Blog > What Is Electronic Invoicing? Benefits and How It Works

What Is Electronic Invoicing? Benefits and How It Works

Electronic invoicing has emerged as a transformative solution that streamlines the invoicing process while minimizing human errors. As companies increasingly shift toward digital solutions, understanding digital invoicing becomes essential for maintaining a competitive advantage.

This article will explore how electronic invoicing works and the advantages it offers to businesses of all sizes.

What is electronic invoicing?

Electronic invoicing, commonly referred to as e-invoicing, is the automated creation, delivery, and management of invoices using electronic methods. It involves exchanging the invoice document between a supplier and a buyer in an electronic format. Electronic invoices eliminate the need for paper-based invoices and traditional mailing methods.

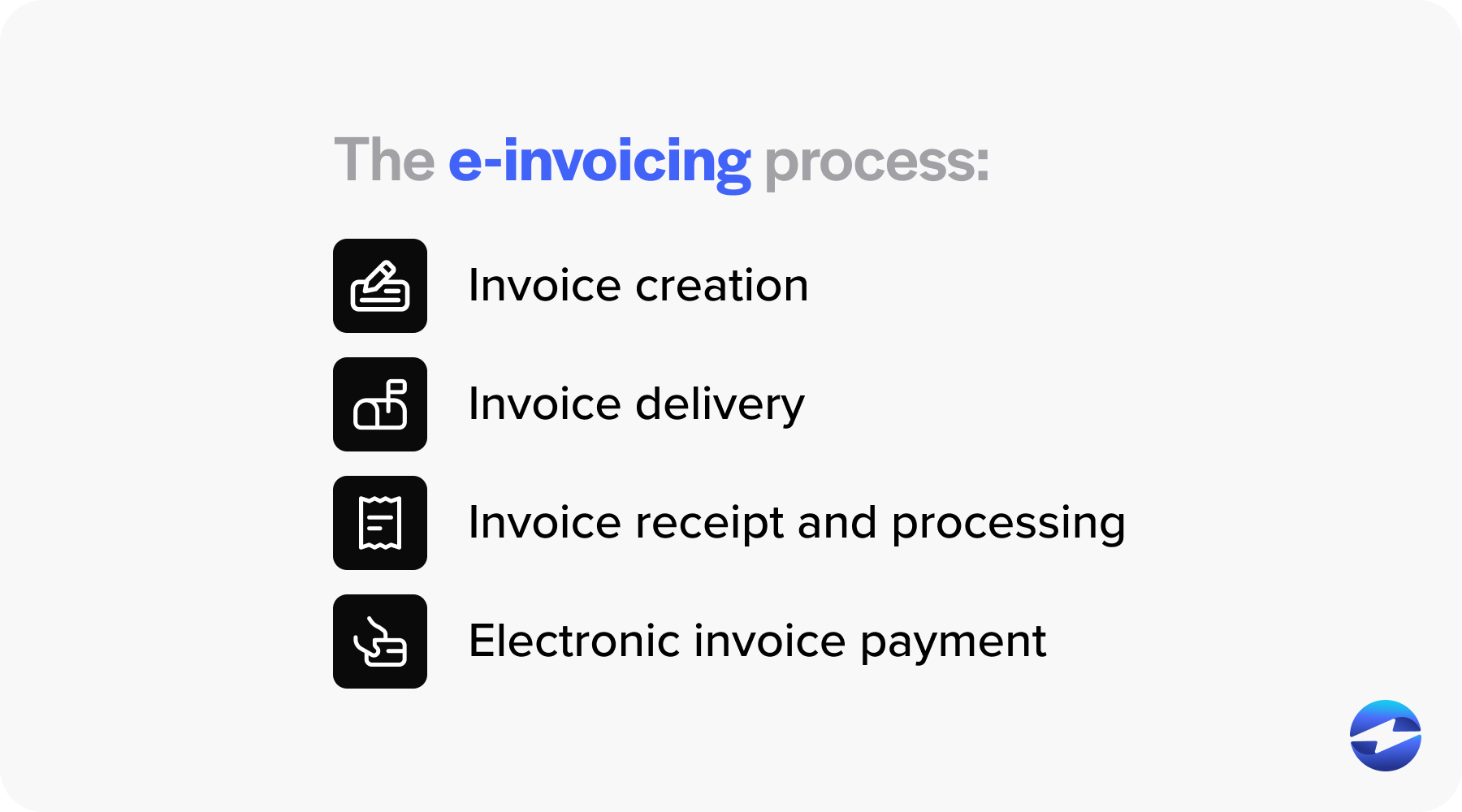

How does electronic invoicing work?

Understanding how electronic invoice processing works is crucial for businesses aiming to streamline their financial operations and improve efficiency. This understanding is key to making informed decisions about implementing and optimizing electronic invoice processing within a company’s financial ecosystem.

Here is a quick breakdown of the e-invoicing process:

- Invoice creation: The seller generates an invoice using an e-invoicing solution or software. This digital invoice contains all the transaction details in a structured format that business systems can directly process.

- Invoice delivery: Upon creation, the electronic invoice is securely transmitted to the buyer through the e-invoicing platform. This can be done via a direct integration between the two parties’ financial systems or through a network provider.

- Invoice receipt and processing: The buyer receives the invoice in their electronic invoicing system. The structured format allows for automated matching against purchase orders and acceptance for payment without the need for manual data entry, reducing entry errors.

- Payment: Once approved, electronic invoice payment can be promptly executed according to payment terms, often through integrated payment methods that expedite the entire process and improve cash flow.

Overall, e-invoicing ensures a standardized and efficient approach to invoice exchanges, providing benefits such as faster invoice processing, reduced human error, and improved adherence to payment terms.

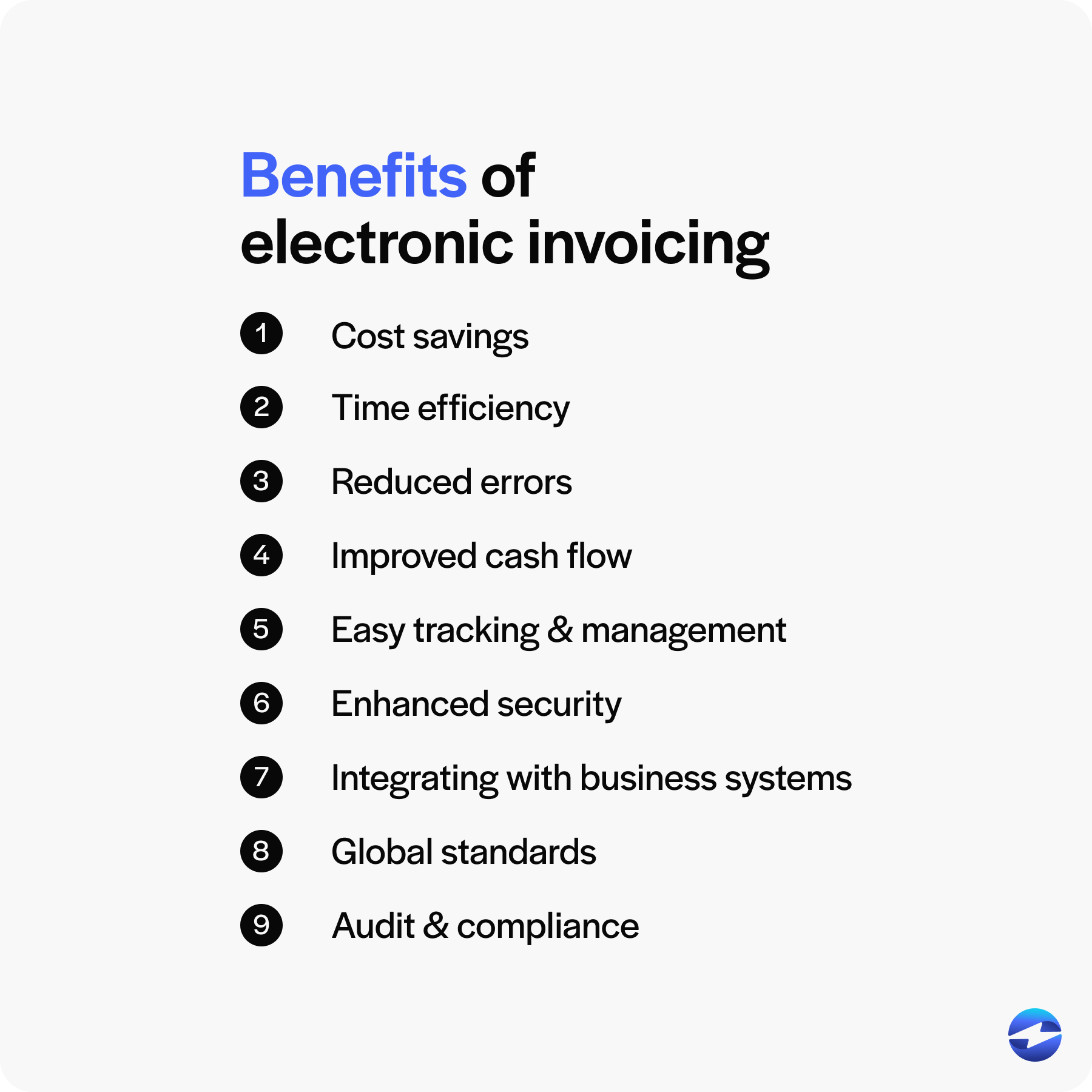

What are the benefits of electronic invoicing?

Understanding the benefits of digital invoicing is essential for businesses looking to optimize their financial processes and gain a competitive edge.

Here is a list of some of the benefits of using e-invoicing:

- Cost savings: Implementing e-invoicing systems significantly reduces costs associated with paper invoices, such as printing, postage, and storage expenses.

- Time efficiency: E-invoicing solutions facilitate faster processing. Invoices can be sent, received, and processed much quicker than traditional methods, which typically reduces the time it takes for businesses to get paid.

- Reduced errors: Since e-invoicing eliminates manual data entry, the probability of human error is greatly diminished. This includes errors in inputting figures, lost invoices, and misinterpreting invoice details.

- Improved cash flow: Businesses often experience improved cash flow as e-invoicing is faster due to quick approvals and shorter payment cycles.

- Easy tracking and management: Electronic invoices can be tracked in real-time, providing instant confirmation of receipt and status updates, which is not feasible with paper-based systems.

- Enhanced security: E-invoicing provides a higher level of security with data encryption and secure transmission protocols, minimizing the risk of invoice fraud.

- Integrating with business systems: Many e-invoicing platforms enable seamless integration with existing business systems, allowing for automated workflows and better data management.

- Global standards: E-invoicing solutions can conform to international standards, making it easier to do business globally with standardized document formats and e-invoicing regulations.

- Audit and compliance: Digital records facilitate easier auditing and ensure compliance with tax regulations, as digital data can be archived and retrieved efficiently.

While e-invoicing brings a multitude of advantages, it’s important to note the disadvantages it carries as well.

Are there any disadvantages to electronic invoicing?

Along with its advantages, it’s equally important to understand the disadvantages of e-invoicing. A comprehensive understanding of both the benefits and drawbacks ensures a balanced approach, enabling businesses to fully leverage the advantages while effectively managing any potential downsides.

- Initial setup cost and complexity: Implementing an e-invoicing system may involve initial setup costs and some complexity, particularly for small businesses with limited resources.

- Training and adaptation: Staff may require training on new systems, and both employees and clients may take time to adapt to the electronic invoicing process.

- Compatibility issues: Different e-invoicing standards and systems may not always be compatible, potentially causing issues when exchanging invoices with trading partners who use different systems.

Despite these drawbacks, the benefits of transitioning to an electronic invoicing system outweigh the challenges. It not only enhances efficiency but also leads to cost savings and better financial management in the long term.

Implementing electronic invoicing

Implementing electronic invoicing is a strategic move for businesses looking to modernize their payment process. To ensure a smooth transition, organizations must follow a set of important steps, starting with understanding legal requirements, choosing the right solution, and integrating it with their existing business systems.

Here are the steps required to implement electronic invoicing into your payment collections process:

- Understand legal and regulatory requirements: Research the e-invoicing regulations in your region or industry. Different countries may have specific legal requirements, such as digital signatures and data storage.

- Choose the right E-invoicing solution: Evaluate and select an e-invoicing software or platform that meets your business needs. Consider factors such as integration with existing accounting systems, ease of use, security features, and scalability.

- Integrate E-invoicing with your existing systems: Work with your IT team or software provider to integrate the e-invoicing solution with your current accounting, Enterprise Resource Planning (ERP), or Customer Relationship Management (CRM) systems. This ensures seamless data flow and reduces manual entry errors.

- Set up data formats and standards: Ensure your e-invoices comply with the necessary data formats and standards. This will facilitate the exchange of invoices between different systems and platforms.

- Train your team: Provide training for your staff on how to use the e-invoicing system, including creating, sending, and managing electronic invoices. Ensure they understand the new process and its benefits.

- Communicate with customers and suppliers: Notify your customers and suppliers about your transition to e-invoicing. Provide them with any necessary information on sending or receiving electronic invoices and ensure they’re comfortable with the new system.

- Test the system: Before fully launching e-invoicing, conduct tests to ensure everything works as expected. Send test invoices to a few customers or suppliers to check for any issues and make adjustments as needed.

- Go live and monitor the system: Once testing is complete and any issues have been resolved, implement the e-invoicing system fully. Monitor its performance, gather user feedback, and make any necessary improvements.

- Maintain compliance and security: Continuously monitor the system to ensure compliance with legal and regulatory requirements. Implement security measures to protect sensitive financial data and regularly update the system to safeguard against new threats.

- Evaluate and optimize: Periodically review the e-invoicing process to identify areas for improvement. Look for ways to optimize the system for better efficiency, cost savings, and customer satisfaction.

By following these steps, businesses can successfully implement e-invoicing, leading to faster payment cycles, reduced costs, and improved financial management. Implementing electronic invoicing becomes paramount as the popularity of digital transactions increases.

The growing importance of electronic invoicing

More and more businesses are transitioning from traditional paper-based invoicing to electronic invoicing, largely due to the numerous benefits that e-invoicing offers. This shift is reshaping the way companies handle their financial transactions, providing them with a structured format for the exchange of invoices. Upgrading to an electronic invoicing system allows reinforces consistency and coordination among trading partners, underscoring its growing importance in today’s digital economy.

For a seamless transition to electronic invoicing, look to trusted payment processors like EBizCharge.

A seamless electronic invoicing experience

As mentioned, a reliable payment processor will be able to facilitate seamless electronic invoicing.

EBizCharge is a payment processing solution that simplifies electronic invoice creation and delivery in a standardized format, enabling businesses to enjoy all the e-invoicing benefits. This top-rated software provides quicker invoice processing, reduces human error, and streamlines cash flow by integrating with various business systems such as ERP and CRM software. EBizCharge goes beyond just invoice generation and management; its comprehensive suite of tools ensures that electronic invoice payment is just one aspect of a holistic payment processing experience. EBizCharge also offers an array of features, including encrypted payment data, detailed reporting, and compatibility with multiple payment methods.