operations.

These costs range from direct expenses that can be traced back to the production of goods, such as raw materials and labor, to indirect costs that cannot be directly linked to a finished product, like maintenance and utilities.

Direct and indirect costs

In manufacturing cost accounting, costs are classified as either direct or indirect.

Direct costs are easily traceable to the production of specific goods or services. They encompass direct materials (raw materials that form an integral part of the finished product) and direct labor (wages and benefits for the employees who actively work to convert materials into the finished product).

On the other hand, indirect costs aren’t directly attributable to a specific product and are often referred to as manufacturing overhead. These include expenses like equipment depreciation, rent, utilities, and support staff salaries. While not directly linked to production, these costs are essential for the operation and must be allocated proportionally across all products.

Material costs

Material costs are the costs of the raw materials that become part of the finished product. They’re a substantial component of direct costs.

In the manufacturing accounting process, the procurement, management, and usage of materials directly influence the cost of the finished product. Tracking these costs is crucial for inventory valuation and determining the costs of goods sold (COGS).

Stock and inventory costs

Stock and inventory costs are the expenses related to storing and managing the materials and finished goods. These costs involve warehousing, handling, and insurance.

Efficient inventory management is essential to minimize these costs, avoiding unnecessary storage fees or losses from obsolescence and shrinkage.

Labor costs

Labor costs include the wages, benefits, and associated taxes paid to employees directly involved in production. This can range from the operations on the factory floor to the production supervisors who ensure the manufacturing process runs smoothly.

In addition to direct labor costs, indirect labor, such as maintenance staff or quality control, is accounted for in overhead.

Overhead costs

Overhead costs are broad and pertain to the amalgamation of indirect costs that support production but aren’t directly tied to a specific product. They include indirect labor, facility costs, maintenance and repairs, equipment depreciation, and utilities.

To ensure accurate product costing, manufacturing overhead must be allocated to products based on a rational method, such as machine or labor hours.

Product costs

Product costs are the sum of all costs directly tied to creating a product. This includes direct materials, direct labor, and allocated overhead.

These costs are vital for determining pricing strategies, evaluating product profitability, and managing inventory on the balance sheet before the goods are sold.

Production costs

Production costs, or manufacturing costs, consist of expenses directly incurred in producing goods.

Apart from direct materials and labor, production costs include expenditures related to the operation and maintenance of the production facility. Accurately capturing production costs is essential for budgeting and settling standard product costs.

Operational costs

Operational costs embody all the expenditures a manufacturing business incurs daily.

Operational costs are broader than production costs, including administrative expenses, sales and marketing, research and development, and other overheads. Controlling operational costs is crucial for maintaining profitability.

Depreciation costs

Depreciation costs represent the portion of costs of manufacturing equipment and assets that diminish value over time and are a significant part of manufacturing overhead. It affects the financial statements but doesn’t involve actual cash outflow.

Depreciation costs can be categorized as straight-line depreciation, declining balance depreciation, and sum-of-years depreciation.

Straight-line depreciation allocates the cost of a tangible asset over its useful life consistently and linearly. Declining balance depreciation is an accelerated depreciation method used in manufacturing accounting, in which the depreciation expense decreases over the asset’s useful life.

Contrary to the straight-line method that spreads the cost evenly across the life of the asset, the declining balance method applies a constant depreciation rate to the remaining book value each accounting period, leading to larger depreciation expenses in the earlier years.

Lastly, sum-of-years depreciation is used to accelerate an asset’s depreciation rate. In this method, the depreciation expense is highest in the first year of the asset’s life and decreases over subsequent years. This reflects how some assets may be more productive or provide more value in their earlier years.

Fixed costs

Fixed costs are expenses that remain constant regardless of the level of production or sales. Examples include rent, insurance, and salaries of administrative personnel.

For manufacturers, fixed costs provide stability and predictability in budgeting but can present challenges in maintaining profitability during periods of reduced production.

Variable costs

Variable costs change in direct proportion to the output level and can include raw materials, direct labor, and energy costs.

Variable costs increase as production ramps up and decrease when production slows, making them a key focus in cost-cutting measures. Reducing them directly affects the cost per unit of product.

Understanding these costs is critical for pricing, budgeting, and financial analysis. Manufacturing businesses can accurately account for them to assess their financial performance, determine product profitability, and generate effective strategies.

Knowing how to calculate manufacturing accounting costs can help your company better understand its financial impact.

Cost of goods manufactured vs. cost of goods sold: How to calculate each

Cost of goods manufactured (COGM) and cost of goods sold (COGS) are two essential calculations in manufacturing accounting that inform the valuation of inventory and cost management.

Understanding these concepts is critical for accurately assessing a manufacturing company’s financial infrastructure.

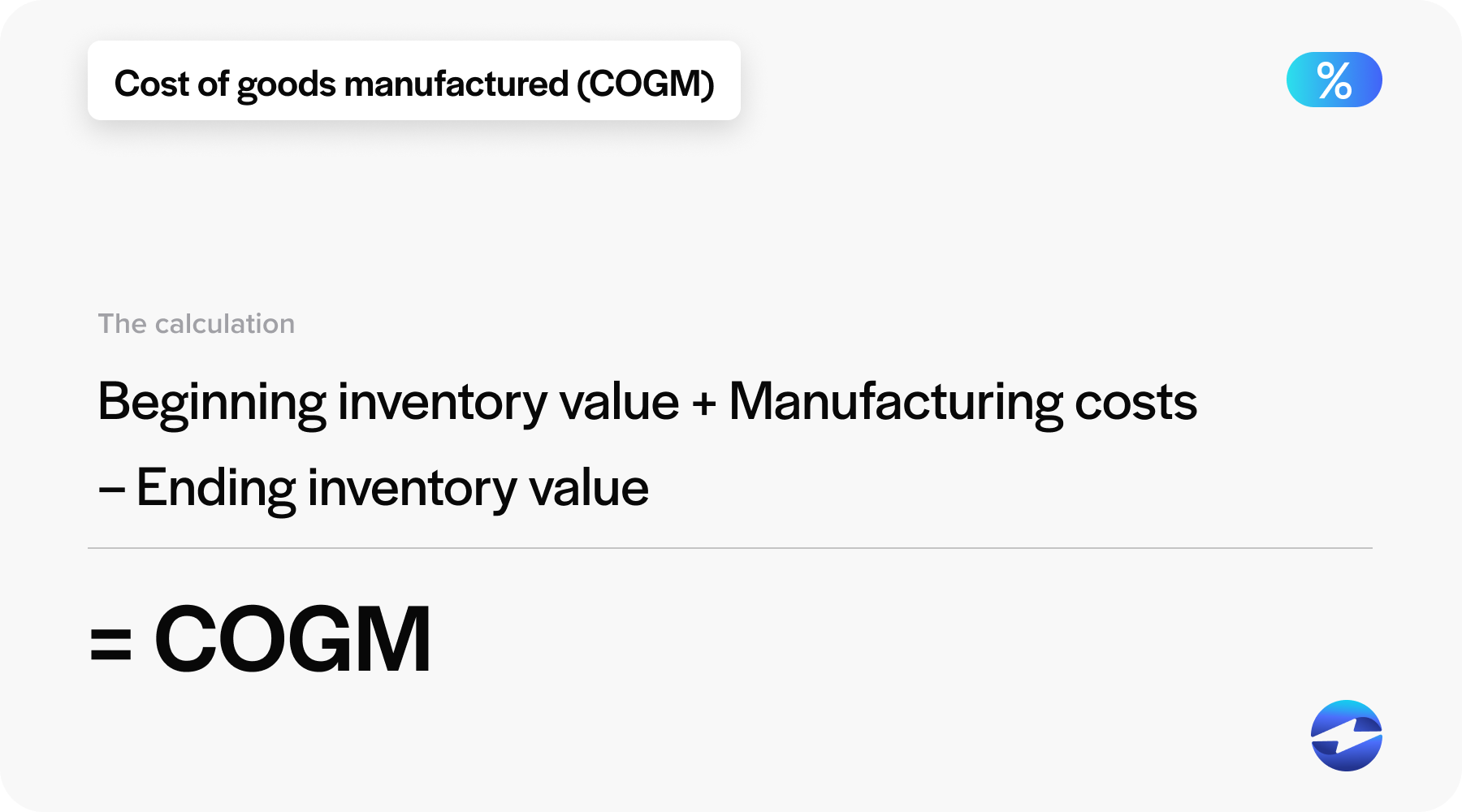

COGM

COGM is the total cost incurred by a manufacturing company to produce goods during a specific period. This includes all the expenses related to the production process, such as raw materials, labor, and overhead costs.

Here’s the equation for calculating COGM:

COGM = Beginning Inventory Value + Manufacturing Costs – Ending Inventory Value

COGM helps businesses understand the total cost of manufacturing their products and is essential in calculating the COGS.

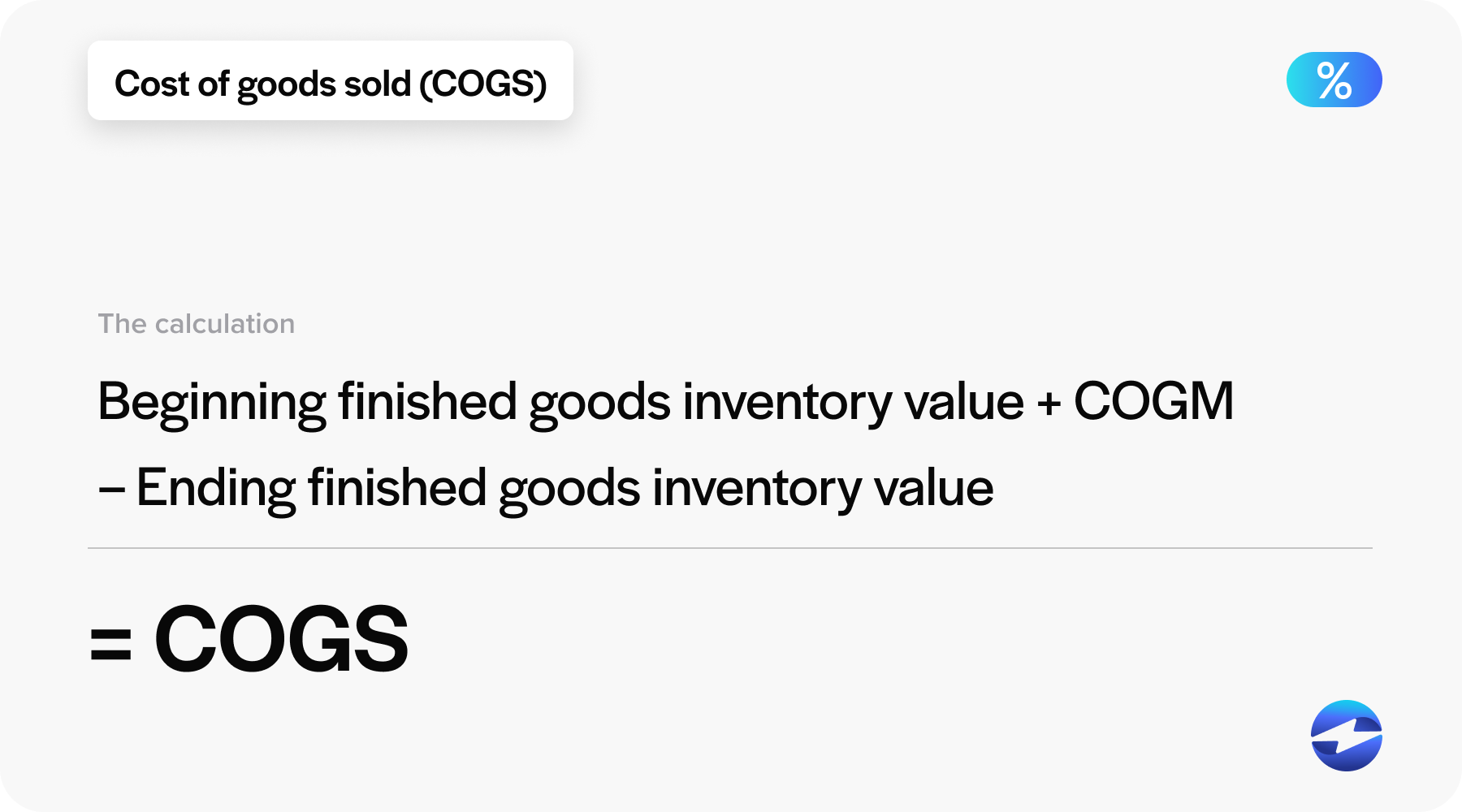

COGS

On the other hand, COGS represents the cost of goods sold during a specific period. It includes the COGM of the items sold, adjusted for changes in inventory levels.

Here’s the equation for calculating COGS:

COGS = Beginning Finished Goods Inventory Value + COGM – Ending Finished Goods Inventory Value

COGS is essential for the income statement since it impacts the net income of the manufacturing business.

By accurately calculating COGM and COGS, manufacturing businesses can control production costs, maintain efficient inventory levels, and enhance reporting accuracy.

In addition to understanding how to calculate COGM and COGS, it’s important to familiarize yourself with inventory valuation.

What is inventory valuation?

Inventory valuation is a critical process in manufacturing accounting that determines the monetary value of a company’s inventory at the end of an accounting period. It’s essential for financial reporting and informs the COGs on the income statement, influencing the calculation of a company’s profitability.

Several inventory valuation methods are used in manufacturing accounting such as:

- FIFO (First In, First Out): The FIFO method assumes the oldest inventory items are sold first, meaning the cost of the earliest goods purchased or manufactured is assigned to the COGS. Under FIFO, the remaining inventory consists of the most recently produced or purchased goods. This method is particularly useful when dealing with perishable goods or items subject to rapid technological advancement, as it correlates with the flow of goods in many businesses.

- LIFO (Last In, First Out): The LIFO method assumes that the most recent inventory items are sold first. Under LIFO, the cost of the newer inventory is used to calculate the COGS, while the older inventory costs remain on the balance sheet. LIFO is less commonly used globally and isn’t permitted under International Financial Reporting Standards (IFRS), though it’s allowed under U.S. Generally Accepted Accounting Principles (GAAP).

- Weighted average cost (WAC): The WAC method mitigates price fluctuations by calculating the average cost of all goods available for sale during an accounting period and assigning this cost to the COGS and the ending inventory. WAC is found by dividing the total cost of goods available for sale by the total units available for sale, thus reaching an average cost per unit. This is useful for homogeneous goods and where tracking individual items is impractical.

Now that you know what inventory valuation is, you should also familiarize yourself with manufacturing costing methods used for production.

Costing methods for production

Manufacturing businesses use various costing methods to accurately assign production costs to their products and services. The need for different costing methods arises primarily due to the diversity in the types of manufacturing processes, product complexities, production volume, and the level of customization involved.

Since each business has unique circumstances and financial goals, the chosen costing approach must provide the most relevant information for financial reporting.

- Job order costing: Job order costing is applied in manufacturing settings where products are produced based on specific customer orders, and each batch has distinctive characteristics. It assigns direct materials, direct labor, and an allocated portion of manufacturing overhead to each job or order. This method is immensely beneficial when products aren’t uniform and require different resource amounts.

- Process costing: Process costing is the go-to method for manufacturers that produce similar products on a large scale, such as in the food processing or chemical industries. This method accumulates costs for a continuous flow of units through production processes. Since the units are indistinguishable, costs are averaged over the units produced during a period. This enables streamlined accounting, where costs are tracked by department or process, not per individual unit. It’s particularly useful for understanding the cost efficiency of a process or department in producing a single product or a range of similar products.

- Activity-based costing: Activity-based costing is a more refined approach to identifying, assigning, and managing the costs of producing goods or services. By distinguishing between high and low overhead activities, it prevents cost distortion in product costs that traditional costing methods may not address. Activity-based costing is particularly beneficial for companies with diverse products and services, which incur overhead costs at different rates.

Selecting the proper costing method is crucial for manufacturers as it impacts how costs are reported and analyzed, affecting managerial decisions, pricing strategies, and financial outcomes.

5 manufacturing accounting best practices

Employing best practices is critical for ensuring accurate financial reporting and controlling costs to maintain and improve financial health.

Here are five best practices to get you started:

- Enhance production efficiency

- Ensure precise allocation of indirect costs

- Adopt real-time cost tracking

- Implement immediate inventory management

- Leverage advanced manufacturing software

1. Enhance production efficiency

By accelerating operations and introducing time-saving techniques, businesses can significantly reduce production costs. This is particularly evident in reducing direct labor costs and manufacturing overheads, which comprise a significant portion of total product costs.

Improvements in production efficiency can also lead to better utilization of raw materials, minimizing waste and thus lowering material costs. Reducing COGS can reflect such changes in financial statements, which can increase profit margins.

2. Ensure precise allocation of indirect costs

Allocating indirect costs can contribute to a more accurate calculation of production costs.

When indirect costs, such as utility bills or rents, are distributed to each product or service, businesses can determine actual production costs. This leads to better pricing strategies and improves profit margins.

Additionally, precision in cost allocation aids in identifying cost-saving opportunities. By tracking the flow of indirect costs, management can pinpoint areas where operational efficiency can be enhanced, leading to cost reductions.

3. Adopt real-time cost tracking

Adopting real-time cost tracking for components and products can significantly improve accounting for manufacturing companies by enhancing the accuracy and timeliness of financial data. This approach ensures that all cost-related information, such as material, labor, and overhead expenses, is current and reflects any real-time fluctuations.

This level of accuracy allows for more precise financial reporting and aids in maintaining accurate records of production costs.

Real-time cost tracking also facilitates better budget management by allowing manufacturers to compare actual expenditures against planned budgets, enabling timely adjustments to prevent cost overruns.

4. Implement immediate inventory management

Immediate inventory management is a pivotal upgrade for manufacturing accounting, providing real-time data on inventory levels and reducing errors and discrepancies.

Adopting immediate inventory management gives businesses a clear view of their inventory levels, which helps them track direct materials and manufacturing overheads. This, in turn, allows for a more accurate calculation of a product’s standard cost and can improve operations.

5. Leverage advanced manufacturing accounting software

Reliable manufacturing accounting software can significantly enhance the effectiveness and accuracy of accounting for manufacturing companies.

By integrating advanced software into their operations, manufacturing businesses benefit from automating routine tasks, such as tracking raw materials and work-in-progress inventory, and computing standard costs for direct materials, direct labor, and manufacturing overheads.

EBizCharge is a prime example of robust payment software that provides manufacturing accounting services designed to streamline invoicing processes associated with manufacturing.

The automated EBizCharge software can also reduce human error and optimize production by providing real-time updates on inventory levels and production costs for better cash flow.

Simplifying manufacturing accounting with EBizCharge

In the manufacturing world, where factors such as raw materials, production costs, and overhead expenses intertwine, simplifying accounting processes is crucial for better financial reporting and growth initiatives.

EBizCharge emerges as a vital solution, transforming these intricate processes by providing comprehensive manufacturing accounting services.

EBizCharge seamlessly integrates with various accounting software to reduce manual data entry and potential errors. This software ensures that critical financial data, from inventory levels to the cost of direct labor, is up-to-date and reliable. It also allows manufacturing businesses to focus on their core production process without the stress of time-consuming financial management tasks.

For manufacturers looking to modernize their cost accounting practices, EBizCharge is a gateway to financial clarity and administrative ease.

Summary

- What is manufacturing accounting?

- Challenges in manufacturing accounting

- What costs are associated with manufacturing accounting?

- Cost of goods manufactured vs. cost of goods sold: How to calculate each

- What is inventory valuation?

- 5 manufacturing accounting best practices

- Simplifying manufacturing accounting with EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge